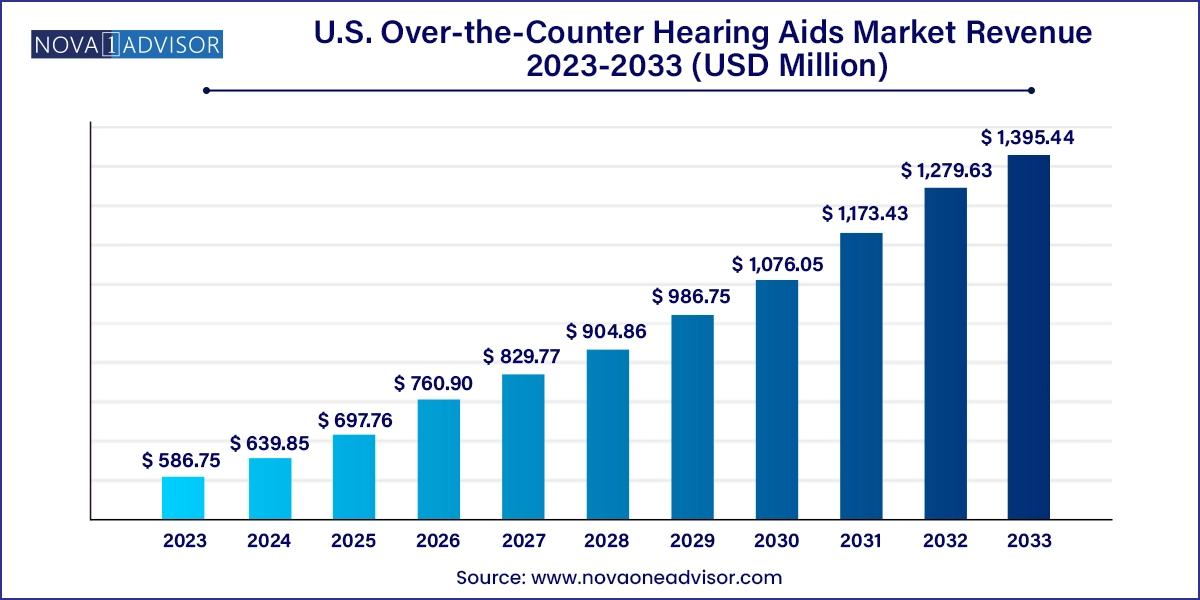

The U.S. Over-the-Counter hearing aids market size was exhibited at USD 586.75 million in 2023 and is projected to hit around USD 1,395.44 million by 2033, growing at a CAGR of 9.05% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 639.85 Million |

| Market Size by 2033 | USD 1,395.44 Million |

| Growth Rate From 2024 to 2033 | CAGR of 9.05% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Technology, Distribution Channel |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. |

| Key Companies Profiled | Eargo Inc.; GN Store Nord A/S (Jabra); Bose Corporation; MDHearing; Audicus; Sony Corporation; Starkey Laboratories, Inc. (Starkey); hearX IP (Pty) Ltd. (Lexie); Sonova; WSAudiology; NUHEARA LIMITED; Audien Hearing; Novidan. |

The increasing prevalence of deafness, the rising adoption of hearing aids, and the growing number of new launches of products are some of the major factors expected to facilitate market growth over the forecast period. The key factors driving the accessibility of Over-the-Counter (OTC) hearing aids in the U.S. are cost-effectiveness, a wide distribution channel of OTC hearing aids, and simplified regulation by the U.S. government for OTC hearing aids.

Hearing loss or impairment is a common condition in the U.S. with the presence of industries such as defense and manufacturing, which cause significant noise pollution. As per Deafness and Hearing Loss Statistics in June 2023, over 48 million people across the U.S. live with some level of hearing loss. Furthermore, over 22 million people are exposed to hazardous noise levels in their workplaces. This is mainly due to the rise in noise pollution and increasing life expectancy, which is leading to a high incidence of age-related hearing loss.

OTC hearing aids have lower prices when compared to prescription products and, hence, are more affordable. This is one of the important factors responsible for the growing demand for OTC devices. According to the American Speech Language Hearing Association, the estimated average price of the product is around USD 1,500 per pair compared to that of prescription hearing aids, which range from USD 1,000 to USD 7,000 per pair.

The canal hearing aids segment dominated the market, accounting for the largest share of 33.05% in 2023. Technological advancements, new product approvals, and compact design are some of the key factors expected to drive market growth. The canal hearing aids segment includes Invisible-In-the-Canal (IIC), In the canal (ITC), and Completely-In-Canal (CIC) hearing aids. The design facilitates eliminating external noise, which is anticipated to drive the adoption of these devices. For instance, in January 2024, Eargo, Inc. launched Eargo SE. The Eargo SE is a simplified, self-fitting OTC device tailored to Eargo’s hallmark essentials: Open-fit, rechargeable, virtually invisible, lifetime support, and CIC form factor.

According to the National Center for Health Statistics, published in February 2023, about 37.5 million Americans, constituting roughly 15% of adults aged 18 and above in the U.S., have trouble hearing without the assistance of a hearing aid. This positions deafness as the third most prevalent chronic health issue in the U.S. As a result, the adoption of canal hearing aids is expected to surge as they are highly discreet and barely noticeable.

However, the Behind-the-Ear (BTE) hearing aids segment is expected to witness the fastest growth over the forecast period from 2024 to 2033. This can be attributed to its diverse advantages, such as ease of handling and high preference by the young population. These devices fit properly into various ear molds, eliminating the need for device replacement in case of growing children.

The retail stores segment dominated the market, with a share of 48.90% in 2023. This can be attributed to higher profit margins in retail stores and an increase in the availability of OTC hearing aids in retail stores. Customers can purchase these devices directly from retail places, either in person, via mail, or online. To sell OTC products, retailers do not require a licensed professional, such as an audiologist.

In addition, retailers such as CVS, Walmart, and Walgreens are implementing expansion strategies to enhance the sales of OTC hearing aids. For instance, in October 2022, Walgreens added OTC hearing aids to its 8,000+ retail locations. Some OTC hearing aids available in retail stores like CVS, Walmart, Walgreen, Hy-Vee, Inc., and Sam’s Club are Lexie B1 Self-fitting, Lucid Hearing Enrich PRO, Go Prime OTC Hearing Aids, and Liberty SIE 128, among others.

However, the online segment is projected to exhibit the fastest growth at a CAGR over the forecast period. This can be attributed to the increasing penetration of e-commerce channels and their higher adoption. Furthermore, technological advancements are another major factor expected to significantly boost the online segment's growth. Online platforms provide a seamless shopping experience with various features, such as product recommendations, virtual shopping, and personalized customer support. These advancements have enhanced the online shopping experience for consumers and have contributed to the popularity of the online distribution channel.

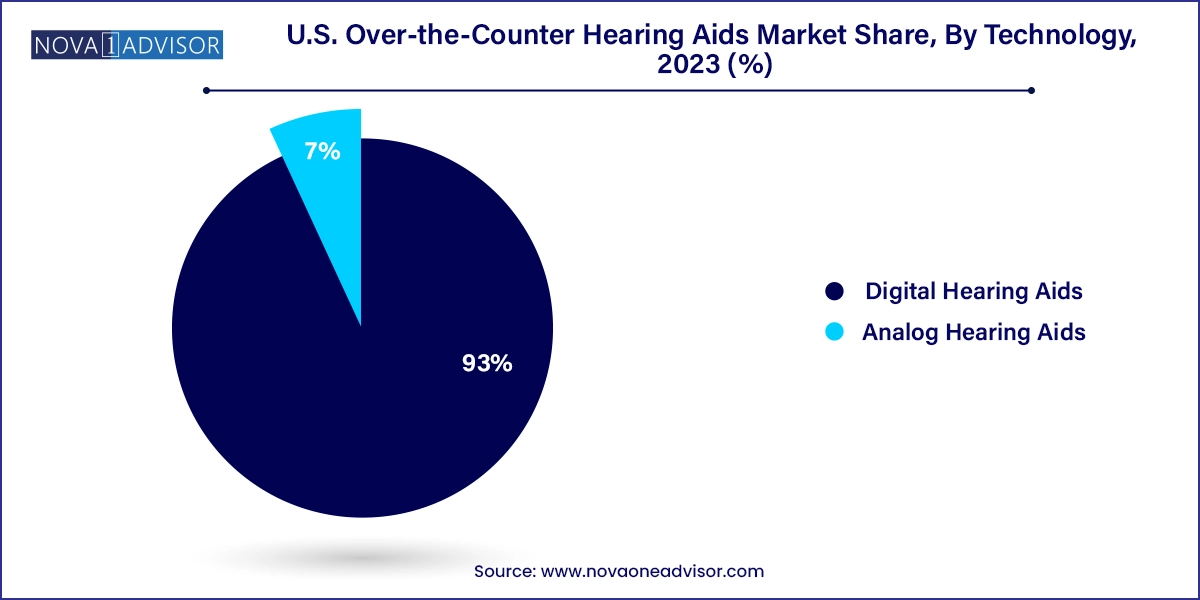

Based on technology, the digital hearing aids segment dominated the market with a share of 93.0% in 2023 and is expected to retain its position during the forecast period. Digital hearing aids can be programmed according to the external environment to amplify sound and reduce noise. These devices are technologically advanced and eliminate background noise, providing an enhanced hearing experience.

Digital hearing aids have several advantages over traditional analog hearing aids, such as directional microphones, feedback reduction, signal processing, speech enhancement, and noise reduction. In addition, companies are developing a new generation of digital hearing aids along with innovative technology and improved compatibility with smartphones, propelling segment growth. Furthermore, increased awareness about digital devices and their usage is expected to facilitate market growth in the U.S.

The analog segment is expected to witness substantial growth over the forecast period. Analog hearing aids work by raising the intensity of continuous sound waves. All sounds, including noise & speech, are uniformly amplified by these devices. In some analog devices, a microchip embedded in the device allows the user to program different settings to suit diverse listening environments.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Over-the-Counter hearing aids market

Product

Technology

Distribution Channel