The U.S. next generation sequencing market size was estimated at USD 4.10 billion in 2023 and is projected to hit around USD 25.71 billion by 2033, growing at a CAGR of 20.15% during the forecast period from 2024 to 2033.

The U.S. Next Generation Sequencing (NGS) market has become one of the most dynamic and transformative sectors in the country’s biotechnology and healthcare landscape. As the demand for personalized medicine, genetic screening, and high-throughput data continues to accelerate, NGS has emerged as a central pillar in unlocking genomic information with speed, precision, and affordability. Once confined to research labs and niche academic projects, NGS technologies are now widely adopted across clinical diagnostics, oncology, reproductive health, infectious disease monitoring, drug discovery, and beyond.

In the U.S., the market benefits from robust investment in biotech R&D, a progressive regulatory environment, and a thriving startup ecosystem. Leading hospitals, research institutes, and clinical laboratories have integrated NGS platforms into daily operations. Simultaneously, consumer genomics services and direct-to-consumer testing (e.g., ancestry mapping and wellness profiling) have introduced sequencing technologies to the public, increasing awareness and adoption.

NGS technologies have revolutionized the way diseases are diagnosed, monitored, and treated. In oncology, for instance, comprehensive tumor profiling through targeted sequencing enables tailored therapies and improved patient outcomes. In infectious diseases, NGS allows rapid strain identification and epidemiological tracking—capabilities that were crucial during the COVID-19 pandemic and continue to influence public health strategies. The application spectrum is expanding daily, fueling innovation and competition across the value chain, from reagents and consumables to data analytics and cloud-based genomic platforms.

Adoption of NGS in Clinical Diagnostics: NGS is increasingly used in clinical workflows for cancer diagnostics, rare genetic diseases, and non-invasive prenatal testing (NIPT).

Emergence of Long-Read Sequencing and Single-Cell Genomics: While short-read technologies dominate, there is growing interest in platforms like Oxford Nanopore and PacBio for more comprehensive genomic insights.

AI-Enabled Genomic Data Analysis: Artificial intelligence and machine learning are being integrated into secondary and tertiary NGS data analysis to manage complex datasets efficiently.

Boom in Consumer Genomics Services: Companies offering ancestry, lifestyle, and wellness testing are democratizing access to genomic insights.

Partnerships Between Pharma and Sequencing Firms: Biopharma companies are increasingly leveraging NGS for biomarker discovery and drug development.

Expansion of Cloud-Based Genomic Platforms: Cloud-native sequencing data platforms are enabling collaboration, real-time analysis, and scalability for researchers and clinicians.

| Report Attribute | Details |

| Market Size in 2024 | USD 4.93 Billion |

| Market Size by 2033 | USD 25.71 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 20.15% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Technology, product, application, workflow, end-use |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Illumina, Inc.; QIAGEN; Thermo Fisher Scientific, Inc.; BGI; Pacific Biosciences; Bio Rad Laboratories; Oxford Nanopore Technologies, Inc.; F. Hoffmann-La Roche AG; Agilent Technologies, Inc.; Eurofins Scientific |

The most influential driver of the U.S. NGS market is the growing application of NGS in oncology, particularly in diagnostics and treatment personalization. Cancer is the second leading cause of death in the U.S., and traditional diagnostic tools often fall short in characterizing complex mutations, leading to suboptimal treatment plans. NGS enables comprehensive genomic profiling (CGP), which helps identify actionable mutations in a patient’s tumor, guiding the selection of targeted therapies and immunotherapies.

One compelling example is companion diagnostics, where an NGS-based test is developed alongside a specific drug to ensure that it is prescribed only to genetically suitable patients. Companies like Foundation Medicine and Thermo Fisher Scientific have partnered with pharmaceutical giants to create these integrated diagnostics. Additionally, liquid biopsy technologies using NGS to analyze circulating tumor DNA (ctDNA) are gaining traction, enabling non-invasive monitoring of treatment response and disease recurrence.

While sequencing costs have dropped dramatically over the past decade, NGS data analysis remains a significant bottleneck. The vast volume of data generated by NGS platforms often hundreds of gigabytes per run requires sophisticated computational infrastructure, skilled bioinformaticians, and standardized interpretation protocols. Primary analysis (base calling), secondary analysis (alignment and variant calling), and tertiary analysis (clinical interpretation) must be executed with high precision to ensure accuracy.

Smaller labs and hospitals often struggle to integrate this workflow, resulting in increased turnaround time and reduced cost-efficiency. Moreover, the lack of universal guidelines for data interpretation poses a risk in clinical contexts. Despite ongoing innovation in AI-driven tools, the need for human validation and regulatory compliance adds to operational complexity. Until simplified, automated, and FDA-approved end-to-end solutions become widely available, this remains a barrier to mainstream adoption.

A promising opportunity for the U.S. NGS market lies in reproductive genomics, especially in non-invasive prenatal testing (NIPT), preimplantation genetic testing (PGT), and newborn screening. NIPT using NGS is rapidly becoming the standard of care for assessing the risk of chromosomal abnormalities such as trisomy 21 (Down syndrome), with significant advantages over traditional screening methods.

With rising awareness, delayed pregnancies, and improved insurance coverage, more expectant parents are opting for NIPT, creating a substantial market for NGS labs and test developers. Similarly, IVF clinics increasingly rely on PGT to select embryos without genetic disorders, improving implantation rates and reducing miscarriage risk. In 2024, several startups launched integrated platforms combining NGS testing, counseling, and personalized reproductive plans, targeting fertility clinics and OB/GYN practices nationwide.

Targeted sequencing and resequencing dominated the U.S. NGS market, particularly in oncology, rare disease diagnostics, and infectious disease surveillance. This technology allows high sensitivity for known genetic markers with lower costs and faster turnaround times compared to whole genome sequencing (WGS). DNA-based targeted panels are widely used in cancer diagnosis to identify specific mutations such as BRCA1/2, EGFR, and KRAS, while RNA-based panels assist in gene fusion detection, often seen in lung cancer and leukemia. Labs prefer targeted approaches due to the lower data burden and streamlined clinical interpretation.

However, whole genome sequencing is projected to be the fastest growing segment, driven by its comprehensive nature and falling costs. WGS is particularly valuable for undiagnosed diseases, complex genetic disorders, and advanced cancer research. In 2025, the NIH funded several U.S. institutions to pilot WGS in newborn screening programs, a move expected to accelerate clinical adoption. WGS also benefits epidemiology and public health by enabling real-time pathogen tracking and variant evolution studies, such as in the case of SARS-CoV-2.

Consumables held the largest market share, due to their recurring use in every sequencing run. Sample preparation kits, target enrichment reagents, and library prep consumables are required for nearly all sequencing workflows, ensuring a steady revenue stream. Companies like Illumina and Qiagen generate a significant portion of their revenue from consumables, which are often platform-specific and proprietary. As sequencing volume increases in hospitals, research labs, and biopharma companies, the demand for high-quality, reliable consumables continues to grow.

Platforms are the fastest growing product segment, especially those combining sequencing and data analysis in one system. New compact and scalable platforms are being adopted by community hospitals and specialty clinics, expanding market reach beyond academic centers. In addition, benchtop sequencers with plug-and-play functionality and cloud-based analytics are attracting mid-sized clinical labs that want end-to-end control without building in-house data infrastructure.

Oncology dominated the application landscape, accounting for the majority of sequencing tests performed in the U.S. In both diagnostics and research, NGS helps identify mutations, predict drug response, and monitor minimal residual disease. Cancer-specific panels are now reimbursed by major insurers, and the FDA has approved multiple NGS-based diagnostics for clinical use. Research institutions are using NGS to uncover novel tumor biomarkers and resistance mechanisms, further enhancing its role in cancer management.

Reproductive health is the fastest growing application, particularly NIPT and PGT. As fertility treatments rise and pregnancy ages increase, prospective parents are increasingly opting for safe, non-invasive, and accurate genetic screening. Startups in this space offer direct-to-consumer genetic testing options, while larger labs are collaborating with OB/GYNs to integrate NGS into routine prenatal care. This trend is expected to continue with advances in single-gene disorder testing and population-wide carrier screening initiatives.

Pre-sequencing steps currently dominate the workflow segment, as they are necessary regardless of application. Library preparation is the most resource-intensive and time-consuming step, especially in high-throughput labs. Commercial kits that streamline DNA/RNA extraction and normalization have become essential tools for labs looking to scale efficiently. Automation in this area—such as robotic liquid handlers and pre-assembled prep kits—has seen increased adoption among labs aiming for reproducibility and speed.

NGS data analysis is the fastest growing workflow, owing to the rise in clinical applications requiring rapid interpretation. As patient data security and compliance grow in importance, cloud-native, HIPAA-compliant data analysis platforms are gaining popularity. Vendors are now offering machine learning-powered pipelines that flag likely pathogenic variants, reducing the burden on genetic counselors and improving clinical decision-making.

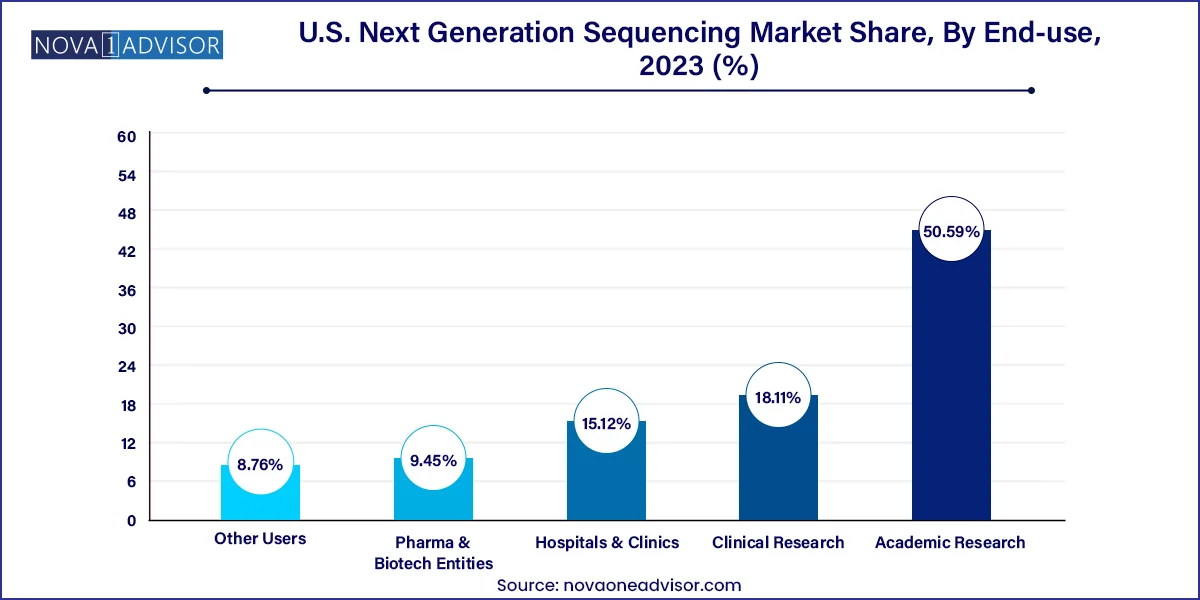

Academic and research institutions remain the largest end-users, due to their historical leadership in genomic science, grant funding, and broad research mandates. Prestigious universities, federal research labs, and consortia like the All of Us Research Program rely heavily on NGS to investigate everything from rare diseases to pharmacogenomics. These institutions also collaborate with industry partners, generating translational insights that inform commercial product development.

Hospitals and clinics represent the fastest growing end-use segment, driven by the clinical integration of NGS. As genetic testing becomes part of standard diagnostics in oncology, cardiology, and prenatal care, hospitals are investing in in-house sequencing capabilities or partnering with specialized labs. This expansion has led to the hiring of molecular pathologists, bioinformaticians, and genetic counselors within clinical settings—transforming patient care delivery.

The U.S. dominates the global NGS landscape through its leading-edge R&D capabilities, biotech ecosystem, and regulatory flexibility. Federal initiatives like the Precision Medicine Initiative and Cancer Moonshot have allocated billions of dollars to genomic research, accelerating clinical adoption and innovation. Academic powerhouses such as Stanford, Harvard, and NIH-affiliated labs consistently push the boundaries of genomic science.

The private sector is equally vibrant. Venture capital investment in genomics startups remains robust, while public companies continue to launch new sequencing platforms, analytics tools, and assay kits. Regulatory bodies like the FDA and CLIA offer clear guidance for clinical implementation, and payers including Medicare have expanded reimbursement for certain genomic tests, further incentivizing adoption.

The U.S. also leads in data governance and cloud computing, making it feasible to manage petabyte-scale genomic data securely and efficiently. National data-sharing initiatives are helping researchers build population-scale biobanks, while hospitals adopt EMR-integrated genomics for personalized medicine. The combination of policy support, consumer demand, and institutional expertise ensures sustained growth and leadership in NGS innovation.

March 2025 – Illumina Inc. announced the commercial launch of the NovaSeq X series, a high-throughput platform capable of sequencing 20,000 genomes annually, aimed at large biobanks and national genomics programs.

January 2025 – Invitae Corporation expanded its reproductive health portfolio by launching a carrier screening panel covering over 500 conditions, powered by its NGS platform.

December 2024 – Thermo Fisher Scientific unveiled a compact, benchtop NGS system designed for rapid oncology panel sequencing in decentralized labs.

October 2024 – Myriad Genetics launched a new AI-driven data interpretation platform to support clinicians in identifying pathogenic variants in inherited cancer syndromes.

August 2024 – 23andMe received FDA approval for an expanded direct-to-consumer genetic test that includes pharmacogenomic insights based on targeted sequencing.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Next Generation Sequencing market.

By Technology

By Product

By Application

By Workflow

By End-use