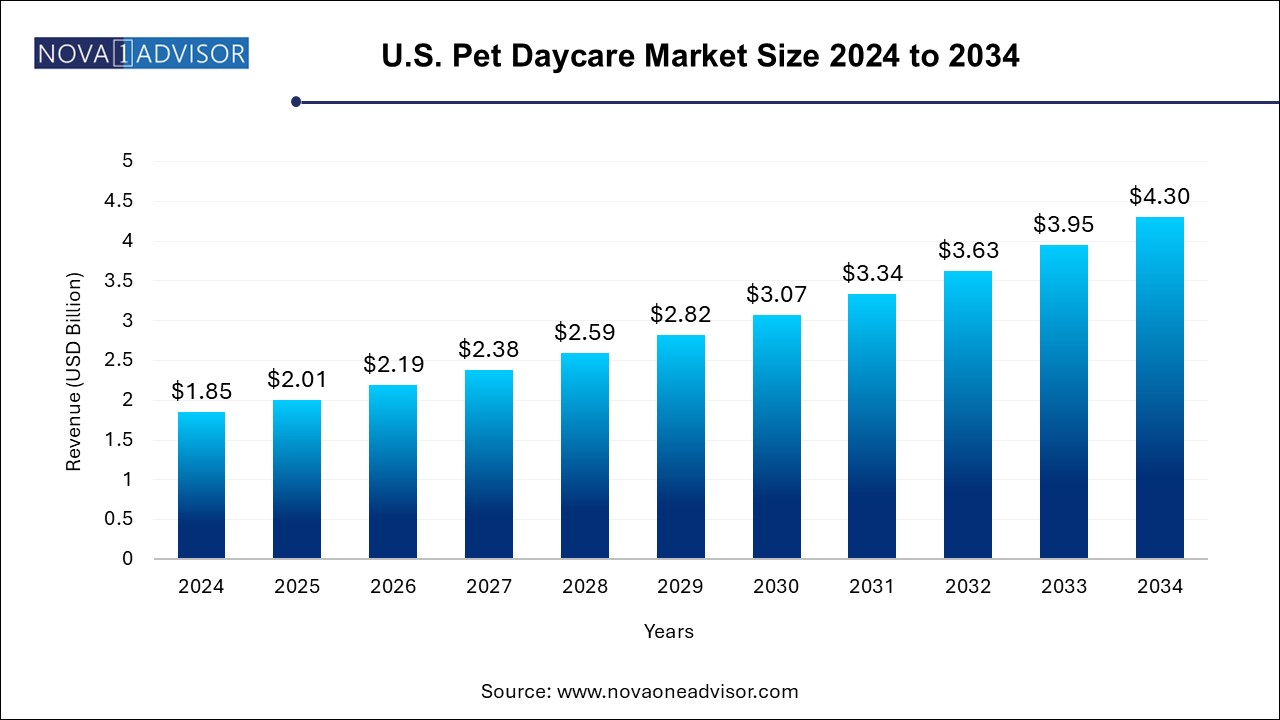

The U.S. pet daycare market size was exhibited at USD 1.85 billion in 2024 and is projected to hit around USD 4.30 billion by 2034, growing at a CAGR of 8.79% during the forecast period 2024 to 2034.

The U.S. Pet Daycare Market is rapidly expanding as pet ownership in the country continues to climb, accompanied by a surge in consumer spending on companion animal welfare. Pet daycare services provide daytime supervision, exercise, socialization, and personalized attention for pets primarily dogs and, to a lesser extent, cats and other small animals. These services are designed to meet the needs of modern pet owners who have busy work lives, frequent travel schedules, or value enriched environments for their pets during the day.

This market has transitioned from a luxury service to a standard part of pet care in urban and suburban settings. As of 2025, the pet daycare sector reflects a shift in human-animal relationships, where pets are considered family members whose physical, emotional, and social needs require structured support. The market includes a variety of service models ranging from large-scale commercial facilities with luxury suites and activity zones to small boutique providers and home-based daycares.

Growth in this sector is driven by factors such as dual-income households, the millennial and Gen Z affinity for pets, increasing awareness of pet behavioral health, and a rise in pet insurance and wellness spending. Additionally, the COVID-19 pandemic played a paradoxical role by initially restricting access and later fueling demand as people returned to offices and resumed pre-pandemic routines, needing safe, stimulating environments for their pets during the day.

| Report Coverage | Details |

| Market Size in 2025 | USD 2.01 Billion |

| Market Size by 2034 | USD 4.30 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 8.79% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Pet, Service, Delivery Channel |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | A Place for Rover, Inc., Dogtopia Enterprises, Paradise 4 Paws, LLC, Come Sit Stay, Fetch! Pet Care, Barkley Ventures, Inc., PetSmart LLC, Housecarers, Camp Run-A-Mutt Entrepreneurial Resources, Camp Bow Wow |

A significant driver for the U.S. pet daycare market is the deepening emotional bond between pet owners and their animals. More than ever before, pets are being treated as family members, often referred to as "fur babies" or "four-legged children." This humanization has led to a willingness among pet owners to invest in high-quality, emotionally enriching, and socially engaging care options.

As per the American Pet Products Association (APPA), over 70% of U.S. households now own a pet, and spending on pet services continues to increase annually. Pet parents seek services that go beyond basic needs, opting for daycare centers with webcams, indoor playgrounds, customized meal plans, and on-site veterinary professionals. As disposable income rises and the pet-as-family trend persists, the demand for structured, professional daycare solutions will remain robust.

Despite its growth, the pet daycare market is hindered by affordability concerns and access disparities. Comprehensive daycare services, especially those with specialized staff, enrichment programs, and premium amenities, often come at a high price point, making them inaccessible for a significant portion of pet owners.

The market is also unevenly distributed, with a heavy concentration of services in urban centers and affluent suburban areas. In contrast, rural regions and lower-income urban neighborhoods remain underserved. Moreover, lack of regulation and standardization can lead to inconsistent service quality, undermining consumer trust and deterring repeat business. For providers, balancing service innovation with affordability will be key to scaling in a price-sensitive environment.

An emerging opportunity in the U.S. pet daycare market lies in offering tailored services for senior pets and animals with disabilities, anxiety, or chronic conditions. These pets require a higher degree of care, including mobility assistance, medication administration, modified exercise routines, and individual attention. Few existing facilities are fully equipped or trained to handle such needs, creating a niche yet growing demand.

With the aging of the pet population—especially as veterinary care and pet nutrition extend lifespans—pet owners are seeking daycare providers capable of offering senior-friendly programs. Specialized offerings not only command premium pricing but also foster customer loyalty. Facilities that incorporate quiet zones, orthopedic bedding, low-impact play areas, and certified vet techs are well-positioned to capture this high-value market segment.

Dogs dominate the U.S. pet daycare market, accounting for the overwhelming majority of daycare attendance. Within this segment, medium breeds such as Labradors, Golden Retrievers, and Pit Bull mixes are the most common participants, due to their energy levels, need for socialization, and compatibility with group play. These dogs thrive in structured playgroups, agility zones, and behavioral enrichment programs offered by modern facilities. Daycare services for dogs often include physical exercise, mental stimulation, grooming, and real-time video monitoring for pet parents.

Cats, while a smaller segment, are among the fastest-growing categories, especially in urban markets with high-rise living where enrichment and socialization are limited at home. Progressive daycare centers now feature cat-specific spaces designed to reduce stress, provide climbing structures, and offer human interaction. While cats are less social than dogs, short-term daycare during home renovations, moves, or family travel is becoming more common. Boutique facilities are investing in cat cafes, feline spa services, and interactive toys to tap into this emerging demand.

Day Boarding remains the dominant service category, offering full-day or half-day stays with structured activities, nap times, feeding, and interaction. Most commercial pet daycare facilities design their operations around this model, catering to working professionals and frequent travelers. Day boarding serves as both a physical outlet and behavioral enhancement tool, reducing destructive behavior at home and improving pet sociability. Many providers also offer themed events, birthday parties, and breed-specific play sessions as part of this model.

Pet Sitting is growing rapidly, particularly among clients who prefer in-home care or have pets with separation anxiety or medical needs. In contrast to commercial boarding, pet sitting offers one-on-one attention and a familiar environment, minimizing stress for the pet. Pet sitting services are often tech-enabled with daily updates, location tracking, and live video calls. The rise of app-based platforms like Rover and Wag! has made pet sitting highly accessible and scalable, appealing to digitally savvy pet owners.

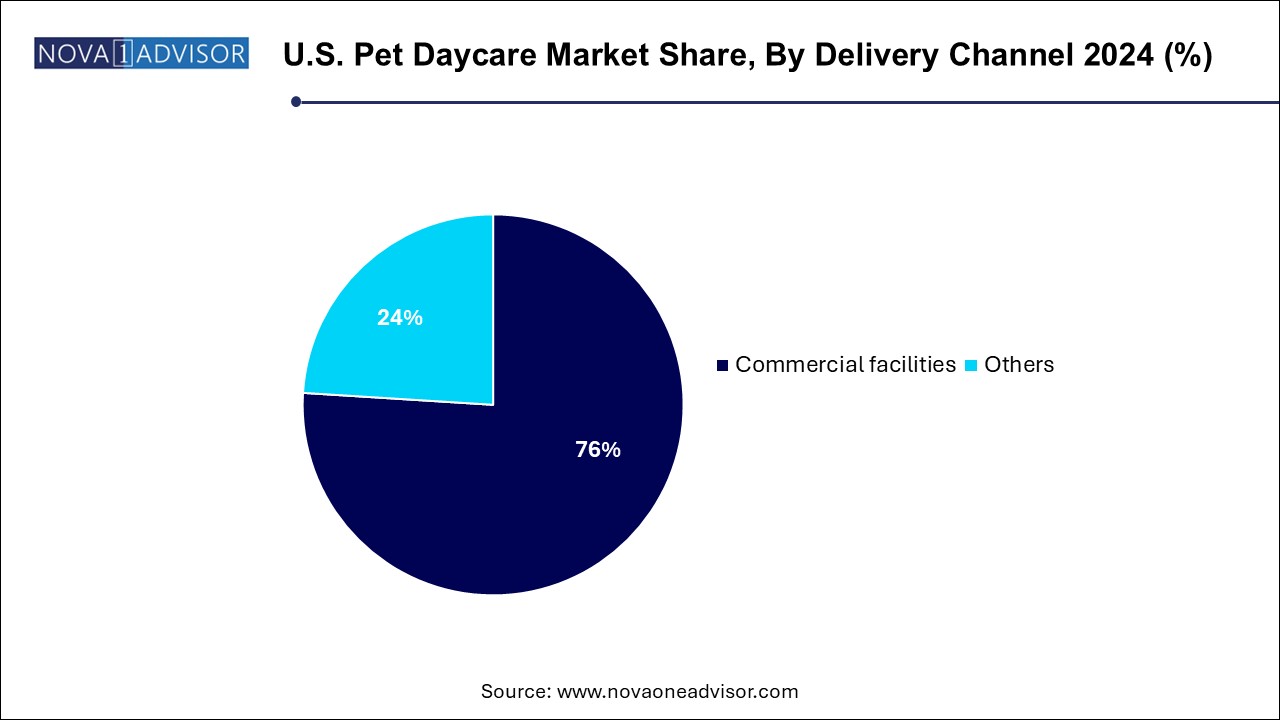

Commercial Facilities lead the market, especially in metropolitan and suburban regions where professionalized services and safety assurances are valued. These facilities often provide standardized routines, veterinary oversight, and insurance coverage. With increasing scrutiny on pet safety, commercial providers are adopting features like air filtration systems, temperature controls, and staff training programs to build consumer trust. National chains and franchises such as Dogtopia and Camp Bow Wow have expanded rapidly due to consistent quality and brand recognition.

Other delivery channels, including home-based care and mobile daycare, are growing fast, fueled by demand for personalized services and convenience. These models cater to niche preferences such as breed-specific care, age-segmented activities, or multi-pet households. Mobile daycare services that bring trained staff and play equipment to the client’s home or community parks are especially popular in cities. Home-based providers, often operating with fewer pets, offer a more intimate setting and are ideal for animals with special needs or socialization challenges.

The pet daycare landscape across the U.S. is shaped by demographic trends, urbanization, disposable income levels, and cultural shifts in pet ownership. High-density states such as California, New York, Texas, and Florida are leading the market in terms of number of daycare facilities and total pet service expenditure. Major urban centers like Los Angeles, Austin, Chicago, and Seattle have emerged as innovation hubs for premium pet services, with trends quickly cascading into secondary cities.

National associations such as the IBPSA (International Boarding & Pet Services Association) and APPA help standardize best practices, facilitate training, and shape consumer expectations. Meanwhile, city-level regulations around kennel licenses, zoning, and pet safety are influencing how and where facilities can operate. The U.S. market continues to evolve with growing acceptance of pets in shared spaces—including workplaces and retail environments—further normalizing the role of pet daycare in everyday life.

Dogtopia (March 2025): Launched a national campaign focused on dog wellness with on-site behaviorists and customized training routines across all locations.

Camp Bow Wow (January 2025): Announced expansion into six new states with flagship eco-friendly daycare centers.

Wag Hotels (February 2025): Introduced luxury cat-only suites with climate control and interactive webcams at their flagship California location.

Rover (December 2024): Acquired a regional pet sitting network to expand in-home service coverage across the Midwest.

PetSmart (November 2024): Opened its first in-store hybrid daycare and veterinary clinic model, blending convenience with wellness.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. pet daycare market

By Pet

By Service

By Delivery Channel