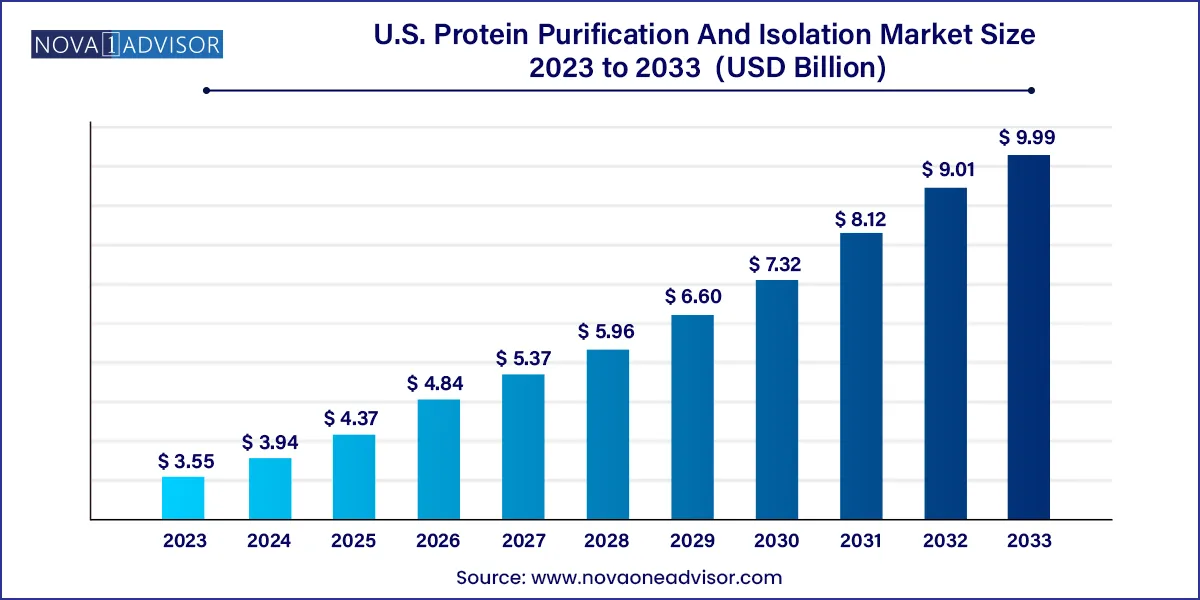

The U.S. protein purification and isolation market size was valued at USD 3.55 billion in 2023 and is projected to surpass around USD 9.99 billion by 2033, registering a CAGR of 10.9% over the forecast period of 2024 to 2033.

The U.S. protein purification and isolation market represents one of the most technologically advanced and commercially vital sectors in the broader biotechnology and life sciences ecosystem. Protein purification—the process of isolating one or more proteins from a complex mixture is a critical technique used extensively in biomedical research, pharmaceutical manufacturing, diagnostics, and clinical applications. Its importance has expanded with the rise of proteomics, personalized medicine, and the increasing demand for biologics, vaccines, and biosimilars.

The U.S. has been at the forefront of innovation in this domain, supported by world-class academic institutions, robust research funding, cutting-edge biotech startups, and global pharmaceutical giants. This market has experienced considerable momentum in recent years, driven by the explosion of recombinant protein technologies, the need for high-throughput analytical tools, and increased investments in biopharmaceutical R&D.

From monoclonal antibody production to vaccine development (such as for COVID-19 and cancer immunotherapy), the ability to purify proteins with high specificity and efficiency is essential. The market also benefits from the growing number of clinical trials involving therapeutic proteins and an increasing pipeline of targeted therapies, many of which rely on validated protein targets. The U.S. is home to major life sciences hubs such as Boston, San Diego, and the San Francisco Bay Area, which continue to expand infrastructure and research capabilities to meet this rising demand.

Rise of Automation and High-Throughput Systems: Advanced robotic systems and automated chromatography platforms are gaining prominence for increased productivity and reproducibility.

Increased Use of Affinity Tags and Magnetic Beads: These technologies are simplifying workflows in both academic labs and commercial facilities.

Expansion of Proteomics and Genomics Research: Initiatives in understanding disease pathways and identifying novel biomarkers are fueling protein study needs.

Integration of AI and Machine Learning: Predictive algorithms for protein expression and purification optimization are being integrated into bioprocessing software.

Growth in Contract Research and Manufacturing: CROs and CMOs are scaling up protein purification services for biotech and pharma clients.

Sustainability and Green Bioprocessing: Eco-friendly reagents and reusable purification columns are being prioritized in line with ESG goals.

Advances in Membrane Technologies: Ultrafiltration and tangential flow filtration are evolving for better scale-up performance.

Personalized Medicine Driving Diagnostic Protein Analysis: Tailored therapies rely on protein profiling and diagnostics, boosting demand for purification tools.

Point-of-Care Diagnostic Development: Miniaturized protein purification kits are increasingly used in decentralized clinical testing.

Academic-Industry Collaborations: Joint research efforts are promoting the translation of novel purification technologies into real-world solutions.

| Report Attribute | Details |

| Market Size in 2024 | USD 3.94 Billion |

| Market Size by 2033 | USD 9.99 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 10.9% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, technology, application, end-use |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Thermo Fisher Scientific, Inc.; Merck KGaA; QIAGEN N.V; Bio-Rad Laboratories, Inc.; Agilent Technologies; GE Healthcare; Promega Corporation; Norgen Biotek Corp.; Abcam plc; Danaher |

The surging demand for recombinant proteins and biopharmaceuticals is a powerful driver propelling the U.S. protein purification and isolation market. Therapeutic proteins such as insulin analogs, monoclonal antibodies, growth factors, and cytokines require precise isolation techniques to ensure efficacy, safety, and consistency. With over 100 approved monoclonal antibody therapies in the U.S. and numerous biologics in development, the need for scalable, cost-effective, and regulatory-compliant purification platforms has become more urgent than ever.

Major biotech firms like Amgen and Genentech heavily invest in purification infrastructure to support large-scale production of complex proteins. Additionally, the recent advancements in gene therapy, cell-based therapies, and mRNA vaccine production have further expanded protein purification’s scope. The push for personalized and precision medicines—such as CAR-T cell therapies—requires individualized protein characterization, which in turn fuels demand for high-performance purification systems.

One of the primary restraints facing the market is the high capital cost and technical complexity associated with advanced purification equipment and processes. Instruments such as multi-modal chromatography systems, mass spectrometry-coupled analyzers, and high-resolution electrophoresis units can be prohibitively expensive for smaller laboratories, particularly academic and early-stage biotech firms.

Moreover, skilled personnel are essential to operate and maintain these sophisticated systems. The need for continuous calibration, validation, and troubleshooting can further burden resource-constrained facilities. Even consumables like chromatography columns and specialty resins are cost-intensive, especially for labs that frequently process large sample volumes or conduct screening studies. These factors can delay the adoption of cutting-edge purification platforms across smaller institutions or startups, despite their promising research pipelines.

A key opportunity within the U.S. market lies in the rising application of protein purification and isolation in diagnostics and point-of-care (POC) testing. The post-pandemic focus on rapid and accessible diagnostics has led to a surge in protein-based test development, including antigen assays, lateral flow immunoassays, and ELISA kits. Each of these technologies relies on the consistent and scalable purification of high-quality proteins for accurate and reliable results.

Startups and diagnostic developers are now leveraging simplified purification kits and magnetic bead-based systems to produce diagnostic proteins rapidly and at lower costs. For instance, in early 2024, several U.S.-based companies began piloting portable diagnostic toolkits that included integrated protein purification capabilities to support decentralized testing in rural or resource-limited settings. With the growth in wearable biosensors, cancer diagnostics, and infectious disease testing, the need for fast, field-deployable purification solutions is poised to surge.

Chromatography continues to be the most dominant technology segment in the protein purification landscape, accounting for a large share of lab-based and industrial bioprocessing activities. Within this umbrella, affinity and ion-exchange chromatography methods are particularly favored for their specificity and reliability in isolating high-purity proteins. These techniques are widely used by both pharmaceutical manufacturers and research labs due to their scalability and compatibility with regulatory protocols. As purification demands for biologics and biosimilars increase, multi-column continuous chromatography systems are gaining traction for improving throughput and reducing buffer consumption.

Electrophoresis is the fastest-growing segment, with techniques such as capillary electrophoresis and isoelectric focusing gaining widespread adoption for analytical and quality control purposes. These technologies offer superior resolution, speed, and accuracy, especially when characterizing protein heterogeneity or charge variants. In biopharma settings, electrophoresis is crucial for release testing, stability assessment, and batch-to-batch consistency evaluations. Additionally, gel electrophoresis remains a standard in academic labs for validating protein expression before scaling up to larger purification efforts.

Consumables currently dominate the U.S. protein purification and isolation market, owing to their recurring nature and widespread use in both small-scale and industrial applications. Consumables include items such as resins, membranes, buffers, and filter units—integral components in almost every stage of protein separation. In particular, affinity resins and size-exclusion columns are essential in both manual and automated workflows. The increasing number of protein expression experiments, especially in proteomics and drug discovery, is driving repeat purchases of consumables across academia and industry.

Simultaneously, magnetic beads are among the fastest-growing product segments, driven by their utility in simplified and automation-friendly workflows. These beads enable efficient protein isolation with minimal sample loss and are increasingly used in diagnostic kit development, rapid screening assays, and high-throughput labs. With the miniaturization of lab processes and growing interest in point-of-care diagnostics, magnetic bead systems are being incorporated into new platforms that support decentralized and mobile testing environments. Their versatility and ability to support parallel assays make them ideal for multiplex biomarker studies.

Drug screening applications lead the U.S. market in terms of revenue, reflecting the heavy dependence on protein isolation to identify, validate, and test drug targets. Proteins involved in receptor binding, signal transduction, or immune modulation must be purified for in vitro and in vivo studies, making purification an essential step in preclinical and clinical research. As the pharmaceutical industry continues to expand its biologics pipeline, the demand for reliable, reproducible purification tools has increased proportionally.

Biomarker discovery is emerging as the fastest-growing application, fueled by advancements in mass spectrometry, proteomics platforms, and AI-based data analytics. The ability to purify and identify disease-specific proteins is central to the development of diagnostic and prognostic assays. Research initiatives supported by NIH and private investors are increasingly targeting early-stage detection for cancer, neurodegenerative diseases, and autoimmune disorders—all of which rely heavily on protein biomarker validation.

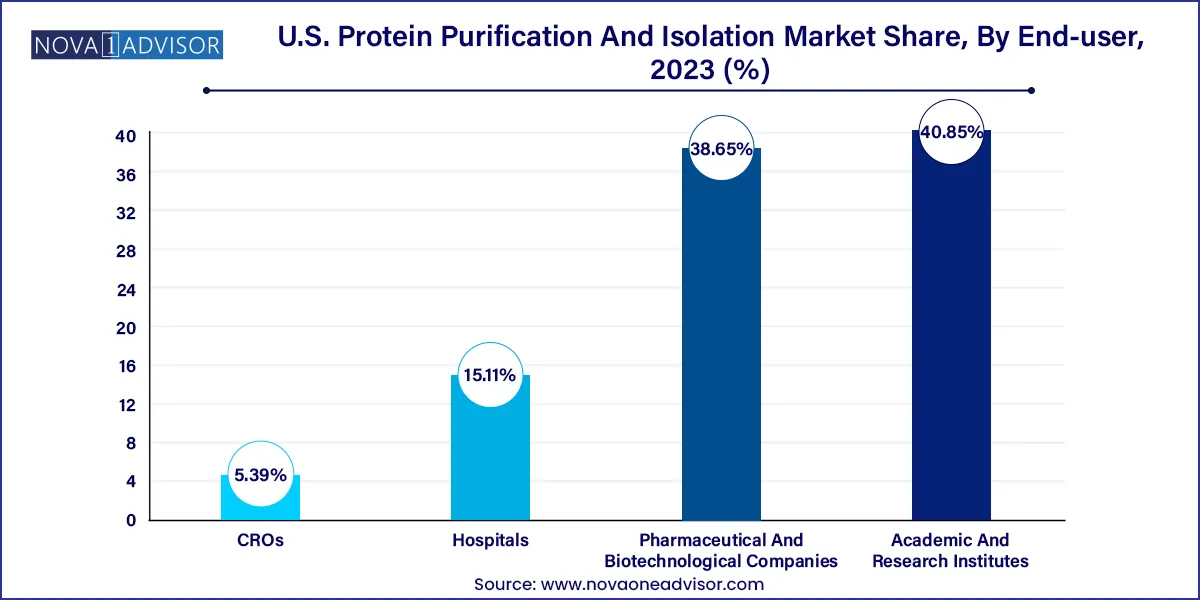

Pharmaceutical and biotechnological companies dominate the end-use segment, thanks to their extensive R&D activities and large-scale biologics production needs. These entities invest heavily in process development and downstream processing infrastructure, where protein purification plays a pivotal role in achieving regulatory compliance and product safety. Companies like Pfizer, Amgen, and Genentech routinely deploy cutting-edge purification technologies to optimize manufacturing pipelines and reduce time-to-market.

Contract research organizations (CROs) represent the fastest-growing end-use segment, as pharmaceutical firms increasingly outsource early-stage R&D, biomarker validation, and custom protein services. CROs are expanding their protein analysis capabilities to cater to a growing base of biotech startups that prefer to focus on core innovation while outsourcing technical processes. With increasing pressure to reduce R&D costs and improve turnaround times, CROs are becoming indispensable players in the protein purification ecosystem.

The U.S. market is defined by a confluence of academic excellence, entrepreneurial innovation, and regulatory rigor. It houses numerous academic research institutions, such as Harvard, MIT, Stanford, and the NIH, which conduct cutting-edge proteomics research and receive billions in public and private funding annually. The presence of biotechnology clusters in Boston, San Francisco, and Raleigh-Durham enables collaborations across universities, startups, and Big Pharma to develop and deploy purification technologies.

The U.S. Food and Drug Administration (FDA) and other regulatory bodies also influence the protein purification market through guidelines that dictate purity, sterility, and quality metrics for biologics and diagnostic products. Consequently, U.S.-based companies invest heavily in compliance-ready purification systems that can withstand audit scrutiny.

In addition, the rise in personalized medicine and the expansion of clinical diagnostics has broadened protein purification’s application beyond research and pharma. Initiatives such as the NIH’s "All of Us" program and the Cancer Moonshot are expected to generate massive volumes of protein data, necessitating robust purification workflows and advanced analytical tools.

March 2025: Thermo Fisher Scientific announced a collaboration with a major pharmaceutical company to co-develop an advanced affinity chromatography system optimized for cell and gene therapy applications.

February 2025: Bio-Rad Laboratories launched a next-gen magnetic bead platform for automated protein purification in personalized diagnostic kit manufacturing.

January 2025: Agilent Technologies expanded its electrophoresis portfolio with the launch of a high-throughput capillary electrophoresis system tailored for monoclonal antibody analysis.

December 2024: GE HealthCare's Cytiva unit introduced a new range of pre-packed columns designed for continuous protein purification workflows in large-scale biologics manufacturing.

November 2024: Merck KGaA (MilliporeSigma in the U.S.) announced the expansion of its St. Louis facility, focusing on resin production for protein purification in vaccine and oncology drug manufacturing.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Protein Purification And Isolation market.

By Product

By Technology

By Application

By End-use