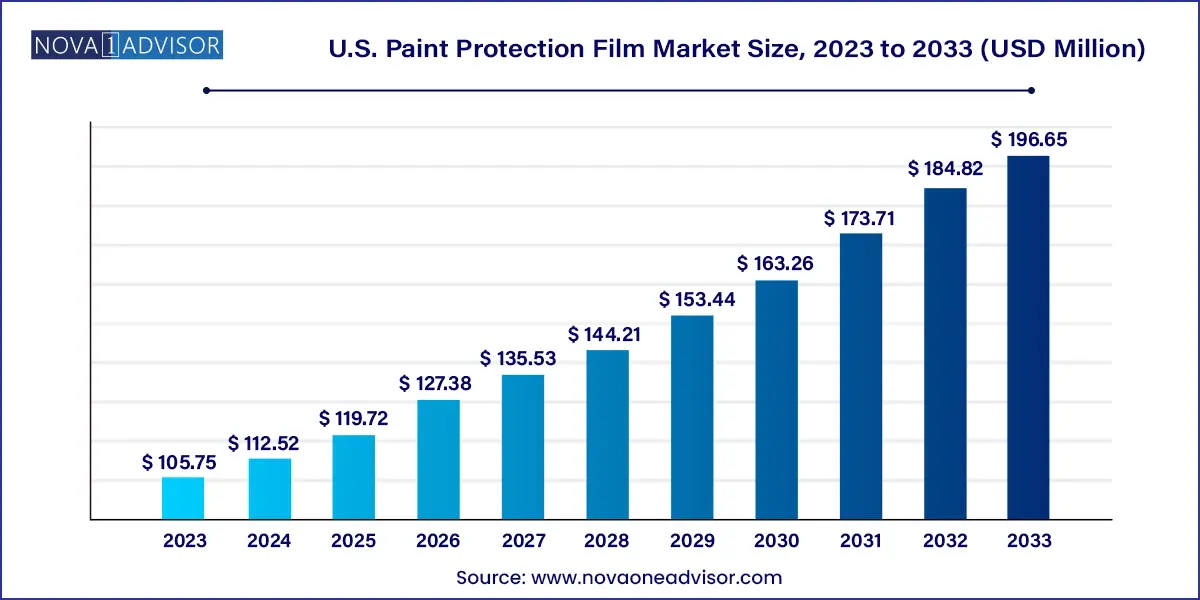

The U.S. paint protection film market size was exhibited at USD 105.75 million in 2023 and is projected to hit around USD 196.65 million by 2033, growing at a CAGR of 6.4% during the forecast period 2024 to 2033.

The U.S. Paint Protection Film (PPF) market is a significant segment of the vehicle protection and aftermarket automotive care industry, with rapidly expanding applications across multiple domains including transportation, electronics, and defense. Paint protection films are clear or colored urethane films applied over painted surfaces to shield them from abrasion, chipping, weathering, and minor impacts. These films offer a dual benefit enhancing aesthetics while preserving the value and integrity of high-end products such as automobiles, aircraft, and consumer electronics.

The market has seen remarkable growth over the last decade due to rising consumer awareness around vehicle care, the increasing value-consciousness of car buyers, and the surge in sales of luxury and performance vehicles in the United States. Paint protection films are no longer restricted to exotic car enthusiasts; mainstream vehicle owners are also investing in partial or full-body PPF wraps to preserve factory paint and resale value. The rise in online detailing content, social media influence, and ceramic coating integration has contributed to the cultural mainstreaming of PPFs.

Beyond the automotive segment, paint protection films have found expanding roles in aerospace, where lightweight and damage-resistant coatings are necessary, and electronics, where high-touch gadgets like smartphones and tablets require durable, transparent protective layers. With increased innovation in self-healing materials, hydrophobic coatings, and matte finish variants, manufacturers are pushing the boundaries of what PPFs can do resulting in strong growth projections for the coming years.

Surging demand for matte and satin finish PPFs: Consumers are increasingly choosing non-glossy finishes for a unique and premium aesthetic.

Integration of self-healing nanotechnology: Films that can repair light scratches via heat or ambient temperature are becoming standard in high-end installations.

Wider adoption among non-luxury vehicle owners: Mainstream car buyers are recognizing the long-term value of protective films in preserving their vehicles.

Growth of DIY and consumer-grade PPF kits: E-commerce platforms and YouTube tutorials have fueled demand for self-installation solutions.

Customization and colored PPFs gaining popularity: Vehicle wraps combining color and protection are transforming cars into artistic expressions.

OEM integration of PPF at factory or dealership levels: Auto manufacturers are exploring direct-to-consumer PPF offerings on new models.

Expansion of PPF to marine and recreational vehicles (RVs): High-net-worth individuals are protecting boats and RVs from salt, debris, and sun exposure.

Sustainability push with recyclable TPU-based PPFs: Eco-conscious brands are innovating with environmentally responsible alternatives.

| Report Coverage | Details |

| Market Size in 2024 | USD 112.52 Million |

| Market Size by 2033 | USD 196.65 Million |

| Growth Rate From 2024 to 2033 | CAGR of 6.4% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Material, Application |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. |

| Key Companies Profiled | 3M, XPEL, Inc., Dow Chemical, Eastman Chemical Company, Hexis S.A.S, PremiumShield, STEK-USA, Reflek Technologies Corporation, Avery Dennison Corporation, Saint-Gobain S.A. |

A key driver of the U.S. paint protection film market is the surge in luxury and performance vehicle ownership across the country. Buyers of premium vehicles, such as Tesla, BMW, Mercedes-Benz, Porsche, and Lexus, are increasingly inclined to protect their significant automotive investments. These vehicles often feature high-gloss or metallic paint finishes that are vulnerable to swirl marks, stone chips, and bird droppings, especially in urban and highway environments.

With the average cost of new luxury cars climbing and longer financing terms becoming common, owners are motivated to maintain showroom-like appearance for years. Paint protection films offer a nearly invisible layer of armor that helps preserve the factory finish while allowing for easy cleaning and maintenance. Some owners are willing to pay $2,000–$7,000 for full-body installations, showcasing the perceived value and importance of PPF in the luxury vehicle ownership experience.

Despite growing awareness and demand, the U.S. PPF market is somewhat restrained by the high cost of professional installation and the technical skills required. Unlike simple vinyl wraps or detailing services, PPF installations demand specialized training, cleanroom environments, and precision tools to avoid bubbles, misalignment, or adhesive failure.

For full-body wraps, the cost can exceed several thousand dollars, placing PPF out of reach for budget-conscious vehicle owners. Additionally, improper installations can lead to edge peeling, orange peel textures, or trapped debris—diminishing the intended protective benefits. Although DIY kits have become popular, they still face criticism for limited durability and aesthetic issues compared to professionally installed solutions. These factors may slow down mass adoption unless manufacturers and installers work to reduce costs or improve access to affordable, user-friendly alternatives.

One of the most promising opportunities in the U.S. PPF market lies in the diversification of applications beyond traditional automotive use. In sectors such as aerospace, defense, marine, and consumer electronics, PPF technology is being adapted for specific protective purposes. In aerospace, PPFs help mitigate corrosion and erosion on wing edges, nose cones, and rotor blades without adding significant weight or requiring constant repainting.

Similarly, in electronics, high-end smartphones, tablets, and smartwatches benefit from ultra-thin, optically clear films that resist scratches and smudges. With the growing prevalence of personal and enterprise-grade electronic devices, manufacturers are exploring OEM-level integration of protective films. Furthermore, high-net-worth consumers are installing PPFs on yachts, RVs, and even custom furniture and architectural elements like kitchen surfaces and glass railings. This multi-industry versatility significantly expands the addressable market for film manufacturers and installers in the United States.

Thermoplastic Polyurethane (TPU) is the dominant material segment in the U.S. paint protection film market, primarily due to its superior elasticity, transparency, and resistance to environmental stressors. TPU-based films are self-healing, allowing light scratches to disappear when exposed to heat or sunlight. They also offer high elongation and impact resistance, making them suitable for curved vehicle surfaces, mirrors, hoods, and fenders. Leading brands such as XPEL, 3M, and SunTek base their premium PPF products on TPU due to its balance of flexibility and durability. In addition, TPU films offer better UV protection, helping prevent yellowing and cracking over time.

Polyvinyl Chloride (PVC), while traditionally used in vinyl wraps and signage, is gaining some niche adoption in cost-sensitive PPF applications. Though less flexible and more prone to cracking under stress, PVC-based films are more affordable and can be used on flat or less exposed vehicle surfaces. These films are also common in budget-oriented DIY kits, especially for temporary use. However, their limited self-healing and weather resistance properties mean they are more suited for indoor or decorative applications than for long-term protection.

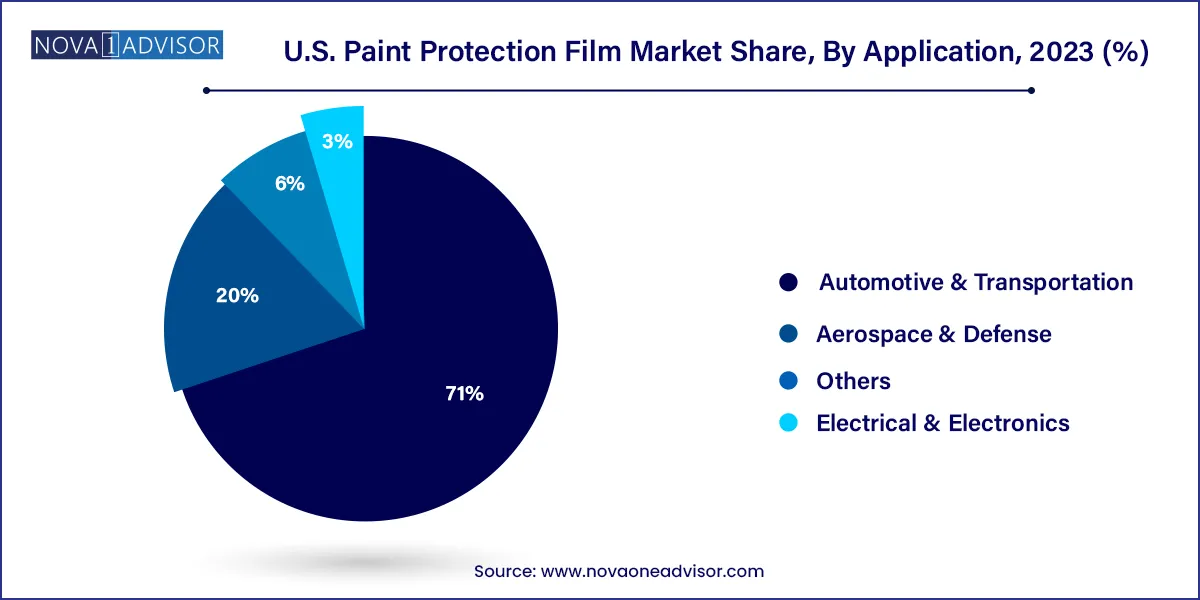

Automotive & transportation applications dominate the U.S. paint protection film market by a wide margin. PPF has become a staple of the aftermarket automotive detailing industry, with service providers offering everything from bumper packages to full-body wraps. The explosion of social media content from auto detailing professionals has demystified PPF for general consumers, while dealership-level offerings for new vehicles have made PPF more accessible. Vehicle leasing companies and fleet managers are also investing in PPF as a means of preserving residual value, particularly for high-mileage service vehicles and luxury fleet models.

Aerospace & defense is emerging as the fastest-growing application segment due to increasing emphasis on lightweight durability in aircraft maintenance and military applications. Helicopter rotor blades, leading edges of wings, and fuselage areas are being protected using advanced, low-profile PPFs that resist UV radiation, sand abrasion, and high-speed particulate damage. In military applications, matte and camouflage-patterned films are being tested for use on land vehicles to enhance visual stealth and durability. With the defense sector's growing interest in material longevity and cost efficiency, PPFs offer an elegant solution to surface preservation without recurring painting expenses.

The U.S. represents a highly developed market for paint protection films, characterized by widespread vehicle ownership, a mature automotive aftermarket, and a culture of automotive aesthetics and care. In metropolitan regions such as Los Angeles, Miami, Houston, and New York City, PPF installations are a status symbol among luxury car owners. Many car dealerships, especially those catering to high-end brands like Porsche, Tesla, and Mercedes-Benz, now offer factory-backed or third-party PPF packages.

The United States also hosts some of the world’s leading PPF manufacturers and training academies, which has helped in maintaining high installation standards. Franchises and mobile PPF businesses are expanding nationwide to serve suburban and rural markets. Additionally, the U.S. government’s procurement and maintenance departments are exploring PPF use for federal fleets, military vehicles, and aerospace equipment. The prevalence of extreme weather—such as snow, road salt, and UV exposure—further increases the utility of PPF in protecting paint from premature wear and tear.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. paint protection film market

Material

Application