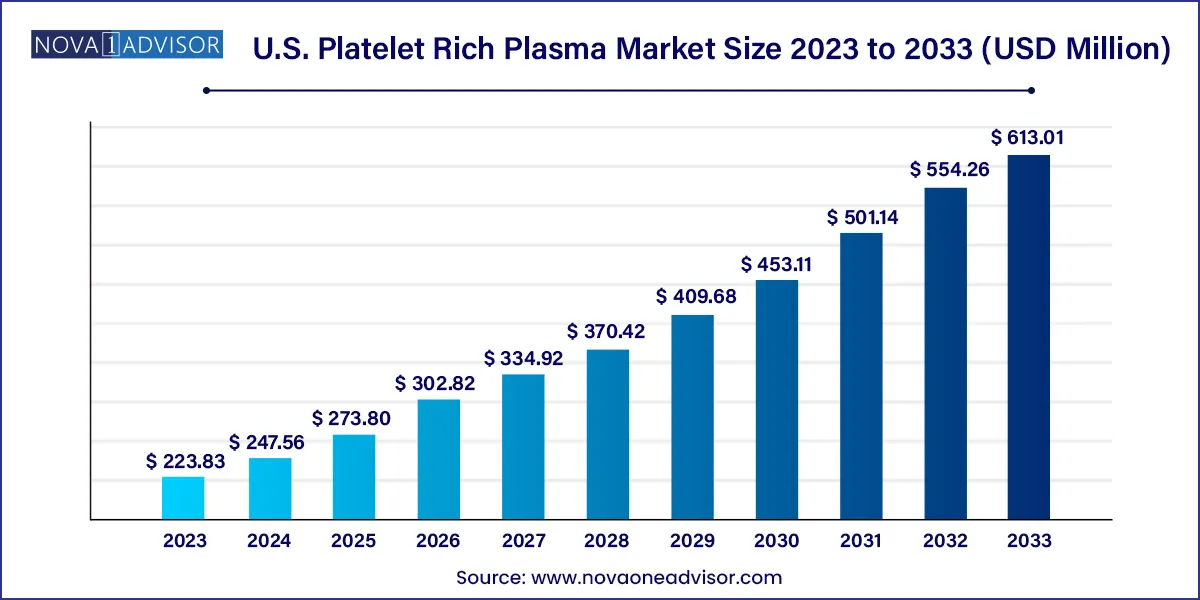

The U.S. platelet rich plasma market size was exhibited at USD 223.83 million in 2023 and is projected to hit around USD 613.01 million by 2033, growing at a CAGR of 10.6% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 247.56 Million |

| Market Size by 2033 | USD 613.01 Million |

| Growth Rate From 2024 to 2033 | CAGR of 10.6% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Type, Application, End-use |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | U.S. |

| Key Companies Profiled | Johnson & Johnson Services, Inc; Arthrex, Inc.; EmCyte Corporation; Dr PRP USA LLC; Juventix Regenerative Medical, LLC; Terumo Corporation; Zimmer Biomet; Stryker; Apex Biologix; Celling Biosciences |

Platelet-rich Plasma (PRP) therapy has proven effective and safe in various medical applications, offering benefits such as accelerated healing, enhanced wound closure, reduced swelling and inflammation, and stabilization of bone or soft tissue. These advantages expand the use of PRP in treating chronic ailments, leading to boost market revenue. Platelets play a critical role in wound healing due to their hemostatic function and the presence of growth factors and cytokines. Research studies confirm the safety and affordability of platelet-rich plasma as a regenerative therapy for cutaneous wound healing, improving patient care.

While increased acceptability of PRP in dental and oral surgical procedures, such as managing bisphosphonate-related osteonecrosis of the jaw to enhance wound healing, have also yielded promising results. In the past few years, platelet rich plasma injections have gained significant traction among popular sports professionals, including Jermaine Defoe, Rafael Nadal, Alex Rodriguez, Tiger Woods, and many more. Furthermore, the World Anti-doping Association (WADA) removed the PRP from the prohibited substances list in 2011. Wide application of these products by high profile athletes in the U.S. for early osteoarthritis (OA) and chronic injuries significantly contribute to market growth.

PRP and stem cell-based biological interventions have been proven to accelerate recovery while maintaining the performance of athletes. Moreover, research studies have demonstrated that PRP can be used successfully in combination with other treatments to ensure rapid healing. The effects of PRP therapy combined with 70% glycolic acid effectively manage acne scars. Similarly, PRP along with hyaluronic acid significantly improves skin general appearance, firmness, and texture.

High costs associated with platelet rich plasma products make it difficult for clinicians to deploy this therapy on a large scale, which impedes market growth to some extent. Conversely, insurance firms cover few PRP therapy costs, including diagnostic tests, consultation fees, and other medical expenses. The CMS covers autologous PRP only for patients with chronic non-healing diabetic, venous wounds, or when enrolled in a clinical research study, thus reducing the amount of out-of-pocket charges.

Pure platelet rich plasma dominated the market with a revenue share of 51.8% in 2023. Certain benefits associated with this PRP type, including tissue generation & repair, rapid healing, and enhancement in overall function, have raised the demand for pure PRP across different therapeutic applications. In addition, effective elimination of adverse effects, such as an allergic or immune reaction, with this therapeutic approach has considerably benefitted the segment growth.

Pure platelet rich plasma is considered to be more suitable for application for bone regeneration than leukocyte platelet rich plasma. The combined use of this therapy with β-tricalcium phosphate is reflected to be an effective and safe alternative for the treatment of bone defects. Key players are also providing advanced products in this segment. Pure Spin PRP, a U.S.-based firm, is one such player offering an advanced PRP system for centrifugation with maximum platelet recovery.

Leukocyte-rich PRP (LR-PRP) is anticipated to grow at a CAGR of around 11% during the forecast period. LR-PRP promotes bone regeneration by improved viability, proliferation, migration of cells in vitro, osteogenesis, and angiogenesis in vitro & in vivo, however, these products produce harmful effects as compared to pure type. Conversely, these are powerful tools for soft tissue reconstruction with a reduction in operating time, postoperative pain, and risk of complications in wound healing.

In terms of revenue, the orthopedics held the maximum share of 26.7% in 2023 in the U.S. PRP market. Platelet rich plasma injections in orthopedic therapeutics have been recognized to be more convenient as compared to conventional therapeutics as the former stimulates healing and causes degenerative tissue to repair & regenerate itself. Long-lasting relief and optimized healing after surgery are certain advantages associated with this therapy that have supplemented the demand for PRP in soft tissue reconstruction and bone reconstruction.

Furthermore, an increase in the prevalence of OA in the U.S. boosts the demand for this regenerative therapy in orthopedics. As per the Centers for Disease Control and Prevention (CDC), there were 54 million cases of arthritis, and it is estimated that 78.0 million U.S. adults aged 18 years or older would have arthritis by 2040. Moreover, an increase in the number of research studies constantly illustrating the benefits of isolated PRP usage in combination with surgical treatments in the management of OA is set to propel the market growth.

An increase in cosmetic surgeries is set to boost the cosmetic surgery and dermatology segment, poised to grow at the highest CAGR through 2023-2033. As per the American Society of Plastic Surgeons, there were nearly 5.9 million reconstructive procedures in 2019 in the U.S. The rise in the adoption of PRP treatments by plastic surgeons & dermatologists to improve the volume, tone, and texture of the skin also drives segment growth. It reduces the appearance of wrinkles and offers positive aesthetic results when combined with fat grafting procedures.

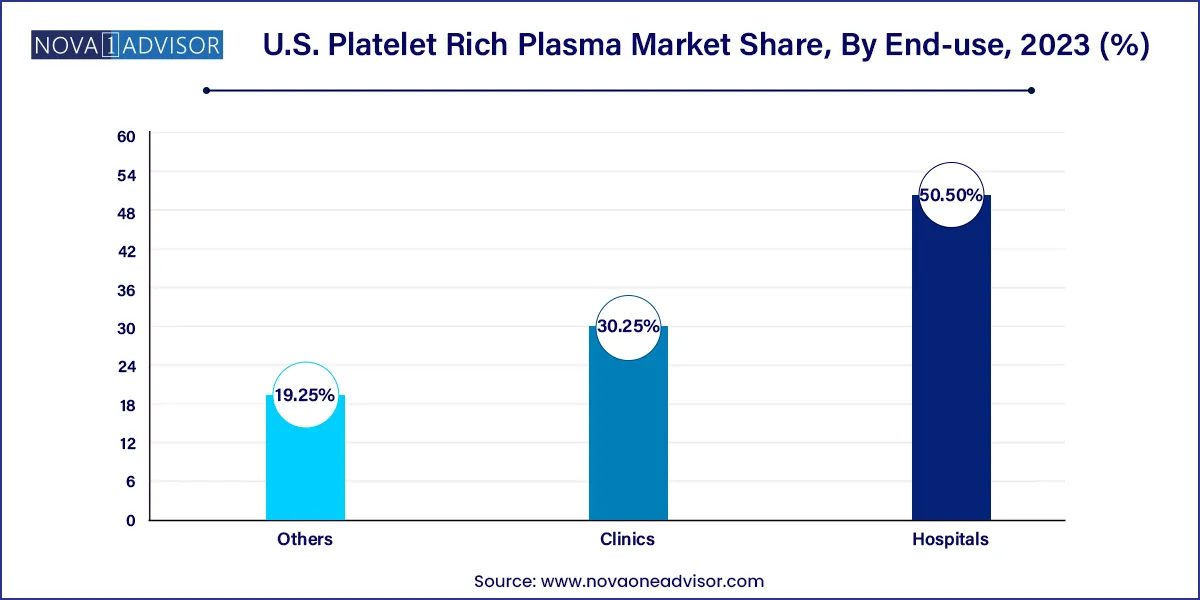

The hospital segment accounted for the largest revenue share of 50.5% in 2023 with a substantial number of hospitals in the U.S. that provide PRP-based therapies. In addition, the growth in the knee OA cases is a major health concern in the U.S. As there are limited or no definitive curative therapies for osteoarthritis, it creates a major opportunity for these therapies to be highly adopted by hospitals for the treatment of knee OA. This factor contributes to the segment’s dominance in the market.

Others end-use segment includes academic institutes, research institutes, and Point-of-care (POC) settings and is estimated to witness the fastest growth rate of 11.3% over the forecast period. Recent product approval for the rapid and safe preparation of this therapy at PoC settings in the U.S. is one of the major factors responsible for high growth. For instance, in September 2021, Royal Biologics recently received FDA 510K approval for their Maxx™-PRP concentration system. This patented next-generation device enables the safe and rapid preparation of platelet-rich plasma (PRP) by concentrating autologous whole blood.

Similarly, the Fidia PRP Kit of the Fidia Farmaceutici s.p.a., an Italy-based company with operations in the U.S., received FDA approval in November 2019 for rapid and safe preparation of autologous platelet rich plasma at the patient’s PoC. Apex Biologix’s XCELL PRP Platelet Concentrating System 60ml was granted approval in April 2019. The availability of these systems and kits for PRP preparation to be used at POC settings is likely to drive the segment at a lucrative pace.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. platelet rich plasma market.

Type

Application

End-use

Chapter 1 Methodology and Scope

1.1 Market Segmentation and Scope

1.1.1 Segment Definitions

1.1.1.1 Type Segment

1.1.1.2 Application Segment

1.1.1.3 End-USE Segment

1.2 Estimates and Forecast Timeline

1.3 Information Procurement

1.4 Objectives

1.4.1 Objective - 1

1.4.2 Objective - 2

1.4.3 Objective - 3

1.5 Research Methodology

1.6 Information Procurement

1.6.1 Purchased Database

1.6.2 Internal Database

1.6.3 Secondary Sources

1.6.4 Primary Research

1.7 Information or Data Analysis

1.7.1 Data Analysis Models

1.8 Market Formulation & Validation

1.9 Model Details

1.9.1 Commodity Flow Analysis

1.10 List of Secondary Sources

1.11 List of Abbreviations

Chapter 2. Executive Summary

2.1. Market Snapshot

2.2. Type, Application, and End Use Snapshot

2.3. Competitive Landscape Snapshot

Chapter 3. Market Variables, Trends & Scope

3.1. Market Segmentation and Scope

3.2. Market Lineage Outlook

3.2.1. Parent Market Outlook

3.2.2. Related/Ancillary Market Outlook

3.3. Market Trends and Outlook

3.4. Market Dynamics

3.3.1 Increasing number of cosmetic surgery procedures

3.3.2 Rise in the incidence of orthopedic disorders and sports injuries

3.3.3 Extending medical applications of platelet rich plasma

3.5. Market Restraint Analysis

3.5.1. High costs associated with PRP products

3.6. Business Environment Analysis

3.6.1. SWOT Analysis; By Factor (Political & Legal, Economic And Technological)

3.6.2. Porter’s Five Forces Analysis

3.6.3. COVID-19 Impact Analysis

Chapter 4. The U.S. Platelet Rich Plasma Market: Segment Analysis by Type, 2021 - 2033

4.1. U.S. Platelet Rich Plasma Market: Type Movement Analysis

4.2. Pure PRP

4.2.1. The U.S. pure PRP market estimates and forecast, 2021 - 2033

4.3. Leukocyte Rich PRP

4.3.1. The U.S. leukocyte rich PRP market estimates and forecast, 2021 - 2033

4.4. Others

4.4.1. The U.S. other type market estimates and forecast, 2021 - 2033

Chapter 5. The U.S. Platelet Rich Plasma Market: Segment Analysis by Application, 2021 - 2033

5.1. The U.S. Platelet Rich Plasma Market: Application Movement Analysis

5.2. Orthopedics

5.2.1. The U.S. platelet rich plasma for orthopedics market estimates and forecast, 2021 - 2033

5.3. Sports Medicine

5.3.1. The U.S. platelet rich plasma for Sports Medicine market estimates and forecast, 2021 - 2033

5.4. Cosmetic Surgery

5.4.1. The U.S. platelet rich plasma for cosmetic surgery market estimates and forecast, 2021 - 2033

5.5. Dermatology

5.5.1. The U.S. platelet rich plasma for dermatology market estimates and forecast, 2021 - 2033

5.5.2. The U.S. platelet rich plasma for ulcer healing dermatology market estimates and forecast, 2021 - 2033

5.5.2.1. The U.S. platelet rich plasma for venous ulcer market estimates and forecast, 2021 - 2033

5.5.2.2. The U.S. platelet rich plasma for traumatic ulcer market estimates and forecast, 2021 - 2033

5.5.2.3. The U.S. platelet rich plasma for diabetic ulcer market estimates and forecast, 2021 - 2033

5.5.2.4. The U.S. platelet rich plasma for pyoderma gangrenosum ulcer market estimates and forecast, 2021 - 2033

5.5.2.5. The U.S. platelet rich plasma for trophic ulcer market estimates and forecast, 2021 - 2033

5.5.2.6. The U.S. platelet rich plasma for vasculitic ulcer market estimates and forecast, 2021 - 2033

5.5.2.7. The U.S. platelet rich plasma for other ulcer market estimates and forecast, 2021 - 2033

5.5.3. The U.S. platelet rich plasma for other dermatology market estimates and forecast, 2021 - 2033

5.6. Ophthalmic surgery

5.6.1. The U.S. platelet rich plasma for ophthalmic surgery market estimates and forecast, 2021 - 2033

5.7. Neurosurgery

5.7.1. The U.S. platelet rich plasma for general surgery market estimates and forecast, 2021 - 2033

5.8. General Surgery

5.8.1. The U.S. platelet rich plasma for general surgery market estimates and forecast, 2021 - 2033

5.9. Others

5.9.1. The U.S. platelet rich plasma for others market estimates and forecast, 2021 - 2033

Chapter 6. The U.S. Platelet Rich Plasma Market: Segment Analysis by End Use, 2021 - 2033

6.1. U.S. Platelet Rich Plasma Market: End Use Movement Analysis

6.2. Hospitals

6.2.1. The U.S. platelet rich plasma for hospitals market estimates and forecast, 2021 - 2033

6.3. Clinics

6.3.1. The U.S. platelet rich plasma for clinics estimates and forecast, 2021 - 2033

6.4. Others

6.4.1. The U.S. platelet rich plasma market for other end user estimates and forecast, 2021 - 2033

Chapter 7. Company Profile

7.1. Company Categorization

7.2. Strategy Mapping

7.2.1. New Product Launch

7.2.2. Partnerships

7.2.3. Acquisition

7.2.4. Collaboration

7.2.5. Funding

7.3. Key Company Market Share Analysis, 2022

7.3.1. Company Profiles

7.3.2. Johnson & Johnson

7.3.2.1. Company overview

7.3.2.2. DePuy Synthes

7.3.2.2.1. Company overview

7.3.2.2.2. Financial Performance

7.3.2.2.3. Product benchmarking

7.3.2.2.4. Strategic initiatives

7.3.3. Arthrex, Inc.

7.3.3.1. Company overview

7.3.3.2. Financial Performance

7.3.3.3. Product benchmarking

7.3.3.4. Strategic initiatives

7.3.4. EmCyte Corporation

7.3.4.1. Company overview

7.3.4.2. Product benchmarking

7.3.4.3. Strategic initiatives

7.3.5. DR. PRP America, Llc

7.3.5.1. Company overview

7.3.5.2. Product benchmarking

7.3.6. Juventix

7.3.6.1. Company overview

7.3.6.2. Financial Performance

7.3.6.3. Product benchmarking

7.3.7. Terumo Corporation

7.3.7.1. Company overview

7.3.7.2. Terumo Bct, Inc.

7.3.7.2.1. Company overview

7.3.7.2.2. Financial Performance

7.3.7.2.3. Product benchmarking

7.3.7.2.4. Strategic initiatives

7.3.8. Zimmer Biomet

7.3.8.1. Company overview

7.3.8.2. Financial Performance

7.3.8.3. Product benchmarking

7.3.8.4. Strategic initiatives

7.3.9. Stryker

7.3.9.1. Company overview

7.3.9.2. Financial Performance

7.3.9.3. Product benchmarking

7.3.9.4. Strategic initiatives

7.3.10. Apex Biologix

7.3.10.1. Company overview

7.3.10.2. Financial Performance

7.3.10.3. Product benchmarking

7.3.10.4. Strategic initiatives

7.3.11. Celling Biosciences

7.3.11.1. Company overview

7.3.11.2. Financial Performance

7.3.11.3. Product benchmarking

7.3.11.4. Strategic initiatives