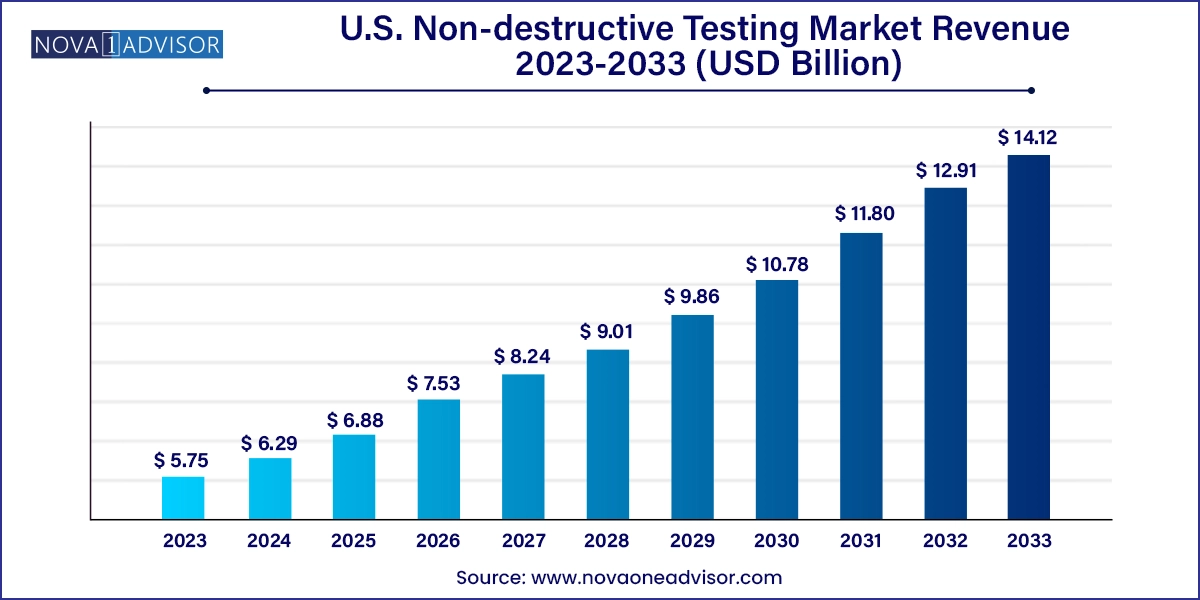

The U.S. non-destructive testing market size was exhibited at USD 5.75 billion in 2023 and is projected to hit around USD 14.12 billion by 2033, growing at a CAGR of 9.4% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 6.29 Billion |

| Market Size by 2033 | USD 14.12 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 9.4% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Offering, Test Method, Vertical |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. |

| Key Companies Profiled | Bureau Veritas; Fischer Technologies Inc.; MISTRAS Group, Inc.; Comet Group (YXLON International GmbH); MME Group; TWI Ltd; Nikon Metrology Inc.; Olympus Corporation; Sonatest; Zetec Inc. |

The increasing technological developments in advanced non-destructive testing (NDT) processes have resulted in better and more precise safety & fault detection. With the presence of a large manufacturing sector in the U.S. and the increasing awareness among manufacturers regarding the adoption of NDT techniques, the U.S. market is anticipated to witness growth in the coming years.

The implementation of NDT techniques in projects saves time and resources due to the detection of faults in complex areas and irregular surfaces, which results in the early completion of projects. This detection and reduction in failures is projected to fuel the demand for non-destructive testing in the coming years. In addition, the ease of operating and efficiency in fault detection provided by ultrasonic equipment, compared to other NDT equipment, is a significant factor contributing to the increasing adoption of the ultrasonic test method. Moreover, advancements in ultrasonic technology anticipated within the next seven years are likely to further boost the adoption of this testing procedure due to its simplicity.

The market is projected to experience significant growth during the forecast period. This growth can be attributed to the increasing construction and manufacturing projects in the U.S. The fast pace of such projects necessitates the implementation of testing processes to ensure the quality of work. This trend is expected to have a positive impact on the growth of NDT in the U.S. market.

Increasing oil and gas projects in the U.S. are expected to deploy NDT techniques to complete the projects in prescribed timelines and with finesse, thus fueling the demand for NDT equipment in the U.S. In addition, the advancements in non-destructive testing technology have led to the development of radiographic testing equipment such as industrial CT scanners, which precisely detect faults in machinery and components. However, the cost of the NDT equipment and the expertise required to perform the tests increases the complexity and difficulty of deploying the radiographic testing method.

The services segment dominated the market with the largest revenue share of 77.1% in 2023 and is expected to remain dominant over the forecast period. Due to the significant upfront cost associated with non-destructive equipment as well as the technicalities involved in deployment and installation, most of the end-users outsource their NDT operations. Furthermore, stringent government regulations pertaining to workplace safety further encourage end-users to outsource their NDT operations to third-party service providers.

The equipment segment is anticipated to witness a steady CAGR from 2024 to 2033. This growth is mainly due to technological advancements, which have resulted in the availability of state-of-the-art equipment variants. The availability of these advanced equipment variants has broadened the range of applications for NDT equipment, thereby generating additional demand.

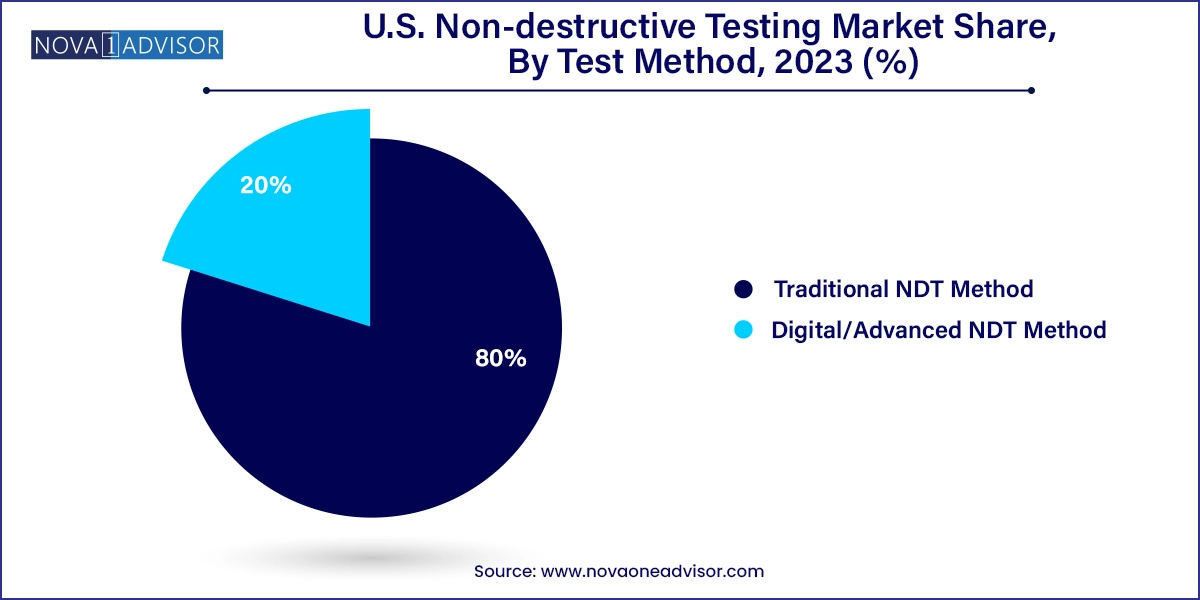

The traditional test method segment dominated the U.S. market with the largest revenue share of 80.0% in 2023. This market growth is due to increasing adoption of traditional non-destructive testing (NDT) methods, including visual testing, magnetic particle testing, liquid penetrant testing, eddy current testing, ultrasonic testing, and radiographic testing. The ultrasonic testing sub-segment dominates the market due to its portability, easy usability, and better accuracy compared to other traditional NDT techniques. The adoption of ultrasonic testing is experiencing significant growth and is expected to dominate in the forthcoming years.

Within the ultrasonic testing segment, phased array ultrasonic testing (PAUT) has emerged as the dominant segment with the largest revenue share of 22.6% in 2023. With the detailed visualization feature offered by the PAUT, which enables the identification of defect size, depth, shape, and orientation, PAUT is the most preferred method and is considered an advanced version of ultrasonic testing as it employs multiple transducers and sets of ultrasonic testing (UT) probes comprised of numerous smaller elements.

The manufacturing vertical segment dominated the market with the largest revenue share of 21.6% in 2022. This growth is a result of the increasing volume of the manufacturing sector in the U.S. The manufacturing vertical is expected to deploy numerous NDT processes thereby leading to an increase in demand for non-destructive testing services in the U.S. Moreover, non-destructive testing has been traditionally used extensively in oil and gas applications. Test methods such as ultrasonic and eddy current have been used to detect cracks in the pipes both underground and elevated. However, with increasing awareness, non-destructive testing techniques are being deployed in several other applications such as aerospace, defense, and automotive.

The oil & gas vertical is further sub-segmented into upstream, midstream, & downstream. The downstream activities in the oil & gas industry include refining petroleum products to produce end products, such as gasoline and kerosene. Refineries and petrochemical plants work with large volumes of oil flowing through tubing, pressure vessels, storage tanks, and pipes. Hence, downstream oil & gas companies particularly need to ensure the safety of the environment, workers, and the facility by ensuring the integrity of equipment and spot welding.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. non-destructive testing market

Offering

Test Method

Vertical