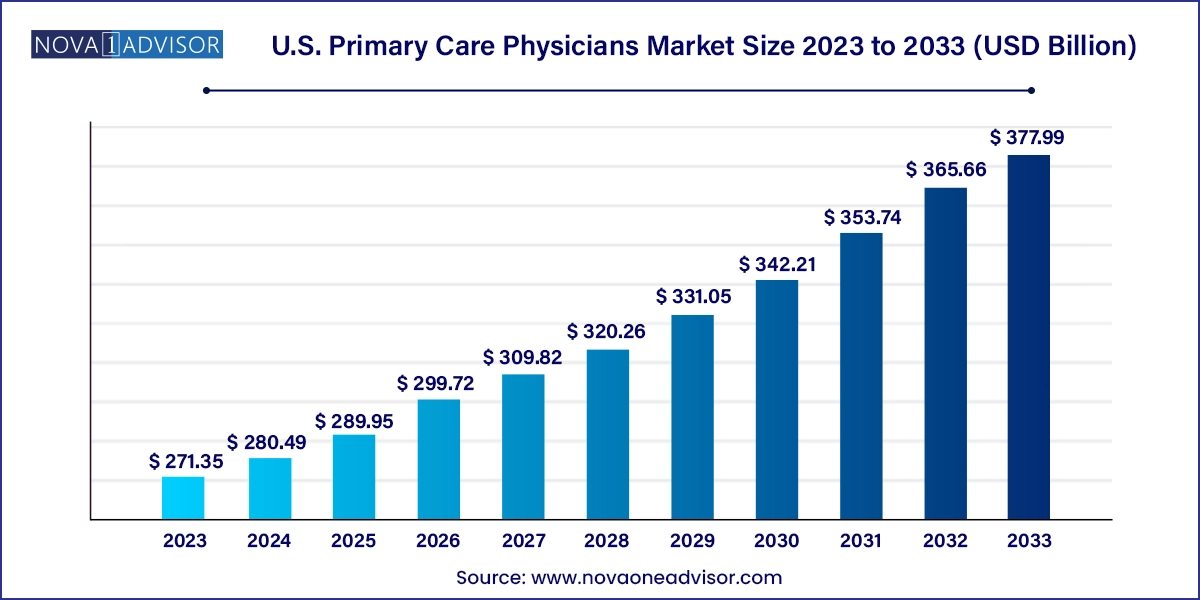

The U.S. primary care physicians market size was exhibited at USD 271.35 billion in 2023 and is projected to hit around USD 377.99 billion by 2033, growing at a CAGR of 3.37% during the forecast period 2024 to 2033.

The U.S. Primary Care Physicians (PCP) market plays a pivotal role in the nation's healthcare ecosystem, serving as the first point of contact for most individuals seeking medical attention. These physicians act as gatekeepers who provide preventative care, diagnose common illnesses, manage chronic diseases, and refer patients to specialized care when needed. The importance of primary care has grown exponentially as healthcare systems pivot toward value-based care models, emphasizing preventive care and early diagnosis to improve health outcomes and reduce overall healthcare costs.

In recent years, the U.S. PCP market has been under a dual influence of rising demand and mounting pressure. An aging population, increasing prevalence of chronic conditions, and a growing focus on patient-centric and coordinated care have driven demand for primary care services. On the other hand, shortages of trained physicians, burnout, and administrative burdens continue to challenge the capacity of the healthcare system. According to the Association of American Medical Colleges (AAMC), the U.S. could see a shortage of up to 48,000 primary care physicians by 2034, emphasizing the urgency to address supply-side bottlenecks.

Telehealth has emerged as a crucial component of primary care delivery, particularly accelerated during the COVID-19 pandemic. Virtual consultations have helped bridge access gaps, especially in rural or underserved areas, and are now becoming a staple of modern practice models. Moreover, increased investments in value-based care models have encouraged providers to adopt integrated care approaches, supported by advanced electronic health records (EHRs) and population health analytics. These changes are shaping a dynamic future for the U.S. primary care landscape, one that prioritizes accessibility, efficiency, and outcomes over volume.

Rapid Adoption of Telehealth: Primary care practices have integrated telemedicine tools to provide virtual consultations, especially in the aftermath of the COVID-19 pandemic.

Shift Toward Value-Based Care Models: PCPs are transitioning from fee-for-service to value-based reimbursement models that reward quality and patient outcomes.

Growing Demand for Geriatric Care: With the aging baby boomer population, geriatrics is becoming a focus area within primary care, prompting tailored service models.

Increased Use of AI and Predictive Analytics: Practices are employing AI tools for population health management, chronic disease monitoring, and predictive diagnostics.

Rise of Concierge and Direct Primary Care (DPC): These membership-based models offer enhanced access and personalized care, gaining popularity among affluent patient groups.

Healthcare Workforce Shortages: The looming shortage of PCPs has triggered discussions about leveraging physician assistants (PAs) and nurse practitioners (NPs) for primary care.

Government Incentives for Rural Practice: Federal and state-level programs provide loan forgiveness and other incentives to encourage PCPs to serve in underserved areas.

EHR Integration and Interoperability Challenges: Despite wide adoption, integration and usability issues continue to hamper workflow efficiency and physician satisfaction.

| Report Coverage | Details |

| Market Size in 2024 | USD 280.49 Billion |

| Market Size by 2033 | USD 377.99 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 3.37% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Type, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | U.S. |

| Key Companies Profiled | MDVIP; 1Life Healthcare, Inc. (One Medical Group); Rhode Island Primary Care Physicians Corporation (RIPCPC); Duly Health and Care (Formerly DuPage Medical Group); Optum, Inc.; ChenMed LLC; Premier Medical Associates; Colonial Healthcare; New West Physicians; Crossover Health Medical Group |

One of the strongest drivers of growth in the U.S. Primary Care Physicians Market is the aging population. As of 2024, nearly 17% of the U.S. population is aged 65 and older, a number projected to rise significantly over the next decade. Older adults typically require more frequent medical attention due to the prevalence of chronic diseases such as hypertension, diabetes, and arthritis. This population segment often needs coordinated and continuous care, making primary care physicians indispensable.

Additionally, preventive screenings, management of polypharmacy (multiple medications), and care planning for age-related cognitive decline are becoming central to primary care. Geriatric-focused PCPs are uniquely positioned to deliver these services. Consequently, the demand for primary care services is expected to increase substantially as the elderly population grows, bolstering the need for systemic reforms and investment in PCP training and retention.

A major restraint confronting the U.S. PCP market is the increasing rate of physician burnout and the resultant workforce shortages. Long working hours, bureaucratic tasks such as EHR documentation, and rising patient loads have significantly affected job satisfaction and mental health among physicians. A 2023 survey by Medscape found that over 60% of PCPs reported feeling burned out, with a significant number considering early retirement or career change.

This issue is further compounded by the limited number of medical graduates choosing primary care due to relatively lower remuneration compared to specialties. While residency programs and incentives exist, the time lag between education and practice availability continues to constrain physician supply. Unless addressed through systemic changes such as team-based care, administrative support, and improved work-life balance the shortage could jeopardize timely access to care for millions of Americans.

An important opportunity lies in expanding the roles of Advanced Practice Providers (APPs), including nurse practitioners (NPs) and physician assistants (PAs), in primary care settings. With appropriate training and supervision, APPs can perform most primary care functions, including diagnosing conditions, prescribing medications, and managing chronic diseases. In many U.S. states, especially those with full practice authority, NPs can operate independently.

This model is increasingly adopted in community clinics, urgent care centers, and even private practices to reduce the burden on physicians. For example, retail health clinics operated by CVS Health or Walgreens now commonly rely on APPs to deliver convenient, affordable care. With policy support and continued investment in training, the utilization of APPs can serve as a practical solution to mitigate the physician shortfall while maintaining service quality and expanding access.

General Practice, Family Physician and Geriatrics segment dominated the market in 2024. These physicians often serve as the cornerstone of family and community health services, providing comprehensive care across all age groups. Their ability to diagnose a wide variety of conditions and establish long-term patient relationships fosters continuity and preventive care. This segment plays a pivotal role in managing chronic diseases, coordinating specialist referrals, and guiding patients through complex health decisions. The inclusion of geriatrics further strengthens the segment’s position, especially in the context of the aging U.S. population. The increasing focus on holistic and family-oriented care has continued to sustain demand in this category.

On the other hand, the General Internal Medicine segment is expected to emerge as the fastest-growing category during the forecast period. Internists typically specialize in diagnosing and managing adult diseases, particularly in hospital and outpatient settings. As chronic conditions such as diabetes, cardiovascular diseases, and respiratory issues surge, internists are increasingly sought after for their specialized training in adult care. They also play a crucial role in preventive health strategies and long-term disease management. Enhanced collaborations with hospital systems and the integration of internal medicine into value-based care models are accelerating this segment’s expansion.

The Southeast region emerged as the leading market for primary care physicians. This is attributed to the region’s large population base, aging demographics, and a high burden of chronic conditions such as obesity, diabetes, and cardiovascular diseases. States like Florida and Georgia have numerous retirement communities and aging residents who frequently require primary care services. Furthermore, increased Medicaid enrollment and public health initiatives have driven investment in primary care infrastructure across the Southeast.

Conversely, the Southwest region is poised to be the fastest-growing regional segment over the coming years. Rapid population growth in states such as Texas, Arizona, and New Mexico, coupled with efforts to enhance healthcare access in rural and underserved communities, is driving this trend. Telehealth adoption, community health programs, and government incentives for rural practice have also contributed to the increasing number of PCPs operating in this region. As healthcare access expands and urbanization continues, the Southwest market is set for robust growth.

In the United States, the landscape of primary care is undergoing profound transformation. States like California, Texas, and Florida are witnessing significant expansion in physician groups, urgent care centers, and virtual care startups. In New York, value-based care partnerships are becoming the norm as payers and providers align incentives to reduce hospitalization and improve health outcomes. At the federal level, initiatives like the Centers for Medicare and Medicaid Services (CMS) Primary Care First model and the ACO REACH program are incentivizing improved coordination, reduced costs, and better health outcomes.

The U.S. Department of Health and Human Services has prioritized primary care workforce expansion through funding grants, particularly in rural and underserved areas. States are experimenting with scope-of-practice reforms that allow nurse practitioners to practice independently, thereby enhancing access. Medicaid expansion and reforms in commercial insurance markets are also leading to broader coverage for preventive services. With rising investments in health tech and digital health platforms, especially in primary care-focused startups, the U.S. market is becoming increasingly tech-enabled and consumer-oriented.

March 2024 – Amazon Clinic Expansion: Amazon announced its expansion of Amazon Clinic to all 50 U.S. states, offering virtual primary care services and prescription refills for common conditions through licensed providers. This move intensifies competition in the digital health space, especially for PCPs offering hybrid care models.

February 2024 – CVS Health Launches Advanced Primary Care Centers: CVS Health launched several advanced primary care clinics under its Oak Street Health acquisition, focusing on chronic care management and preventive services for Medicare beneficiaries.

January 2024 – UnitedHealth Group Acquires Crystal Run Healthcare: UnitedHealth’s Optum arm completed the acquisition of Crystal Run Healthcare, a large multispecialty physician group, to expand its value-based primary care network in New York and New Jersey.

December 2023 – Teladoc Health Integrates AI Diagnostics: Teladoc Health began pilot-testing AI-based tools in its primary care platforms to enhance diagnostic accuracy, reduce physician workload, and improve virtual care efficiency.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. primary care physicians market

Type

Regional