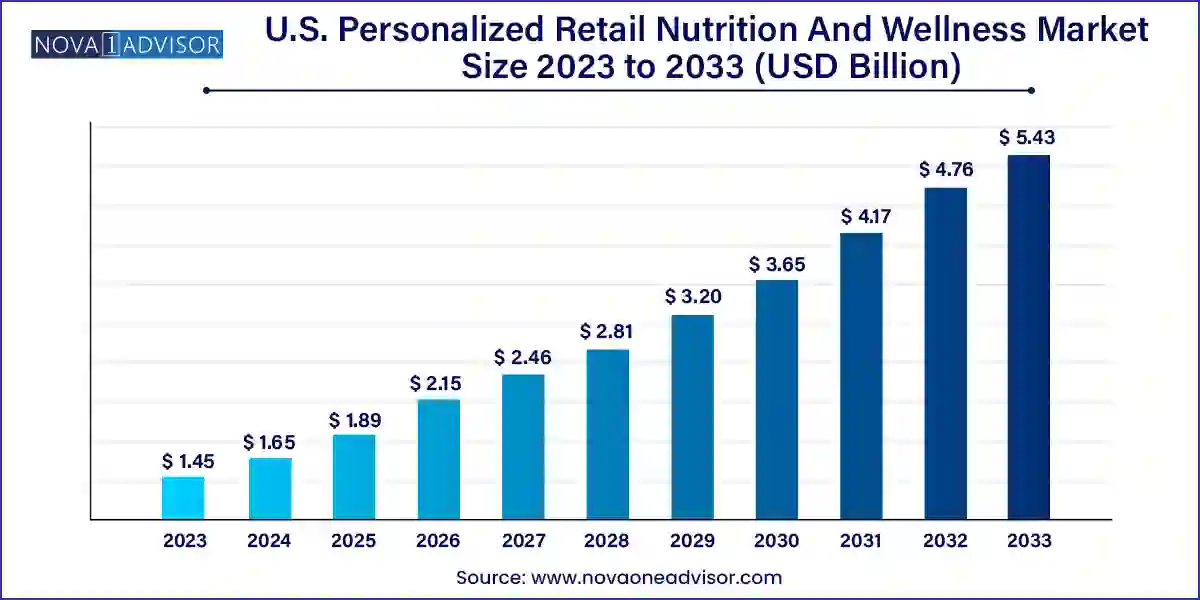

The U.S. personalized retail nutrition and wellness market size was exhibited at USD 1.45 billion in 2023 and is projected to hit around USD 5.43 billion by 2033, growing at a CAGR of 14.11% during the forecast period 2024 to 2033.

The U.S. personalized retail nutrition and wellness market has been undergoing a dynamic transformation in response to increasing consumer awareness, technological advancements, and a broader shift toward individualized healthcare. This market focuses on delivering customized dietary and wellness solutions that cater to the unique genetic, metabolic, and lifestyle needs of individuals. The growing adoption of digital platforms, wearables, mobile health applications, and AI-driven diagnostics has empowered consumers to gain a deeper understanding of their health profiles and actively pursue tailored nutrition strategies.

The concept of "one-size-fits-all" in health and wellness is steadily becoming obsolete. Consumers today seek specific recommendations for vitamins, minerals, proteins, botanicals, and other nutritional components based on their unique physiological conditions. This has prompted a surge in demand for customized supplements, functional foods, and advanced testing kits that assess nutritional deficiencies and potential health risks.

Large retailers, startups, and direct-to-consumer brands have entered this space with innovative product offerings. Companies are leveraging data analytics, genomic testing, and consumer lifestyle assessments to offer highly personalized services. As a result, the market is experiencing accelerated growth, with notable traction in subscription-based models and repeat recommendation platforms that build long-term consumer relationships.

AI and Machine Learning Integration: Companies are using AI algorithms to analyze consumer data, lifestyle habits, and genetic reports to provide intelligent nutrition recommendations.

DNA-based Diet Plans: Increased adoption of genomic sequencing and DNA kits for dietary planning has made nutrigenomics a growing sub-segment.

Subscription-based Supplement Models: Personalized vitamin subscriptions are gaining popularity, with monthly deliveries based on test results and periodic reassessments.

Rise of Holistic Wellness Platforms: Firms are offering all-in-one platforms that include diagnostics, nutrition plans, fitness coaching, and mental wellness.

Focus on Gut Health: Increased interest in microbiome testing and prebiotic/probiotic supplements due to their impact on immunity and digestion.

Mobile App Integration: Apps that track eating habits, physical activity, and provide real-time personalized suggestions are trending.

Eco-friendly and Clean Label Products: Consumers prefer brands that provide transparency, sustainability, and natural ingredients.

Collaborations Between Tech and Health Companies: Partnerships between genomics firms and tech giants are expanding access to personalized nutrition.

| Report Coverage | Details |

| Market Size in 2024 | USD 1.65 Billion |

| Market Size by 2033 | USD 5.43 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 14.11% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Type |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | U.S. |

| Key Companies Profiled | Cargill, Incorporated, Nature's Bounty, Bayer AG, PlateJoy LLC, Better Therapeutics, Inc, Viome Life Sciences, Inc., Noom, Inc, Savor Health, Nutrigenomix, DNAfit (Prenetics Global), Nature's Lab |

One of the most significant drivers propelling the U.S. personalized retail nutrition and wellness market is the rising awareness among consumers regarding the benefits of personalized health interventions. Unlike traditional approaches, which often rely on generalized dietary guidelines, personalized nutrition considers a person's genetics, lifestyle, and health history. This approach resonates particularly well with millennials and Gen Z consumers who are tech-savvy and inclined toward self-monitoring of health.

A surge in health issues like obesity, diabetes, and cardiovascular diseases has further reinforced the need for targeted preventive care. The ongoing digital health revolution, alongside growing disposable income and interest in self-care, has created fertile ground for the growth of this market. Consumers now seek greater control over their health outcomes, and personalized nutrition offers them the tools and insights to make informed choices.

Despite its promising potential, the high cost of personalized nutrition solutions remains a significant barrier for widespread adoption. Personalized testing, including DNA and microbiome analysis, often comes with a premium price tag. Additionally, subscription models that provide tailored supplements or dietary plans on a regular basis may not be affordable for all demographics, especially those with limited disposable income.

Moreover, not all consumers have access to digital literacy or the technological infrastructure required to benefit from these solutions. Rural populations, in particular, may find it challenging to access advanced diagnostics or online platforms due to internet connectivity issues. This economic and infrastructural divide could restrict the growth of personalized wellness offerings across broader population segments.

The growing popularity of wearable health devices presents a major opportunity in the personalized retail nutrition and wellness market. Devices such as fitness trackers, smartwatches, and continuous glucose monitors collect real-time physiological data like heart rate, sleep patterns, calorie expenditure, and blood glucose levels. When integrated with personalized nutrition platforms, these insights can power dynamic dietary recommendations that evolve with an individual’s changing health metrics.

For example, a person recovering from illness or undergoing weight management can receive updated nutritional advice based on daily activity levels and vitals. Companies such as Fitbit and Apple have already begun forming partnerships with health and nutrition firms to leverage this synergy. This convergence of technology and nutrition creates a more holistic and responsive health management system, driving long-term engagement and improved outcomes.

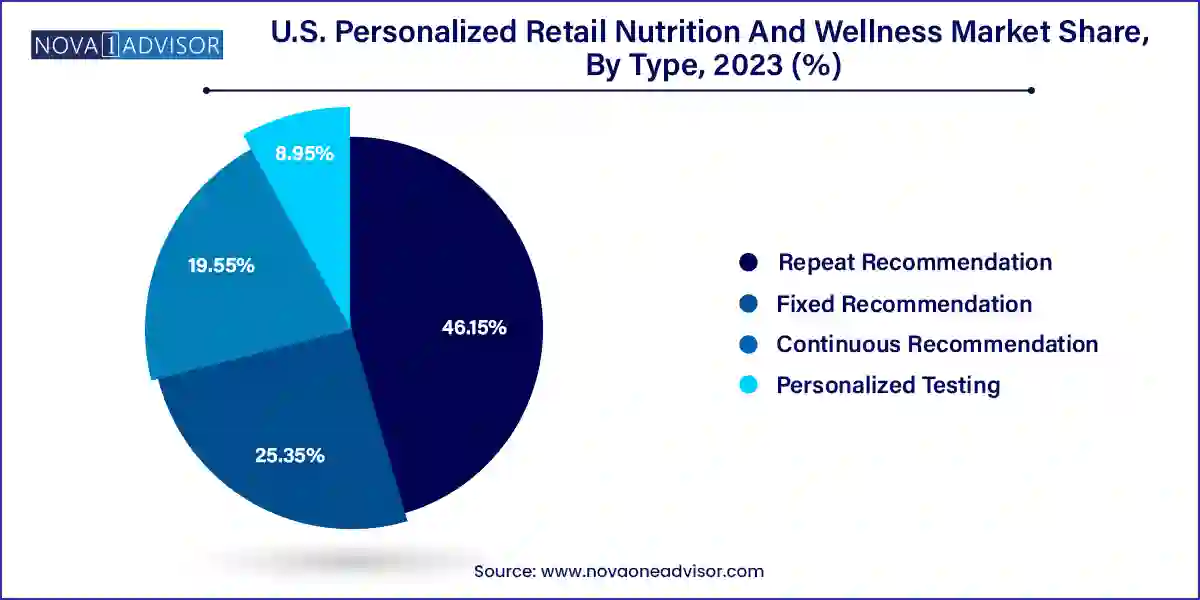

Continuous Recommendation is emerging as the fastest-growing segment, fueled by innovations in AI-driven analytics, real-time health monitoring, and consumer lifestyle tracking. This segment thrives on dynamic, continuously updated nutrition advice supported by subscription services. Companies offer tailored vitamin packs, functional food deliveries, and botanical supplements adjusted periodically based on wearable data and health tests. For example, consumers using platforms like Care/of or Baze receive personalized recommendations that adapt to their health journey over time.

Within this segment, Functional Foods with dynamic composition based on ongoing consumer feedback and health tracking show tremendous promise. Carotenoid-rich food products, prebiotic and probiotic mixes, and personalized protein blends are among the fastest-growing product categories. Additionally, Traditional Botanicals such as turmeric, ashwagandha, and ginseng are being incorporated into customized regimens due to their rising popularity among consumers interested in natural wellness alternatives.

Repeat Recommendation sits between the two and has gained attention for offering semi-customized products updated at regular intervals. These include quarterly or bi-annual re-evaluation-based dietary supplements and functional foods. Brands adopting this model often blend convenience with personalization, appealing to health-conscious professionals who value updates but don’t require constant recalibration.

Personalized Testing, while still a niche in terms of volume, plays a foundational role in enabling all types of recommendation scopes. Consumers increasingly invest in gut microbiome analysis, vitamin deficiency tests, or DNA-based assessments to unlock insights that guide their nutrition path. As affordability improves and awareness grows, testing is expected to evolve into a cornerstone of all personalization categories.

The U.S. stands as a global leader in the adoption and innovation of personalized nutrition and wellness practices. A confluence of factors such as a tech-savvy population, advanced healthcare infrastructure, and a vibrant startup ecosystem has positioned the country at the forefront of this market. According to industry surveys, nearly 60% of U.S. consumers express interest in personalized nutrition plans, with more than 30% already using tailored supplements or dietary interventions.

Urban centers like San Francisco, New York, and Austin have become hubs for innovation in personalized wellness, with numerous startups and research institutions collaborating on cutting-edge solutions. Furthermore, government health campaigns focusing on preventive care and chronic disease management have created a favorable regulatory environment. The U.S. Food and Drug Administration (FDA) has also begun providing guidance for nutrigenomic-based health solutions, paving the way for more scientifically backed, consumer-safe offerings.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. personalized retail nutrition and wellness market

Type Scope