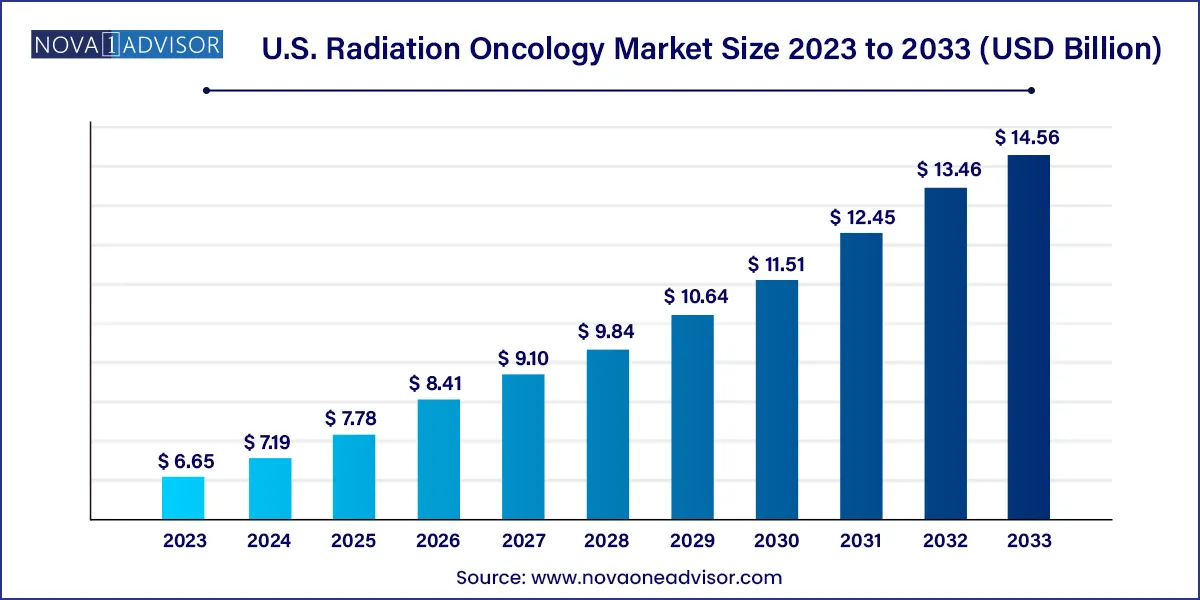

The U.S. radiation oncology market size was exhibited at USD 6.65 billion in 2023 and is projected to hit around USD 14.56 billion by 2033, growing at a CAGR of 8.15% during the forecast period 2024 to 2033.

The U.S. radiation oncology market represents a cornerstone of cancer treatment infrastructure, reflecting continuous innovation, expanding patient access, and growing clinical precision. Radiation oncology focuses on the controlled use of ionizing radiation to destroy malignant cells while minimizing harm to healthy tissue. It has become a pivotal component in multidisciplinary cancer care, used alone or in combination with surgery, chemotherapy, and immunotherapy. Given the escalating burden of cancer in the U.S.—with an estimated 2 million new cases projected in 2025 radiation therapy remains indispensable to modern oncological practice.

Radiation therapy in the U.S. is technologically advanced and widely accessible. The country is home to some of the most renowned cancer centers and research institutions, including MD Anderson Cancer Center, Mayo Clinic, and Memorial Sloan Kettering, all of which heavily utilize radiation technologies in treatment protocols. U.S. hospitals and outpatient cancer centers are increasingly adopting image-guided, intensity-modulated, and stereotactic radiation therapies to enhance tumor targeting and reduce side effects.

Technological evolution is central to the market's growth, with U.S. firms such as Varian (a Siemens Healthineers company), Elekta, and Accuray leading the global charge in next-generation radiation systems. Clinical interest is also expanding into precision-focused approaches like proton beam therapy and adaptive radiotherapy. These high-capital technologies, although not yet widespread, are transforming the landscape by providing new treatment options for radioresistant and recurrent tumors.

With a growing elderly population, higher survival rates, favorable reimbursement models, and robust clinical trial activity, the U.S. radiation oncology market is poised for sustained growth through 2030 and beyond.

Expansion of AI and Automation in Radiotherapy Planning: AI algorithms are streamlining tumor contouring, dose planning, and image registration for faster and more accurate treatments.

Increased Use of Adaptive Radiotherapy: Real-time imaging and plan adjustments during treatment are enabling precise delivery, especially in head, neck, and pelvic tumors.

Integration of MR-Linac Systems: MRI-guided radiotherapy, such as Elekta Unity, is gaining ground due to superior soft-tissue contrast and adaptive capabilities.

Rising Adoption of Proton Beam Therapy: With multiple new centers operational or under construction, proton therapy is expanding beyond pediatrics to adult indications.

Use of Stereotactic Body Radiotherapy (SBRT): SBRT is becoming the standard for early-stage lung cancer and oligometastatic disease due to its high precision.

Shift Toward Outpatient and Ambulatory Radiotherapy Centers: Freestanding facilities are emerging as efficient alternatives to hospital-based settings, especially in rural areas.

Emergence of Radiogenomics: Integration of genetic markers with radiotherapy personalization is an evolving area, improving response prediction.

Focus on Hypofractionation Regimens: Fewer, higher-dose sessions are becoming preferred for prostate and breast cancer due to convenience and efficacy.

| Report Coverage | Details |

| Market Size in 2024 | USD 7.19 Billion |

| Market Size by 2033 | USD 14.56 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 8.15% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Type, Technology, Application |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | U.S. |

| Key Companies Profiled | Elekta AB; Accuray Incorporated; Mevion Medical Systems, Inc.; Varian Medical Systems; C.R. Bard, Inc.; Ion Beam Applications SA |

Technological Advancements in External Beam Radiation Therapy (EBRT) Systems

A major driver of growth in the U.S. radiation oncology market is the relentless pace of technological advancement, particularly in EBRT. From traditional linear accelerators to state-of-the-art AI-enabled systems, the range of solutions has expanded significantly. In March 2025, Varian introduced its TrueBeam® Edge, a next-generation radiotherapy platform integrating artificial intelligence to optimize treatment planning and delivery. This system enhances motion management, adaptive radiotherapy, and precise dose sculpting, allowing clinicians to better treat tumors located near critical organs. Such innovations not only improve clinical outcomes but also reduce treatment duration, enabling facilities to treat more patients with improved efficiency.

High Capital Investment and Maintenance Costs for Advanced Equipment

Despite the clinical benefits, radiation oncology technologies especially proton therapy and MRI-guided linacs require substantial upfront capital investment, often ranging in tens of millions of dollars. Maintenance, shielding infrastructure, and the need for specialized staffing further increase operational costs. As a result, these technologies are primarily limited to large academic centers and well-funded health systems. Community hospitals and rural facilities often lack access to such high-end modalities, creating disparities in patient care. Even with reimbursement improvements, the return on investment is slow, posing a challenge to market penetration for advanced systems.

Growth in Personalized and Adaptive Radiotherapy Supported by Imaging Integration

An exciting opportunity in the U.S. radiation oncology market lies in the integration of real-time imaging with adaptive planning. Technologies like the Elekta Unity MR-Linac allow oncologists to visualize tumors with high-definition MRI during each treatment session, adjusting therapy in real-time. In February 2025, Elekta released updated clinical outcomes for the Unity system, demonstrating improved control in soft-tissue tumors and enhanced sparing of healthy tissue. As patient-specific radiation plans become increasingly dynamic, the potential for precision, efficacy, and patient satisfaction grows. This trend aligns with broader oncology shifts toward personalization, supported by radiogenomics, imaging biomarkers, and immune profiling.

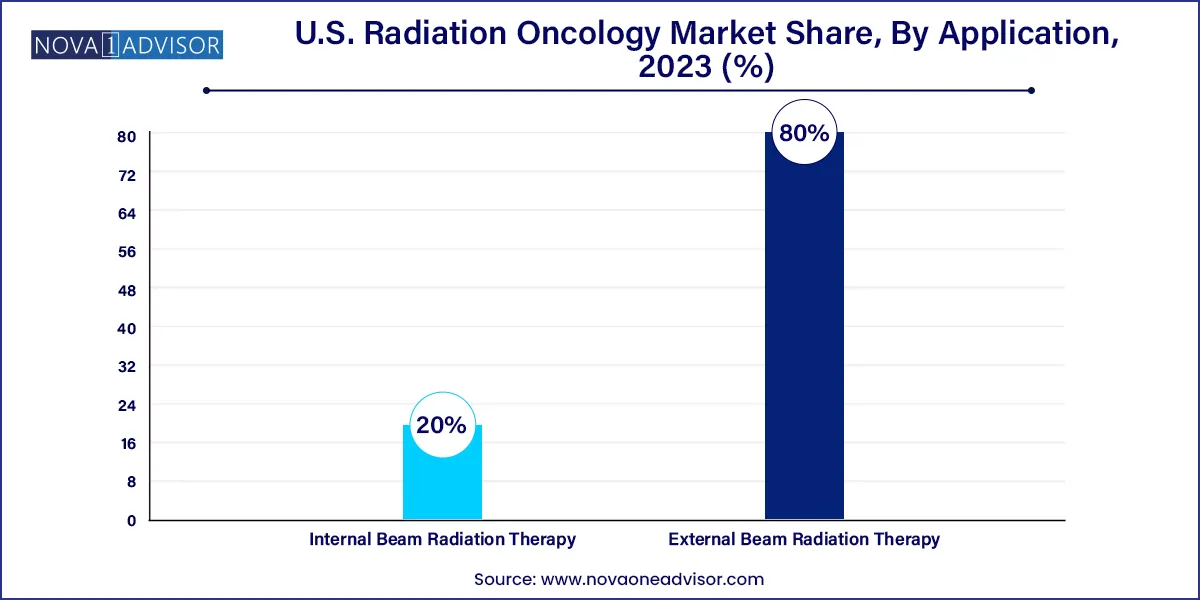

External Beam Radiation Therapy (EBRT) dominated the type segment, comprising the bulk of procedures in the U.S. market. EBRT encompasses a wide variety of technologies, including linear accelerators, tomotherapy, and CyberKnife systems. Linear accelerators, such as those offered by Varian and Elekta, are the mainstay across both academic and community cancer centers due to their versatility in treating multiple tumor types. CyberKnife systems are gaining traction in treating small, complex lesions such as brain metastases or spinal tumors. Proton therapy, although niche, is increasingly employed in pediatric cancers and radioresistant tumors due to its superior dose conformity and reduced exit dose.

Proton Therapy is the fastest-growing modality under EBRT. Several new centers—like the New York Proton Center and Mayo Clinic’s Arizona proton unit—have opened recently, reflecting a shift toward precision oncology. Proton beam therapy’s ability to minimize radiation to surrounding tissues makes it ideal for treating tumors in sensitive locations such as the base of the skull or near the spine. Technological improvements and strategic collaborations with insurers are gradually making proton therapy more accessible. Compact systems like the Mevion S250 are also reducing space and cost requirements, paving the way for broader adoption in tertiary care centers.

Intensity-Modulated Radiotherapy (IMRT) dominated the technology segment within EBRT. IMRT is widely used for its ability to deliver high radiation doses to tumors with complex shapes while sparing adjacent organs. Its role is well established in prostate, head and neck, and breast cancers. As software and planning systems improve, IMRT remains a clinical favorite, offering consistent results across diverse settings. Hospitals and outpatient centers alike rely on it for its precision, safety, and favorable reimbursement environment.

Image-Guided Radiotherapy (IGRT) is the fastest-growing technology in EBRT. IGRT uses imaging during each treatment session to verify tumor position, allowing for more accurate delivery and reduced treatment margins. The technology is critical for tumors that move during breathing, such as those in the lung or liver. Integration of IGRT with artificial intelligence and machine learning further enhances adaptive therapy possibilities, allowing radiation oncologists to fine-tune dosimetry in real time. IGRT adoption is growing particularly in high-volume cancer centers and in protocols involving hypofractionation.

Prostate cancer was the dominant application in both external and internal beam radiotherapy. Due to the high prevalence of prostate cancer among American men and the suitability of radiotherapy as both a curative and palliative option, EBRT and brachytherapy remain front-line therapies. IMRT and SBRT are extensively used in localized prostate cancer, offering excellent disease control with minimal side effects. Low-dose rate (LDR) brachytherapy is also commonly employed in early-stage cases, with patients benefiting from fewer hospital visits and durable remission.

Breast cancer is emerging as the fastest-growing application area, particularly in post-lumpectomy radiotherapy. The widespread use of radiotherapy in early-stage and triple-negative breast cancer, combined with greater patient awareness and advancements in 3D CRT and IMRT, is driving demand. Hypofractionated regimens, which shorten treatment to three to four weeks, are now standard for most patients, enhancing convenience and reducing costs. Simultaneously, APBI (accelerated partial breast irradiation) using brachytherapy is gaining popularity in selected low-risk patients.

The U.S. remains the global leader in radiation oncology, boasting the highest number of radiotherapy centers, equipment installations, and clinical trials worldwide. According to the American Society for Radiation Oncology (ASTRO), over 60% of all cancer patients in the U.S. receive radiation therapy during their treatment journey. With an aging population and increasing incidence of cancers, particularly prostate, lung, and breast cancers, the volume of radiotherapy procedures continues to rise.

U.S.-based institutions are also at the forefront of research in adaptive therapy, proton beam delivery, and radiogenomic integration. Funding from federal bodies such as the National Cancer Institute and private investments are fueling the development of new software, imaging tools, and biologically guided radiation platforms. Moreover, government initiatives aimed at reducing disparities in cancer care are encouraging the installation of radiotherapy equipment in underserved regions, expanding market reach.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. radiation oncology market.

Type

Technology

Application