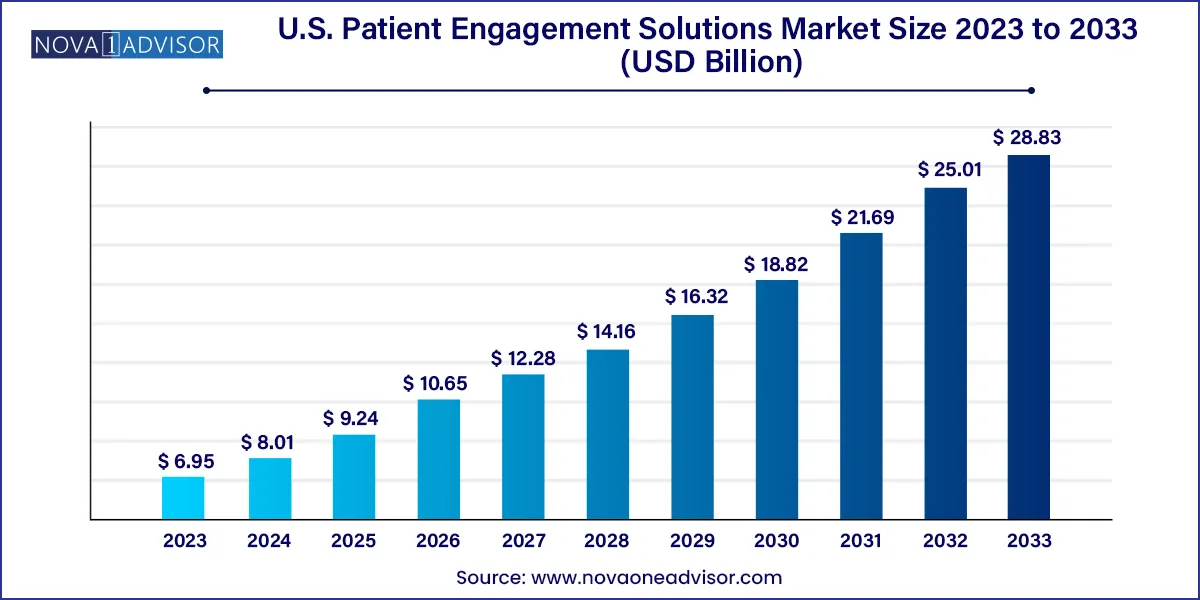

The U.S. patient engagement solutions market size was exhibited at USD 6.95 billion in 2023 and is projected to hit around USD 28.83 billion by 2033, growing at a CAGR of 15.29% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 8.01 Billion |

| Market Size by 2033 | USD 28.83 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 15.29% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Delivery Type, Component, Type, Service Type, Functionality, Therapeutic Area, Application, End-user |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | U.S. |

| Key Companies Profiled | Cerner Corporation (Oracle); NextGen Healthcare, Inc.; Epic Systems Corporation; Allscripts Healthcare, LLC; McKesson Corporation; ResMed; Koninklijke Philips N.V.; Klara Technologies, Inc.; CPSI; Experian Information Solutions, Inc.; athenahealth, Inc. |

Growing adoption of digital health technologies, consumerism in healthcare, the COVID-19 pandemic, and supportive government initiatives are some of the key drivers of this market. Other factors contributing to the market growth include the rising prevalence of chronic diseases and the presence of key companies. Major players in the U.S. are involved in deploying various strategic initiatives to increase their market share.

The COVID-19 pandemic significantly propelled the market. The market players were involved in the launch of new solutions and features in response to the pandemic while government and regulatory bodies supported the adoption with favorable policies. For example, in April 2021, the American Medical Association published a 128-page playbook for implementing Telehealth during a pandemic. It was intended for practices that were yet to adopt Telehealth but were looking to make a rapid start.

In February 2021, Mytonomy collaborated with Media & Entertainment Services Alliance to make new COVID-19 safety and vaccine content available through its platform. In December 2021, GetWellNetwork launched additional GetWell Loop digital care plans to support the COVID-19 vaccine distribution across the U.S. Increasing awareness regarding U.S. patient engagement solutions by government organizations such as the Agency of Healthcare Research and Quality and The Office of National Coordinator for Health Information Technology are expected to fuel the market growth.

Also, the provision of funds for the implementation of health information exchange systems by the government and non-government organizations along with improved reimbursement policies are anticipated to increase the demand for patient engagement solutions during the forecast period. Rising healthcare consumerism is another key factor estimated to propel market growth. Patients are becoming increasingly active in taking charge of their healthcare journey and care management.

This trend of empowered consumers is expected to demand more quality and value in their care delivery and engagement with their providers just like shopping for any other good or service. Market players are leveraging technology in healthcare to facilitate easier access to services and to speed up the transformation to a more patient-friendly system. In July 2019, IQVIA invested USD 14 million along with other investors in a series B round, in 'Belong.Life', a provider of social media apps for cancer patients.

This is one of the many examples of investments by market players in patient engagement solutions and technologies and is thus expected to contribute to market growth. In November 2018, Force Therapeutics LLC received USD 21 million in investment in a round led by Insight Venture Partners. This supported the company’s plans for national expansion across major health systems, rapid product development, and client acquisition.

The web & cloud-based solutions segment dominated the U.S. patient engagement solutions market by delivery type in 2023 and is also anticipated to expand at the fastest CAGR of over 15%. Government initiatives such as the Electronic Health Record Incentive Program, which aims at increasing U.S. patient engagement with the help of patient portals, are anticipated to propel the growth during the forecast period.

In May 2019, Icon plc released a web-based clinical trial platform, to deliver patients with study-related data and connectivity with the nearest investigative location. Elsevier, on the other hand, launched PatientPass, a cloud-based patient education platform in the U.S. in September 2020. In October 2020, Cerner extended its partnership with Amazon Web Services (AWS) by allowing users of the Halo fitness tracker to share data directly with their providers. The collaboration with Amazon also includes the migration of many of Cerner’s solutions to the public cloud.

The software & hardware segment contributed to the largest share of the market by component in 2023 and is also estimated to grow at a CAGR of 15.5% during the forecast period, as patient engagement solutions are primarily software-centric. Patient engagement solutions help doctors educate the patients and engage them in order to enhance treatment efficiency. It helps in recording patient information and helping the doctors in setting patient appointments, diet, and medication records. The patient-doctor sessions can be recorded and stored on patient portals for further analysis and interpretations. This facilitates patient participation and reduces the readmission rate.

The growing use of mhealth Apps and remote monitoring devices is also expected to contribute to segment growth. In addition, the services segment is also estimated to grow notably during the forecast period. As more and more healthcare organizations, clinics, and hospitals adopt digital health solutions, it is expected to increase demand for training, consulting, implementation, and support & maintenance services, thus driving the segment growth.

The communication segment held over 30% of the market in 2023, while the health tracking & insights segment is anticipated to progress at the fastest rate of over 16% in the coming years. In August 2020, Loudoun Medical Group in the U.S. utilized IBM’s Phytel to automate outreach to its diabetic patient population. This resulted in USD 192,000 in revenue and helped the Loudoun Medical Group to enhance the quality of care provided to its patients. Communication technologies form the core of patient engagement solutions.

The COVID-19 pandemic further propelled the development, integration, and adoption of communication solutions such as telehealth, remote data exchange, remote monitoring, and online payments. The application of AI, analytics, and machine learning in patient engagement is expected to enhance tracking and reporting capabilities. This, in turn, is anticipated to increase patient compliance in tracking their health journey and improve patient outcomes in the long term.

Outpatient health management held over 35% of the market in terms of application in 2023. The others segment, comprising patient engagement for clinical studies and preventive care, is projected to expand at the fastest rate of more than 15% during the forecast period. This is due to market players developing newer products to help simplify the management of health at individual and large population levels.

dbMotion, for example, is an interoperable platform for population health management, offered by Allscripts Healthcare. Amadeus by Orion health is another population health management solution that serves as a foundation platform for the company’s care management and patient engagement applications. Aerial platform by Medecision is a scalable, SaaS solution used by home health and community-based organizations among others, to provide personalized member and patient engagement.

Chronic disease management represented the largest share of over 40% of the U.S. patient engagement solutions industry in 2023. According to the National Center for Chronic Disease Prevention and Health Promotion estimates, 4 in 10 Americans suffer from 2 or more chronic diseases. Rising tobacco use, poor nutrition, lack of physical activity, and alcoholism were identified as the key contributors to the rising incidence of chronic diseases in the U.S.

Health & wellness segment, on the other hand, is expected to register exponential growth of more than 15% during the forecast period. This is owing to the increasing adoption of patient engagement solutions in preventive care and general health management, such as weight management and mental health. Concerns and awareness regarding mental health, for instance, are driving patients and providers to adopt novel ways to track treatment.

Patient engagement solutions allow providers and patients to stay connected during the patient's care journey and ensure optimum delivery of care. As per the National Institute of Mental Health, 51.5 million American adults lived with a mental illness in 2019. The growing number of patients seeking treatment for mental health disorders ranging from depression to panic disorders is expected to propel the market growth.

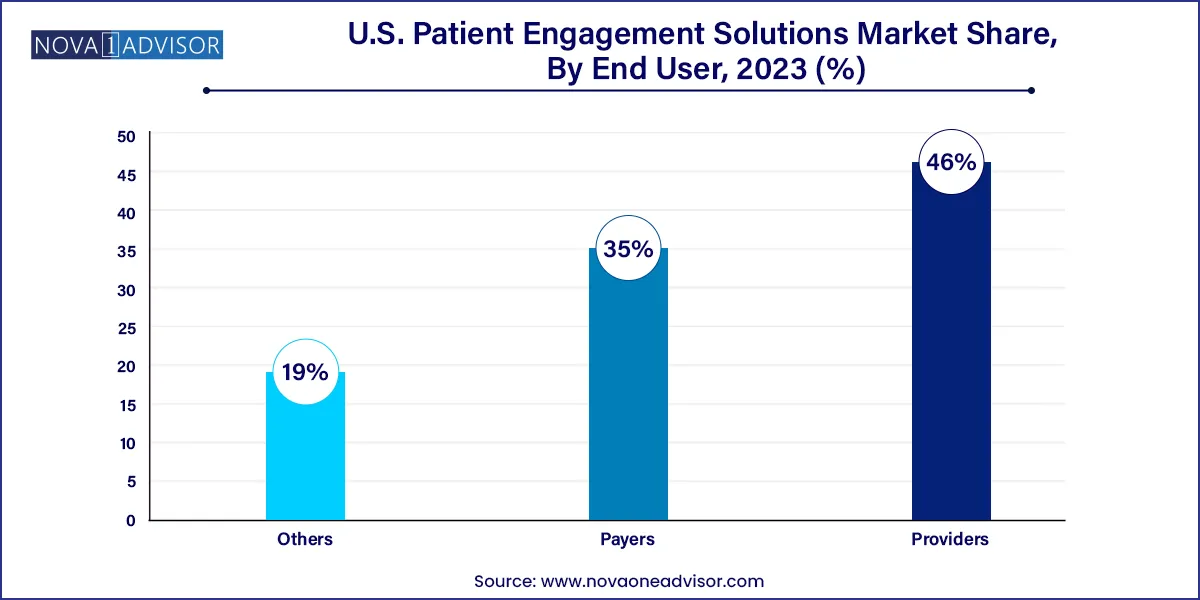

Providers contributed over 46% of the market share by end-user in 2023. The payers segment, on the other hand, is expected to register the highest growth of over 15% in the coming years. This is owing to the rising need to deliver care and patient education in an engaging way for chronic disease management. Medhost’s YourCare Everywhere is a health and wellness consumer engagement solution designed to enable two-way communication between patients and providers.

Force Therapeutics Platform, on the other hand, provides video-based education, messaging, digitized workflows, data & analytics, and other features to achieve better patient outcomes. The increasing use of mobile health and advancements in cloud technology is expected to boost the adoption of patient engagement solutions in the near future. Payers are adopting risk-sharing strategies with providers, with an intention to manage consumer care and engage patients at every stage to manage chronic health conditions.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. patient engagement solutions market.

Delivery Type

Component

Type

Service Type

Functionality

Therapeutic Area

Application

End-user