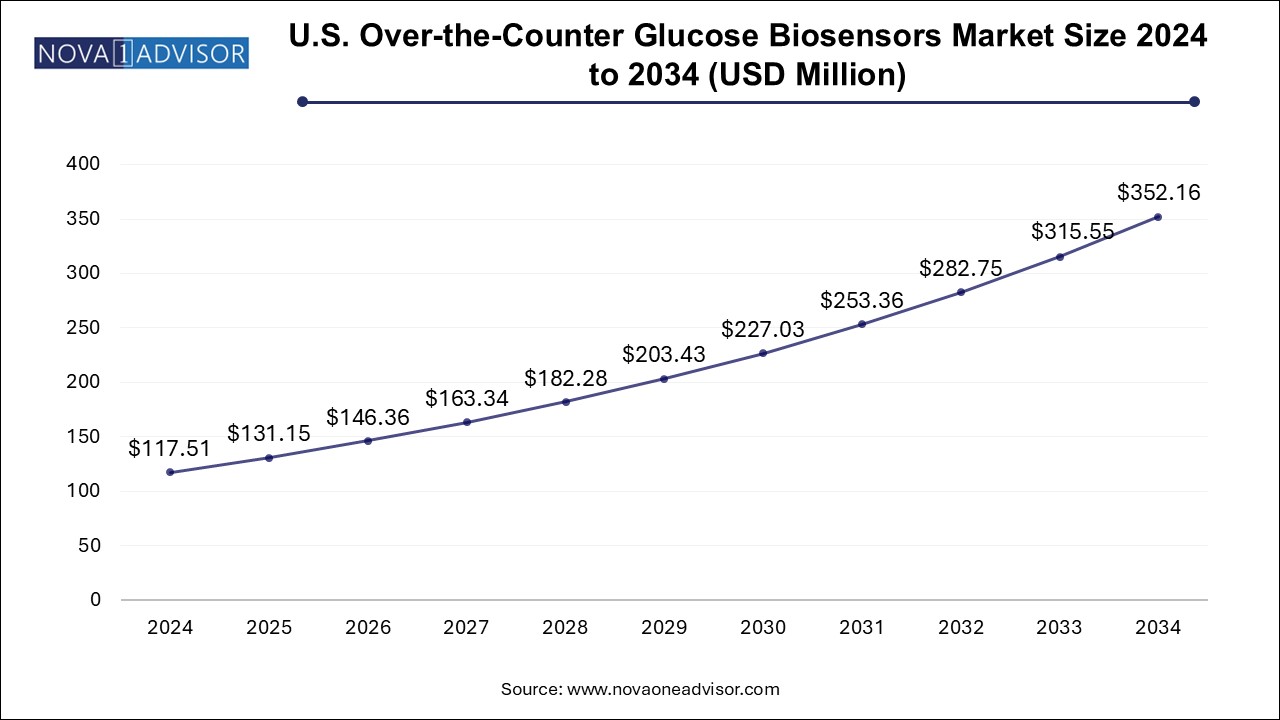

The U.S. over-the-counter glucose biosensors market size was exhibited at USD 117.51 million in 2024 and is projected to hit around USD 352.16 million by 2034, growing at a CAGR of 11.6% during the forecast period 2025 to 2034.

The U.S. over-the-counter (OTC) glucose biosensors market represents a dynamic and fast-growing sector within the broader diabetes management ecosystem. These biosensors—critical components in blood glucose monitoring devices—have become indispensable for millions of Americans managing diabetes and prediabetes. As the incidence of diabetes continues to escalate, especially Type 2 diabetes linked to obesity, sedentary lifestyles, and aging populations, there is a surging demand for real-time, affordable, and non-prescription glucose monitoring tools.

Glucose biosensors function by detecting glucose concentrations in blood, interstitial fluid, or other biological samples using biochemical and electrochemical reactions. OTC biosensors are primarily embedded in self-monitoring blood glucose (SMBG) devices or continuous glucose monitoring (CGM) systems, allowing individuals to monitor their glucose levels without a prescription or the need for clinical oversight. These devices empower patients with greater control over their health, reducing dependence on healthcare providers for routine monitoring and helping prevent complications like neuropathy, retinopathy, and cardiovascular diseases.

The market has benefited from several technological advancements, including miniaturization of sensors, integration with smartphones and wearable devices, and increasing accuracy and response time of readings. In addition, public health initiatives, rising health literacy, and widespread insurance support for diabetes management tools have further accelerated market adoption. Over the past decade, the U.S. has seen a transformation in how diabetic patients engage with their disease, with OTC biosensors enabling proactive and personalized glucose tracking at home, work, or on the go.

Manufacturers are increasingly focused on producing user-friendly devices with painless or non-invasive features, Bluetooth connectivity, and data-sharing capabilities with healthcare providers. As innovation continues, the market is shifting from traditional test-strip-based glucose meters toward continuous and flash glucose monitoring platforms with disposable biosensor patches. Furthermore, the direct-to-consumer (DTC) model is gaining momentum, with several players selling biosensor-enabled devices through retail pharmacies, e-commerce platforms, and subscription models, widening accessibility.

Growing Preference for Non-Invasive or Minimally Invasive Devices: Users are moving away from traditional finger-prick methods toward CGM systems that rely on interstitial fluid biosensors.

Integration of IoT and Wearable Technologies: Glucose biosensors are increasingly integrated into smartwatches, fitness trackers, and mobile applications, enhancing patient engagement.

Direct-to-Consumer (DTC) Distribution Channels Expansion: Retail pharmacies and e-commerce platforms are facilitating broader access to OTC biosensors without clinical gatekeeping.

Shift Toward Subscription-Based and On-Demand Diagnostics: Companies are offering glucose monitoring kits bundled with app subscriptions and monthly refills, streamlining consumer access.

Increasing Use Among Prediabetic and Health-Conscious Consumers: Beyond diagnosed diabetics, glucose biosensors are being adopted by prediabetics, athletes, and those interested in biohacking and metabolic health.

Personalized Data Analytics and AI Integration: Real-time data from biosensors is being harnessed through AI tools to offer predictive alerts, behavioral nudges, and health insights.

Declining Sensor Costs Driving Adoption: As technology matures and economies of scale improve, sensor production costs have decreased, making OTC biosensors more affordable.

| Report Coverage | Details |

| Market Size in 2025 | USD 131.15 Million |

| Market Size by 2034 | USD 352.16 Million |

| Growth Rate From 2025 to 2034 | CAGR of 11.6% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | End-use |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | Abbott; DexCom, Inc. |

A primary driver behind the expansion of the U.S. OTC glucose biosensors market is the rising prevalence of diabetes and the corresponding shift toward patient empowerment and self-management. According to the CDC, over 37 million Americans have diabetes, and nearly 96 million are estimated to have prediabetes. This surge has led to growing awareness about the importance of routine glucose monitoring for preventing disease progression and managing complications.

OTC glucose biosensors allow consumers to monitor their blood glucose levels without requiring physician prescriptions or in-clinic visits. This convenience aligns well with contemporary healthcare paradigms that emphasize decentralization, personalization, and technology-enabled self-care. As people become more proactive about their health and seek tools that offer autonomy and data-driven decision-making, the demand for OTC biosensors is poised to rise significantly. Their ability to deliver quick, reliable readings at the point of care—combined with seamless integration into digital health ecosystems—has made them essential for a wide range of users, from newly diagnosed diabetics to fitness enthusiasts tracking glucose fluctuations during exercise or fasting.

Despite strong growth, a significant restraint for the OTC glucose biosensors market remains the issue of data accuracy and the need for frequent calibration, particularly in lower-cost or non-invasive sensors. Inconsistent readings can lead to poor decision-making around insulin dosing, diet adjustments, or physical activity, which can be dangerous for insulin-dependent patients. While high-end CGMs offer robust accuracy, the widespread availability of low-cost biosensors without adequate regulatory scrutiny raises concerns about quality control and reliability.

Some biosensors also require periodic calibration using fingerstick glucose readings, which diminishes the convenience factor that attracts consumers to OTC options in the first place. Moreover, ambient factors such as temperature, dehydration, or pressure on the sensor site can affect accuracy. For non-prescription users unfamiliar with interpreting data nuances, misleading glucose readings could lead to anxiety or false reassurance. Until sensor accuracy reaches uniformly high standards across all price points, this issue will continue to hinder trust and adoption in certain segments of the consumer base.

The market holds a powerful opportunity in expanding its target user base beyond diabetic patients into preventive and lifestyle-driven healthcare. Increasing interest in metabolic health, wellness optimization, and biohacking has opened doors for glucose biosensors to serve as general-purpose health trackers. Individuals without a formal diagnosis of diabetes are using these devices to better understand how food, exercise, sleep, and stress affect their glucose levels.

Startups like Levels and NutriSense have pioneered this lifestyle application of biosensors, offering subscription-based services that pair CGM patches with real-time analytics and nutritional coaching. These services target fitness enthusiasts, weight-loss seekers, and individuals pursuing low-carb or ketogenic diets who seek metabolic insights. By positioning glucose biosensors as tools for personalized health optimization rather than mere medical devices, companies can access a significantly larger market and tap into wellness-focused consumer segments that prioritize preventive care over reactive treatments.

Homecare has emerged as the dominant end-use segment in the U.S. OTC glucose biosensors market. The convenience, affordability, and immediate availability of these devices have made them a staple in diabetes self-management regimens. Individuals managing chronic conditions like Type 1 or Type 2 diabetes rely on home-based testing several times a day to adjust medication, diet, or activity levels accordingly. The COVID-19 pandemic further catalyzed this shift, as patients sought to minimize visits to healthcare facilities while maintaining consistent health monitoring. Homecare also supports greater autonomy for elderly patients and those in remote areas who may face mobility issues or transportation barriers. The user-centric design of modern biosensors—with large displays, minimal setup steps, and audible alerts—caters effectively to this demographic.

The Meanwhile, specialty clinics are projected to be the fastest-growing end-use segment during the forecast period. These include outpatient diabetes centers, endocrinology clinics, and metabolic health facilities that provide targeted support for glycemic control. Specialty clinics often incorporate OTC biosensors into initial consultations, ongoing monitoring programs, and patient education sessions. As healthcare shifts toward outcome-based reimbursement models, clinics are increasingly incentivized to empower patients with tools like biosensors to reduce long-term complications and hospitalizations. The integration of biosensors into remote patient monitoring (RPM) programs, especially for high-risk populations, is also accelerating their adoption in these settings.

The United States presents a unique landscape for the OTC glucose biosensors market, shaped by its expansive healthcare ecosystem, high chronic disease burden, and consumer-driven health behavior. The country's robust insurance infrastructure—coupled with evolving reimbursement policies—has made glucose monitoring devices more accessible even outside the formal healthcare system. States with high diabetes prevalence, such as Mississippi, Alabama, Louisiana, and West Virginia, represent critical hotspots for market penetration, especially in rural and economically disadvantaged areas.

Urban centers such as New York, Chicago, Los Angeles, and Houston are witnessing a surge in tech-enabled biosensor adoption driven by a tech-savvy, health-conscious consumer base. E-commerce channels, including Amazon, Walmart Online, and direct-to-consumer portals from device manufacturers, are playing an increasingly important role in distributing biosensors across all 50 states. Additionally, retail giants like CVS and Walgreens have dedicated shelf space to OTC biosensors, with in-store promotional campaigns aimed at pre-diabetic and newly diagnosed consumers.

Public-private partnerships are also fostering market growth. For instance, the National Institutes of Health (NIH) and the CDC have launched multiple outreach programs that include community screenings using biosensor-based glucose testing. This aligns with the Biden administration’s broader goals to reduce the economic burden of chronic diseases through early detection and intervention.

March 2025: Abbott Laboratories launched its “FreeStyle Libre Smart Pack,” a bundled offering that includes OTC biosensors, a Bluetooth-enabled reader, and app access. This launch is aimed at improving self-monitoring for individuals with pre-diabetes.

February 2025: Dexcom expanded its online sales platform to include an OTC version of its glucose sensors for non-insulin-using patients, making it easier for users to purchase without prescriptions.

January 2025: Roche Diabetes Care partnered with Kroger Pharmacy to roll out discounted OTC glucose meters and biosensors under a new preventive health initiative across 1,200 retail stores.

October 2024: Walmart Health expanded its private-label line of OTC glucose testing kits under the “ReliOn” brand, citing rising demand among uninsured and underinsured populations.

August 2024: Trividia Health introduced an upgraded version of its “True Metrix Air” biosensor system, featuring enhanced accuracy and real-time Bluetooth syncing for better home monitoring.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. over-the-counter glucose biosensors market

By End-use