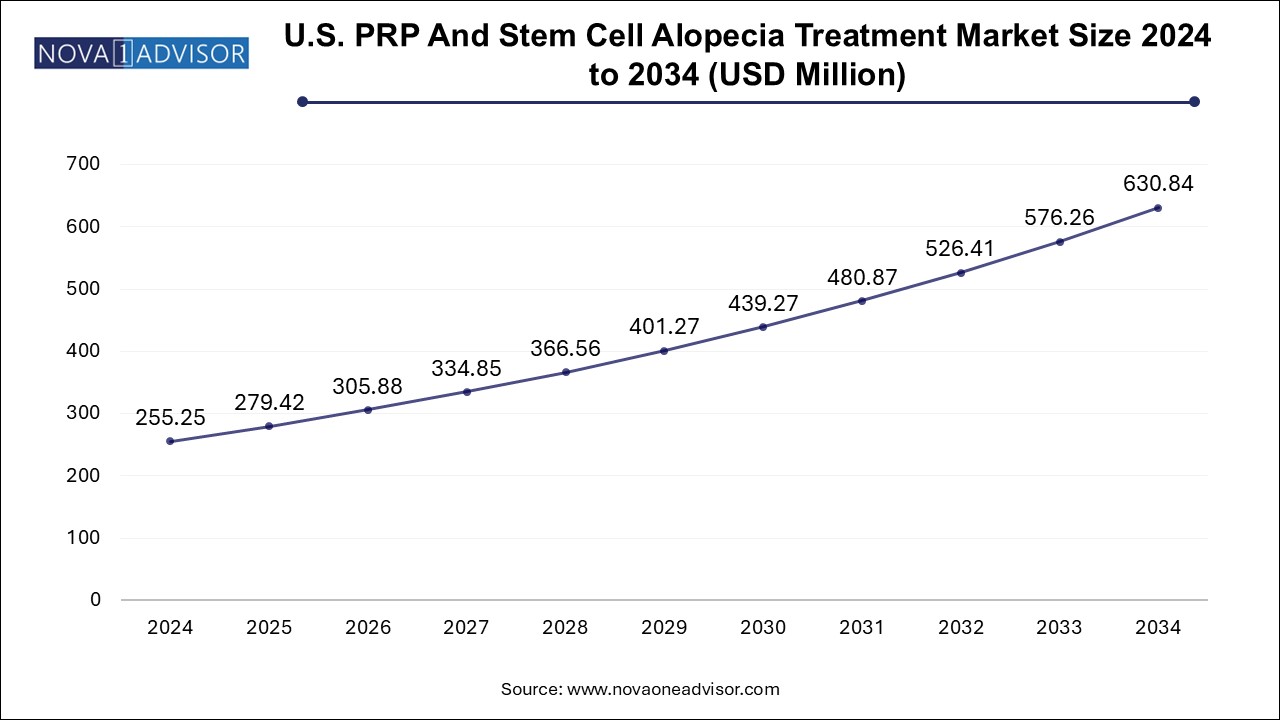

The U.S. PRP and stem cell alopecia treatment market size was exhibited at USD 255.25 million in 2024 and is projected to hit around USD 630.84 million by 2034, growing at a CAGR of 9.47% during the forecast period 2025 to 2034.

The U.S. PRP (Platelet-Rich Plasma) and stem cell alopecia treatment market represents a rapidly evolving sector in aesthetic and regenerative medicine. As the aesthetic demands of patients continue to rise and conventional hair restoration methods plateau in efficacy, PRP and stem cell-based therapies have emerged as promising alternatives for addressing various forms of alopecia. These minimally invasive, autologous-based treatments offer the potential for follicular rejuvenation, reduced inflammation, and long-term hair regrowth—without the downtime or surgical risks associated with traditional options like hair transplantation.

Alopecia, or hair loss, affects millions of Americans, both men and women, across age groups and ethnicities. Androgenic alopecia, the most common type, affects approximately 50 million men and 30 million women in the U.S. alone. While medications such as minoxidil and finasteride are widely used, their limitations in efficacy and long-term adherence challenges have created opportunities for regenerative therapies like PRP and stem cells to fill the treatment gap.

PRP therapy involves extracting a patient’s blood, processing it to isolate a platelet-rich concentrate, and injecting it into the scalp to stimulate hair follicles. Stem cell therapy, typically derived from adipose tissue or bone marrow, promotes tissue regeneration and has shown encouraging results in early clinical trials for alopecia. These approaches are increasingly adopted by dermatologists and aesthetic clinics across the U.S., especially in urban centers where patients are more likely to pursue elective procedures with innovative profiles.

Factors such as increasing consumer awareness, rising disposable income, technological advancements in processing equipment, and growing numbers of trained aesthetic professionals contribute to the market’s steady growth. With evolving clinical protocols, patient-tailored treatment regimens, and supportive marketing by dermatology practices, the U.S. PRP and stem cell alopecia treatment market is poised for significant expansion over the forecast period.

Shift Toward Non-surgical Regenerative Therapies: Patients are opting for less invasive treatments like PRP and stem cell injections over traditional hair transplants.

Combination Treatment Protocols: Dermatologists are combining PRP or stem cells with microneedling, laser therapy, or exosome therapy to enhance efficacy.

Adoption of FDA-cleared PRP Kits and Devices: Clinics are increasingly using standardized PRP preparation kits that ensure safety, consistency, and compliance.

Rise of Personalized Medicine: Treatment regimens are being tailored based on patient-specific hair loss patterns, scalp condition, and comorbidities.

Technological Advancements in Cell Processing: Automated centrifugation and real-time viability testing are improving the precision of PRP and stem cell therapies.

Social Media and Aesthetic Marketing: Influencers and clinics are leveraging digital platforms to promote hair restoration results and create patient awareness.

Increased Male Participation: Men, who were once reluctant to seek cosmetic help, are now the largest demographic group undergoing PRP-based hair regrowth procedures.

Insurance Exclusion Driving Self-pay Growth: With treatments largely paid out-of-pocket, the market is becoming attractive for aesthetic entrepreneurs and private dermatology chains.

| Report Coverage | Details |

| Market Size in 2025 | USD 279.42 Million |

| Market Size by 2034 | USD 630.84 Million |

| Growth Rate From 2025 to 2034 | CAGR of 9.47% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Treatment, Indication, End-use |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | Bauman Medical Group; P.A.; Virginia Surgical Center; Nova Medical Hair Transplant; Chicago Hair Transplant Clinic; Dr. V Medical Aesthetics; City Facial Plastics; Orange County Hair Restoration; MAXIM Hair Restoration; New Jersey Hair Restoration Center; Hair Restoration Institute of Minnesota; Morgenstern Hair Restoration LLC; and Houston Hair Transplant Center |

One of the key drivers accelerating the U.S. PRP and stem cell alopecia treatment market is the growing preference for minimally invasive cosmetic procedures. As public perception shifts toward preventive aesthetics and natural-looking results, patients are increasingly turning to non-surgical treatments that require minimal recovery time. Hair loss, once stigmatized, is now widely accepted as a treatable condition, leading more individuals to seek help at earlier stages.

PRP therapy aligns perfectly with this demand. It uses the patient’s own blood, reduces risk of allergic reactions, and is administered in under an hour. Likewise, autologous stem cell therapies are gaining popularity for their regenerative potential and the perception of biological "healing" rather than superficial masking. These treatments are increasingly offered as outpatient procedures with high satisfaction rates and repeat visit potential. The appeal of personalized, needle-based hair restoration is propelling clinics and medspas across the country to adopt these procedures into their service portfolios.

A critical restraint in the market is the absence of uniform clinical standards and lack of insurance coverage for PRP and stem cell-based treatments. While clinical studies and anecdotal evidence suggest promising results, there remains a lack of large-scale, long-term, randomized controlled trials (RCTs) that meet the benchmarks of FDA approval or insurance reimbursement.

This leads to significant variability in pricing, quality of care, and outcome predictability across clinics. Moreover, patients bear the full financial burden—often several hundred to thousands of dollars per session—leading to hesitancy or dropout after a few sessions. For stem cell therapies, regulatory ambiguity persists regarding the classification of autologous treatments, especially when involving enzymatic processing or laboratory expansion of cells. Until clearer clinical protocols and regulatory approvals are widely implemented, these issues may inhibit the market from reaching its full potential.

An exciting opportunity within the U.S. PRP and stem cell alopecia treatment market is the integration of these therapies with digital health tools, AI-based scalp diagnostics, and personalized tracking platforms. Startups and technology providers are introducing handheld imaging devices, AI-powered scalp scanners, and treatment outcome simulators that enable dermatologists to diagnose and track alopecia progression with precision.

When combined with data from electronic health records, genomics, or patient lifestyle inputs, AI can help customize PRP or stem cell therapy regimens—improving both outcomes and patient engagement. Moreover, the use of AR/VR tools for treatment visualization and post-procedure expectations is elevating patient satisfaction. Clinics that invest in such integrated platforms will likely see improved retention, stronger word-of-mouth, and better clinical documentation, enhancing both efficacy and business scalability.

The Platelet-Rich Plasma (PRP) Therapy dominated the U.S. market in 2024, accounting for the largest share of alopecia-related regenerative treatments. PRP therapy has gained significant traction over the past five years due to its affordability, accessibility, and strong anecdotal outcomes. As a minimally invasive, in-office procedure, PRP injections are often recommended as first-line regenerative solutions for both male and female pattern hair loss. Dermatology clinics, aesthetic centers, and even medical spas offer PRP with increasing regularity, and patient interest continues to rise thanks to celebrity endorsements and digital promotions.

Stem Cell Therapy is expected to be the fastest-growing treatment segment during the forecast period. While still relatively nascent, stem cell-based solutions for alopecia are witnessing rising adoption in specialized dermatology practices and research-driven clinics. Adipose-derived and bone marrow-derived mesenchymal stem cells (MSCs) are the most commonly used sources, with newer protocols exploring exosome-based applications. Although costlier than PRP, the long-term regenerative promise of stem cells and their appeal among early adopters and higher-income patients are contributing to their rapid expansion.

Androgenic alopecia accounted for the largest market share, reflecting its status as the most common form of hair loss in the U.S. population. Affecting both genders, it manifests as male pattern baldness or female thinning and progresses over time. PRP and stem cell therapies have demonstrated efficacy in slowing progression and revitalizing dormant follicles, making them attractive alternatives to lifelong medications. This segment is also well-suited for patient education campaigns and structured treatment packages offered by clinics.

Cicatricial alopecia is emerging as the fastest-growing indication, largely due to increasing diagnosis and improved awareness of scarring-related hair loss. These are often autoimmune or inflammatory in nature, and conventional therapies such as steroids or immunomodulators may fall short. Stem cell-based regenerative strategies offer promising options to modulate inflammation and initiate follicular repair in early-stage patients, leading dermatologists to explore this application more actively.

Dermatology clinics are the dominant end-users of PRP and stem cell alopecia therapies, as they are at the forefront of aesthetic innovation and regenerative care. These clinics typically have the staff, training, and equipment necessary to perform such procedures with precision. Moreover, they benefit from strong patient trust, referral networks, and the capacity to offer tailored, subscription-based treatment models that ensure ongoing care and higher revenue per patient.

Hospitals, however, are expected to grow at the fastest rate, especially large multispecialty institutions offering integrative dermatology services. As clinical validation improves and regulations become clearer, hospitals are more likely to add these treatments to their dermatology, plastic surgery, or wellness departments. Additionally, academic hospitals involved in clinical trials and R&D are playing a key role in developing next-gen stem cell protocols and contributing to long-term efficacy data.

The U.S. market is characterized by a high degree of awareness, advanced healthcare infrastructure, and consumer willingness to invest in aesthetic health. Urban centers such as New York, Los Angeles, Miami, Dallas, and Chicago lead in the number of dermatology clinics offering PRP and stem cell therapies for hair restoration. These areas are home to both high-income populations and a culture that values cosmetic enhancement, driving demand.

States such as California, Florida, and Texas are also witnessing growth due to their density of aesthetic practitioners and favorable regulations around elective procedures. Moreover, the rise of direct-to-consumer (DTC) platforms offering hair analysis, consultation, and clinic referrals is further boosting accessibility. The U.S. is also a hub for PRP device manufacturing and stem cell therapy R&D, ensuring a steady pipeline of innovations entering the market. While coverage by public or private insurance remains minimal, patient financing solutions and aesthetic credit systems are expanding access.

In February 2025, Eclipse launched an upgraded PRP kit with rapid dual-spin centrifugation, reducing preparation time by 30% and improving platelet concentration efficiency.

In December 2024, Stemson Therapeutics announced positive preliminary data from its phase I trial of autologous dermal papilla stem cell therapy in androgenic alopecia patients.

In October 2024, Bosley Medical partnered with a West Coast dermatology chain to launch stem cell-enhanced PRP combination treatments under a subscription model.

In September 2024, HairScience Institute USA unveiled a new exosome-based topical delivery system to complement PRP therapy in post-injection care.

In July 2024, the American Academy of Dermatology (AAD) released new guidance on best practices for PRP in alopecia, standardizing treatment intervals and injection techniques.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. PRP and stem cell alopecia treatment market

By Treatment

By Indication

By End-use