The U.S. pharmaceutical filtration market size was valued at USD 4.85 billion in 2023 and is projected to surpass around USD 8.39 billion by 2033, registering a CAGR of 5.63% over the forecast period of 2024 to 2033.

The U.S. pharmaceutical filtration market represents a vital segment of the biopharmaceutical and drug manufacturing ecosystem, encompassing a wide range of filtration technologies used to ensure purity, safety, and compliance in pharmaceutical products. Filtration plays a critical role across every stage of drug development and manufacturing ranging from raw material filtration and formulation to sterilization and final product packaging.

As pharmaceutical pipelines grow increasingly complex with biologics, biosimilars, and cell and gene therapies gaining ground—the demand for high-performance filtration solutions has expanded dramatically. Regulatory requirements by the FDA, USP, and cGMP guidelines mandate robust filtration protocols to prevent contamination, maintain batch consistency, and ensure patient safety. From membrane filters to single-use systems, the technologies deployed must meet high standards of precision and reliability.

The U.S. remains one of the largest pharmaceutical manufacturing hubs globally, with substantial investments in both R&D and production infrastructure. With a rising prevalence of chronic diseases, increased vaccine production, and strong innovation in personalized medicine, pharmaceutical companies are scaling up both small- and large-volume manufacturing operations—thereby boosting demand for specialized filtration equipment and consumables.

Moreover, the adoption of single-use technologies, automation, and closed-loop processing is revolutionizing how filtration systems are integrated into modern facilities. As continuous manufacturing gains popularity and regulatory authorities encourage streamlined and flexible production models, the pharmaceutical filtration landscape is undergoing significant transformation in both scale and sophistication.

Rising adoption of single-use filtration systems to reduce contamination risk and cleaning costs in biologics manufacturing.

Shift toward high-performance membrane technologies, such as PVDF and PTFE membranes, for enhanced sterility and throughput.

Integration of filtration systems into continuous and modular manufacturing lines, improving scalability and speed-to-market.

Increasing demand for sterile filtration across mRNA vaccines, monoclonal antibodies, and other sensitive biologics.

Emergence of nanofiltration for viral clearance and protein fractionation, offering precision separation at the molecular level.

Expansion of prefilters and depth media in upstream processing to protect final stage membranes and improve process efficiency.

Technological advancements in filter cartridges and holders that enable higher flow rates, reduced fouling, and automated monitoring.

Regulatory emphasis on validated and traceable filtration processes, driving the adoption of integrated filtration validation tools.

Growing outsourcing of filtration-dependent processes to CDMOs (Contract Development and Manufacturing Organizations).

Environmental and sustainability initiatives, encouraging adoption of recyclable, biodegradable, or low-waste filtration formats.

| Report Attribute | Details |

| Market Size in 2024 | USD 5.12 Billion |

| Market Size by 2033 | USD 8.39 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 5.63% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, technique, type, application, scale of operation |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Eaton; Merck KGaA; Amazon Filters Ltd.; Thermo Fisher Scientific Inc; Parker Hannifin Corp; 3M; Sartorius AG.; Graver Technologies; Danaher; Meissner Filtration Products, Inc. |

A key driver of the U.S. pharmaceutical filtration market is the surge in biologics and sterile injectable drug production. Unlike small-molecule drugs, biologics including vaccines, monoclonal antibodies, and recombinant proteins are highly sensitive to contamination and degradation. This necessitates high-precision sterile filtration throughout the production cycle.

The increased deployment of mRNA vaccines during the COVID-19 pandemic spotlighted the need for robust, scalable filtration systems for both upstream and downstream processes. Additionally, the approval pipeline for biologics continues to expand, with over 50% of new drug approvals by the FDA involving complex biologics. This trend demands enhanced filtration processes to ensure viral clearance, protein purification, and endotoxin removal.

Further, stringent regulatory expectations by the FDA for aseptic manufacturing environments have led to the widespread adoption of validated sterile filtration technologies. The use of closed filtration systems and single-use technologies minimizes operator exposure and cross-contamination risks, aligning with the biopharma industry’s increasing focus on patient safety and production reliability.

One of the primary restraints in the U.S. pharmaceutical filtration market is the high cost of advanced filtration technologies and the complexity associated with system validation. Especially in sterile drug manufacturing and high-value biologics, filtration processes must be validated rigorously for compatibility, microbial retention, chemical resistance, and throughput efficiency.

Membrane filters, for example, are required to undergo bacterial challenge tests, integrity testing, and extractables/leachables evaluation each of which adds to the overall cost and time-to-market. For small- to mid-sized pharmaceutical companies, this presents a financial and operational challenge.

Additionally, integrating filtration systems into existing batch or continuous manufacturing processes requires compatibility with other unit operations, such as chromatography or aseptic filling, which can be technically complex. System scalability, risk mitigation, and data traceability further increase the investment required. As a result, capital expenditures and operational validation hurdles can limit adoption among smaller or resource-constrained players.

The pandemic created a tectonic shift in pharmaceutical production infrastructure, especially in the area of mRNA-based vaccines and therapies. The subsequent expansion of mRNA manufacturing capacity across the U.S. represents a major opportunity for the filtration market, as nucleic acid therapies require high-fidelity sterile and ultrafiltration processes for buffer exchange, concentration, purification, and formulation.

mRNA vaccine production workflows heavily rely on tangential flow filtration (TFF), sterile membrane filters, and virus filtration steps to meet quality and safety benchmarks. With continued R&D in mRNA applications for cancer, infectious disease, and genetic disorders, the demand for robust and scalable filtration systems is growing.

Filtration vendors have an opportunity to design custom filter cartridges, membrane formats, and closed-loop systems tailored to nucleic acid-based platforms. The growing partnerships between biotech firms and CDMOs in this space also present a path for filtration providers to expand their client base and service offerings.

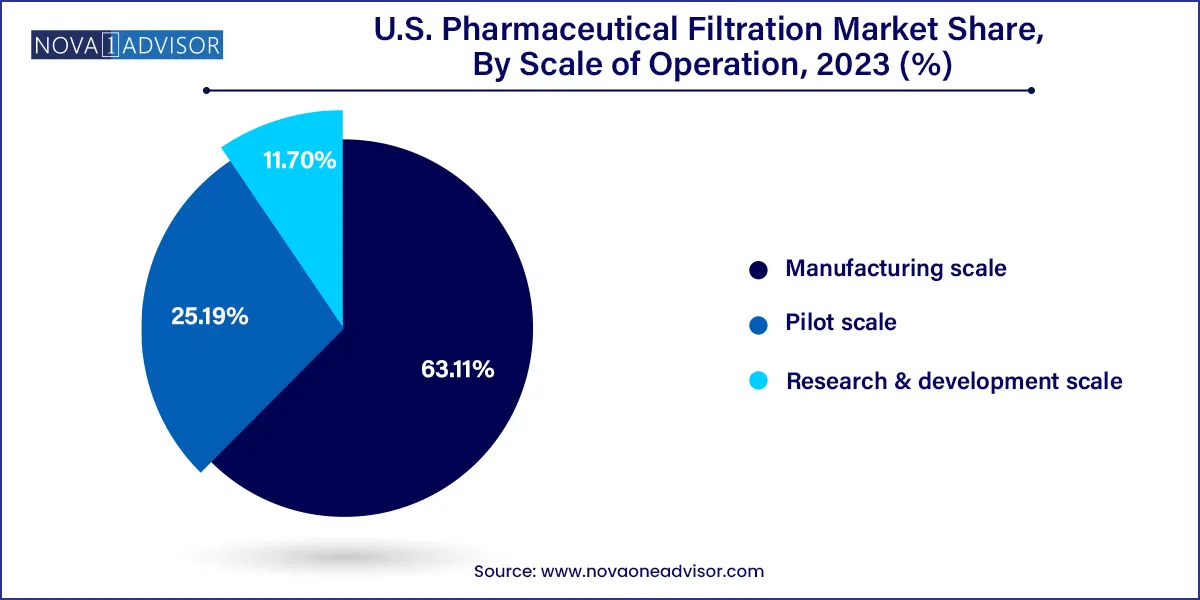

Manufacturing scale filtration dominates the U.S. market, driven by the large number of commercial-scale production sites for small and large molecules. These facilities require high-throughput filtration systems, automated filter skids, and large-volume filter capsules or cartridges.

Pilot-scale filtration is growing rapidly, especially among early-stage biotech firms and CDMOs. These operations require scalable, flexible systems that can simulate commercial production while allowing process development and optimization. Innovations in modular filtration units and single-use skids are catering specifically to this segment.

Membrane filters currently dominate the U.S. pharmaceutical filtration market, especially in final product processing. These filters offer precise microbial retention and are essential in sterile filtration processes for parenteral drugs, biologics, and cell therapy products. Among these, PVDF and PTFE membrane filters have gained particular traction due to their chemical resistance, low protein binding, and high flow rates. These membranes are used extensively in protein purification, vaccine processing, and viral filtration applications.

Single-use systems are the fastest-growing product category, fueled by the shift toward flexible, modular manufacturing environments. These systems reduce cross-contamination, eliminate cleaning validation, and are ideal for multiproduct facilities. As single-use bioreactors and chromatography systems become mainstream, demand for compatible single-use filtration assemblies is accelerating. Key applications include formulation and filling, sterile buffer filtration, and media preparation.

Microfiltration is the leading filtration technique, particularly in sterile filtration and prefiltration steps. It enables efficient removal of bacteria and particles from solutions, making it indispensable in injectable drug production. The dominance of microfiltration is also supported by the versatility of its application across upstream and downstream processes.

Nanofiltration is the fastest-growing technique, especially in the context of viral clearance, protein separation, and solvent recovery. It offers precise separation at the molecular level, suitable for applications requiring removal of endotoxins, viruses, and DNA fragments. Its utility in advanced biologics and gene therapy workflows is making nanofiltration a priority for new facility investments.

Sterile filtration leads the market, as it is mandated for all injectable and ophthalmic products. Filtration is used as a terminal sterilization method when heat-based methods are not feasible. Sterile filters must meet stringent FDA criteria for microbial retention and integrity testing.

Non-sterile filtration, while less regulated, plays an essential role in buffer preparation, raw material processing, and air/gas filtration. It remains a critical supporting segment, especially in large-scale raw material handling and bioburden control.

Final product processing is the largest application segment, particularly for sterile filtration, formulation, and filling solutions. Filtration ensures that finished drug products meet microbial and particulate specifications. Within this, sterile filtration and viral clearance are critical sub-segments in biologics manufacturing.

Raw material filtration is emerging as the fastest-growing application, due to the need for media, buffer, and excipient preparation free from particulates and microbial contamination. With increasing emphasis on upstream quality, manufacturers are adopting high-grade prefilters and depth media to ensure process robustness.

The United States commands a leadership position in pharmaceutical filtration, supported by its status as a global hub for drug development, clinical research, and commercial manufacturing. The presence of major pharma companies (Pfizer, Moderna, J&J), biotechnology innovators, and advanced manufacturing facilities creates a constant demand for filtration solutions.

Regulatory standards set by the FDA and USP for aseptic manufacturing and sterile drug production necessitate the deployment of validated, high-performance filtration systems. Additionally, investments in new biopharma plants and mRNA vaccine production facilities—especially in states like Massachusetts, North Carolina, and California—are driving regional demand for filtration technologies.

Moreover, the U.S. government's focus on pharmaceutical supply chain resilience, pandemic preparedness, and onshoring of essential medicine production is leading to capacity expansion across biologics and vaccine segments, directly benefiting filtration suppliers.

March 2025: Merck Millipore announced the launch of its new Stericup Quick Release-GP Filter System, designed to improve filtration speed and reduce contamination risk in sterile pharmaceutical operations.

February 2025: Sartorius opened a new filtration membrane production facility in New York, boosting its ability to supply single-use filters to biopharmaceutical manufacturers across North America.

January 2025: 3M Health Care introduced Zeta Plus Encapsulated System with A Series Media, designed for depth filtration in protein purification and viral clearance workflows.

December 2024: Parker Hannifin launched an AI-driven filtration monitoring module integrated into its filtration skids to track membrane fouling and optimize cleaning schedules.

November 2024: Cytiva (formerly GE Healthcare Life Sciences) partnered with a leading U.S. CDMO to deliver integrated filtration and purification systems for gene therapy production.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Pharmaceutical Filtration market.

By Product

By Technique

By Type

By Application

By Scale of Operation