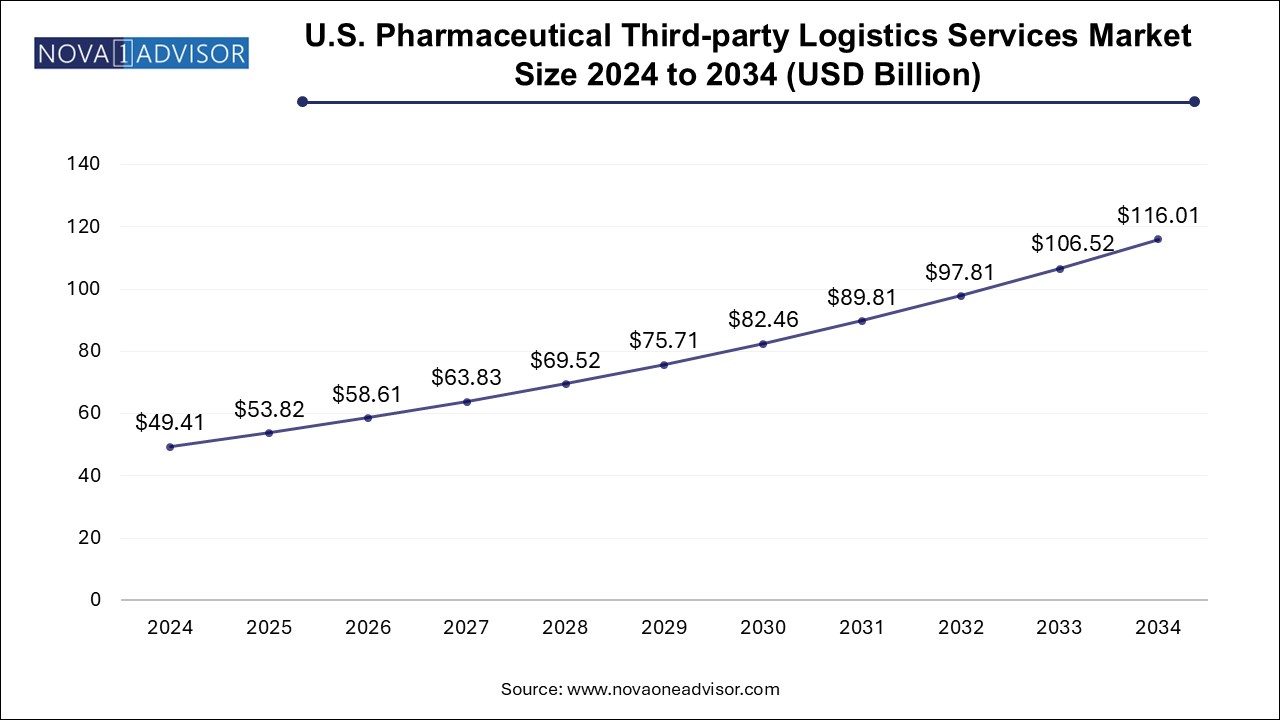

The U.S. pharmaceutical third-party logistics services market size was exhibited at USD 49.41 billion in 2024 and is projected to hit around USD 116.01 billion by 2034, growing at a CAGR of 8.91% during the forecast period 2025 to 2034.

The U.S. pharmaceutical third-party logistics (3PL) services market has emerged as a critical pillar in the healthcare supply chain, reflecting the rapidly evolving complexities of drug distribution and the growing need for efficient, secure, and temperature-controlled logistics. The rising burden of chronic diseases, technological advancements in temperature-sensitive biologics, and the increasing penetration of specialty drugs have collectively reshaped pharmaceutical logistics, leading to an unprecedented demand for third-party logistics providers.

3PL services in the pharmaceutical space encompass a wide range of activities, including warehousing, transportation, order-to-cash management, serialization compliance, and customized solutions for high-value biologics and cellular therapies. The pharmaceutical industry in the U.S. is transitioning from conventional distribution frameworks to more outsourced, specialized, and compliant logistics models. As biopharmaceutical manufacturers focus on core competencies such as research, development, and innovation, outsourcing logistics has become a strategic approach to enhance efficiency and maintain regulatory adherence.

The U.S. 3PL pharmaceutical market is poised for robust growth through 2034, driven by a surge in cold chain requirements for advanced therapies, stringent DSCSA (Drug Supply Chain Security Act) regulations, and the proliferation of cell and gene therapy products that require meticulous storage and transport. Additionally, the growing complexity in drug formats and the fragmented distribution across rural and urban centers have further elevated the need for technologically integrated 3PL providers.

Rapid Expansion of Cold Chain Infrastructure: With the rise of biologics, mRNA vaccines, and cell/gene therapies, there is increasing investment in cold chain storage and transportation capabilities.

DSCSA Compliance Driving Serialization Adoption: Regulatory requirements under DSCSA have pushed logistics providers to adopt serialization and traceability solutions to ensure drug integrity and prevent counterfeiting.

Technology-Driven Logistics Optimization: Integration of AI, blockchain, IoT, and cloud-based solutions in 3PL operations is transforming inventory tracking, delivery timelines, and compliance management.

Growth in Cell and Gene Therapy Logistics: These ultra-sensitive therapies demand cryogenic storage and real-time monitoring, prompting a niche segment within 3PL providers.

Manufacturer Preference for Value-Added Services: Beyond storage and shipping, manufacturers are increasingly opting for integrated order-to-cash, title model, and sampling services offered by leading 3PLs.

Sustainability in Logistics Operations: Growing focus on environmentally friendly packaging and fuel-efficient transportation as pharmaceutical companies align logistics with ESG goals.

Expansion of Specialty Pharmacies and Direct-to-Patient Deliveries: 3PLs are adapting to more patient-centric models, supporting home delivery of specialty drugs requiring specific handling.

| Report Coverage | Details |

| Market Size in 2025 | USD 53.82 Billion |

| Market Size by 2034 | USD 116.01 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 8.91% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Product Type, Temperature, Therapeutic Area, Manufacturer Size, Service |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | CEVA Logistics; Cencora Corporation (ICS); DB SCHENKER; Kuehne+Nagel; Kerry Logistics Network Limited; Cardinal Health; McKesson Corporation; EVERSANA; Thermo Fisher Scientific; Knipper Health |

One of the foremost drivers in the U.S. pharmaceutical 3PL services market is the complexity associated with the distribution of biologics and advanced therapies. Unlike traditional small-molecule drugs, biologics such as monoclonal antibodies, vaccines, and cell and gene therapies are highly sensitive to environmental conditions. These products often require refrigerated, frozen, or even cryogenic temperatures during storage and transportation. The handling of these products demands stringent regulatory compliance and real-time monitoring of temperature excursions, humidity, shock, and vibration. Consequently, pharmaceutical companies are increasingly outsourcing logistics to specialized 3PL partners with proven capabilities in cold chain management, regulatory documentation, and risk mitigation strategies. This trend is especially evident in the distribution of mRNA-based vaccines and autologous cell therapies, where any deviation in environmental parameters can compromise efficacy and safety.

Despite the growth opportunities, the U.S. pharmaceutical 3PL services market faces challenges associated with the stringent regulatory landscape. The implementation of the DSCSA, for instance, requires logistics providers to ensure full traceability of prescription drugs throughout the supply chain. This involves serialization, aggregation, data exchange, and electronic tracking, all of which demand heavy investments in IT infrastructure, data security, and workforce training. Non-compliance can lead to severe penalties, shipment delays, and product recalls. Moreover, the constant evolution of regulations, particularly for newly introduced therapies such as gene editing products, adds complexity for 3PL providers. Ensuring alignment with FDA, DEA, and USP standards across all logistics operations can strain resources and limit scalability for smaller 3PL firms.

The ongoing shift toward personalized medicine is creating a transformative opportunity for 3PL providers in the U.S. The advent of individualized therapies—especially in oncology, immunology, and rare diseases—has necessitated a more agile and responsive logistics framework. Personalized drugs often have shorter shelf lives, require cold chain or cryogenic handling, and are directly shipped to healthcare providers or patients within a narrow time window. This evolution toward patient-centric delivery models is prompting logistics firms to invest in advanced forecasting systems, real-time GPS-enabled tracking, and mobile cold storage units. Additionally, the rise of home care services and telehealth platforms is encouraging partnerships between 3PLs and specialty pharmacies to streamline last-mile delivery. Companies that can tailor their logistics models to cater to these niche demands stand to gain a competitive edge in the coming decade.

The Branded pharmaceuticals dominated the U.S. pharmaceutical 3PL market in 2024 and are expected to maintain this position through 2034. Branded drugs typically require higher levels of oversight in storage and handling, particularly in categories such as biologics and oncology treatments. These drugs are associated with stringent temperature controls and authentication requirements, which favor 3PL providers with high-end infrastructure. Furthermore, manufacturers of branded drugs prioritize reliability, real-time tracking, and compliance, making them more inclined to establish long-term logistics partnerships.

Conversely, gene and cell therapies are projected to be the fastest-growing segments by product type. These emerging therapies demand complex handling protocols such as cryogenic storage, just-in-time delivery, and end-to-end traceability. For example, CAR-T therapies often require patient-specific customization and rapid distribution between collection sites, processing labs, and treatment centers. These unique demands are driving innovation in specialized 3PL services and the emergence of niche logistics providers focused solely on advanced therapies.

The Refrigerated logistics services currently dominate the temperature segment of the market. A substantial share of pharmaceuticals, including vaccines, insulin, and certain antibiotics, fall within the 2°C to 8°C range. As such, a well-established infrastructure exists to support this segment. Major players have invested significantly in refrigerated fleets, passive packaging technologies, and smart sensors for temperature monitoring, which makes this category both high in demand and well-supported.

Cryogenic logistics is the fastest-growing temperature segment, primarily due to the expansion of cell and gene therapies. Cryogenic conditions (typically below -150°C) are essential for preserving cellular integrity and genetic material. Logistics providers such as Cryoport have developed proprietary technologies like vapor-phase liquid nitrogen containers to facilitate safe and compliant transport. As more clinical trials and commercial therapies rely on cryogenic preservation, this segment is expected to witness exponential growth.

The Oncology emerged as the dominant therapeutic area in the pharmaceutical 3PL services market. The rising incidence of various cancers in the U.S. has led to a proliferation of specialty oncology drugs, including immunotherapies and precision-targeted biologics. These drugs often require cold chain logistics, specialized warehousing, and rapid deployment to hospitals or treatment centers. Due to the critical nature of cancer care, manufacturers seek highly reliable 3PL providers with robust infrastructure and compliance certifications.

On the other hand, neurology is expected to grow at the fastest pace, driven by increasing prevalence of neurodegenerative conditions such as Alzheimer’s disease, Parkinson’s, and multiple sclerosis. The introduction of novel biologics and disease-modifying therapies in neurology—many of which are temperature-sensitive—necessitates advanced logistics support. This trend will continue to expand the demand for 3PL providers with experience in specialty care distribution and direct-to-site delivery.

The Large manufacturers currently dominate the use of pharmaceutical 3PL services in the U.S., owing to their scale of production and broad geographic reach. These companies outsource logistics to optimize operational efficiency and concentrate on R&D and commercialization. Large pharmaceutical firms also have the resources to implement advanced logistics systems and negotiate long-term contracts with leading 3PL providers.

Small manufacturers, however, are expected to represent the fastest-growing user group. With the democratization of drug development through biotech innovation and venture capital funding, small-scale firms are launching novel therapies at a rapid pace. Since these companies typically lack in-house logistics capabilities, they depend heavily on third-party services to access nationwide markets. This dynamic is expected to create new opportunities for flexible, cost-efficient, and specialized 3PL firms.

The Storage and shipping continue to be the cornerstone services offered by 3PL providers, dominating the service segment. The primary value of a 3PL partner lies in its ability to offer temperature-controlled storage, timely transport, and nationwide distribution coverage. These services form the bedrock of pharmaceutical logistics, especially for products with strict shelf-life and handling requirements.

Title model and DSCSA/serialization services are the fastest-growing segments. The title model allows 3PL firms to take ownership of inventory on behalf of the manufacturer, enabling more streamlined distribution and billing processes. Simultaneously, serialization services are being increasingly adopted to comply with federal mandates and to prevent counterfeit drugs from entering the supply chain. As compliance deadlines near, demand for these tech-enabled services will rise.

The U.S. pharmaceutical logistics landscape is deeply influenced by the country’s vast geography, urban-rural disparities, and decentralized healthcare system. High healthcare expenditure, the presence of global pharmaceutical giants, and an advanced regulatory environment make the U.S. one of the most attractive markets for 3PL service providers.

In recent years, hubs such as California, Texas, and New Jersey have emerged as critical nodes for pharmaceutical warehousing and distribution due to their proximity to biotech clusters, ports, and international airports. Moreover, states like Massachusetts—home to a burgeoning biotech ecosystem—are increasingly reliant on 3PL services for clinical trial logistics and commercialization of cell/gene therapies.

Rural and underserved regions in the U.S. pose logistical challenges, particularly for time- and temperature-sensitive deliveries. To overcome these challenges, 3PL companies are leveraging drone-based deliveries, regional hubs, and predictive analytics to optimize delivery timelines and minimize risks.

March 2025: UPS Healthcare announced the expansion of its cold chain capabilities in Louisville, KY, including a new freezer farm and upgraded temperature monitoring technologies to support vaccine and biologic distribution.

January 2025: AmerisourceBergen unveiled a new serialization-compliant distribution center in Ohio to strengthen its DSCSA service offerings, catering to the approaching regulatory milestones.

November 2024: FedEx Healthcare launched SenseAware ID, a real-time tracking system that provides visibility into location, temperature, light exposure, and shock for sensitive pharma shipments.

September 2024: Cryoport, Inc. partnered with a major gene therapy manufacturer to deliver advanced cryogenic logistics solutions across the U.S., signaling growth in ultra-low temperature capabilities.

July 2024: Cardinal Health introduced AI-based forecasting and inventory optimization tools integrated with its 3PL solutions, aiming to reduce wastage and stockouts in pharmaceutical supply chains.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. pharmaceutical third-party logistics services market

By Product Type

By Temperature

By Therapeutic Area

By Manufacturer Size

By Service