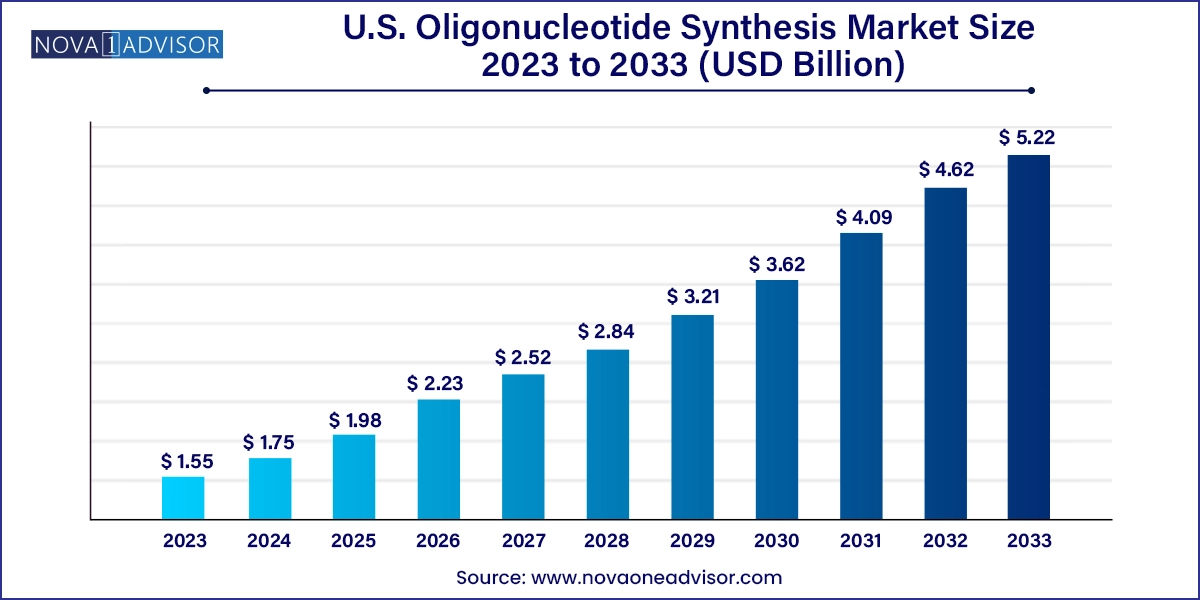

The U.S. oligonucleotide synthesis market size was valued at USD 1.55 billion in 2023 and is anticipated to reach around USD 5.22 billion by 2033, growing at a CAGR of 12.90% from 2024 to 2033.

The U.S. oligonucleotide synthesis market is a cornerstone of modern molecular biology and genetic engineering, supporting innovations across diagnostics, therapeutics, and research domains. Oligonucleotides, which are short sequences of nucleic acids, serve as foundational tools in gene editing, PCR assays, sequencing technologies, antisense therapies, and synthetic biology applications. The market is driven by the rising prevalence of genetic disorders, increasing demand for precision medicine, and expanding applications in emerging therapeutic modalities such as CRISPR gene editing and RNA interference (RNAi).

The synthesis of oligonucleotides has progressed from small-scale laboratory operations to large-scale commercial manufacturing, owing to technological advancements in automated synthesizers, high-throughput purification methods, and improved chemical reagents. The U.S. plays a pivotal role in global oligonucleotide development, benefiting from its leadership in biopharmaceutical innovation, the presence of numerous genomics and life sciences companies, and government funding directed toward biotechnology and personalized medicine. With the evolution of synthetic biology and the growing interest in mRNA and antisense therapeutics, the U.S. oligonucleotide synthesis market is poised for robust growth.

Expansion of Nucleic Acid Therapeutics: Increasing adoption of oligonucleotides in antisense, siRNA, and mRNA-based drugs.

Rising Demand for CRISPR Oligos: Growth in gene-editing research boosts demand for synthetic guide RNAs.

Customization and High-Purity Requirements: Surge in demand for customized oligos with modifications and high purity levels.

Miniaturization and Automation of Synthesizers: Advancements in benchtop and microfluidic synthesizers for on-demand synthesis.

Integration with Synthetic Biology Platforms: Use of synthetic oligos for constructing gene circuits and metabolic pathways.

Increase in Outsourcing and Custom Synthesis Services: Pharmaceutical and biotech firms leveraging CROs for oligo synthesis.

Quality and Regulatory Compliance Focus: Emphasis on GMP-grade oligos for therapeutic development.

| Report Attribute | Details |

| Market Size in 2024 | USD 1.75 Billion |

| Market Size by 2033 | USD 5.22 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 12.90% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product & service, application, end-use |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Thermo Fisher Scientific, Inc.; Merck KGaA; Danaher Corporation; Dharmacon Inc.; Agilent Technologies; Bio-synthesis; LGC Biosearch Technologies; Twist Bioscience; TriLink BioTechnologies; Genscript |

One of the most significant drivers for the U.S. oligonucleotide synthesis market is the growing application of oligos in genetic therapies. Antisense oligonucleotides (ASOs), RNA interference (RNAi), and mRNA-based therapeutics rely heavily on high-fidelity and chemically modified oligos. Drugs such as Spinraza (nusinersen) for spinal muscular atrophy and Onpattro (patisiran) for hereditary transthyretin-mediated amyloidosis exemplify the therapeutic potential of oligonucleotide platforms.

These applications require precise, customizable synthesis capabilities to ensure biological efficacy and patient safety. As the field of gene therapy expands, fueled by regulatory approvals and venture capital interest, oligonucleotide synthesis becomes increasingly critical. The need for scalable, GMP-compliant manufacturing is further propelling growth, particularly as clinical pipelines in rare diseases and oncology continue to integrate nucleic acid-based interventions.

While the market is expanding, a notable restraint is the high cost associated with large-scale oligonucleotide synthesis. Producing therapeutic-grade oligos, especially with complex chemical modifications or in large quantities, requires sophisticated instrumentation, high-quality reagents, and strict adherence to regulatory standards. This elevates production costs and limits accessibility for smaller biotech firms or academic researchers.

Additionally, purification of oligonucleotides to clinical standards demands resource-intensive techniques such as HPLC or PAGE, which can significantly increase timelines and costs. Although technology is progressing, the industry continues to grapple with balancing cost-efficiency and quality assurance, particularly for therapeutic-grade products destined for human use.

The expansion of personalized medicine presents a compelling opportunity for the U.S. oligonucleotide synthesis market. Oligonucleotides play a critical role in PCR-based genotyping, next-generation sequencing, and real-time molecular diagnostics, all of which underpin individualized treatment approaches. The rise of liquid biopsy techniques, for instance, relies on oligo-based probes and primers to detect circulating tumor DNA (ctDNA) or other biomarkers in patient blood samples.

Moreover, oligonucleotide synthesis enables the rapid creation of custom panels and diagnostic assays tailored to specific patient profiles. Pharmaceutical firms are increasingly incorporating companion diagnostics in their therapeutic pipelines, necessitating reliable and scalable oligo production. This alignment between diagnostics and personalized care is expected to fuel substantial demand for both research-grade and GMP-compliant oligonucleotides.

Oligonucleotides, particularly DNA oligos, dominate the product segment due to their foundational use in PCR, qPCR, gene synthesis, and sequencing applications. DNA oligos, whether column-based or array-based, are essential across academic and industrial laboratories for designing primers, probes, and synthetic genes. Their versatility and widespread use in genotyping, cloning, and diagnostic assays contribute to their market dominance. Short turnaround times and increasing customization options have further enhanced their appeal.

RNA oligos are witnessing the fastest growth, particularly CRISPR guide RNAs and long RNA oligos used in gene editing and therapeutic applications. The emergence of mRNA vaccines and RNA therapeutics has amplified the demand for high-purity RNA oligos with specific chemical modifications. CRISPR-Cas9 technologies require high-fidelity single-guide RNAs (sgRNAs), which are synthesized in large volumes for both basic research and translational applications.

PCR primers remain the dominant application, given their indispensable role in diagnostics, research, and routine laboratory processes. Every PCR reaction, from COVID-19 diagnostics to forensic analysis, relies on precisely synthesized primers. Their cost-effectiveness, ease of synthesis, and broad applicability ensure a stable and recurring demand within this category.

Antisense oligonucleotides represent the fastest-growing application, driven by clinical advancements in rare genetic disorders and oncology. ASOs are designed to selectively bind RNA transcripts, thereby modulating gene expression. This targeted approach is especially valuable in diseases lacking conventional drug targets. Ongoing clinical trials and FDA approvals are setting the stage for wider adoption and increased oligo synthesis demand.

Academic research institutes dominate end-user adoption, due to their extensive use of custom oligonucleotides for experimental design, CRISPR editing, and molecular biology assays. University labs, often supported by NIH grants, continue to invest in oligo synthesis for gene function studies, disease models, and synthetic biology experiments. The need for rapid customization and affordable options drives continuous demand in this segment.

Pharmaceutical and biotechnology companies represent the fastest-growing end-use category, fueled by the integration of oligo-based modalities in drug discovery, vaccine development, and clinical diagnostics. With increasing investment in nucleic acid-based therapeutics and gene-editing platforms, these companies require large-scale, GMP-compliant oligo synthesis for both research and clinical-grade products. Strategic collaborations with CDMOs and oligo manufacturers are expanding in tandem with drug development pipelines.

The United States leads the global oligonucleotide synthesis landscape, bolstered by a thriving biotech sector, leading academic institutions, and a favorable regulatory environment. Government agencies like the NIH and BARDA fund oligo-driven research and therapeutics development, creating a robust foundation for innovation. The U.S. FDA has approved multiple oligonucleotide-based drugs, setting regulatory precedents and encouraging further investment.

Regions such as Boston, San Diego, and the Bay Area serve as nucleic acid therapeutics hubs, housing leading firms like Ionis Pharmaceuticals, Alnylam, and Moderna. Contract development and manufacturing organizations (CDMOs) in the U.S. are also ramping up capacity to meet rising demands for clinical-grade oligos. The convergence of diagnostics, personalized medicine, and therapeutic innovation positions the U.S. as a key market for oligonucleotide synthesis now and into the future.

March 2025: Thermo Fisher Scientific announced the launch of a new oligonucleotide synthesizer optimized for RNA and CRISPR applications.

February 2025: Agilent Technologies acquired a startup specializing in high-throughput purification for therapeutic oligos, expanding its clinical oligo synthesis portfolio.

November 2024: Integrated DNA Technologies (IDT) opened a new manufacturing facility in Iowa to scale up production of custom oligos and CRISPR guide RNAs.

August 2024: LGC Biosearch Technologies launched a novel set of fluorescently labeled oligos designed for digital PCR-based diagnostics.

June 2024: Eurofins Genomics announced the enhancement of its oligo modification services to support advanced mRNA therapeutics and vaccines.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Oligonucleotide Synthesis market.

By Product & Service

By Application

By End-use