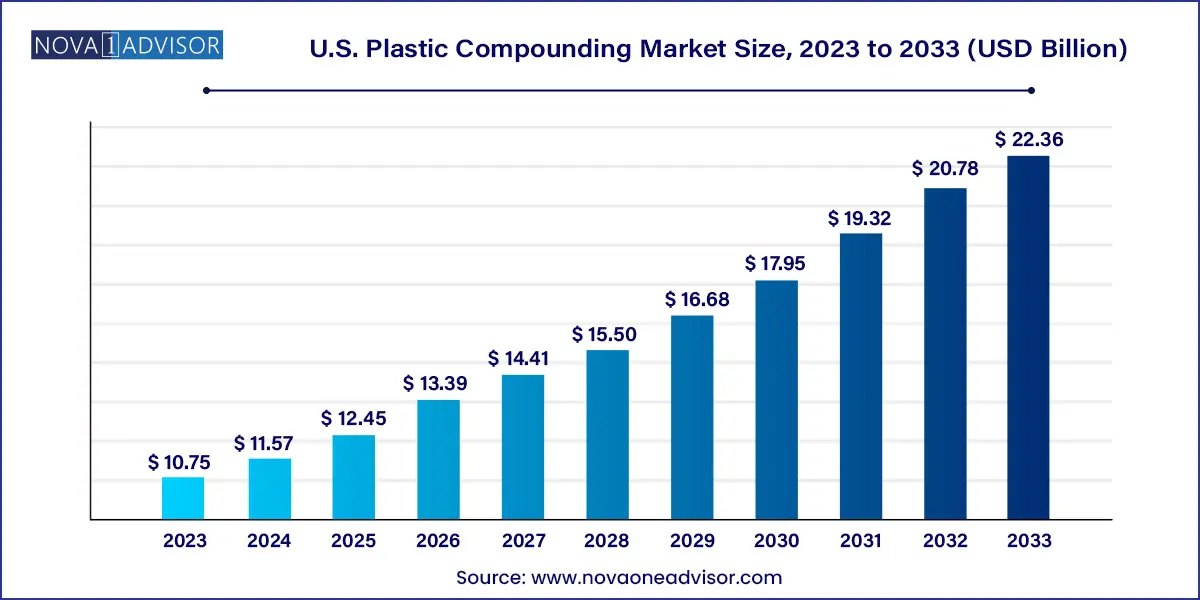

The U.S. plastic compounding market size was exhibited at USD 10.75 billion in 2023 and is projected to hit around USD 22.36 billion by 2033, growing at a CAGR of 7.6% during the forecast period 2024 to 2033.

The U.S. plastic compounding market is a robust and rapidly evolving segment of the broader polymer and materials industry, playing a pivotal role in customizing plastic materials for use in demanding applications across industries. Plastic compounding refers to the process of melting base resins and mixing them with various additives, fillers, reinforcements, colorants, and performance enhancers to yield materials with tailored mechanical, thermal, electrical, and aesthetic properties.

In the United States, the plastic compounding market has been on a growth trajectory driven by high demand from the automotive, packaging, electrical & electronics, construction, and medical sectors. From lightweight automotive parts and advanced medical devices to flexible packaging and electronic housings, compounded plastics serve as the backbone of modern manufacturing.

Manufacturers in the U.S. leverage compounding to enhance the functionality and sustainability of thermoplastics by improving impact strength, UV resistance, flame retardancy, conductivity, and recyclability. The U.S. market is particularly advanced in the development of high-performance thermoplastics for industrial and structural applications, with a growing emphasis on bio-based and recyclable alternatives in response to regulatory and environmental pressures.

Plastic compounding companies are increasingly adopting automation, digital process control, and in-line quality monitoring to ensure consistent product performance. Moreover, strategic partnerships between compounders, resin suppliers, and end-users are fostering rapid innovation in the formulation and customization of plastic compounds.

Shift toward sustainable and recycled content compounds: The demand for recycled plastics in automotive, packaging, and electronics is reshaping compounding formulations.

Growth in engineering thermoplastics (ETPs): Materials like PA, PBT, and PC are seeing rising use in high-performance and metal-replacement applications.

Expansion of specialty compounds for electric vehicles (EVs): Flame-retardant, thermally stable compounds are being developed for EV battery housings and connectors.

Integration of antimicrobial additives in medical and consumer compounds: Post-pandemic, there's increased demand for materials with embedded hygiene features.

Smart compounding with sensors and AI-driven mixing systems: Quality control and productivity gains are being realized through process digitization.

Increased use of lightweighting compounds in aerospace and transport: Weight-reduction goals are driving demand for TPO, TPV, and fiber-reinforced PP.

Customization for 3D printing and additive manufacturing needs: Compounders are tailoring materials for extrusion and injection-based 3D printers.

| Report Coverage | Details |

| Market Size in 2024 | USD 11.57 Billion |

| Market Size by 2033 | USD 22.36 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 7.6% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Application |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Adell Plastics Inc.; Asahi Kasei Corporation Celanese Corporation; DuPont de Nemours Inc.; Solvay SA; LyondellBasell Industries Holdings B.V.; Dow Inc.; RTP Company Avient Corporation; Polyvisions Inc.; ingfa Science & Technology Co. Ltd.; Kraton Corporation; Kuraray Co. Ltd.; Polykemi AB; Citadel Plastics; DSM N.V.Arkema Group; Sumitomo Bakelite Co. Ltd.;Nova Polymers Inc.; Europlas (PVCu) Ltd.; US Plastics Recovery; A. Schulman Inc.; Teknor Apex Company; Cabot Corporation; Tosaf Group; Mexichem Specialty Compounds Ltd.; Ravago Manufacturing Americas; Plastics Color Corporation; AmeriLux International LLC; Astra Polymers Compounding Co. Ltd. |

One of the most powerful drivers in the U.S. plastic compounding market is the robust demand from the automotive sector, particularly for lightweight, durable, and aesthetically flexible materials. In the face of tightening emission regulations and fuel economy standards, automakers are under constant pressure to reduce vehicle weight without compromising safety or performance. Plastic compounds offer an ideal solution by replacing metal parts in interior, exterior, and under-the-hood applications.

Compounded polypropylene, polyamide, and TPOs are widely used for dashboards, bumpers, trims, and structural components, offering a balance of stiffness, heat resistance, and impact strength. The rise of electric vehicles (EVs) has further increased the need for specialized compounds that meet flame-retardancy, EMI shielding, and thermal insulation requirements for battery enclosures and powertrain components. The expanding domestic production of EVs in states like Michigan, Ohio, and Georgia continues to stimulate demand for high-performance compounded plastics in automotive design and assembly.

Despite promising growth prospects, the U.S. plastic compounding market faces a significant challenge in the form of fluctuating raw material prices. The availability and pricing of base resins such as polyethylene, polypropylene, and engineering thermoplastics are heavily influenced by global petrochemical markets, supply chain disruptions, and geopolitical events.

For instance, resin shortages during the COVID-19 pandemic and the Texas freeze of 2021 led to steep price hikes and delayed deliveries, impacting compounding operations and downstream production. Compounders also rely on various additives, colorants, and reinforcements many of which are imported or derived from crude oil making them susceptible to foreign exchange rates and trade policy shifts. These fluctuations can compress margins for compounders, increase procurement risks for end-users, and necessitate pricing adjustments that disrupt long-term contracts and supply agreements.

A major opportunity in the U.S. plastic compounding market lies in the growing emphasis on sustainable and circular materials. With mounting regulatory mandates around single-use plastics and corporate sustainability pledges, demand for recycled content and bio-based polymers is on the rise. Compounders are at the forefront of this transition, developing innovative formulations that incorporate post-consumer recycled (PCR) plastics, post-industrial recycled (PIR) content, and renewable feedstocks.

For instance, packaging brands are increasingly sourcing compounded PET and PE with high PCR content, supported by optical sorting and purification technologies. Automotive OEMs are specifying recycled PP compounds for interior trims, while construction firms are adopting recycled PVC blends for piping and flooring. Bio-based compounds using PLA, PHA, and castor oil derivatives are also gaining traction, particularly in medical packaging and consumer goods. Compounders that can offer high-quality, consistent, and traceable recycled/bio-based products are well-positioned to lead in this evolving market landscape.

Polypropylene (PP) is the most dominant product in the U.S. plastic compounding market due to its wide applicability, low cost, and excellent property customization potential. It is extensively used in automotive interiors and exteriors, appliances, packaging, and household goods. PP compounds are easy to mold and can be modified with glass fiber, talc, rubber, or flame retardants to serve a variety of end-use conditions. In the automotive sector, compounded PP is used for instrument panels, door trims, and battery trays. In packaging, it serves in caps, closures, and rigid containers where clarity and barrier properties are key.

Thermoplastic polyolefins (TPO) are the fastest-growing product segment, particularly fueled by demand from the automotive and building sectors. These materials combine the flexibility of elastomers with the processability of thermoplastics, making them ideal for bumpers, roofing membranes, and industrial applications requiring high UV resistance. The rising trend of using TPOs for pickup truck bed liners and automotive fascias, especially in North America, is accelerating their growth. Their recyclability, light weight, and design versatility make them a preferred choice for OEMs and aftermarket fabricators seeking sustainability and performance.

Automotive applications dominate the U.S. plastic compounding market, accounting for the largest revenue share across product categories. Modern vehicles incorporate over 300 pounds of plastics, and much of this comes in the form of compounded resins tailored to specific functional needs. From impact-modified ABS for dashboards to glass-fiber-reinforced PA for under-the-hood components, the automotive industry is a key driver of compounding innovation. As OEMs strive to meet federal CAFE standards and consumer expectations for lightweight, fuel-efficient vehicles, the reliance on advanced compounds is only expected to intensify.

Medical devices represent the fastest-growing application area, spurred by increasing healthcare spending, aging populations, and demand for disposable and durable equipment. Compounded plastics used in medical devices require biocompatibility, sterilizability, and precision performance. PVC compounds are widely used in IV bags and tubing, while PC and PP compounds serve in diagnostic devices, syringe components, and instrument housings. Innovations in antimicrobial, transparent, and gamma-stable compounds are enabling next-gen applications in wearable devices and remote diagnostics, expanding the footprint of plastic compounding in U.S. healthcare.

The United States hosts one of the world’s most technologically advanced plastic compounding markets, supported by a vast polymer manufacturing ecosystem, sophisticated downstream industries, and robust demand across sectors. The Midwest and Southeast are key production hubs, with states like Ohio, Michigan, Texas, and Georgia leading in resin processing and compound formulation.

The country’s regulatory framework supports product safety, innovation, and traceability, with standards enforced by agencies such as the FDA (for medical and food packaging applications) and the EPA (for sustainability). Government funding and private investment in materials R&D are also catalyzing the growth of high-performance and sustainable compounds.

Moreover, the U.S. boasts a well-integrated supply chain for both virgin and recycled plastics, with numerous collaborations between chemical companies, recyclers, and manufacturers aimed at achieving closed-loop material cycles. The growing presence of electric vehicle manufacturing, 3D printing technologies, and infrastructure development initiatives under federal funding programs will continue to stimulate demand for advanced plastic compounds tailored to local needs.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. plastic compounding market

Product

Application