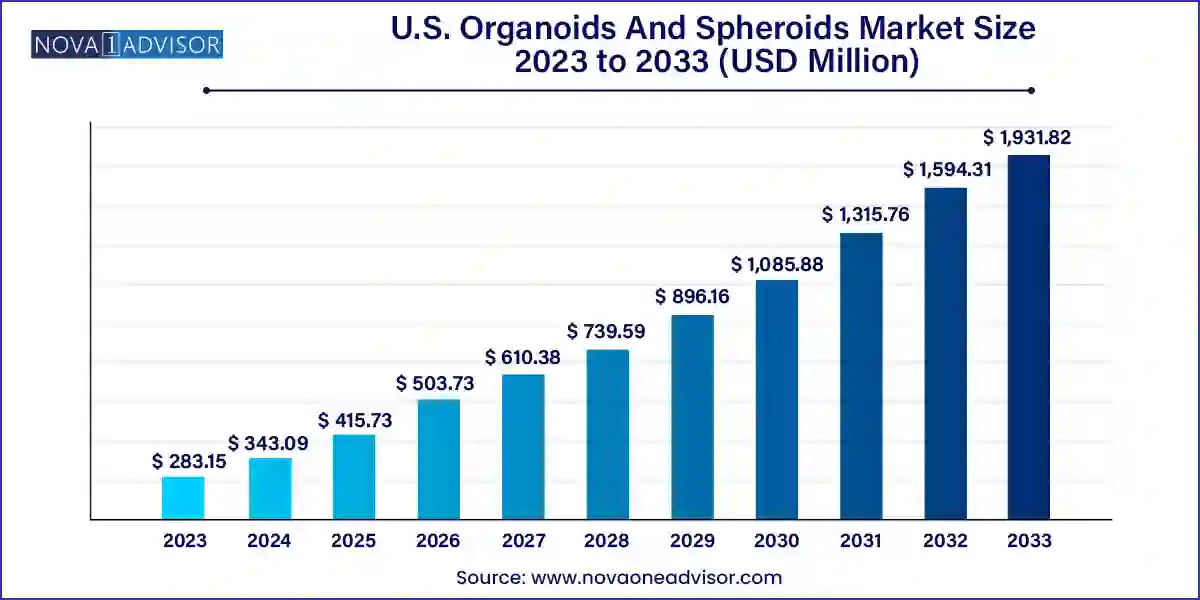

The U.S. organoids and spheroids market size was exhibited at USD 283.15 million in 2023 and is projected to hit around USD 1,931.82 million by 2033, growing at a CAGR of 21.17% during the forecast period 2024 to 2033.

The U.S. organoids and spheroids market is positioned at the cutting edge of biomedical research, drug discovery, and regenerative medicine. Representing a paradigm shift from traditional 2D cell cultures, organoids and spheroids offer 3D biological systems that more accurately mimic the in vivo environment, supporting superior cellular interactions, structure-function relationships, and physiological responses.

Organoids are miniature, self-organizing, three-dimensional structures derived from stem cells or primary tissues. These models closely replicate the micro-anatomy and functionality of human organs, such as brain, liver, kidney, intestine, and pancreas. In contrast, spheroids clusters of cells grown in suspension offer simpler, yet effective platforms to study tumor behavior, metastasis, and therapeutic resistance.

The U.S. is at the forefront of innovation in this space, driven by academic and clinical research institutions, advanced biopharmaceutical pipelines, and increased public-private investments in tissue engineering, stem cell biology, and personalized medicine. The National Institutes of Health (NIH) and other federal agencies continue to fund projects exploring organoid applications in disease modeling, precision oncology, neurodegenerative disorders, and toxicological screening.

Ongoing collaborations between biotechnology companies and research institutes have also accelerated the commercial application of 3D cultures in drug screening, biomarker identification, and preclinical validation, allowing pharmaceutical firms to reduce dependency on animal testing while enhancing prediction accuracy of human responses. As precision medicine gains traction, the demand for patient-specific organoid platforms will only grow, ushering in a new era of functional modeling and personalized therapies.

Shift from 2D to 3D Culture Systems: Enhanced modeling of human physiology using organoids and spheroids is becoming standard in preclinical workflows.

Integration with CRISPR and Genome Editing: Organoids derived from patient cells are being genetically edited to study disease progression and therapy response.

Emergence of Bioprinting for Complex Organoid Assembly: 3D bioprinting is enabling precise architecture and spatial cell arrangement within organoid models.

Use of Organoids in Infectious Disease Modeling: The COVID-19 pandemic highlighted the use of lung and intestinal organoids for viral entry and replication studies.

Commercialization of Ready-to-Use Kits and Reagents: Companies are offering standardized organoid/spheroid culture kits to enable reproducibility and scalability.

Pharma Partnerships and Investment Surge: Pharma giants are partnering with startups to integrate organoids into their drug development pipelines.

Application in Rare and Genetic Disease Research: Disease-specific organoids are being developed to model rare conditions for drug repurposing and testing.

| Report Coverage | Details |

| Market Size in 2024 | USD 343.09 Million |

| Market Size by 2033 | USD 1,931.82 Million |

| Growth Rate From 2024 to 2033 | CAGR of 21.17% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Type, Application, End-user |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | U.S. |

| Key Companies Profiled | Thermo Fisher Scientific, Inc; Sigma-Aldrich Co. LLC; 3D Biomatrix; Corning Incorporated; 3D Biotek LLC; Perkin Elmer, Inc.; Danaher; Prellis Biologics; Aragen Bioscience; Cell Microsystems |

The most powerful growth catalyst for the U.S. organoids and spheroids market is the increasing adoption of personalized medicine platforms, especially in oncology and rare diseases. Traditional preclinical models, such as 2D cultures and animal testing, often fail to accurately predict patient-specific drug responses. Organoids particularly those derived from patient biopsies or iPSCs provide a functionally relevant, scalable platform to screen therapeutic options and customize treatment protocols.

For instance, tumor organoids can be cultured from patient-derived tumor tissues and tested ex vivo for sensitivity to various chemotherapeutic and targeted agents. These organoids preserve the genetic, morphological, and histological characteristics of the original tumor, providing a high-fidelity model of disease. The pharmaceutical industry increasingly relies on such models to de-risk clinical trials, shorten R&D timelines, and identify viable biomarkers. In this way, organoids and spheroids bridge the gap between bench and bedside, driving their integration into mainstream healthcare strategies.

Despite their promise, one of the most pressing restraints in the market is the lack of standardization in organoid and spheroid generation protocols. Different labs and vendors often use diverse culture conditions, media compositions, and growth factors, leading to high variability in organoid morphology, growth rates, and functional behavior.

Reproducibility is crucial, especially in pharmaceutical testing, where batch-to-batch consistency impacts regulatory approval and clinical reliability. Moreover, many organoid models are still labor-intensive and technically demanding, requiring specialized training and infrastructure. While commercial kits help bridge this gap, variability remains a challenge, particularly in multi-center clinical studies and industrial-scale production. Without consensus protocols and robust quality metrics, the translation of organoid platforms from research to clinical and commercial applications may be hampered.

A game-changing opportunity lies in the application of organoids and spheroids in regenerative medicine and tissue engineering. Recent breakthroughs suggest that organoids derived from pluripotent or adult stem cells could be used to regenerate damaged tissues or even replace organ function in diseases like inflammatory bowel disease, liver cirrhosis, retinal degeneration, and chronic kidney disease.

Clinical trials involving transplantation of mini-intestines or retinal organoids are already underway in academic settings. Similarly, spheroids composed of MSC-derived constructs are being used to promote wound healing, cartilage repair, and vascular regeneration. These platforms have the potential to reduce the dependency on donor organs, address chronic disease complications, and offer long-term curative strategies. For CDMOs, hospitals, and biopharma companies, this opens up a multi-billion-dollar opportunity to develop biofabrication, cell banking, and scalable manufacturing platforms tailored for clinical-grade tissue grafts and implants.

Organoids dominated the U.S. market in terms of revenue share, owing to their complexity, functional relevance, and widespread adoption in disease modeling and drug screening. Among organoids, intestinal and hepatic organoids are the most frequently used due to their application in metabolism, liver toxicity testing, and gastrointestinal disease studies. Organoids can replicate organ-like functionality over extended culture durations, making them more valuable in long-term experiments. Moreover, protocols such as air-liquid interface (ALI) methods and Lgr5+ stem cell cultures have enabled long-term maintenance and proliferation of mini-organs, aiding precision oncology and microbiome research.

Spheroids are the fastest-growing segment, primarily due to their ease of use, lower cost, and compatibility with high-throughput screening systems. Particularly, multicellular tumor spheroids (MCTS) are widely used in cancer biology to evaluate tumor architecture, hypoxia gradients, and therapeutic resistance. The simplicity of spheroid formation—via hanging drop, low-attachment plates, and micropatterned devices—makes them ideal for academic labs and early-phase screening. Neurospheres and embryoid bodies are also gaining traction in neurodegenerative disease and stem cell research, respectively. The accessibility and scalability of spheroids make them a vital component in early drug development workflows.

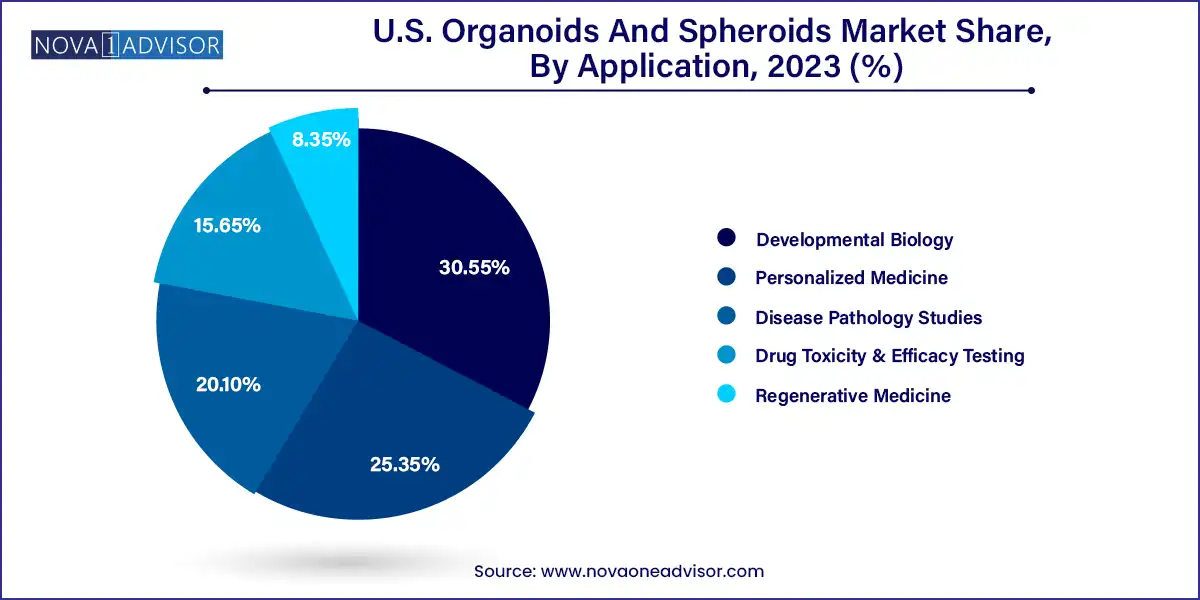

Drug toxicity and efficacy testing was the leading application segment, accounting for the highest market share. The demand for preclinical validation platforms that closely resemble human tissues is driving the use of both organoids and spheroids in pharma R&D. Organoids derived from liver or intestinal tissues are especially valuable in identifying hepatotoxicity or drug-drug interactions, while tumor spheroids are essential for evaluating chemotherapeutic regimens. The reproducibility and predictive value of 3D cultures help pharma companies reduce animal testing, lower R&D costs, and improve clinical success rates.

Regenerative medicine is the fastest-growing application area, as stem cell-derived organoids and MSC spheroids enter preclinical and early clinical trials. Research on cardiac patches, kidney tubules, and brain-region organoids is growing rapidly, and academic collaborations are aiming to commercialize these constructs for implantation. These 3D models not only support tissue regeneration but also provide a scaffold for host integration and vascularization, making them promising tools for next-gen medical therapies. The intersection of organoids with gene editing, bioprinting, and scaffold engineering presents a fertile ground for innovation.

The United States remains the undisputed leader in organoids and spheroids research and commercialization. Home to some of the most renowned medical and research institutions such as the Harvard Stem Cell Institute, Salk Institute, and MD Anderson Cancer Center the U.S. has built a robust ecosystem for translational research, biotech innovation, and clinical applications.

The federal funding landscape through agencies like the NIH, NSF, and BARDA, along with support from private foundations such as the Chan Zuckerberg Initiative and the Gates Foundation, has propelled rapid development and adoption. Biotech clusters in Boston/Cambridge, San Diego, San Francisco, and Research Triangle Park are home to startups and incubators focused on 3D cultures, disease-on-a-chip, and tissue modeling. Simultaneously, collaborations between biopharma and organoid platforms are increasingly leading to preclinical service agreements, co-development pacts, and patient-specific modeling programs.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. organoids and spheroids market

Type

Application

End-use