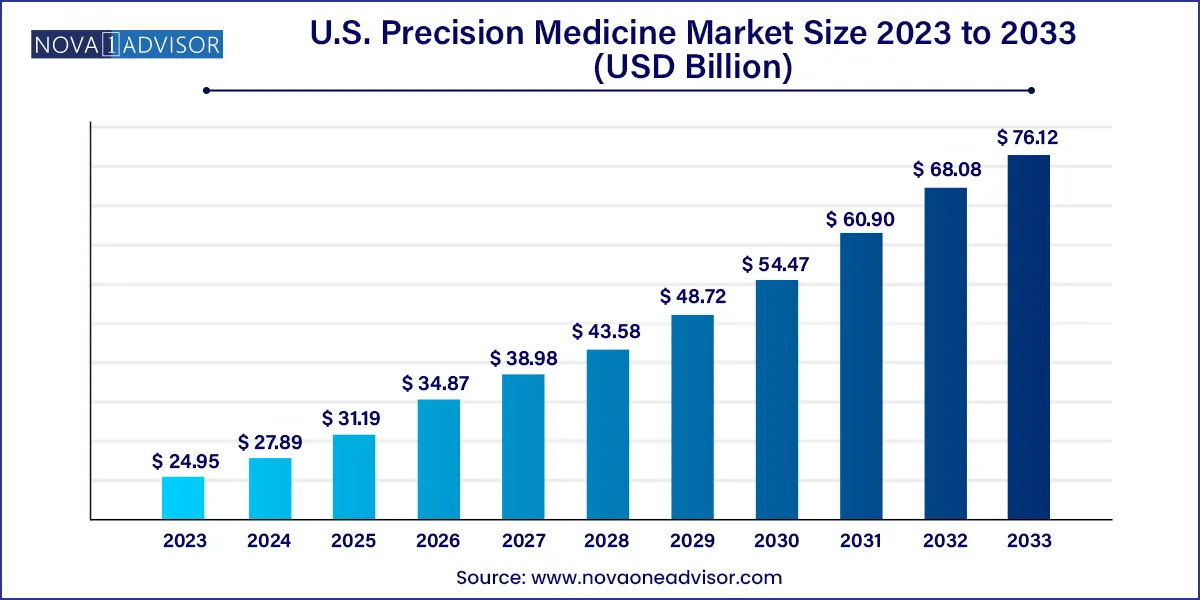

The U.S. precision medicine market size was valued at USD 24.95 billion in 2023 and is projected to reach around USD 76.12 billion by 2033, registering a CAGR of 11.80% from 2024 to 2033.

The U.S. Precision Medicine market is witnessing rapid growth, propelled by several factors. Precision medicine, which involves tailoring medical treatment to individual characteristics of each patient, has gained prominence due to advancements in technology, particularly in genomics, data analytics, and artificial intelligence. This has enabled healthcare providers to offer more personalized diagnosis and treatment options. Additionally, increasing awareness among healthcare professionals and patients about the potential benefits of precision medicine has driven demand. Government initiatives and funding support for research and development in this field have also played a crucial role in fostering market growth. Furthermore, the rising prevalence of chronic diseases and the need for more effective and targeted therapies have further accelerated the adoption of precision medicine approaches. Collaborations between pharmaceutical companies, research institutions, and healthcare providers have facilitated the translation of scientific discoveries into clinical applications, driving market expansion. Overall, the U.S. Precision Medicine market is poised for continued growth as it continues to revolutionize healthcare delivery and outcomes.

The growth of the U.S. Precision Medicine market can be attributed to several key factors. Firstly, advancements in technology, particularly in genomics, data analytics, and artificial intelligence, have enabled more precise diagnosis and treatment selection tailored to individual patients. Additionally, increasing awareness among both healthcare professionals and patients about the benefits of personalized medicine has fueled demand. Moreover, government initiatives and funding support for precision medicine research and development have provided a conducive environment for market growth. Furthermore, the rising prevalence of chronic diseases, coupled with the need for more effective and targeted therapies, has spurred the adoption of precision medicine approaches. Lastly, collaborations between pharmaceutical companies, research institutions, and healthcare providers have facilitated the translation of scientific discoveries into clinical applications, driving market expansion.

| Report Attribute | Details |

| Market Size in 2024 | USD 27.89 Billion |

| Market Size by 2033 | USD 76.12 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 11.80 % |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Technology, By Application, By End-Use, By Sequencing Technology, By Product, By Route of Administration, and By Drugs |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Biocrates Life Sciences, Quest Diagnostics, NanoString Technologies, Pfizer, AbbVie Inc., AstraZeneca, Johnson & Johnson Services, Inc, Thermo Fisher Scientific, Inc., Illumina, Inc., ARIEL Precision Medicine, Inc., and Others. |

Driver

Rising government initiatives and funding

One major factor propelling the U.S. precision medicine market is funding from governments. The research and development (R&D) sector is moving more quickly due to financial support from the public and commercial sectors, opening up new possibilities for customized healthcare. Extensive research endeavors, sometimes including worldwide partnerships, are underway to identify the fundamental genetic and environmental components of many medical conditions. Research institutes and businesses that concentrate on creating precision medical techniques or technology can apply for grants and subsidies. The commercialization of new goods and services is accelerating due to this capital inflow, which is propelling the market upward.

Restraint

Data privacy concerns and regulatory challenges

A significant quantity of sensitive patient data, including genetic data, must be gathered and analyzed to practice precision medicine. Patients and healthcare professionals may become hesitant due to worries about data privacy, security breaches, and the abuse of genetic information, which present moral and legal issues. Such factors hamper the overall growth of the U.S. precision medicine market. Furthermore, the regulatory environment around precision medicine is changing, and creating coherent and uniform regulatory frameworks may provide difficulties. Market access and acceptance may be impacted by the approval and reimbursement procedures for personalized medicines, which may be more complicated than those for conventional treatments.

Opportunity

The expanding applications of machine learning (ML) and artificial intelligence (AI) in precision medicine

Utilizing these technologies makes it possible to quickly evaluate enormous volumes of patient data to provide individualized and focused therapies. Several precision medicine applications utilize AI and ML based on patient-specific genetic and molecular profiles. This incorporation of AI/ML algorithms with precision medicine facilitates the resolution of complex problems in personalized medical care by physicians, researchers, and practitioners. The drug development process may be sped up by using AI and ML to forecast novel medication effectiveness and identify possible therapeutic targets.

Assisting in the identification of individuals who are most likely to benefit from a certain medication, these technologies can help increase the effectiveness and success of clinical studies. They can identify patterns and connections that human researchers would miss, which can result in more precise diagnoses and potent therapies. Therefore, throughout the projected period, the U.S. precision medicine market is anticipated to rise in tandem with the increasing use of AI and ML in precision medicine.

The market is segmented into bioinformatics, big data analytics, drug discovery, gene sequencing, companion diagnostics, and others. The drug discovery segment dominated the U.S. precision medicine market. Precision medicine relies heavily on biomarkers that are measurable indicators of biological processes. Biomarkers play a crucial role in patient stratification, allowing researchers to identify subpopulations that are more likely to respond to a particular treatment. This approach facilitates the development of drugs with higher efficacy and fewer side effects.

Precision medicine enables the stratification of patients in clinical trials based on their genetic and molecular profiles. This approach helps identify patient subgroups that are more likely to benefit from the experimental treatment, improving the efficiency of clinical trials and increasing the chances of success. Thus, this is expected to drive the segment growth.

The market is bifurcated into CNS, immunology, oncology, respiratory, and others. The oncology segment held the largest share of the U.S. precision medicine market in 2023 due to the rise in cancer incidence and advancements in technology. Applications of precision medicine are mostly focused on improving the treatment of cancer diseases, and throughout the projected period, there is anticipated to be a notable increase in growth. The rising incidence of cancer and the increasing number of treatment options undergoing clinical trials are the primary drivers of the segment's notable rise.

The U.S. precision medicine market is expanding as a result of cancer patients using precision oncology more frequently. According to a Nature Medicine journal article from April 2022, the usage of precision medicine in cancer patients has expanded due to the growing use of genetic profiling for diagnosis and therapeutic recommendations in various tumor types. Precision medicine is reportedly utilized for patients who have a higher chance of acquiring specific cancers, especially those with a family history of the disease. Therefore, the expansion of this market is being driven by the rising incidence of cancer patients and the growing effectiveness of precision medicine.

Based on the end-user, the market is segmented into diagnostic companies, pharmaceutical companies, healthcare IT companies, and others. The pharmaceutical companies segment held the dominating share of the U.S. precision medicine market. Pharmaceutical companies invest in the development of companion diagnostics, which are essential tools for identifying patients who are most likely to benefit from specific therapies. These diagnostics help personalize treatment decisions by matching patients with the most suitable drugs based on their genetic and molecular profiles.

Moreover, collaboration is a key trend in the precision medicine landscape. Pharmaceutical companies often collaborate with diagnostic companies, research institutions, and technology firms to leverage expertise and resources. These collaborations enhance the understanding of disease mechanisms, identify relevant biomarkers, and accelerate drug development.

The market is segmented into pyrosequencing, sequencing by synthesis, sequencing by ligation, single-molecule real-time sequencing, ion semiconductor sequencing, chain termination sequencing, and nanopore sequencing. The single molecule real-time sequencing (SMRT) segment is expected to dominate the U.S. precision medicine market over the forecast period.

SMRT provides longer reads compared to traditional short-read sequencing technologies. This capability is crucial for accurately characterizing complex genomic regions, such as repetitive sequences, structural variations, and genomic rearrangements. The long reads generated by SMRT sequencing enhance the resolution of genomic information, aiding in the identification of disease-causing mutations. Thus, these properties drive the market growth.

The market is segmented into consumables, instruments, and services. The consumables segment led the U.S. precision medicine market in 2023. Precision medicine involves tailoring medical treatment to individual characteristics, such as genetic makeup. Consumables in this context often include genetic testing kits, diagnostic reagents, and other materials used in molecular diagnostics. The market is being driven by advancements in genomics, increased awareness of personalized healthcare, and a growing emphasis on targeted therapies.

The market can be segmented into injectable and oral. The oral segment held the largest share of the U.S. precision medicine market in 2023 owing to its therapeutic and dosing advantages. Oral drugs provide a convenient method of drug delivery, allowing patients to take their medication at home or on the go without the need for medical supervision. This convenience promotes better adherence to treatment plans. In addition, compared to some other routes of administration (such as injections or intravenous infusions), taking medications orally is generally less invasive and more comfortable for patients. Thus, these advantages drive the segment expansion.

The market can be segmented into Alectinib, Osimertinib, Mepolizumab, Aripiprazole Lauroxil, and Others. The Mepolizumab segment is anticipated to grow significantly in the U.S. precision medicine market during the forecast period due to the rising prevalence of asthma because this drug is used to treat severe respiratory conditions. The increasing prevalence of asthma is one of the important variables that propels the segment expansion.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Precision Medicine market.

By Technology

By Application

By End-Use

By Sequencing Technology

By Product

By Route of Administration

By Drugs