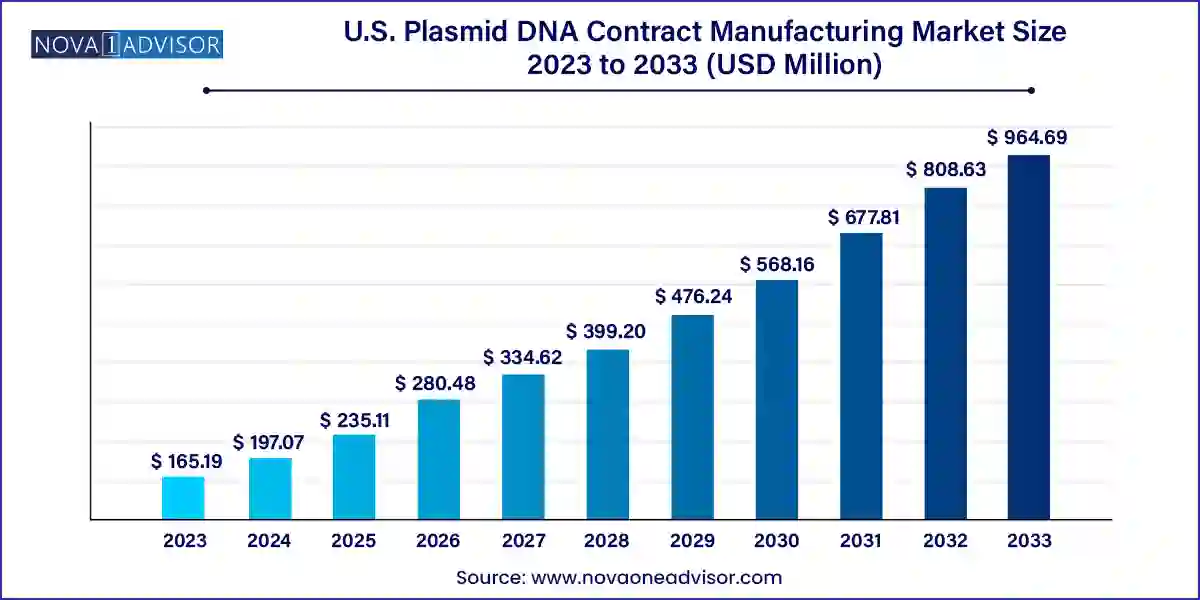

The U.S. plasmid DNA contract manufacturing market size was valued at USD 165.19 million in 2023 and is projected to surpass around USD 964.69 million by 2033, registering a CAGR of 19.3% over the forecast period of 2024 to 2033.

The U.S. plasmid DNA contract manufacturing market has become a cornerstone in the development and production of advanced therapeutics, especially in the booming fields of gene therapy, cell therapy, and DNA-based vaccines. Plasmid DNA (pDNA), a small circular DNA molecule separate from chromosomal DNA, plays a vital role as a raw material in the manufacturing of viral vectors, mRNA therapeutics, and gene-modified cell therapies. With the rising demand for complex biologics and advanced therapy medicinal products (ATMPs), contract development and manufacturing organizations (CDMOs) specializing in pDNA production have emerged as essential partners for biotech and pharmaceutical innovators.

In recent years, the U.S. has witnessed a dramatic increase in clinical trial activity involving gene and cell therapy platforms, most of which require high-quality plasmid DNA for transfection and downstream processing. However, the challenges of in-house plasmid DNA production such as scalability, contamination control, and regulatory compliance have prompted many developers to rely on CDMOs for specialized manufacturing services. These CDMOs provide end-to-end capabilities ranging from research-grade to GMP-grade plasmids, supporting programs from preclinical development to commercial launch.

The U.S. market has also benefited from strong government and private sector investment in biomanufacturing capacity, particularly following the COVID-19 pandemic, which accelerated demand for DNA-based vaccine components and gene-based diagnostics. As the biotech landscape matures, CDMOs that offer scalable, high-quality, and regulatory-compliant pDNA production solutions are becoming indispensable to developers focused on accelerating their pipelines without compromising quality or compliance.

Growing demand for GMP-grade plasmid DNA to support late-stage clinical and commercial gene therapy products.

Increased outsourcing by biotech startups and small pharma due to lack of internal biomanufacturing infrastructure.

Rising investment in plasmid DNA facilities in the U.S., driven by reshoring and national biosecurity initiatives.

Adoption of cell-free DNA synthesis and synthetic biology approaches to improve yield and production efficiency.

Strategic partnerships between gene therapy developers and CDMOs for long-term supply agreements and technology transfer.

Diversification of applications beyond human therapeutics, including use in veterinary medicine, agriculture, and industrial biotechnology.

Regulatory push for compliance with advanced quality systems, prompting CDMOs to adopt automation and digital QA/QC tools.

Consolidation among CDMOs as large players acquire smaller firms to expand plasmid DNA manufacturing capabilities and geographic reach.

| Report Attribute | Details |

| Market Size in 2024 | USD 197.07 million |

| Market Size by 2033 | USD 964.69 million |

| Growth Rate From 2024 to 2033 | CAGR of 19.3% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Applications, therapeutic area, end-use |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Aldevron; Charles River Laboratories; Akron Biotech VGXI, Inc.; Catalent, Inc.; DH Life Sciences, LLC; Recipharm AB; TriLink BioTechnologies; AGC BiologicsThermo Fisher; Scientific Inc. |

A key driver of the U.S. plasmid DNA contract manufacturing market is the explosive growth of cell and gene therapy development. The U.S. Food and Drug Administration (FDA) has reported a steady increase in the number of Investigational New Drug (IND) applications for cell and gene therapy products. These therapies often rely on viral vectors such as lentivirus or adeno-associated virus (AAV) for gene delivery, and plasmid DNA serves as the essential starting material for producing these vectors.

Producing plasmid DNA in sufficient quality and quantity is a technically challenging, labor-intensive process. CDMOs offer the infrastructure and expertise required to manufacture plasmids under current Good Manufacturing Practice (cGMP) standards, ensuring purity, stability, and regulatory compliance. As more gene therapy products advance into clinical trials and toward commercialization, the need for reliable, high-capacity pDNA manufacturing partners is critical to avoid supply bottlenecks and support scale-up demands.

Despite the growing demand, a major challenge restraining the U.S. plasmid DNA contract manufacturing market is the technical complexity and production challenges involved in plasmid manufacturing. Producing large quantities of high-quality plasmid DNA requires stringent process controls, optimized fermentation, precise purification techniques, and robust quality assurance systems. The high viscosity of plasmid solutions, risks of endotoxin contamination, and batch variability pose further complications.

Moreover, transitioning from research-grade to GMP-grade production involves a significant regulatory and cost burden, which can be a deterrent for CDMOs with limited expertise or infrastructure. These challenges are further compounded by the scarcity of skilled personnel in biomanufacturing, making it difficult to scale operations quickly. As a result, delays in technology transfer or manufacturing scale-up can hinder clinical timelines and product development.

An emerging opportunity in the U.S. plasmid DNA contract manufacturing market is the expanding use of pDNA in DNA-based vaccines and novel therapeutics. The COVID-19 pandemic showcased the viability of nucleic acid-based platforms, sparking global interest in DNA vaccines for other infectious diseases such as Zika, HPV, and influenza. Additionally, companies are exploring pDNA-based therapies for autoimmune disorders and cancer immunotherapy.

This trend creates long-term opportunities for CDMOs to serve a broader base of clients working on vaccine development, beyond the traditional cell and gene therapy market. The ability of plasmid DNA to serve as both a gene delivery vector and a vaccine platform means CDMOs offering flexibility in plasmid design, fast turnaround, and scalable manufacturing stand to benefit from a diverse and growing customer base. Strategic investments in advanced fermentation systems, modular GMP suites, and digital production technologies will enable service providers to meet these emerging demands.

Cell and gene therapy was the dominant application segment in the U.S. plasmid DNA contract manufacturing market in 2024, accounting for the majority of service demand. These therapies often require multiple plasmids for vector production, gene editing, or transfection steps. For instance, AAV vector production typically involves three plasmids—one containing the therapeutic gene, another with replication and capsid genes, and a third with helper genes. The sheer volume of plasmid DNA needed for viral vector manufacturing, combined with the demand for cGMP-grade production, has created significant reliance on CDMOs in this segment.

Immunotherapy is emerging as the fastest-growing application area, driven by the rise of DNA-based cancer vaccines and personalized neoantigen therapies. DNA plasmids can be used to encode tumor antigens, stimulating the patient’s immune system to target cancer cells. As checkpoint inhibitors and CAR-T therapies gain momentum, there is growing interest in integrating plasmid-based approaches to enhance immune system targeting. Several U.S. biotech companies are developing next-generation immunotherapies using plasmid DNA as a core component, and they increasingly turn to CDMOs for specialized production services.

Cancer remained the leading therapeutic area in 2024 due to the widespread application of pDNA in oncology research and gene-modified cancer therapies. From CAR-T and TCR therapies to gene-directed enzyme prodrug therapies (GDEPT), plasmid DNA is central to innovation in cancer treatment. U.S.-based biopharma companies are increasingly conducting early-phase trials of plasmid-based cancer therapies, and CDMOs are pivotal in supporting these programs by providing timely, quality-assured plasmid material for both clinical and commercial purposes.

Infectious diseases represent the fastest-growing therapeutic area, fueled by interest in DNA vaccines and rapid response platforms for emerging pathogens. The COVID-19 pandemic accelerated the development of DNA-based vaccine candidates, many of which used plasmids to express viral antigens. Companies like Inovio Pharmaceuticals are pioneering DNA vaccines against various infectious agents, and their reliance on contract manufacturers has set a precedent for others in the industry. As public health authorities emphasize preparedness for future outbreaks, the role of CDMOs in producing plasmid DNA for infectious disease applications will expand significantly.

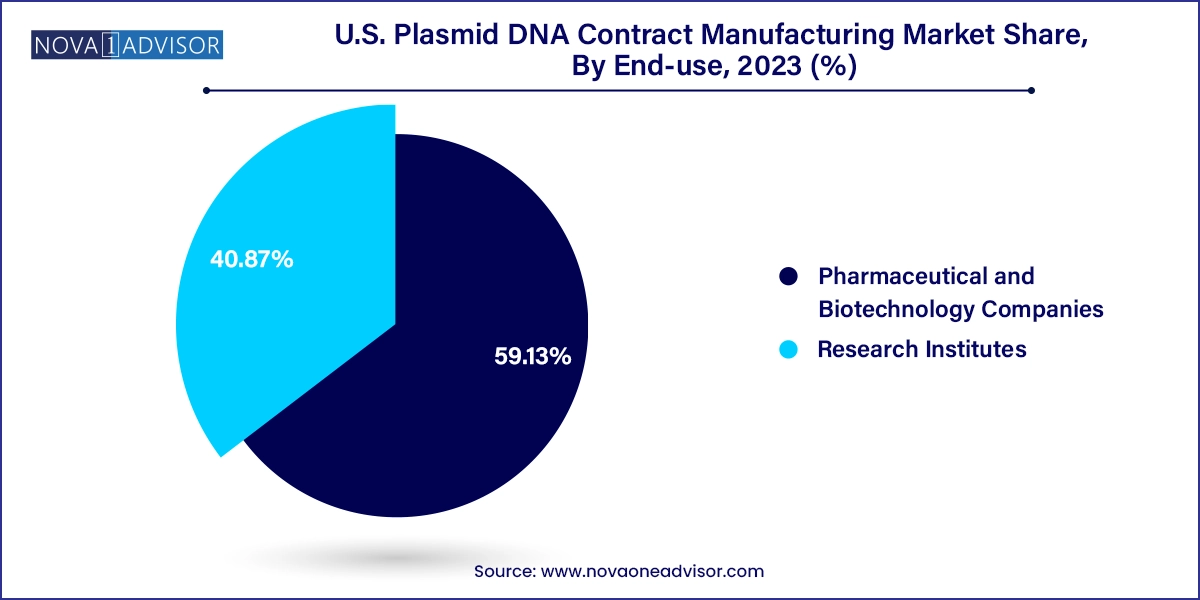

Pharmaceutical and biotechnology companies were the dominant end-use segment in 2024, reflecting their role as the primary drivers of innovation in gene and cell therapy. These companies, especially small and mid-sized biotechs, often lack the infrastructure to produce GMP-grade plasmid DNA internally. As a result, they partner with CDMOs to fulfill their manufacturing needs from early development through to commercialization. Larger pharma firms are also forming strategic alliances with CDMOs to secure long-term plasmid supply for pipeline security and commercial launches.

Research institutes and academic centers are the fastest-growing end-use segment, driven by increased federal funding and translational research initiatives. Universities and non-profit labs are conducting a growing number of preclinical studies involving gene editing, RNA therapeutics, and synthetic biology many of which require high-quality plasmid DNA. With time and budget constraints, these institutions prefer outsourcing plasmid production to experienced CDMOs offering custom synthesis, batch documentation, and flexible production scales. This trend is expected to grow further as academia continues to contribute significantly to the early discovery phase of next-gen therapies.

The United States is uniquely positioned as the global leader in plasmid DNA contract manufacturing, owing to its advanced biotech ecosystem, robust regulatory frameworks, and world-class research infrastructure. Key states like California, Massachusetts, North Carolina, and Texas are hubs for biotech innovation and house several prominent CDMOs, research centers, and biopharma headquarters. These regions benefit from strong industry-academia partnerships, access to venture capital, and favorable regulatory engagement from the FDA.

Moreover, the U.S. government has played an active role in strengthening domestic biomanufacturing. Initiatives by the Biomedical Advanced Research and Development Authority (BARDA) and Operation Warp Speed demonstrated the importance of a resilient, local supply chain for DNA-based medical countermeasures. In response, CDMOs across the country have expanded their GMP capacity and embraced digital manufacturing solutions to meet growing domestic and international demand. The strategic push to reshore biomanufacturing from overseas facilities, especially for critical starting materials like plasmid DNA, continues to fuel investments in this market.

March 2025 – Aldevron, a leading U.S.-based CDMO, announced the expansion of its GMP plasmid manufacturing facility in Fargo, North Dakota, doubling its capacity to support commercial gene therapy production.

February 2025 – VGXI Inc. received a grant from the Department of Health and Human Services to boost production of plasmid DNA for infectious disease vaccines as part of the national pandemic preparedness initiative.

January 2025 – Wacker Biotech US signed a long-term contract with a clinical-stage oncology biotech to supply high-quality plasmid DNA for a cancer vaccine program.

December 2024 – Catalent Inc. launched a new plasmid DNA development and manufacturing service integrated with its gene therapy offerings to support clients from plasmid to final product.

November 2024 – Luminous Biosciences, a contract plasmid manufacturer based in California, announced the launch of a synthetic biology division focused on customized DNA constructs for research and diagnostic applications.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Plasmid DNA Contract Manufacturing market.

By Application

By Therapeutic Area

By End-use