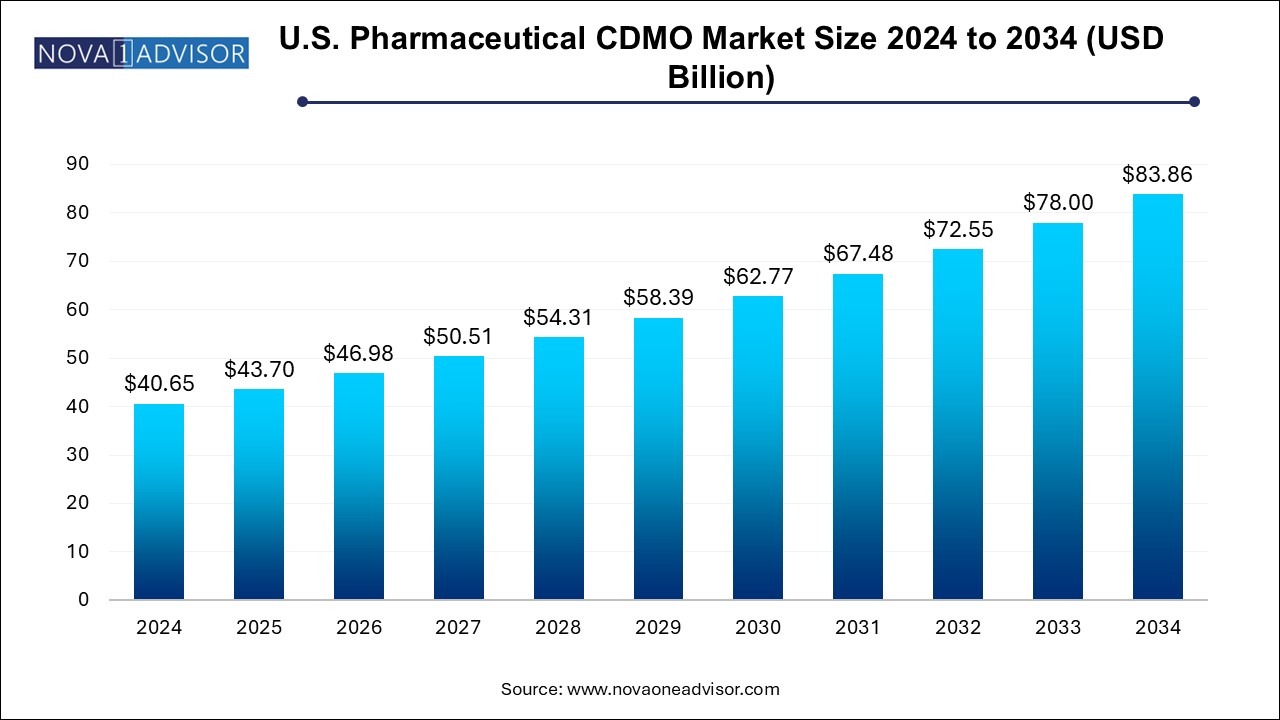

The U.S. pharmaceutical CDMO market size was exhibited at USD 40.65 billion in 2024 and is projected to hit around USD 83.86 billion by 2034, growing at a CAGR of 7.51% during the forecast period 2024 to 2034.

The U.S. pharmaceutical CDMO market is driven by the growing need for biosimilars and biologics. Pharmaceutical businesses depend on CDMOs to supply the specialized knowledge, advanced manufacturing capabilities, and regulatory compliance needed for these complex medicines as they invest more and more in biologic therapies, such as vaccines, and monoclonal antibodies.

From early-stage drug discovery to final commercial production, CDMOs provide a wide range of services. These cover the creation of formulations, the production of materials for clinical trials, stability analyses, procedures for scaling up, and post-market manufacturing. Pharmaceutical businesses need this assistance to manage the challenges of medication development and ensure their goods are prepared for release onto the market. A major worry is the dependability of the drug supply, especially for essential and life-saving medications.

In June 2023, Hikma Pharmaceuticals PLC initiated Dobutamine Injection, USP, in a 250mg/20mL vial in the US. With this launch, Hikma's growing US portfolio of sterile injectable medicines now exceeds 150 products spanning a broader range of therapeutic areas and dosage forms.

How is Artificial Intelligence helping pharmaceutical CDMO processes?

Artificial intelligence and machine learning are crucial to modern contract development and manufacturing organizations' operations. The steady rise in the complexity of manufacturing new medicines and the desire to decrease the time of market boost the demand for faster development and manufacturing. This pressure is fueling the implementation of AI solutions into many pharmaceutical development and manufacturing tasks. AI offers a solid basis for greater automation and knowledge expansion, enabling faster decision-making.

The National Academies of Sciences, Engineering, and Medicine (NASEM) conducted a report on the latest innovations in pharmaceutical manufacturing that stated AI’s crucial role in the modeling, measurement, and control used for pharmaceutical manufacturing. It provides potential benefits to pharmaceutical producers through optimized process design and maintenance to boost constant improvement. Along with other innovative technologies, AI might advance pharmaceutical quality, build more resilient supply chains, and enhance patient medicine availability.

U.S. Pharmaceutical CDMO Market Growth Factors

Driver

Increasing focus on small molecules with complex chemical compositions

Small-molecule medicines are low molecular weight, chemically produced substances frequently found in oral pharmaceuticals. Complex procedures, such as sophisticated chemical synthesis, purification, and formulation, are involved in developing these medications. The creation of targeted medicines, many of which require small or big compounds with extremely particular chemical compositions, is fueled by genomics and personalized medicine developments.

Restraint

Intense competition

Businesses are under a lot of pressure to cut prices to stay competitive as the number of CDMOs in the market rises. Cost-effective solutions are frequently sought by pharmaceutical companies that outsource development and manufacturing. This forces CDMOs to lower their prices, which may affect their profit margins. Contracts may be lost by businesses that cannot match their rivals' lower prices, particularly when big pharmaceutical or biotech corporations are involved.

Opportunity

Investments in continuous manufacturing technology

Improved process control offered by continuous production directly impacts pharmaceutical products' quality and consistency. This is accomplished through constant procedures that yield real-time data, improve essential process parameter monitoring and adjustment, and guarantee continual quality. With fewer manual interventions, the possibility of operator error is significantly reduced. Continuous manufacturing processes can produce a more consistent product in potency, release profiles, and appearance.

| Report Coverage | Details |

| Market Size in 2025 | USD 43.70 Billion |

| Market Size by 2034 | USD 83.86 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 7.51% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Product, Application, End User, and Regions |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | Thermo Fisher Scientific Inc., Laboratory Corporation of America Holdings, Catalent, Inc, Cambrex Corporation, and Others. |

The active pharmaceutical ingredient (API) manufacturing segment dominated the U.S. pharmaceutical CDMO market in 2024. CDMOs provide state-of-the-art technologies for synthesizing APIs, such as green chemical techniques, process intensification, and continuous manufacturing. They also provide compliance and quality assurance that might be challenging for small to mid-sized pharmaceutical companies to accomplish internally, ensuring conformity to strict FDA standards. The need for CDMOs with experience in producing these particular APIs is further fueled by the growing development of highly effective, customized, and uncommon illness medicines.

The finished dosage formulation (FDF) development and manufacturing segment is observed to be the fastest growing in the U.S. pharmaceutical CDMO market during the forecast period. Specialty dosage forms like injectables, oral disintegrating tablets, and extended-release tablets, as well as specialist indications like oncology and rare disorders, are making modern medication formulations more complicated. CDMOs provide specialized facilities, cutting-edge equipment, and technological know-how to manage these challenges. Biopharmaceuticals, such as mRNA-based treatments and monoclonal antibodies, drive the demand for complex manufacturing procedures.

CDMOs are making significant investments in sterile and injectable manufacturing capabilities to meet this demand. In the production of FDF, single-use technologies and lyophilization (freeze-drying) techniques are also becoming more popular.

The phase III segment dominated the U.S. pharmaceutical CDMO market in 2024. Phase III clinical studies target to validate a drug's safety, effectiveness, and ideal dosage in a wider patient group. This stage of medication research is vital and resource-intensive since these studies supply the information required for regulatory approval. Phase III studies require extensive development assistance and large-scale manufacturing capabilities because they involve thousands of individuals across several locations. Top CDMOs are investing in automation, capacity expansion, and advanced technology to explicitly address Phase III requirements. This comprises process-streamlining digital tools and biomanufacturing technologies.

The phase II segment is observed to be the fastest growing in the market during the forecast period. More medications are undergoing Phase II trials due to the biotechnology and pharmaceutical industries' recent innovation boom. Evaluation is necessary due to the profusion of novel therapeutics brought about by advances in genomes, precision medicine, and biologics. Phase II trials are crucial for personalized medicine techniques since they frequently concentrate on improving patient populations. Because of its affordability and growing healthcare infrastructure, areas like Asia-Pacific are emerging as important centers for these trials.

In the United States, pharmaceutical businesses have started discovering that outsourcing manufacturing and development duties is more cost-effective than retaining in-house facilities. Small and mid-sized pharmaceutical enterprises find it difficult to maintain compliant production facilities due to the strict FDA rules in the United States. CDMOs lower regulatory risks by providing infrastructure and compliance expertise. CDMOs provide a range of flexible manufacturing options, such as large-scale production for popular medications and small-batch production for precision medications. Pharmaceutical businesses are drawn to this flexibility.

In April 2023, Endo International plc declared that one of its operating firms, Par Pharmaceutical, Inc., has started shipping the authorized generic (AG) version of Merck's Noxafil 200 mg/5 mL oral suspension in the United States.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. pharmaceutical CDMO market

By Service Type

By Research Phase