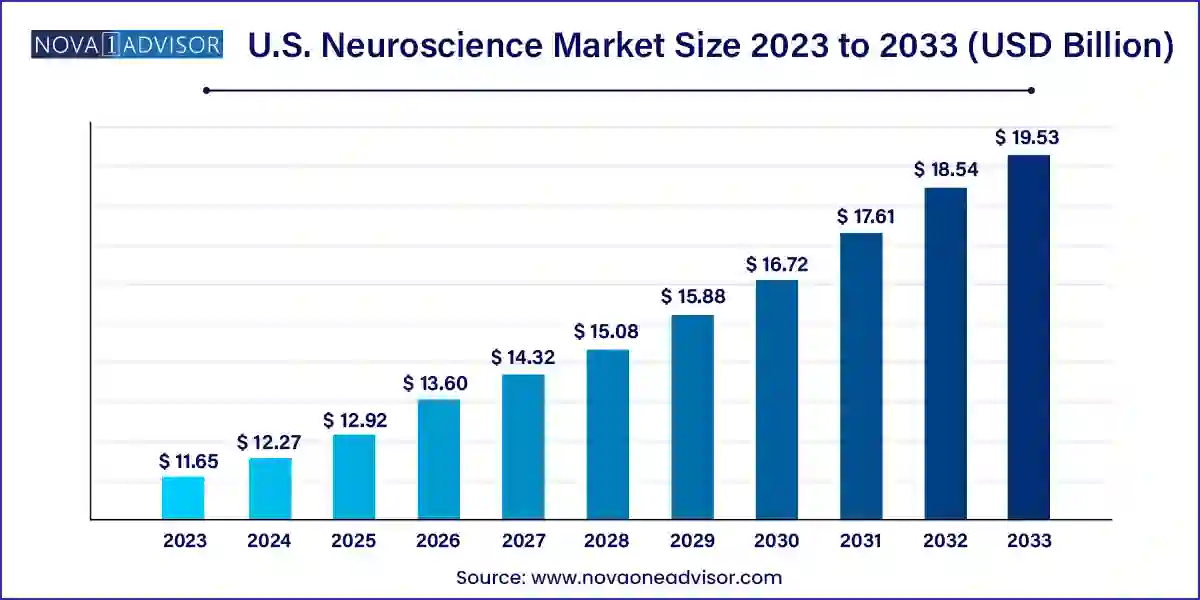

The U.S. neuroscience market size was exhibited at USD 11.65 billion in 2023 and is projected to hit around USD 19.53 billion by 2033, growing at a CAGR of 5.3% during the forecast period 2024 to 2033.

Key Takeaways:

The U.S. neuroscience market stands at the forefront of medical innovation, powered by growing investments in brain-related research, technological advancements, and rising awareness around neurological disorders. Neuroscience, as a multidisciplinary domain, encompasses the study of the brain and nervous system, intersecting fields such as biology, chemistry, cognitive science, and medicine. The U.S., with its advanced healthcare infrastructure and a robust research ecosystem, leads the world in neuroscience innovations and applications.

The burden of neurological diseases in the U.S. is significant, with millions of individuals affected by conditions such as Alzheimer’s disease, Parkinson’s disease, epilepsy, multiple sclerosis, and various psychiatric disorders. The increasing prevalence of these conditions, especially within the aging population, is fueling demand for advanced diagnostics, treatment options, and neurotechnologies. Moreover, the U.S. is home to globally recognized research institutions, universities, and biotech firms that are pioneering cutting-edge neuroscience research, ranging from molecular neuroscience to brain-computer interfaces.

Additionally, neuroscience is becoming a cornerstone in drug development. Pharmaceutical companies are increasingly investing in neuroscience pipelines to address unmet medical needs. The integration of artificial intelligence, machine learning, and high-resolution imaging technologies has revolutionized how the brain is studied and understood. From functional MRI to optogenetics and neuromodulation therapies, the field is advancing rapidly, offering immense commercial and clinical potential.

Surging Interest in Brain-Computer Interfaces (BCIs): Companies like Neuralink and Synchron are developing BCIs that may transform treatments for paralysis and neurological impairments.

Growth in Neurodegenerative Disease Research: The high prevalence of Alzheimer’s and Parkinson’s in the U.S. is prompting increased NIH funding and pharma collaboration.

Adoption of AI in Brain Imaging: AI algorithms are being developed to detect early signs of neurological diseases through imaging, enhancing diagnostic accuracy.

Expansion of Precision Neuroscience: Tailoring neurological treatments to individual genetic and neurobiological profiles is gaining momentum.

Rise in Non-invasive Neuromodulation: Devices such as transcranial magnetic stimulation (TMS) and transcranial direct current stimulation (tDCS) are becoming more common in clinical and research settings.

Emphasis on Mental Health and Cognitive Disorders: With rising awareness, neuroscience tools are being used to study conditions like depression, anxiety, ADHD, and schizophrenia.

Neurotech Investment Booms: Startups focused on neuro-monitoring, wearables, and digital therapeutics are receiving growing venture capital interest.

| Report Coverage | Details |

| Market Size in 2024 | USD 12.27 Billion |

| Market Size by 2033 | USD 19.53 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 5.3% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Component, Technology, End-user |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | U.S. |

| Key Companies Profiled | Carl Zeiss AG; Danaher Corporation; GE Healthcare; Siemens Healthcare Private Limited; Koninklijke Philips N.V.; Canon Inc.; B. Braun SE; Medtronic; Stryker; Boston Scientific Corporation; ABBOTT; Terumo Corporation |

A key driver of the U.S. neuroscience market is the escalating prevalence of neurological and neurodegenerative disorders. The Centers for Disease Control and Prevention (CDC) reports that Alzheimer’s disease alone affects more than 6 million Americans, with this number expected to double by 2050. Similarly, conditions such as epilepsy, traumatic brain injuries, and Parkinson’s disease are on the rise due to aging demographics, improved diagnosis, and longer life expectancy.

This growing disease burden has heightened the demand for early diagnostic tools, novel therapeutics, and real-time monitoring technologies. The situation has triggered extensive research initiatives backed by governmental and private funding. For example, the BRAIN Initiative, launched by the NIH in collaboration with other U.S. agencies and corporations, is dedicated to revolutionizing our understanding of the brain by accelerating the development of innovative technologies. Such programs are pivotal in driving investments and innovations in neuroscience tools and services, leading to a thriving market.

Despite the enthusiasm and innovation, the high cost associated with neuroscience research and clinical tools poses a major barrier. Advanced instruments such as high-resolution brain imaging systems, electron microscopes, and neuromodulation devices involve substantial capital investment, making them inaccessible to smaller research institutions and community healthcare providers. Additionally, operational and maintenance costs of such equipment, coupled with the need for specialized personnel, further exacerbate the financial burden.

Moreover, while there is a growing market for neuroscience-related pharmaceuticals, the drug discovery process in neurology is notoriously complex and expensive. Failures in clinical trials due to the intricacies of brain-related mechanisms often lead to sunk costs. These economic challenges deter smaller players from entering the market and limit broader adoption of high-end neuroscience technologies in routine clinical settings.

The field of personalized neurology presents a transformative opportunity for the U.S. neuroscience market. The move toward individualized treatments based on a patient’s genetic, molecular, and brain profile is enabling clinicians to better predict disease progression and therapeutic responses. With access to genomic data, advanced imaging, and bioinformatics tools, researchers are now capable of customizing treatment protocols for disorders such as epilepsy, depression, and multiple sclerosis.

This approach also enhances neuropharmacology, allowing for the development of drugs tailored to specific neural pathways or receptor types. For instance, pharmacogenomics is being used to evaluate how different individuals metabolize psychiatric medications, minimizing side effects and improving outcomes. The personalization of care not only improves clinical efficacy but also reduces the trial-and-error aspect of neurological treatment, offering significant cost and time savings. In a nation known for high healthcare innovation, this convergence of neuroscience and precision medicine is expected to unlock significant market potential.

Instruments accounted for the largest market share in the U.S. neuroscience industry. High-resolution imaging systems, electrophysiology tools, neural probes, and neuromodulation devices form the backbone of neuroscience research and clinical application. Academic institutions, hospitals, and pharma R&D centers across the U.S. heavily rely on these instruments for studying neural circuits, diagnosing brain disorders, and conducting invasive and non-invasive procedures. The demand for instruments such as fMRI, PET scans, and EEG systems is rising, especially with their application in cognitive neuroscience and brain mapping.

Software and services are growing at the fastest rate, primarily due to the increasing need to process and interpret complex neurological data. AI-based software platforms that support brain image analysis, neural activity pattern detection, and real-time data interpretation are gaining traction. Furthermore, cloud-based neuroinformatics services are enabling seamless sharing and collaboration across research networks. Companies are offering bundled software with neuro-imaging instruments to facilitate comprehensive analysis, boosting this segment’s expansion.

Brain imaging has emerged as the leading technology segment in the U.S. neuroscience market. Techniques such as MRI, CT, PET, and functional MRI are extensively used for the diagnosis and study of neurological and psychiatric conditions. The non-invasive nature, high-resolution output, and clinical utility make brain imaging indispensable in both research and patient care. Hospitals and research centers are investing in advanced neuroimaging suites to better understand disease pathology and treatment efficacy.

Neuro-cellular manipulation is the fastest-growing segment, attributed to its application in cutting-edge research areas like optogenetics and CRISPR-based interventions. These tools allow scientists to manipulate neurons at the molecular level, observe their functions, and investigate disease mechanisms in real time. The U.S. is witnessing a surge in research using such technologies to explore neurodegeneration, synaptic plasticity, and memory formation, opening up new avenues for disease modeling and therapy design.

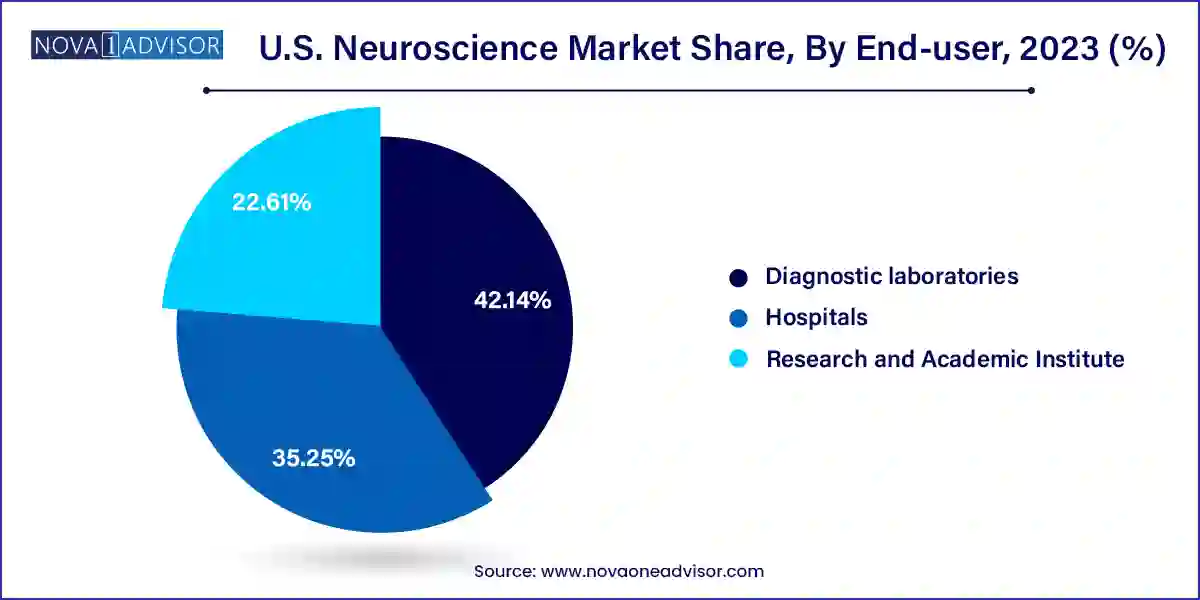

Research and academic institutes represent the largest end-user segment due to their foundational role in neuroscience exploration. Institutions such as Harvard, MIT, Stanford, and the University of California system host some of the most sophisticated neuroscience laboratories in the world. These centers conduct groundbreaking research funded by federal grants (e.g., NIH, DARPA), often collaborating with biotech firms for translational research. The availability of skilled neuroscientists and world-class infrastructure enables them to drive innovation and knowledge dissemination.

Hospitals are the fastest-growing end-users, propelled by the integration of neuroscience in clinical care and surgical planning. Neurosurgery, psychiatry, and neurology departments are increasingly adopting advanced neuroscience tools for pre-operative mapping, seizure monitoring, and neuromodulation therapy. With growing emphasis on mental health and early detection of neurological disorders, hospitals are expanding their neuroscience divisions, contributing to this segment’s rapid growth.

March 2025 – Medtronic announced a collaboration with Mount Sinai Hospital to evaluate its deep brain stimulation (DBS) system for treatment-resistant depression, signaling deeper clinical applications of neuromodulation.

February 2025 – NeuroPace Inc. received FDA approval for expanded indications of its RNS System, enabling its use in a broader spectrum of epilepsy patients.

January 2025 – GE HealthCare launched a new high-definition brain MRI scanner optimized for Alzheimer’s and Parkinson’s research, in partnership with leading U.S. academic centers.

November 2024 – Blackrock Neurotech raised $75 million in Series B funding to scale its BCI platform aimed at restoring communication and mobility for patients with paralysis.

October 2024 – Thermo Fisher Scientific introduced a new range of neuroscience-targeted antibodies and proteomic kits to support neurodegeneration research.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. neuroscience market

Component

Technology

End-user