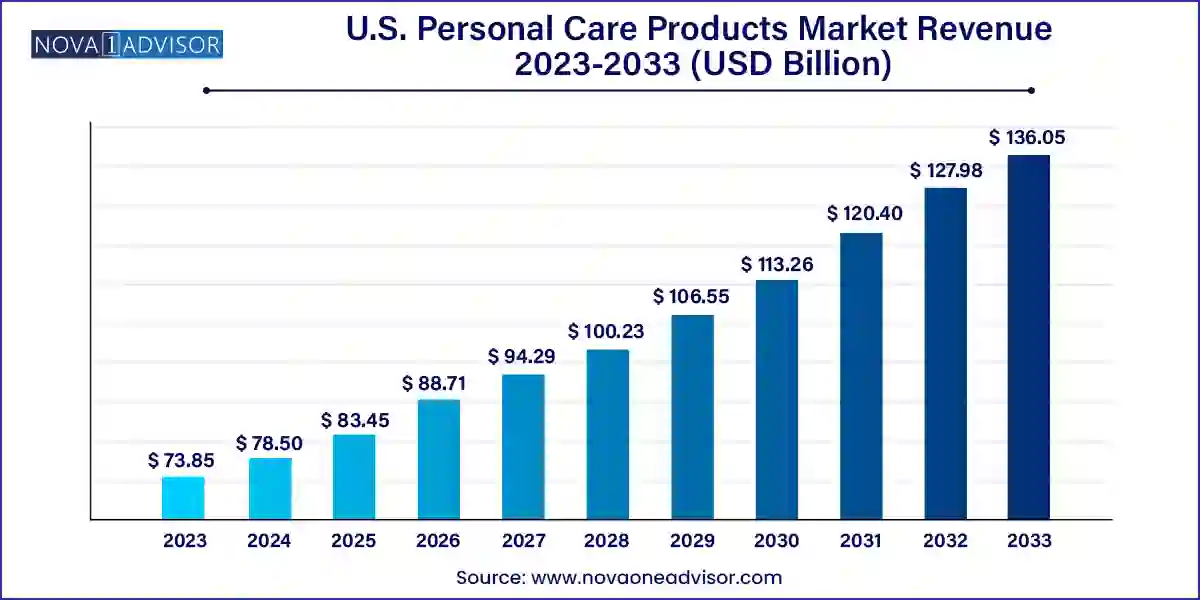

The U.S. personal care products market size was exhibited at USD $73.85 billion in 2023 and is projected to hit around USD 136.05 billion by 2033, growing at a CAGR of 6.3% during the forecast period 2024 to 2033.

The U.S. personal care products market is a dynamic and essential component of the broader consumer goods industry. In 2024, the market was valued at over USD 150 billion and is expected to experience a stable yet innovative-driven expansion through 2034. Characterized by a high degree of consumer awareness, rapid product innovation, and evolving lifestyle trends, this market encompasses skincare, hair care, shower and bath essentials, fragrances, and color cosmetics. These products are no longer just about grooming—they're deeply intertwined with wellness, identity, sustainability, and self-expression.

American consumers show a deep attachment to personal care routines, with preferences varying widely based on age, gender, ethnicity, and cultural influences. The modern U.S. market reflects a shift from conventional formulations to clean-label, organic, and technologically enhanced offerings. Influencer marketing, social media virality, subscription models, and the rise of personalized beauty routines have further transformed the way products are marketed and consumed.

Large multinational corporations dominate the market in terms of scale and distribution, but indie brands and niche players are capturing attention through innovation, authenticity, and agility. Brands that address consumer values—such as cruelty-free testing, ethical sourcing, and gender inclusivity—are outperforming legacy counterparts in certain categories. As the lines between beauty, health, and wellness continue to blur, personal care products are evolving from simple hygiene tools into lifestyle-enhancing essentials.

Rise of Clean Beauty and Natural Ingredients: Consumers are demanding transparency, non-toxic formulations, and naturally derived ingredients in skincare and cosmetics.

Gender-Neutral and Inclusive Products: The market is witnessing a wave of gender-inclusive and unisex offerings that cater to a wider spectrum of identity and usage.

Functional Skincare and Haircare: Products enriched with probiotics, peptides, and adaptogens are growing in popularity as consumers seek benefits beyond surface-level effects.

Personalization and AI-driven Formulations: Technology is enabling customized solutions for skin tone, skin type, hair texture, and lifestyle habits via quizzes, apps, and AI algorithms.

Sustainable Packaging and Zero-Waste Beauty: Eco-friendly containers, refillable formats, and zero-plastic initiatives are becoming important purchasing factors.

Social Media Influence and DTC Growth: TikTok and Instagram are powerful drivers of discovery and virality, particularly among Gen Z and millennials.

Holistic Self-care Movement: The pandemic accelerated interest in wellness-centric personal care, with bath rituals, aromatherapy, and calming skincare routines gaining traction.

Men’s Grooming on the Rise: Men are expanding their grooming habits beyond shaving to include skincare, hair styling, and even subtle cosmetic products.

| Report Coverage | Details |

| Market Size in 2024 | USD 78.50 Billion |

| Market Size by 2033 | USD 136.05 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 6.3% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Gender, Age Group, Distribution Channel. |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. |

| Key Companies Profiled | Coty Inc.; L’Oréal Group; Estee Lauder Companies, Inc.; Revlon Consumer Products LLC; Avon Products, Inc.; Unilever plc; Procter & Gamble (P&G) Company; Beiersdorf AG; Henkel AG & Co KGaA; Kao Corporation |

A major driver of growth in the U.S. personal care products market is the integration of health and wellness into beauty routines. American consumers are increasingly associating personal care with mental well-being, emotional self-care, and physical health. This convergence has created a fertile ground for innovation across skincare, body care, and hair care categories.

For instance, ingredients like CBD, hyaluronic acid, and niacinamide are marketed not only for their skin benefits but also for their calming and anti-stress properties. Brands like Drunk Elephant, The Ordinary, and Tatcha emphasize formulations that align with clean and mindful living. Simultaneously, consumers are embracing at-home spa rituals, sleep-supporting skin treatments, and therapeutic bath products as part of holistic self-care regimens. This shift is fueling a demand for products that offer sensory, emotional, and aesthetic gratification all at once.

One of the major restraints in the U.S. personal care products market is the increased scrutiny over ingredients and the complexity of navigating evolving regulatory frameworks. Consumers are more informed than ever, often researching ingredients independently and avoiding products with parabens, sulfates, phthalates, and synthetic fragrances. This has put pressure on companies to reformulate existing products or launch entirely new lines with cleaner, safer labels.

At the same time, regulatory guidelines from the FDA, coupled with state-level legislation (such as California’s stricter ingredient disclosure laws), are evolving rapidly. Brands need to ensure that their labeling, claims, and testing procedures comply with these frameworks, often requiring significant investment in R&D and compliance. Failure to meet these standards can lead to reputational damage, fines, or product recalls—posing risks especially for startups and mid-sized enterprises.

The shift toward digital-first experiences and subscription-based models presents a substantial opportunity in the U.S. personal care market. With consumers increasingly shopping online, brands that offer tailored discovery, virtual try-ons, and flexible delivery models are winning market share. Direct-to-consumer (DTC) platforms enable companies to build one-on-one relationships, gather first-party data, and respond faster to consumer feedback.

For example, brands like Glossier, Curology, and Function of Beauty have built their identities around digital intimacy, personalization, and community-driven marketing. Subscription boxes like Birchbox or FabFitFun are also thriving, offering curated experiences and trial-size products that drive brand loyalty and product sampling. The opportunity lies in creating seamless, data-enriched customer journeys that combine personalization with convenience and surprise—especially among tech-savvy Gen Z and millennials.

Skincare dominated the U.S. personal care products market in 2024, accounting for the highest revenue share due to the growing emphasis on healthy, glowing skin across all age groups and genders. Consumers are embracing multi-step routines that include cleansers, toners, serums, exfoliants, and SPFs. The anti-aging, anti-acne, and hydration-focused segments have especially seen robust growth. Moreover, the “skinimalism” trend has also promoted the idea of fewer but more effective skincare products. Celebrity-backed and dermatologist-founded brands are especially popular, with products like retinol creams and niacinamide serums selling out quickly online.

Color cosmetics, while traditionally a major segment, is expected to see moderate growth, but hair care is emerging as the fastest-growing segment within the product category. Consumers are exploring specialized hair masks, scalp serums, curl enhancers, and sulfate-free shampoos tailored to their hair texture. The rise of textured hair acceptance, especially among African American communities, has resulted in brands like Pattern Beauty and Mielle Organics gaining momentum. Ingredient consciousness in hair care—such as avoiding silicones and embracing rice water, biotin, or castor oil—has significantly influenced consumer choices.

Women dominated the personal care products market by a wide margin, driven by cultural emphasis on appearance, availability of product variety, and beauty standards that emphasize grooming. From skincare to color cosmetics, women lead both in frequency of use and spend per product. However, the women’s segment is not homogenous—each demographic group within it is influenced by its own lifestyle, media exposure, and purchasing power. Mature women tend to seek anti-aging and firming solutions, while younger segments prioritize glow-enhancing and acne-prevention products.

The fastest-growing segment is men, as the perception of grooming evolves beyond basic hygiene. Male consumers are increasingly open to skincare regimens, hair styling products, and even subtle cosmetic enhancements like tinted moisturizers or brow gels. Brands such as Hims, Lumin, and Bulldog are capitalizing on this shift with male-centric branding and product lines that simplify skincare without sacrificing efficacy. The changing conversation around masculinity, bolstered by celebrity and influencer endorsement, has removed some of the stigma and encouraged experimentation among male consumers.

Adults (ages 31–50) dominate the U.S. personal care market, due to their higher disposable income, brand awareness, and consistent grooming habits. This group often has specific concerns such as aging signs, pigmentation, and lifestyle-induced skin and hair damage. They are more likely to invest in quality over quantity, choosing dermatologist-recommended or scientifically backed products. Their purchasing decisions are also influenced by reviews, testimonials, and trusted endorsements, making them a key demographic for brand retention and upselling.

Teenagers (13–19) represent the fastest-growing user base, largely fueled by social media, influencer culture, and the increasing visibility of skincare in pop culture. Platforms like TikTok and YouTube have popularized ingredients like salicylic acid, niacinamide, and hyaluronic acid, leading teens to develop skincare routines early. This age group is price-sensitive but brand-loyal, often supporting companies that represent diversity, inclusivity, and sustainability. Brands like CeraVe, The Ordinary, and Glow Recipe have become cult favorites among teenage users due to affordability, packaging, and digital marketing.

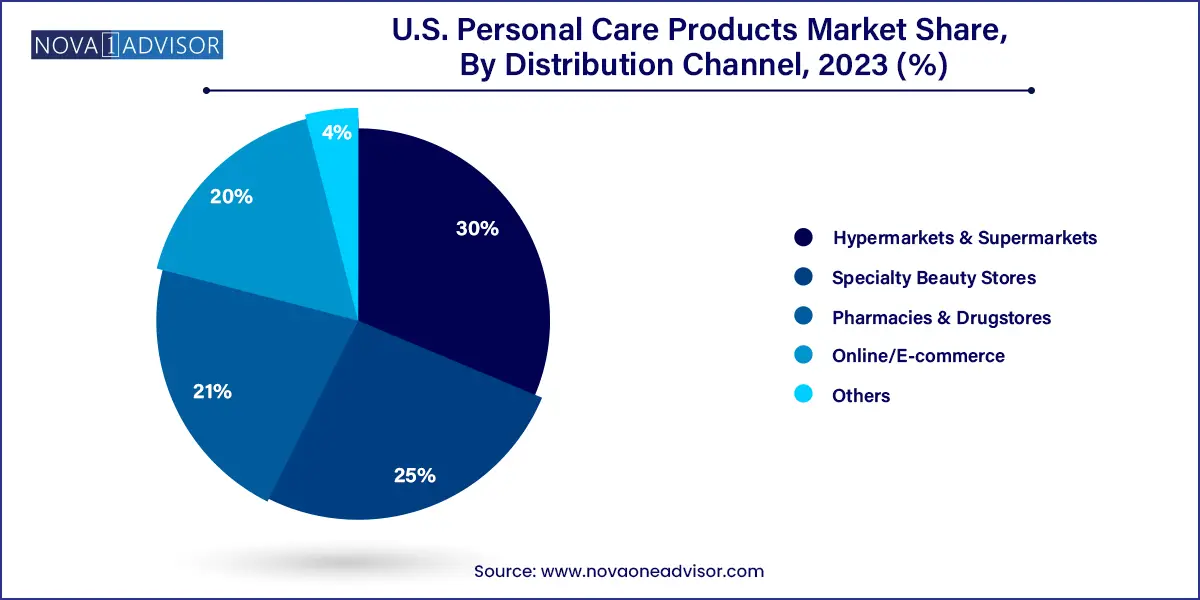

Hypermarkets and supermarkets dominated distribution in 2023, offering wide-ranging product availability, competitive pricing, and immediate accessibility. Retailers like Walmart, Target, and Costco carry a comprehensive mix of mass-market and premium personal care brands, often bundled in value packs. These outlets also benefit from foot traffic and seasonal sales. The beauty sections in these stores have evolved significantly, incorporating influencer-curated shelves, testers, and branded displays to attract more attention from beauty-conscious shoppers.

Online/e-commerce is the fastest-growing distribution channel, accelerated by convenience, product diversity, and influencer-driven discovery. E-commerce giants like Amazon and brand-owned platforms provide consumers with the ability to compare, review, and repurchase with ease. Personalized shopping experiences, including virtual skincare analysis and AI-powered recommendations, further strengthen the appeal of online platforms. Social commerce, particularly via TikTok Shop and Instagram Checkout, has also revolutionized product discovery, driving impulse purchases and viral sales surges.

The U.S. market is characterized by sophisticated consumer behavior, rapid trend adoption, and high levels of competition. Urban areas such as Los Angeles, New York, and Miami act as trend incubators, with diverse, image-conscious consumers driving innovation in cosmetics, skincare, and fragrance. California, in particular, is a hub for organic and clean beauty trends, supported by regulatory frameworks and a wellness-centric culture.

The South and Midwest show high demand for mass-market and multipurpose products due to affordability and family-sized buying habits. However, beauty retailers are expanding their footprint in these regions through mid-tier shopping malls and beauty box partnerships. College towns and tech hubs exhibit a strong inclination toward digital-first and subscription-based offerings, particularly among Gen Z consumers who prioritize speed, reviews, and uniqueness.

Meanwhile, the U.S. also serves as the launchpad for global beauty brands seeking to establish themselves in a mature market. From K-beauty to Ayurvedic products, American consumers show openness to cross-cultural experimentation, making the country a trend-setter for global product evolution.

March 2025 – L’Oréal USA announced the launch of an AI-powered skin diagnostic tool that allows consumers to assess their skin conditions and receive tailored product recommendations via the company’s websites.

February 2025 – Unilever launched a men’s grooming sub-brand called “Maverick” under its Dove Men+Care line, aimed at millennial men who prefer minimalism with performance.

January 2025 – Estée Lauder Companies invested $80 million in a new R&D facility in New Jersey focused on biotech-driven ingredient development for personalized skincare.

December 2024 – Glossier opened its first flagship store in Miami and launched a new product category focused on bath and body rituals, including aromatherapy-inspired lotions.

November 2024 – Procter & Gamble’s Olay expanded its “Regenerist” line to include a nighttime peptide serum and retinol body lotion after clinical trials indicated promising anti-aging benefits.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. personal care products market

Product

Gender

Age Group

Distribution Chanel