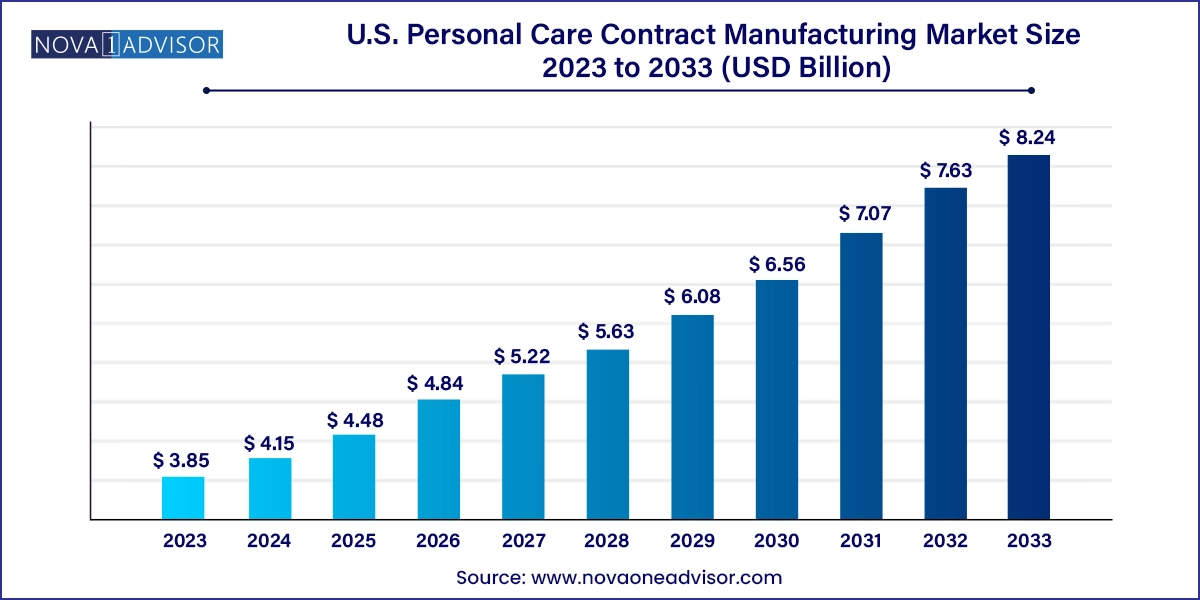

The U.S. personal care contract manufacturing market size was exhibited at USD 3.85 billion in 2023 and is projected to hit around USD 8.24 billion by 2033, growing at a CAGR of 7.9% during the forecast period 2024 to 2033.

The U.S. personal care contract manufacturing market has evolved into a dynamic and innovation-driven sector that supports a wide range of businesses, from multinational conglomerates to indie beauty brands. Personal care products—including skin care, hair care, fragrances, and cosmetics are increasingly being outsourced to specialized contract manufacturers that offer flexibility, scale, expertise, and access to high-end technology.

This market has gained prominence due to shifting consumer preferences toward natural, organic, and cruelty-free formulations, which require precision, agility, and compliance from manufacturers. The U.S., being a global epicenter of cosmetic innovation, houses a vast number of brands that rely heavily on third-party manufacturers for product formulation, filling, testing, and packaging.

Contract manufacturing has become essential not just as a cost-saving strategy but also as a value-adding partnership. Outsourcing allows brands to focus on marketing, sales, and brand development while leveraging the technical capabilities and regulatory know-how of experienced manufacturers. The U.S. Food and Drug Administration (FDA) and the Federal Trade Commission (FTC) also enforce strict regulations, prompting brands to work with compliant and certified contract manufacturers.

In recent years, demand has surged for tailored, small-batch production runs driven by personalization trends and D2C (Direct-to-Consumer) channels. This demand has expanded the role of contract manufacturers from simple production providers to full-spectrum partners offering R&D, formulation, prototyping, and logistics solutions.

Rising demand for natural, clean-label, and organic formulations across all personal care categories.

Growth of influencer- and celebrity-led personal care brands requiring fast-to-market product development.

Increased focus on sustainable packaging and eco-friendly manufacturing practices.

Customization and personalization of skincare and haircare products, requiring agile small-batch production.

Adoption of AI and digital tools for rapid product formulation and customer trend analysis.

Boom in direct-to-consumer (D2C) beauty startups, outsourcing end-to-end operations to contract manufacturers.

Expansion of e-commerce and social commerce platforms, driving shorter product launch cycles.

Surge in men’s grooming and gender-neutral personal care lines, offering new niche segments.

Integration of skincare with wellness and health trends, leading to nutracosmetic hybrids.

M&A activity among contract manufacturers to expand capabilities and reach.

| Report Coverage | Details |

| Market Size in 2024 | USD 4.15 Billion |

| Market Size by 2033 | USD 8.24 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 7.9% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Service |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. |

| Key Companies Profiled | NuWorld; Biogenesi; Bright International; Fareva; Intercos S.p.A.; 220 Laboratories; C-Care; Accupack Midwest, Inc.; Eco Lips, Inc.; Verla International, Ltd |

A key growth driver for the U.S. personal care contract manufacturing market is the explosion of indie brands and D2C business models. These emerging brands often lack the infrastructure to handle formulation, production, packaging, and regulatory compliance in-house. Contract manufacturers fill this gap by providing comprehensive services tailored to varying batch sizes and product types.

This segment thrives on speed-to-market and unique formulations that align with evolving consumer preferences. Contract manufacturers are not just suppliers—they are innovation partners. Brands like Glossier and Function of Beauty, which started small and scaled rapidly, leveraged contract manufacturers for product development and fulfillment. The lower barriers to entry in digital commerce platforms such as Shopify and Amazon also fuel this trend. As brand owners prioritize storytelling and customer engagement, outsourcing manufacturing becomes both a necessity and a strategic advantage.

While contract manufacturing offers numerous benefits, one significant restraint is navigating the complex regulatory framework that governs personal care products in the U.S. Although cosmetics are not pre-approved by the FDA, they must still adhere to the Federal Food, Drug, and Cosmetic Act (FD&C Act), which mandates strict labeling, safety, and ingredient disclosure practices.

Non-compliance can result in warning letters, product recalls, and reputational damage. This puts tremendous pressure on contract manufacturers to maintain detailed records, perform stability testing, and ensure GMP (Good Manufacturing Practice) compliance. Additionally, evolving state-level legislation like California's Proposition 65 and bans on specific ingredients adds layers of complexity. Smaller manufacturers may struggle with the cost and administrative burden of maintaining compliance, which can limit their service offerings or scalability.

A prominent opportunity in the U.S. personal care contract manufacturing market lies in sustainability and green production. Consumers are demanding more transparency and accountability from brands regarding the environmental impact of their products. This trend encompasses both formulation such as avoiding synthetic chemicals and microplastics and packaging, including biodegradable, recyclable, or refillable containers.

Contract manufacturers that invest in renewable energy, water-saving technologies, and zero-waste policies are seeing increased interest from premium and mass-market brands alike. Furthermore, sustainable sourcing of raw materials and cruelty-free certifications (e.g., Leaping Bunny, PETA-approved) provide contract manufacturers with an edge in brand partnerships. Companies that offer traceability, carbon-neutral facilities, and green logistics are well-positioned to capitalize on this shift, especially as ESG (Environmental, Social, and Governance) reporting becomes a core part of corporate strategy.

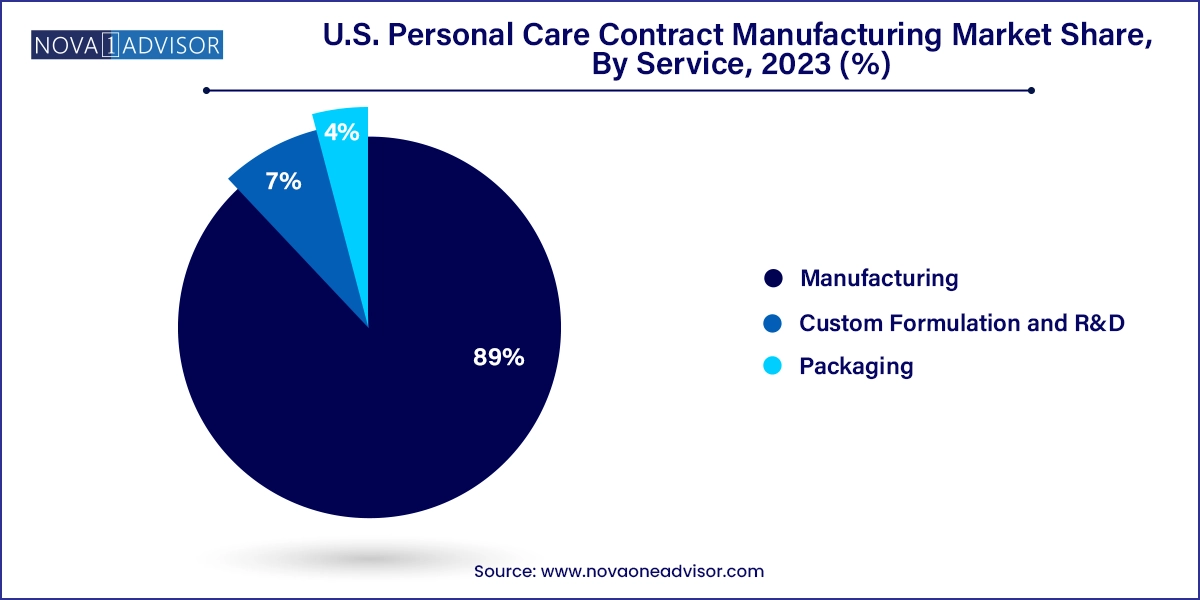

Manufacturing dominated the U.S. personal care contract manufacturing market in 2024, accounting for the largest revenue share. Within manufacturing, skincare and haircare were the leading product segments. Skincare manufacturing dominates due to sustained consumer demand for facial creams, serums, cleansers, and sunscreens. The U.S. skincare market has embraced science-backed ingredients such as niacinamide, peptides, and retinoids, creating opportunities for manufacturers with technical capabilities in emulsification, stability, and preservation. Contract manufacturers often offer private-label solutions alongside bespoke services to support startups and boutique labels.

In parallel, haircare manufacturing is emerging as the fastest-growing manufacturing sub-segment, fueled by consumer interest in scalp health, natural curls, and multifunctional hair treatments. Texture-specific products, heat-protectants, and vegan formulations are particularly popular. Social media-driven trends have enabled rapid product experimentation, and manufacturers must respond with agility. Contract manufacturing facilities are expanding their capabilities to produce sulfate-free, paraben-free, and color-safe formulas. Investment in ingredient traceability and specialized testing (such as dermatological and salon testing) has further strengthened contract manufacturers’ position in this high-potential category.

Custom formulation and R&D services are gaining ground as brands demand unique positioning in a crowded market. Skincare continues to be the top segment due to demand for anti-aging, anti-acne, and sensitive skin formulations. R&D services often include ingredient sourcing, prototype development, testing for stability and performance, and regulatory clearance. Brands focused on personalization—for example, skincare quizzes that lead to tailor-made serums—are pushing the boundaries of what contract R&D can deliver. Contract labs are also collaborating with dermatologists, chemists, and trend forecasters to co-develop cutting-edge formulas.

Make-up and color cosmetics are the fastest-growing R&D sub-segment, driven by rising interest in inclusive beauty and customization. Consumers expect high-performance color cosmetics with skincare benefits and a broad range of shades. R&D labs are working on hybrid foundations, transfer-proof lipsticks, and antioxidant-infused powders. The ability to rapidly create samples, test color payoff across skin tones, and meet clean beauty standards is vital for success in this space. Startups often rely heavily on R&D partnerships to differentiate themselves on ingredient innovation and user experience.

Packaging services continue to dominate in terms of volume due to the need for customized, brand-consistent packaging solutions across all product lines. Packaging for skincare and haircare holds the largest share due to the frequent launch of new SKUs in various sizes and delivery formats (e.g., pumps, tubes, droppers). Brands are increasingly choosing packaging that aligns with sustainability goals—such as recyclable plastics, airless dispensers, and mono-material designs. Contract manufacturers often offer integrated packaging services, which include design consultation, material sourcing, labeling, and filling.

Fragrances and deodorants packaging is growing fastest, due to rising demand for niche, artisanal scents and gender-neutral fragrances. Consumers expect unique bottle shapes, minimalistic aesthetics, and travel-friendly options. Some brands are also exploring refillable packaging to minimize waste. Contract manufacturers that offer in-house design studios or partnerships with packaging engineers are gaining traction. The ability to provide elegant, sturdy, and sensory packaging experiences is becoming a significant differentiator in fragrance branding.

The U.S. personal care contract manufacturing market is shaped by its large, diversified consumer base, advanced regulatory framework, and highly competitive brand landscape. California, New York, Texas, and Florida are key markets, hosting the headquarters of prominent beauty brands, contract manufacturing hubs, and R&D labs. California leads the clean beauty movement and sustainable packaging innovations, while New York is central to the luxury and fashion-driven cosmetics segment.

The country's high penetration of e-commerce and social media platforms such as TikTok, Instagram, and YouTube has allowed micro-brands to flourish, driving demand for quick-turnaround, high-quality manufacturing. Additionally, the U.S. FDA’s regulation of personal care products under the Modernization of Cosmetics Regulation Act (MoCRA) has made compliance-driven manufacturing a cornerstone of business sustainability. Contract manufacturers that offer FDA-registered facilities, ISO certifications, and robust quality assurance systems are favored partners.

Voyant Beauty, a major U.S. contract manufacturer, announced the expansion of its personal care production capacity in Illinois in February 2025, citing increased demand for haircare and skincare product lines.

In January 2025, Knowlton Development Corporation (KDC/One) acquired a California-based packaging and formulation lab to enhance its presence in clean beauty and sustainable packaging innovation.

Cosmetic Solutions Innovation Labs launched a new AI-driven custom formulation platform in March 2025, aimed at helping indie brands prototype and iterate products faster.

Mansfield-King, known for its specialty haircare manufacturing, secured a strategic partnership in December 2024 with a leading influencer brand to co-develop a line of heatless styling solutions.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. personal care contract manufacturing market

Service