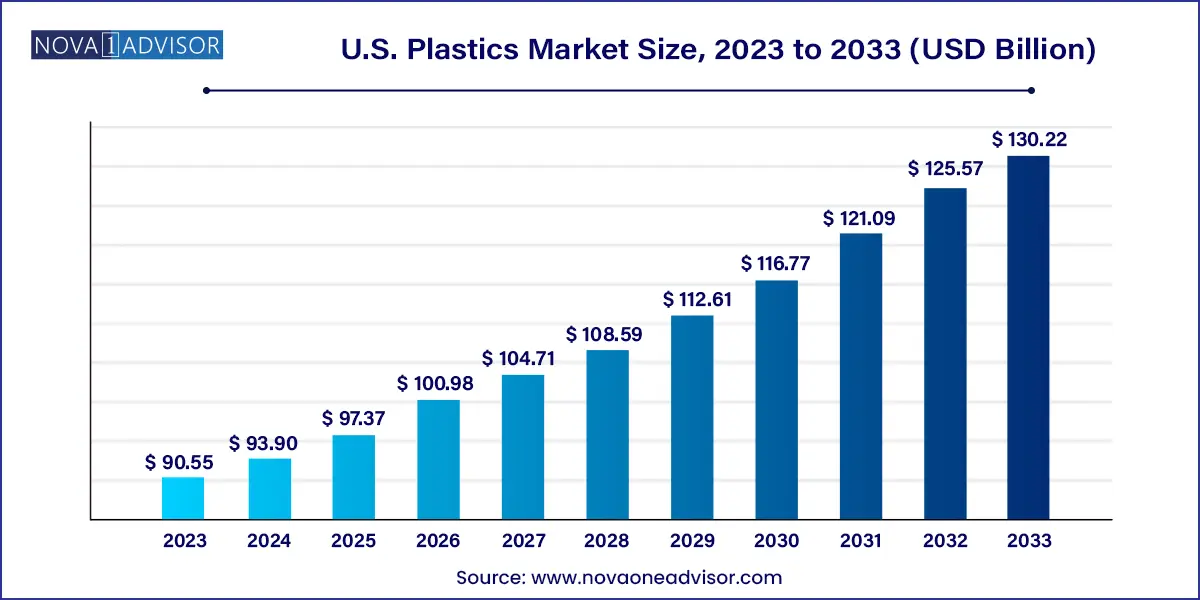

The U.S. plastics market size was exhibited at USD 90.55 billion in 2023 and is projected to hit around USD 130.22 billion by 2033, growing at a CAGR of 3.7% during the forecast period 2024 to 2033.

The U.S. plastics market is an integral part of the country’s manufacturing and industrial ecosystem, powering a wide range of applications from packaging and automotive to medical devices and construction. As one of the largest producers and consumers of plastic materials globally, the United States has developed a sophisticated value chain that spans raw material production, resin conversion, advanced compounding, and downstream fabrication.

Plastics serve as essential materials in a modern economy due to their light weight, durability, corrosion resistance, flexibility, and adaptability. From disposable food containers and structural building materials to lightweight automotive components and high-performance medical devices, plastic polymers are utilized across virtually every major industry. The versatility of plastic resins, coupled with innovations in molding technologies and recyclability improvements, continues to fuel demand in both legacy and emerging applications.

The U.S. plastics market has shown resilience and adaptability, especially during the COVID-19 pandemic, where demand surged for plastic-intensive medical supplies and packaging. As sustainability becomes a central focus of consumer and regulatory interest, the market is increasingly pivoting toward recycled content, biodegradable alternatives, and circular economy principles.

Additionally, technological integration such as 3D printing (additive manufacturing), smart packaging, and high-performance polymers is fostering a new wave of innovation. The U.S. remains a global hub for plastics research, processing equipment manufacturing, and polymer innovation, supported by chemical majors, tech startups, and advanced materials research centers.

Accelerated adoption of post-consumer recycled (PCR) plastics in packaging and consumer goods.

Rising demand for high-performance polymers in electric vehicles (EVs), aerospace, and electronics.

Increasing regulatory and consumer pressure to reduce single-use plastics.

Advancements in biodegradable and compostable bioplastics.

Integration of Internet of Things (IoT) and sensor-enabled smart packaging.

Expansion of plastics in healthcare for diagnostics, disposables, and wearable devices.

Automation and AI-driven monitoring in plastic processing for precision manufacturing.

Cross-industry collaborations to develop closed-loop recycling ecosystems.

| Report Coverage | Details |

| Market Size in 2024 | USD 93.90 Billion |

| Market Size by 2033 | USD 130.22 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 3.7% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, End-use, Application |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | ExxonMobil Chemical; Dow, Inc.; Chevron Phillips Chemical Co., LLC; Westlake Chemical; DuPont; Celanese Corporation; Eastman Chemical Company; Huntsman International LLC; RTP Company |

The primary driver of the U.S. plastics market is the material’s unmatched versatility and cost-effectiveness across a wide range of end-use industries. Plastics offer a unique combination of properties—light weight, moldability, chemical resistance, and durability which make them suitable for high-volume, high-precision applications. In packaging, plastics help reduce transportation costs and extend shelf life. In construction, PVC pipes and insulation materials reduce building maintenance and improve energy efficiency.

In the automotive sector, lightweight plastic components replace heavier metal parts to enhance fuel efficiency and reduce emissions. Polypropylene, polycarbonate, and ABS are widely used in dashboards, bumpers, and interiors. The medical industry leverages plastics like PVC and polycarbonate for syringes, tubing, and diagnostic tools. Given this vast application base, any economic recovery, industrial expansion, or technological innovation in these sectors invariably boosts plastic consumption.

Despite its economic utility, plastic’s environmental footprint remains a key restraint. Plastic waste, especially from single-use packaging, has raised significant concerns regarding pollution, microplastics, and marine life disruption. This has resulted in stricter regulations at both state and federal levels, including bans on plastic bags and mandates for recycled content in packaging.

Furthermore, the lack of uniform recycling infrastructure and challenges in segregating and processing mixed plastic waste have created inefficiencies. The disparity between actual recycling rates and production volumes intensifies public scrutiny. For the U.S. plastics market to sustain long-term growth, producers must adopt eco-design practices, invest in chemical recycling technologies, and comply with evolving environmental legislation.

A major opportunity within the U.S. plastics market lies in the rising demand for engineering plastics and bio-based polymers. Engineering plastics like polyamide (PA), polycarbonate (PC), and polyether ether ketone (PEEK) are increasingly used in sectors that demand high performance under extreme conditions, including aerospace, electronics, medical, and EV battery systems.

Simultaneously, a growing preference for sustainable alternatives is opening new avenues for green polymers such as PLA (polylactic acid), PHA (polyhydroxyalkanoates), and starch blends. Companies focusing on material innovation, recyclability, and compostability are poised to capture new market share as regulations and consumer preferences converge on environmental responsibility. Additionally, investments in advanced compounding and additive technologies allow for the development of functional plastics with antimicrobial, antistatic, or fire-retardant properties.

Polyethylene (PE) dominates the U.S. plastics market in terms of volume and applications. Widely used in packaging, film, containers, and geomembranes, PE is valued for its flexibility, moisture resistance, and cost-effectiveness. Low-density polyethylene (LDPE) and high-density polyethylene (HDPE) serve key functions in bags, bottles, agricultural films, and pipe manufacturing. The rise in e-commerce and fresh food packaging has kept PE demand strong, particularly in film applications. Innovations in multilayer barrier films and recyclable PE laminates are also enhancing its sustainability profile.

Polyamide (PA), commonly referred to as nylon, is the fastest-growing product segment due to its expanding role in automotive, electronics, and industrial applications. Known for its toughness, heat resistance, and chemical stability, polyamide is used in high-stress environments such as fuel lines, cable ties, connectors, and mechanical parts. As electric vehicles become mainstream, the need for lightweight, heat-resistant plastics like PA will grow substantially, particularly for under-the-hood and battery management applications.

Packaging is the dominant end-use segment, accounting for a significant share of total plastic consumption in the U.S. Rigid and flexible plastic packaging meets critical needs in food safety, shelf life extension, and transportation efficiency. Materials such as PET, HDPE, and PP are staples in bottles, jars, caps, films, and trays. The ongoing shift toward lightweight, recyclable, and resealable formats keeps innovation active in this segment. Consumer preference for convenience packaging and e-commerce’s impact on protective solutions are also contributing to sustained demand.

Medical devices represent the fastest-growing end-use segment, particularly post-pandemic, as healthcare infrastructure expands and the need for cost-effective disposables rises. From surgical instruments and IV bags to diagnostic cartridges and ventilator parts, plastics are indispensable. Materials like PVC, PC, and TPEs are used for their biocompatibility, sterilizability, and moldability. The rise of wearable devices and remote monitoring tools is also driving demand for transparent and flexible medical-grade plastics. Regulatory compliance (e.g., FDA-approved materials) ensures sustained innovation in this high-growth segment.

Injection molding is the dominant application method in the U.S. plastics market, known for its versatility, speed, and suitability for mass production. It is widely used to manufacture parts for the automotive, consumer electronics, medical, and packaging industries. Resins like PP, ABS, and PC are molded into complex, high-precision components with minimal waste. Automation and digital control systems have improved injection molding throughput and reduced defect rates, enhancing its industrial appeal.

Thermoforming is the fastest-growing processing technique, especially in packaging and medical disposables. This process involves heating plastic sheets and forming them over molds, ideal for lightweight trays, clamshells, and blisters. The demand for pre-packaged meals, convenience foods, and sterile healthcare packaging is driving this growth. PET and PVC are commonly used thermoforming materials. With increasing investment in thermoformable biodegradable plastics and advanced tooling technologies, this method is gaining adoption across sectors demanding high-volume, low-cost components.

As a standalone market, the United States offers a highly integrated and innovation-led plastic ecosystem. The country is home to major resin producers, compounders, and equipment manufacturers, many of which are vertically integrated and supported by robust research infrastructure. States like Texas, Ohio, Michigan, and California are production powerhouses, each specializing in distinct plastic types and end-user verticals.

The American Chemistry Council, Plastics Industry Association, and other trade groups play a crucial role in promoting sustainable plastic practices and industry compliance. U.S.-based manufacturers are increasingly investing in circular plastic systems, extended producer responsibility (EPR) programs, and chemical recycling technologies. Government incentives supporting infrastructure development, green manufacturing, and re-shoring are expected to boost domestic production and innovation in high-performance and sustainable plastics.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. plastics market

Product

End-use

Application