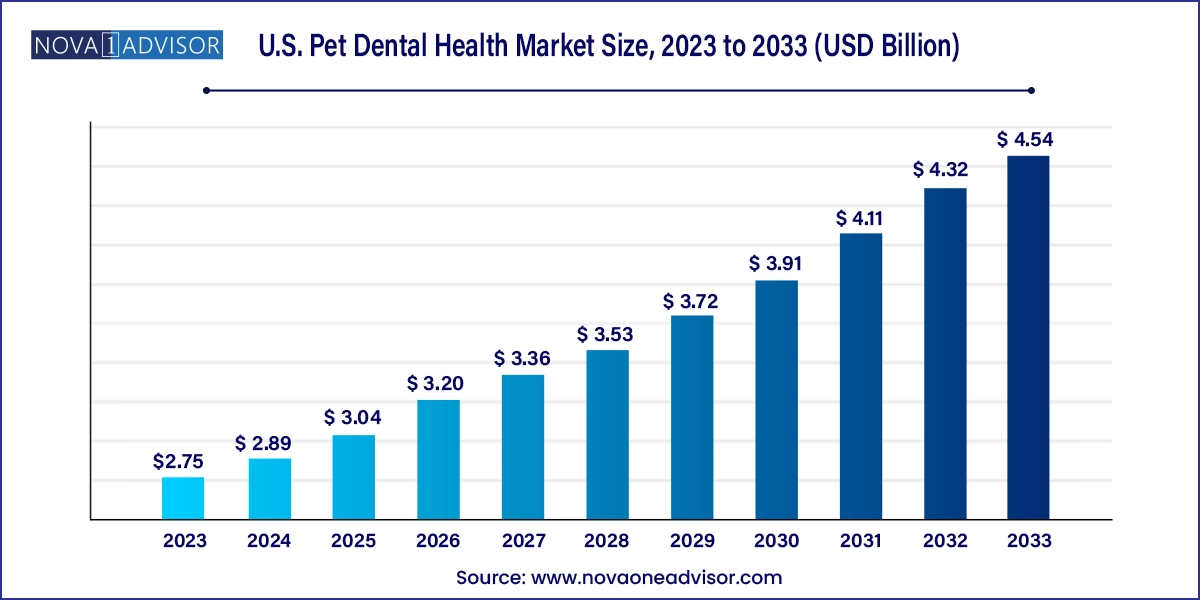

The U.S. pet dental health market size was exhibited at USD 2.75 billion in 2023 and is projected to hit around USD 4.54 billion by 2033, growing at a CAGR of 5.15% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 2.89 Billion |

| Market Size by 2033 | USD 4.54 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 5.15% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Type, Animal Type, Indication, Distribution Channel |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | U.S. |

| Key Companies Profiled | Virbac; Colgate- Palmolive Company; Dechra Pharmaceuticals plc; Nestlé Purina Pet Care; Vetoquinol SA; Nylabone (Central Garden & Pet Company); Barkbox; imRex Inc.; Basepaws, Inc.; Dentalaire, International.; Pedigree (Mars Incorporate); PetIQ, LLC. |

The rise in pet dental diseases, increased awareness among pet owners about preventing painful dental conditions, surge in veterinary dental check-ups & procedures, introduction of innovative pet oral care products by leading companies, and growth in pet ownership rates are key factors contributing to the market’s expansion.

U.S. accounted for over 32.2% in the global pet dental health market share in 2023, owing to the growing awareness of maintaining pet dental health with appropriate oral care products, regular dental cleaning, and other treatments, as these are vital for enhancing the overall health and behavior of animals. These elements are anticipated to present lucrative opportunities for market growth. The American Veterinary Medical Association (AVMA) reports that periodontal diseases are the most prevalent dental conditions in pets aged three years and older. Veterinary centers of America (VCA) Animal Hospitals states that over 80.0% dogs are diagnosed with active dental diseases by the time they reach three years of age.

However, the COVID-19 pandemic led to a downturn in the pet dental health market, particularly in 2020. This negative impact was largely due to lockdown measures implemented in various regions, which led to the closure of and limited access to veterinary services. This situation has posed challenges for pet owners in obtaining primary veterinary dental care due to the cancellations and enforced restriction of veterinary dental appointments. AVMA has noted that providing veterinary services during the pandemic has been a significant challenge for veterinarians. In 2020, the productivity of veterinary practices in the U.S. fell by 25% due to the pandemic. However, as veterinary practices are an essential healthcare business in the country, services began to recover in 2021 as activities gradually resumed.

The U.S. pet dental health market companies have encountered some difficulties in maintaining their supply of veterinary oral care products due to the unpredictability of distribution channels. Nevertheless, government agencies and key market players have implemented several measures to sustain their animal healthcare business throughout the pandemic. For instance, Virbac mentioned in its 2020 annual report that the company did not face supply issues that could have affected their overall sales during the year. However, the production sites were not able to operate at full capacity, leading to delivery issues. The company’s strategies for crisis supply chain management have increased its revenue in the following years.

Products held a significant market share and is expected to grow at the fastest CAGR of over 6.1% during the forecast period, owing to the growing awareness among pet parents regarding animal dental care. A variety of pet oral health products, including enzymatic toothpaste and brushes, oral care solutions, dental care powder, foods, treats, chews, and dental wipes, among others, are available to help maintain the oral health of pets. The veterinary industry’s swift progress has introduced several new products to the market from leading players. Despite the pandemic, some industry participants have experienced substantial growth in the sales of oral care products through online distribution. For instance, Tropiclean witnessed a 15% rise in its pet dental care products in 2020 compared to its sales in 2019.

Services dominated the market with the largest revenue share of 69.3% in 2023. This is due to the extensive array of diagnostic and treatment services for dental care provided by different veterinary practices. Dental health significantly influences the overall health and behaviour of pets, making an annual routine dental check-up essential for them. Prevention is the primary factor in managing dental disorders; therefore, regular teeth cleaning and brushing to remove plaque are vital. The American Animal Hospital Association advises regular oral exams and dental cleanings to eliminate tartar and prevent gum diseases.

Dogs dominated the market and accounted for the largest revenue share of over 59% in 2023, owing to the increasing dog adoption rates and significant dental disease prevalence estimated among them. The escalating rate of dog population in all regions is significantly propelling the market’s growth. As per the American Kennel Club (AKC), there was an increase in dog-owning households in the U.S., from 50% in 2018 to 54% in 2021. Furthermore, the COVID-19 pandemic has prompted many people country-wide to adopt dogs for emotional support.

Cats segment is anticipated to grow at the fastest CAGR of 5.87% during the forecast period. The rise in cases of gingivitis in cats and their awareness is enhances the growth of this segment. For example, the Cornell Feline Health Centre reports that gum diseases like gingivitis and periodontitis are found in 50% to 90% of the cat population. These dental conditions can be triggered by other infectious diseases such as feline leukaemia virus, diabetes mellitus, feline immunodeficiency virus, autoimmune diseases, and kidney diseases. Therefore, regular removal of plaque using oral care methods and routine teeth cleaning is commonly practiced, which has a significant effect on the growth of this segment.

Gum diseases indication dominated the market and held the largest revenue market share of 37.7% in 2023. The high incidence of gum diseases like periodontitis and gingivitis among pets contributes to this. Periodontal diseases, which are caused by bacteria in the mouth and are generally progressive, can harm the gums, teeth, upper and lower jawbones, and other facial structures. As the disease starts below the gum line, noticeable signs and symptoms only appear once it has advanced. Approximately 80% of dogs and 70% of cats over the age of 3 years suffer from active gum diseases. This accounts for the largest portion of the market segment.

Dental calculus is expected to grow at the fastest CAGR of 6.61% over the forecast period, owing to its prevalence among domestic dogs. Only a professional veterinary dentist can eliminate dental calculus through thorough teeth cleaning and polishing. However, consistent teeth brushing can reduce plaque accumulation in animals’ teeth, preventing the advancement of calculus and subsequent severe gum diseases. Dental chews aid in the removal of dental calculus from the tooth surface. If not curtailed in the early stages through routine brushing and good oral hygiene, this common pet oral issue can result in periodontal diseases.

Veterinary hospitals & clinics held the largest market share of 43.0% in 2023. The increase in the number of veterinary hospitals and clinics worldwide, equipped with advanced facilities, contributes to this. These veterinary clinics and hospitals play a vital role in pet dental healthcare by offering professional dental treatments through licensed veterinary dentists. The rise in the number of veterinary professionals also propels the market segment’s growth. As per the American Veterinary Medical Association, the count of veterinary professionals in the U.S. reached 121,461 in 2021.

E-commerce is anticipated to grow at the highest CAGR of 5.58% during the forecast period. With an increasing number of families having companion animals, there is a greater demand for easy access to pet oral care supplies. There are numerous brands of dental care diets, toothbrushes, chews, wipes, snacks, rinses, oral care water additives, pastes, and other products available for use in pet dental care. During the COVID-19 pandemic, online sales of these products increased significantly, enabling practical and simple platforms for pet dental care items. A few examples include Chewy, Amazon, Walmart, Target Brands, Inc. etc.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. pet dental health market

Type

Animal Type

Indication

Distribution Channel

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Segment Definitions

1.2.1. Type

1.2.2. Animal Type

1.2.3. Indication

1.2.4. Distribution Channel

1.2.5. Estimates and forecasts timeline

1.3. Research Methodology

1.4. Information Procurement

1.4.1. Purchased database

1.4.2. internal database

1.4.3. Secondary sources

1.4.4. Primary research

1.4.5. Details of primary research

1.4.5.1. Data for primary interviews in U.S.

1.5. Information or Data Analysis

1.5.1. Data analysis models

1.6. Market Formulation & Validation

1.7. Model Details

1.7.1. Commodity flow analysis (Model 1)

1.7.2. Approach 1: Commodity flow approach

1.8. List of Secondary Sources

1.9. List of Primary Sources

1.10. Objectives

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.2.1. Type outlook

2.2.2. Animal type outlook

2.2.3. Indication outlook

2.2.4. Distribution channel outlook

2.3. Competitive Insights

Chapter 3. U.S. Pet Dental Health Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook

3.2. Market Dynamics

3.2.1. Market driver analysis

3.2.1.1. Rising prevalence of pet dental diseases

3.2.1.2. Growing pet population & adoption

3.2.1.3. Increasing adoption of pet insurance

3.2.1.4. Growing awareness of pet dental care

3.2.2. Market restraint analysis

3.2.2.1. High cost of diagnosis & treatment

3.2.2.2. Lack of veterinary dentistry in underdeveloped/developing countries

3.3. U.S. Pet Dental Heath Market Analysis Tools

3.3.3. Industry Analysis - Porter’s Five Forces

3.3.3.1. Threat of new entrant

3.3.3.2. Threat of substitutes

3.3.3.3. Bargaining power of buyers

3.3.3.4. Bargaining power of suppliers

3.3.3.5. Competitive rivalry

3.3.4. PESTEL Analysis

3.3.4.1. Political & legal landscape

3.3.4.2. Economic landscape

3.3.4.3. Social landscape

3.3.4.4. Technological landscape

3.3.4.5. Environmental landscape

Chapter 4. U.S. Pet Dental Health Market: Type Estimates & Trend Analysis

4.1. U.S. Pet Dental Health Market: Type Dashboard

4.2. U.S. Pet Dental Health Market: Type Movement Analysis

4.3. U.S. Pet Dental Health Market Size & Forecasts and Trend Analyses, 2021 to 2033 for the following

4.4. Products

4.4.1. Market estimates and forecasts 2021 to 2033 (USD Million)

4.4.2. Oral Care Products

4.4.2.1. Market estimates and forecasts 2021 to 2033 (USD Million)

4.4.2.2. Toothpastes & Brushes

4.4.2.2.1. Market estimates and forecasts 2021 to 2033 (USD Million)

4.4.2.3. Oral Care Solutions

4.4.2.3.1. Market estimates and forecasts 2021 to 2033 (USD Million)

4.4.2.4. Foods & Treats

4.4.2.4.1. Market estimates and forecasts 2021 to 2033 (USD Million)

4.4.2.5. Dental Chews

4.4.2.5.1. Market estimates and forecasts 2021 to 2033 (USD Million)

4.4.2.6. Dental Powder

4.4.2.6.1. Market estimates and forecasts 2021 to 2033 (USD Million)

4.4.2.7. Others

4.4.2.7.1. Market estimates and forecasts 2021 to 2033 (USD Million)

4.4.3. Medicines

4.4.3.1. Market estimates and forecasts 2021 to 2033 (USD Million)

4.4.4. Equipment

4.4.4.1. Market estimates and forecasts 2021 to 2033 (USD Million)

4.5. Services

4.5.1. Market estimates and forecasts 2021 to 2033 (USD Million)

4.5.2. Diagnosis

4.5.2.1. Market estimates and forecasts 2021 to 2033 (USD Million)

4.5.3. Treatment

4.5.3.1. Market estimates and forecasts 2021 to 2033 (USD Million)

4.5.3.2. Dental Cleaning

4.5.3.2.1. Market estimates and forecasts 2021 to 2033 (USD Million)

4.5.3.3. Surgery

4.5.3.3.1. Market estimates and forecasts 2021 to 2033 (USD Million)

4.5.3.4. Root Canal Therapy

4.5.3.4.1. Market estimates and forecasts 2021 to 2033 (USD Million)

4.5.3.5. Others

4.5.3.5.1. Market estimates and forecasts 2021 to 2033 (USD Million)

Chapter 5. U.S. Pet Dental Health Market: Animal Type Estimates & Trend Analysis

5.1. U.S. Pet Dental Health Market: Animal Type Dashboard

5.2. U.S. Pet Dental Health Market: Animal Type Movement Analysis

5.3. U.S. Pet Dental Health Market Size & Forecasts and Trend Analyses, 2021 to 2033 for the following

5.4. Dogs

5.4.1. Market estimates and forecasts 2021 to 2033 (USD Million)

5.5. Cats

5.5.1. Market estimates and forecasts 2021 to 2033 (USD Million)

5.6. Others

5.6.1. Market estimates and forecasts 2021 to 2033 (USD Million)

Chapter 6. U.S. Pet Dental Health Market: Indication Estimates & Trend Analysis

6.1. U.S. Pet Dental Health Market: Indication Dashboard

6.2. U.S. Pet Dental Health Market: Indication Movement Analysis

6.3. U.S. Pet Dental Health Market Size & Forecasts and Trend Analyses, 2021 to 2033 for the following

6.4. Gum Disease

6.4.1. Market estimates and forecasts 2021 to 2033 (USD Million)

6.5. Endodontic Disease

6.5.1. Market estimates and forecasts 2021 to 2033 (USD Million)

6.6. Dental Calculus

6.6.1. Market estimates and forecasts 2021 to 2033 (USD Million)

6.7. Oral Tumor

6.7.1. Market estimates and forecasts 2021 to 2033 (USD Million)

6.8. Others

6.8.1. Market estimates and forecasts 2021 to 2033 (USD Million)

Chapter 7. U.S. Pet Dental Health Market: Distribution Channel Estimates & Trend Analysis

7.1. U.S. Pet Dental Health Market: Distribution Channel Dashboard

7.2. U.S. Pet Dental Health Market: Distribution Channel Movement Analysis

7.3. U.S. Pet Dental Health Market Size & Forecasts and Trend Analyses, 2021 to 2033 for the following

7.4. Veterinary Hospitals & Clinics

7.4.1. Market estimates and forecasts 2021 to 2033 (USD Million)

7.5. Retail Pharmacies

7.5.1. Market estimates and forecasts 2021 to 2033 (USD Million)

7.6. E-commerce

7.6.1. Market estimates and forecasts 2021 to 2033 (USD Million)

7.7. Others

7.7.1. Market estimates and forecasts 2021 to 2033 (USD Million)

Chapter 8. Competitive Landscape

8.1. Recent Developments & Impact Analysis, By Key Market Participants

8.2. Company/Competition Categorization

8.3. Vendor Landscape

8.3.1. List of key distributors and channel partners

8.3.2. Key customers

8.3.3. Key company market share analysis, 2023

8.3.4. Virbac

8.3.4.1. Company overview

8.3.4.2. Financial performance

8.3.4.3. Product benchmarking

8.3.4.4. Strategic initiatives

8.3.5. Colgate- Palmolive Company

8.3.5.1. Company overview

8.3.5.2. Financial performance

8.3.5.3. Product benchmarking

8.3.5.4. Strategic initiatives

8.3.6. Dechra Pharmaceuticals plc

8.3.6.1. Company overview

8.3.6.2. Financial performance

8.3.6.3. Product benchmarking

8.3.6.4. Strategic initiatives

8.3.7. Nestlé Purina Pet Care

8.3.7.1. Company overview

8.3.7.2. Financial performance

8.3.7.3. Product benchmarking

8.3.7.4. Strategic initiatives

8.3.8. Vetoquinol SA

8.3.8.1. Company overview

8.3.8.2. Financial performance

8.3.8.3. Product benchmarking

8.3.8.4. Strategic initiatives

8.3.9. Nylabone (Central Garden & Pet Company)

8.3.9.1. Company overview

8.3.9.2. Financial performance

8.3.9.3. Product benchmarking

8.3.9.4. Strategic initiatives

8.3.10. Barkbox; imRex Inc.

8.3.10.1. Company overview

8.3.10.2. Financial performance

8.3.10.3. Product benchmarking

8.3.10.4. Strategic initiatives

8.3.11. Basepaws, Inc.

8.3.11.1. Company overview

8.3.11.2. Financial performance

8.3.11.3. Product benchmarking

8.3.11.4. Strategic initiatives

8.3.12. Dentalaire, International.

8.3.12.1. Company overview

8.3.12.2. Financial performance

8.3.12.3. Product benchmarking

8.3.12.4. Strategic initiatives

8.3.13. Pedigree (Mars Incorporate)

8.3.13.1. Company overview

8.3.13.2. Financial performance

8.3.13.3. Product benchmarking

8.3.13.4. Strategic initiatives

8.3.14. PetIQ, LLC.

8.3.14.1. Company overview

8.3.14.2. Financial performance

8.3.14.3. Product benchmarking

8.3.14.4. Strategic initiatives