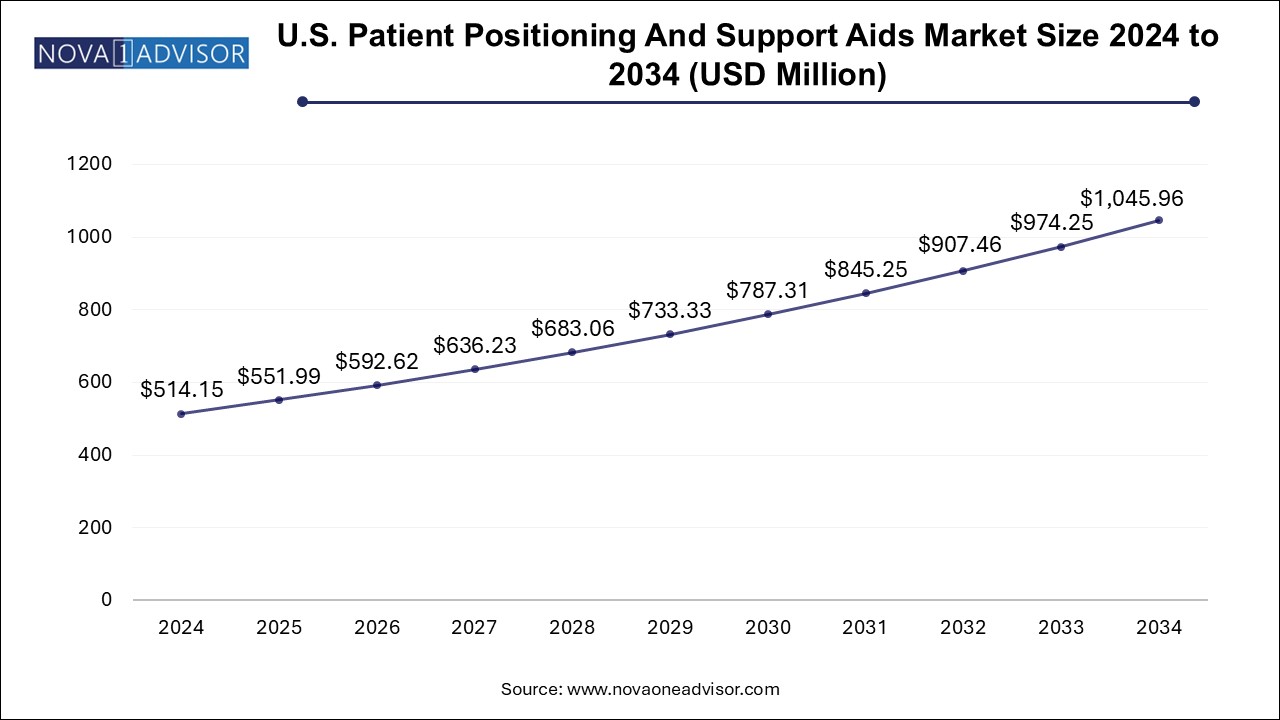

The U.S. patient positioning and support aids market size was exhibited at USD 514.15 million in 2024 and is projected to hit around USD 1045.96 million by 2034, growing at a CAGR of 7.36% during the forecast period 2025 to 2034.

The U.S. patient positioning and support aids market is undergoing a dynamic transformation driven by increasing surgical volume, rising awareness around pressure injury prevention, and the growing emphasis on patient comfort and safety. These aids are essential in healthcare settings, facilitating correct anatomical alignment during medical procedures and ensuring immobility, thereby improving both patient outcomes and procedural efficiency. As the healthcare industry increasingly embraces ergonomic innovation and patient-centric care, demand for versatile and advanced positioning solutions has grown significantly.

In recent years, the market has witnessed a pronounced expansion due to the escalating prevalence of chronic illnesses such as obesity, arthritis, and cardiovascular disorders, which often require prolonged hospital stays and surgical interventions. The aging U.S. population further accentuates the need for consistent, supportive care environments, especially in long-term care settings like nursing homes and home healthcare.

Technological innovation has added further momentum, with companies increasingly launching patient positioning aids integrated with smart sensors and pressure-distributing materials to reduce the risk of pressure ulcers and musculoskeletal strain. While hospitals have historically dominated as the primary end-users, there's rising adoption within home healthcare and rehabilitation centers, encouraged by the broader trend toward outpatient care and remote monitoring.

The market spans a diverse portfolio of products such as gel and foam positioners, pillows and wedges, sling-based aids, repositioning systems, fluidized positioners, air-assisted devices, and slide sheets. With patient safety and caregiver ergonomics being core to healthcare delivery today, this market is expected to experience steady growth over the coming decade.

Rising Demand for Reusable Gel Positioners: Hospitals and outpatient facilities are favoring durable, easy-to-clean gel-based aids to reduce waste and operational costs over disposable foam products.

Growing Emphasis on Pressure Ulcer Prevention: With CMS not reimbursing hospital-acquired pressure ulcers, healthcare providers are investing in better offloading and fluidized positioners.

Surge in Minimally Invasive and Robotic Surgeries: These procedures require precision patient alignment, driving the demand for advanced positioning systems.

Expansion of Home Healthcare Solutions: Post-pandemic, more patients are being treated at home, boosting demand for user-friendly pillows, wedges, and turning systems.

Integration of Smart Sensing Technologies: Patient aids embedded with sensors for posture correction and pressure monitoring are gradually being adopted in technologically advanced healthcare settings.

Ergonomic Innovation for Caregivers: Devices designed to reduce manual handling risks for healthcare workers, such as slide sheets and air-assisted transfer aids, are gaining traction.

Sustainability Focus: Eco-conscious healthcare institutions are moving toward recyclable and biodegradable support aids.

Increased Rehabilitation Investments: Growing insurance coverage for post-operative rehab has propelled demand for positioning solutions in rehabilitation centers.

| Report Coverage | Details |

| Market Size in 2025 | USD 551.99 Million |

| Market Size by 2034 | USD 1045.96 Million |

| Growth Rate From 2025 to 2034 | CAGR of 7.36% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Product, End-use |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | Spry; Medline Industries, LP; Arjo; EHOB; DeRoyal Industries, Inc.; Etac AB; Hillrom (Baxter); Guldmann; ANSELL LTD; Mölnlycke Health Care AB; Stryker; Soule Medical; STERIS; Cardinal Health |

One of the most significant drivers of the U.S. patient positioning and support aids market is the surge in surgical procedures, especially among the aging population. As per the CDC and other national databases, the U.S. sees over 50 million surgeries annually, with projections suggesting further growth due to rising chronic illness incidence and life expectancy. Elderly patients are more prone to mobility challenges and require extensive intraoperative and postoperative support, making positioning aids critical in ensuring safety and reducing complications like deep tissue injuries or falls.

Hospitals are compelled to improve operating room efficiency and minimize adverse patient outcomes, particularly in orthopedic, cardiovascular, and neurological surgeries. Proper positioning prevents complications like nerve compression, respiratory distress, or pressure ulcers—all of which can prolong hospital stays and increase costs. Consequently, hospitals and surgical centers are investing in high-quality, adjustable, and easy-to-use aids, especially those that support bariatric patients or delicate body areas.

Despite the growing need, one restraint that impedes market penetration—particularly in smaller facilities and home settings—is the high cost of technologically advanced positioning systems. Systems embedded with smart sensors, powered actuation, and memory-foam designs are typically expensive and may not be reimbursable under standard insurance policies.

This cost barrier is even more significant in nursing homes and home healthcare environments, where budget constraints limit access to reusable and ergonomic aids. The need for regular sterilization and upkeep of reusable aids further increases long-term expenditure. As a result, some facilities still rely on outdated or improvised methods that compromise patient safety. Bridging this affordability gap will be crucial in ensuring broader adoption across all care settings.

The ongoing transition toward telehealth and home-based recovery models presents a compelling opportunity. The COVID-19 pandemic accelerated the shift from hospital-centric care to more distributed, home-based healthcare solutions. In this context, products like positioning wedges, adjustable pillows, and slide sheets are finding new relevance.

This shift is particularly beneficial for post-operative orthopedic, palliative, and neurological patients who require extended recovery periods. The convenience of deploying positioning aids at home reduces hospital readmission rates and boosts overall patient satisfaction. Manufacturers can capitalize on this opportunity by offering compact, easy-to-clean, and instructional-friendly positioning products tailored for home use, supported by online education and teleconsultation integration.

The Gel and Foam Positioners dominated the U.S. patient positioning and support aids market in 2024 due to their widespread usage across operating rooms, ICUs, and recovery units. Reusable gel positioners, in particular, have gained favor among hospitals for their ability to conform to body contours, distribute pressure effectively, and reduce the risk of skin breakdown during long surgeries. Their durability and ease of cleaning provide a cost advantage over time, even if the upfront investment is higher than disposables. Foam positioners, often used in emergency care or for short-duration procedures, provide an affordable and lightweight alternative.

Within the gel and foam category, reusable gel positioners are the dominating sub-segment, benefiting from infection control protocols and sustainability goals. However, the fastest-growing segment is the repositioning and turning systems, primarily driven by increased awareness of the risks associated with immobility in elderly and bariatric patients. These systems enhance caregiver safety by minimizing physical exertion during repositioning, while simultaneously offering consistent support to the patient. As hospitals invest in injury prevention measures for both patients and staff, adoption of semi-automated and air-assisted systems continues to accelerate.

Pillows and wedges, including bed wedges and specialized positioning pillows, are also gaining ground in home care settings. Bed wedges are favored for patients with acid reflux, respiratory issues, or post-surgical needs, while positioning pillows ensure spinal alignment and comfort. Their ease of use and relatively low cost make them suitable for self-managed care, thereby supporting their steady growth trajectory.

Air-assisted transfer aids and fluidized positioners are also experiencing niche adoption, particularly in trauma centers and burn units where minimal shear and enhanced pressure distribution are critical. Fluidized systems like Flo and Flo-Lock filtered positioners are becoming important for delicate skin integrity management, especially in pediatric and high-risk geriatric care.

The Hospitals remained the dominant end-use segment in 2024, attributed to the sheer volume of patients, complex surgical interventions, and post-operative care demands. Surgical suites and ICUs rely on advanced positioning aids to ensure safety during procedures and avoid complications like aspiration, pressure injuries, or respiratory distress. Hospitals are also primary adopters of reusable systems due to access to cleaning infrastructure and infection control protocols.

In contrast, the fastest-growing segment is home healthcare, driven by the decentralization of patient care. Post-pandemic trends show a growing preference for home recovery supported by telemedicine, especially for post-operative and palliative care patients. Families and caregivers increasingly seek products that are intuitive, safe, and comfortable to use outside traditional clinical settings. Compact repositioning pillows, adjustable bed wedges, and portable slide sheets have become critical tools for enhancing mobility and preventing complications at home.

Rehabilitation centers are also key consumers of patient positioning aids. With therapies requiring repetitive and controlled movements, aids such as wedges, slings, and repositioning devices help support muscular recovery and neurological rehabilitation. These facilities prioritize comfort and adjustability, particularly when dealing with stroke, spinal cord injury, or post-orthopedic surgery patients.

Nursing homes and long-term care centers, while traditionally slower adopters due to budget constraints, are beginning to invest more in safety-focused solutions like offloading boots and slide sheets. Regulatory scrutiny over pressure injuries and patient falls is prompting a re-evaluation of outdated care protocols, supporting slow but steady growth.

Hillrom (now part of Baxter International) introduced an upgraded line of patient positioning products in November 2024, focusing on pressure injury prevention during lengthy surgical procedures. The redesign includes enhanced gel formulations and ergonomic improvements to reduce caregiver strain.

In January 2025, Stryker Corporation unveiled a new ergonomic slide sheet with dual-layer friction reduction, improving both patient handling and caregiver comfort in acute care settings.

Joerns Healthcare, a major U.S.-based player, announced a strategic partnership with multiple home health agencies in December 2024, aiming to expand access to their home-use positioning aids, including offloading boots and repositioning wedges.

AliMed, Inc., known for its customizable surgical aids, launched a smart fluidized positioner prototype in March 2025, equipped with embedded sensors that alert staff to high-risk pressure points in immobilized patients.

In October 2024, Blue Chip Medical Products introduced an antimicrobial wedge pillow line tailored for respiratory patients recovering from COVID-related complications, particularly in nursing homes and rehabilitation centers.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. patient positioning and support aids market

By Product

By End-use