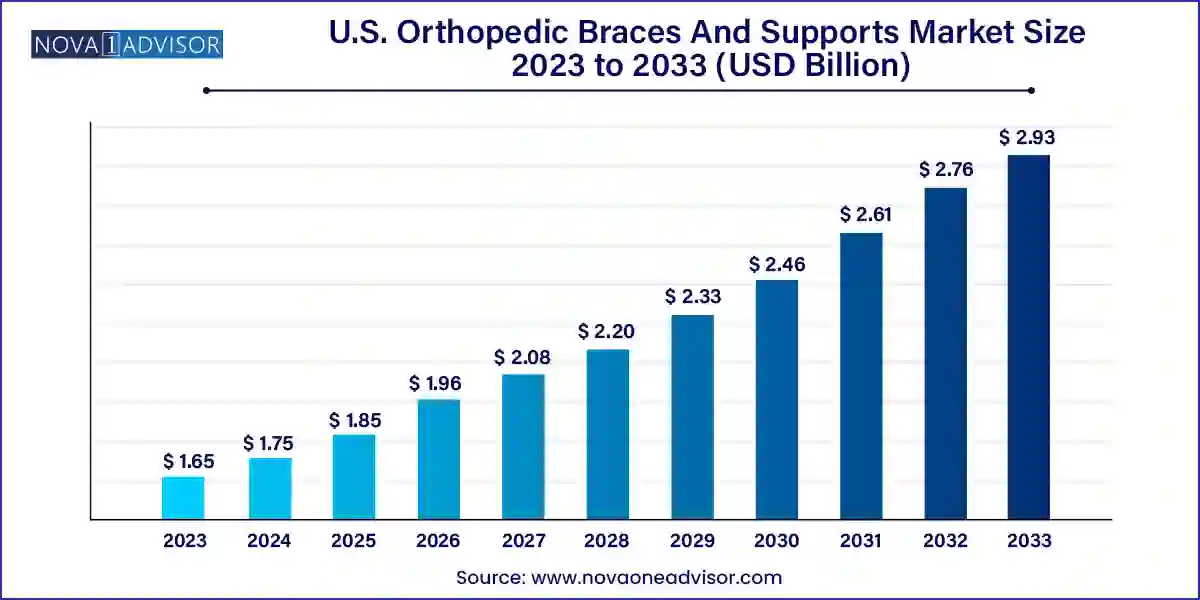

The U.S. orthopedic braces and supports market size was exhibited at USD 1.65 billion in 2023 and is projected to hit around USD 2.93 billion by 2033, growing at a CAGR of 5.9% during the forecast period 2024 to 2033.

The U.S. orthopedic braces and supports market has steadily evolved into a vital component of the nation’s broader musculoskeletal care landscape. Orthopedic braces and support devices play an instrumental role in both acute and chronic orthopedic conditions, facilitating mobility, stabilization, pain management, and injury prevention. This market is buoyed by the confluence of several factors: an aging population, rising incidence of orthopedic injuries, sports-related trauma, post-operative rehabilitation needs, and the increased prevalence of chronic conditions such as arthritis and osteoporosis.

Across the United States, healthcare providers and consumers are increasingly adopting these products not only for therapeutic applications but also as preventive tools in sports and fitness contexts. The availability of a wide range of braces from specialized ligament-supporting devices to multi-functional pain-relieving orthoses has increased consumer accessibility and clinical usability. With the healthcare system placing greater emphasis on non-invasive and cost-effective interventions, orthopedic braces and supports have emerged as frontline solutions for orthopedic management.

In addition, advancements in materials science, coupled with ergonomic and biomechanical innovations, have enabled the development of more lightweight, breathable, and user-friendly devices. Orthopedic supports are now being embedded with smart sensors and responsive materials to provide real-time feedback, thereby improving patient compliance and outcomes. The expansion of online retail and direct-to-consumer channels further supports the growth trajectory of this market, enhancing convenience and price transparency for patients.

Rise in Sports Injuries and Preventive Bracing: Increasing participation in sports and recreational activities across age groups is leading to higher adoption of braces for prevention and injury recovery.

Technological Integration: Incorporation of smart sensors and wearable tech into braces for motion tracking and remote monitoring.

Homecare and Outpatient Shift: Growing shift toward outpatient rehabilitation and homecare settings boosts demand for user-friendly, OTC orthopedic braces.

Customization and 3D Printing: Emergence of custom-fitted braces using 3D scanning and printing for enhanced comfort and clinical efficacy.

Preference for Non-Invasive Treatments: Surge in non-surgical interventions in osteoarthritis and ligament injuries, favoring brace adoption.

Online Retail Expansion: Increasing presence of e-commerce and DTC brands offering braces at competitive pricing with broader access.

Geriatric Population Support: Rising aging demographics demanding assistive devices for mobility, back support, and arthritis management.

Insurance Reimbursement Policies: Improvements in reimbursement coverage for bracing products encouraging use in clinical settings.

Sustainable and Skin-friendly Materials: Focus on hypoallergenic, biodegradable, and breathable materials for prolonged wearability.

Pediatric and Adolescent Bracing: Increasing orthopedic deformities in children (e.g., scoliosis, flat foot) expanding the youth market.

| Report Coverage | Details |

| Market Size in 2024 | USD 1.75 Billion |

| Market Size by 2033 | USD 2.93 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 5.9% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, End-use |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | U.S. |

| Key Companies Profiled | BREG, Inc.; Frank Stubbs Company Inc.; DeRoyal Industries, Inc.; Össur; Fillauer LLC; Ottobock; McDavid; Bauerfeind; Weber Orthopedic LP; DJO, LLC (Enovis) |

Knee Braces & Supports dominated the product segment owing to their widespread application in sports injuries, osteoarthritis management, and post-surgical rehabilitation. Specifically, knee braces for osteoarthritis and ligament injuries remain in high demand. Athletes and elderly populations often rely on unloader and hinged knee braces to stabilize the joint and reduce pain. The growing use of prophylactic braces in contact sports such as football and basketball also contributes to this segment’s dominance. Post-operative knee braces further support patients recovering from total knee arthroplasty, ensuring controlled motion and alignment.

The fastest-growing segment is Walking Boots, particularly pneumatic walking boots, driven by their increasing use in orthopedic fracture care, Achilles tendon injuries, and foot surgeries. These boots offer adjustable pneumatic support, reducing the load on the foot while enabling ambulation. Their adoption is increasing in outpatient surgical centers and among active adults requiring mobility without compromising healing. The convenience of replacing traditional casts with adjustable walking boots also contributes to this segment's rapid growth.

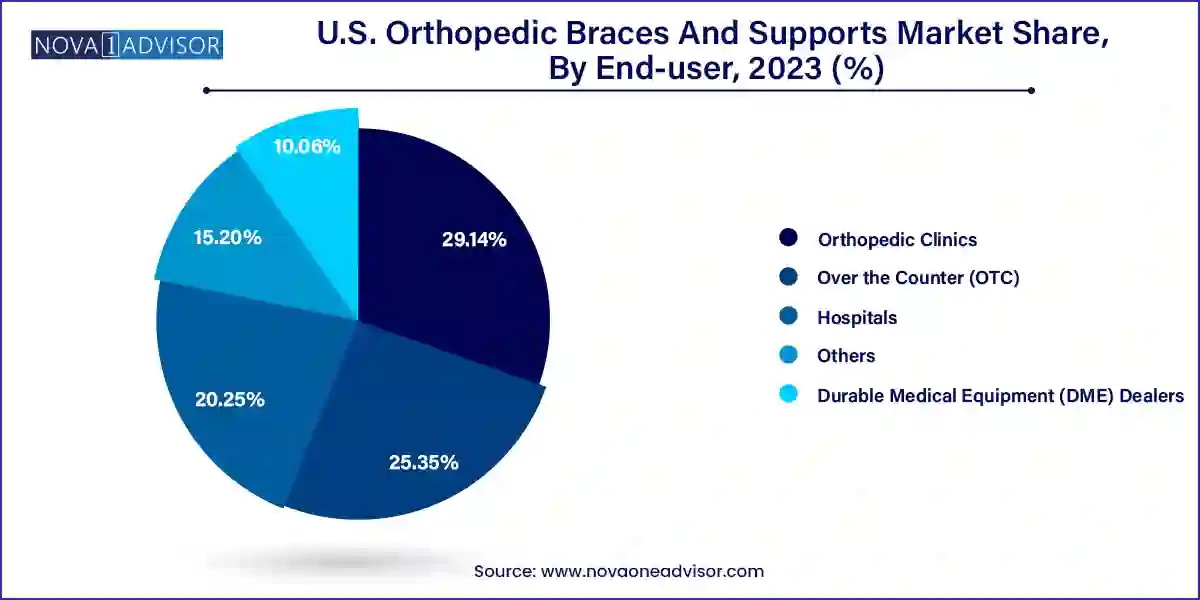

Hospitals remain the dominant end-user, driven by their role in orthopedic surgeries and trauma care. Hospitals procure a wide variety of braces, including pre-operative, intra-operative, and post-operative products. These institutions also offer bracing as part of physical therapy and discharge kits, ensuring continuity of care. The inclusion of bracing in bundled payments and value-based care models encourages integrated usage in surgical episodes.

Over-the-Counter (OTC) is the fastest-growing end-use segment, as more consumers self-manage minor orthopedic issues like sprains, arthritis, and chronic back pain. Retail pharmacies, sports medicine outlets, and online channels stock a broad selection of braces, targeting tech-savvy and wellness-oriented consumers. The rise of health-conscious individuals and aging adults seeking non-prescription solutions continues to propel the OTC market.

The U.S. holds a dominant position in the global orthopedic braces and supports industry due to its well-established healthcare infrastructure, advanced orthopedic practices, and favorable reimbursement mechanisms. The country’s high prevalence of sports injuries, growing elderly population, and adoption of orthopedic interventions in post-operative care make it a lucrative market.

States like California, Texas, and Florida see higher demand for orthopedic braces due to their large populations and high levels of physical activity and sports participation. Major hospital systems such as Mayo Clinic and Cleveland Clinic frequently integrate bracing protocols in orthopedic care. In addition, U.S. military and veteran healthcare systems contribute significantly to the usage of braces, particularly walking boots and knee supports, for rehabilitation after injury.

Digital health trends and regulatory policies in the U.S. also support innovation. The FDA’s 510(k) clearance process continues to streamline the entry of new orthopedic devices, while CMS is gradually expanding its reimbursement scope for bracing and supports used in outpatient settings. With the rise in remote patient monitoring and virtual rehabilitation programs, bracing solutions that integrate with wearables and telehealth platforms are gaining interest.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. orthopedic braces and supports market

Product

End-user