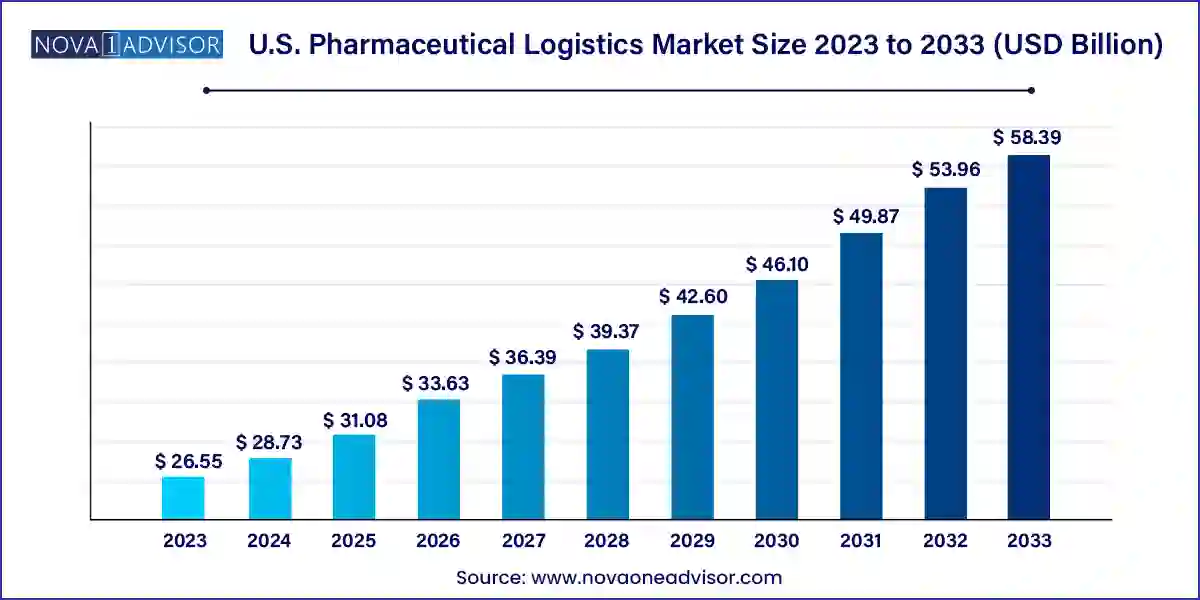

The U.S. pharmaceutical logistics market size was exhibited at USD 26.55 billion in 2023 and is projected to hit around USD 58.39 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2024 to 2033.

The U.S. pharmaceutical logistics market plays a mission-critical role in safeguarding the integrity, efficacy, and timely delivery of high-value, temperature-sensitive, and life-saving pharmaceutical products across the country. The market is a vital backbone of the healthcare infrastructure, enabling the smooth movement of prescription medications, biologics, vaccines, investigational drugs, and raw materials through a meticulously managed supply chain that stretches from manufacturers and distributors to healthcare providers, pharmacies, and ultimately patients.

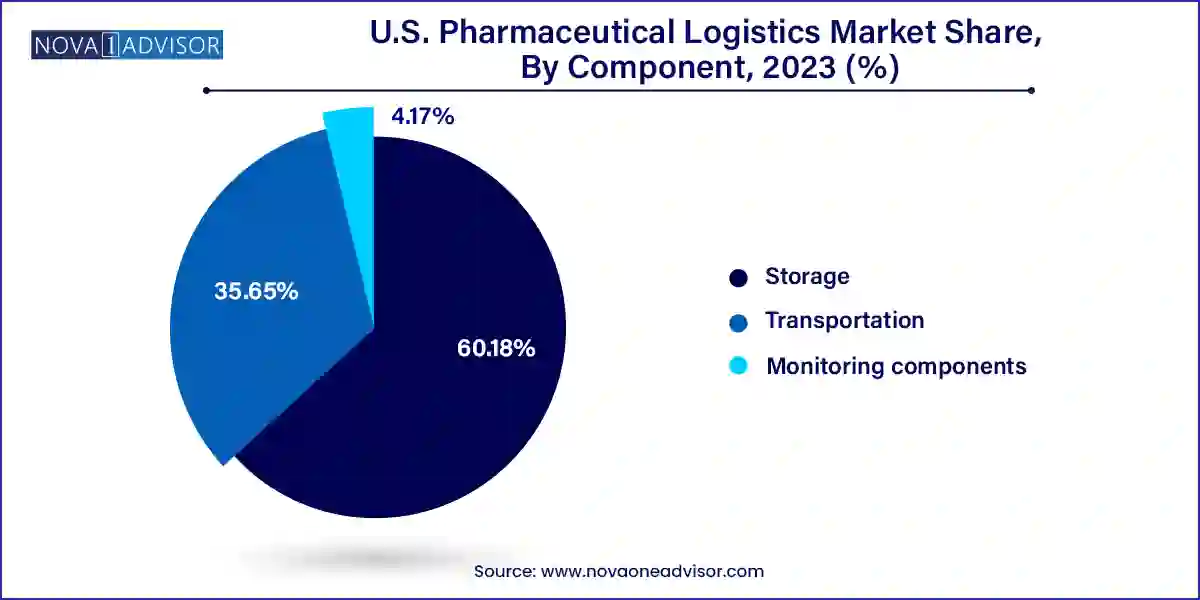

Pharmaceutical logistics involves a complex orchestration of storage, transportation, and monitoring processes, designed to meet strict regulatory and temperature control requirements. As the pharmaceutical industry shifts toward biologics, specialty drugs, and personalized medicine many of which require stringent cold chain management logistics providers are under increasing pressure to ensure zero-compromise delivery models. This is driving investment in cold chain technologies, AI-enabled monitoring systems, and integrated software solutions that enhance visibility, traceability, and compliance throughout the supply chain.

In the U.S., the demand for advanced pharmaceutical logistics is being accelerated by key trends, including the rise in chronic disease prevalence, the expansion of mail-order and specialty pharmacies, and the growing footprint of clinical trials. Additionally, disruptions caused by the COVID-19 pandemic and the subsequent mRNA vaccine rollout have reinforced the importance of supply chain resilience and the need for high-performance logistics solutions. Industry leaders like UPS Healthcare, FedEx, McKesson, AmerisourceBergen, Cardinal Health, DHL, and Thermo Fisher Scientific continue to expand infrastructure and invest in cold chain capabilities to meet the increasing complexity and volume of pharmaceutical supply needs across the country.

Surging demand for cold chain logistics due to biologics, biosimilars, and mRNA-based therapies.

Rapid growth of specialty pharmaceuticals requiring temperature-controlled and time-sensitive transportation.

Expansion of digital monitoring technologies (RFID, IoT, telematics) to ensure real-time tracking and regulatory compliance.

Increased outsourcing of logistics functions to third-party logistics (3PL) providers to enhance scalability and efficiency.

Integration of warehouse automation and robotics to streamline storage and fulfillment operations.

Sustainability push encouraging greener transportation options and eco-friendly packaging solutions.

Post-COVID supply chain diversification, including domestic capacity expansion and multi-modal distribution strategies.

Federal and state regulatory pressure to enhance serialization, traceability, and data reporting throughout the pharmaceutical supply chain.

| Report Coverage | Details |

| Market Size in 2024 | USD 28.73 Billion |

| Market Size by 2033 | USD 58.39 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 8.2% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Type, Component |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | U.S. |

| Key Companies Profiled | FedEx Corp.; Americold Logistics; Lineage Logistics; United States Cold Storage (USCS); CTW Logistics; United Parcel Service Inc.; C H Robinson Worldwide Inc.; SEKO Logistics; Owens and Minor Inc.; Nichirei Logistics Group, Inc. |

The most prominent driver of the U.S. pharmaceutical logistics market is the rising demand for cold chain solutions, propelled by the rapid growth of the biopharmaceutical sector. Unlike traditional small molecule drugs, biologics—including monoclonal antibodies, cell and gene therapies, and mRNA-based vaccines—are highly sensitive to temperature variations and require rigorous storage and transport conditions. Even minor temperature excursions can render these products ineffective or harmful, leading to stringent handling protocols.

The success of COVID-19 mRNA vaccines from Pfizer-BioNTech and Moderna demonstrated the criticality of robust cold chain infrastructure. These vaccines required ultra-low temperature storage and complex logistics coordination, setting a new industry standard. As more pharmaceutical companies shift their pipelines toward biologics and specialty therapies, logistics providers are expanding cold storage warehouses, refrigerated vehicle fleets, and packaging innovations to meet this rising need. For instance, UPS Healthcare announced in March 2024 the expansion of its cold chain logistics capabilities in the U.S. with new facilities and specialized containers to serve the surging biopharma market. This trend is expected to intensify as more precision and temperature-sensitive therapies receive FDA approvals.

One of the biggest restraints confronting the U.S. pharmaceutical logistics market is the substantial capital investment required for infrastructure development and the complex regulatory environment governing pharmaceutical transport. Establishing temperature-controlled warehouses, acquiring GDP-compliant refrigerated vehicles, integrating advanced monitoring systems, and training specialized staff requires significant upfront and recurring expenditure, particularly for smaller logistics firms or new entrants.

Additionally, logistics providers must navigate a labyrinth of federal and state regulations, including FDA Good Distribution Practices (GDP), Drug Supply Chain Security Act (DSCSA), DEA compliance for controlled substances, and HIPAA data security laws. Ensuring full compliance with these standards across various touchpoints from warehouse temperature logs to driver credentials—adds layers of operational and administrative burden. Any deviation or lapse in compliance can result in fines, loss of licensure, or damage to product integrity. These challenges create barriers to scalability, particularly for providers seeking to expand services to remote or underserved areas.

A transformative opportunity in the U.S. pharmaceutical logistics market lies in the integration of IoT and AI-powered monitoring systems that enable real-time tracking, environmental control, and predictive risk management. With the increasing complexity of pharmaceutical products and supply chains, real-time visibility is no longer optional it is a necessity. Technologies such as RFID tags, telematics, smart sensors, cloud-based data dashboards, and AI-driven analytics are enabling unprecedented control over pharmaceutical transport conditions.

These tools allow logistics operators to monitor temperature, humidity, shock, and location data during transit and storage. They also facilitate immediate alerts if there are deviations from acceptable thresholds, allowing corrective actions before damage occurs. AI algorithms can predict potential route delays, temperature excursions, or regulatory compliance risks, empowering proactive decision-making. Leading players like DHL and Cryoport have already integrated smart monitoring systems to offer predictive analytics and end-to-end visibility for their pharmaceutical clients. As demand for transparency, traceability, and risk mitigation rises, technology-enabled logistics solutions are becoming a critical competitive differentiator in the market.

Cold chain logistics dominates the U.S. pharmaceutical logistics market, as the growing emphasis on biologics, vaccines, and specialty medicines requires temperature-controlled handling at every point in the supply chain. The shift toward temperature-sensitive pharmaceuticals has prompted companies to invest in refrigerated vehicles, ultracold freezers, passive containers, and insulated shippers. Products like insulin, monoclonal antibodies, oncology drugs, and gene therapies fall into this category. The development of biologics pipelines by major pharmaceutical firms and the mRNA platform's success has only reinforced the long-term demand for reliable and resilient cold chain solutions.

Non-cold chain logistics remains a significant but slower-growing segment, encompassing the transport and storage of traditional prescription medications, over-the-counter (OTC) drugs, and pharmaceutical ingredients that do not require refrigeration. While this segment constitutes a large volume of the total pharmaceutical movement, growth is relatively moderate compared to the cold chain segment. That said, innovations in packaging, security, and automation are still highly relevant in non-cold chain logistics, particularly for maintaining inventory control and meeting DSCSA serialization requirements.

Transportation is the dominant component in the pharmaceutical logistics market, as the physical movement of pharmaceutical products via road, air, and sea is fundamental to ensuring supply chain continuity. Overland logistics, particularly via temperature-controlled trucks, accounts for a significant share of last-mile delivery in the U.S., especially for hospitals, pharmacies, and clinical trial sites. Air freight is critical for long-distance, high-value shipments or time-sensitive deliveries, while sea freight is often used for bulk import/export of raw materials or APIs. Companies like FedEx, UPS, and Marken have built extensive transport networks designed specifically for GDP-compliant pharmaceutical deliveries.

Monitoring components represent the fastest-growing segment, as visibility and compliance pressures intensify. This segment includes hardware such as RFID devices, GPS sensors, telematics, and networking components, as well as software platforms for real-time monitoring, temperature tracking, inventory management, and compliance reporting. Logistics operators and pharmaceutical manufacturers increasingly deploy integrated dashboards that allow end-to-end visibility of shipment status, temperature profiles, and predictive analytics to ensure regulatory compliance and product safety. The emphasis on digitization is reshaping the market landscape, making monitoring solutions a linchpin in high-performance pharmaceutical logistics.

The U.S. pharmaceutical logistics market is characterized by its complexity, scale, and strategic significance. With a pharmaceutical market valued at over $600 billion annually, the U.S. presents both opportunity and challenge for logistics operators. The country’s expansive geography, regulatory rigor, and high-value pharmaceutical inventory necessitate a robust, integrated logistics ecosystem supported by industry-standard practices like Good Distribution Practice (GDP) and DSCSA compliance.

Moreover, the rise in mail-order pharmacy, specialty pharmacy expansion, and clinical trial decentralization has created a diversified delivery matrix—where the last mile is as crucial as the cross-country haul. Urban hubs like New Jersey, California, Texas, and Illinois host major distribution centers and serve as logistics corridors for pharmaceutical movement. In contrast, rural and underserved areas are now being prioritized through drone delivery pilots, mobile storage units, and micro-fulfillment centers to reduce access disparities.

U.S. logistics providers are also integrating sustainability initiatives, such as electric vehicle deployment, carbon-neutral shipping options, and recyclable cold chain packaging in response to environmental regulations and customer demands. As federal agencies continue to digitize pharmaceutical tracking through serial number traceability and blockchain pilots, the U.S. market is poised to lead global best practices in secure, traceable, and efficient pharmaceutical logistics.

March 2024 – UPS Healthcare announced a major expansion of its cold chain logistics capabilities in the U.S., including a new warehouse in Louisville, Kentucky, and enhanced airfreight services for temperature-sensitive pharmaceuticals.

February 2024 – Cardinal Health launched a real-time logistics monitoring platform for specialty pharmaceutical shipments, providing full temperature and location traceability across its U.S. network.

January 2024 – Marken (a UPS Company) introduced a new fleet of advanced refrigerated containers for clinical trial logistics, focusing on supporting cell and gene therapy distribution.

December 2023 – FedEx Express deployed AI-based route optimization software to enhance delivery efficiency and reduce emissions in its pharmaceutical distribution operations across key U.S. states.

November 2023 – Cryoport acquired a new cold storage facility in California, aimed at expanding its end-to-end support for advanced therapies, including temperature-sensitive APIs and biological materials.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. pharmaceutical logistics market

Type

Component