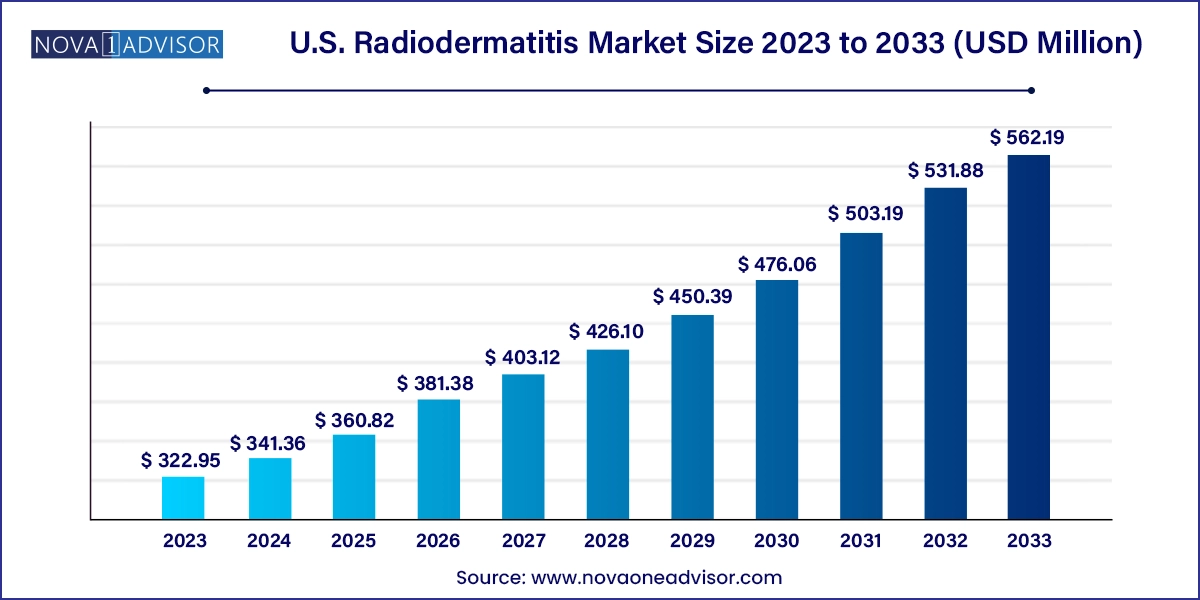

The U.S. radiodermatitis market size was exhibited at USD 322.95 million in 2023 and is projected to hit around USD 562.19 million by 2033, growing at a CAGR of 5.7% during the forecast period 2024 to 2033.

Radiodermatitis, or radiation-induced dermatitis, is a common adverse effect experienced by cancer patients undergoing radiotherapy. It ranges in severity from mild erythema to desquamation and even ulceration in extreme cases. The U.S., with one of the most advanced cancer treatment infrastructures in the world, witnesses a high prevalence of radiodermatitis due to the growing incidence of cancer and the extensive use of radiation therapy. According to the American Cancer Society, over 1.9 million new cancer cases were projected in the U.S. for 2024 alone, with radiotherapy involved in nearly 50-60% of all treatment regimens. This underpins the significance of the radiodermatitis market in the country.

The U.S. Radiodermatitis Market encompasses a wide range of treatment and prevention products such as topical agents (corticosteroids, hydrophilic creams, antibiotics), various advanced dressings (hydrogels, barrier films, honey-impregnated gauze), and is distributed through multiple channels including hospital pharmacies, retail pharmacies, and online platforms. Moreover, facility types play a crucial role in influencing the consumption pattern, with both hospital-based and independent radiotherapy centers actively contributing to market demand.

In recent years, the market has been shaped by heightened awareness among clinicians, patient education initiatives, and the growing emphasis on supportive care in oncology. Several companies have entered or expanded in the U.S. market with advanced formulations and dressing materials specifically targeted at managing radiation-induced skin injuries. Additionally, collaborations between pharmaceutical and healthcare providers to improve product accessibility have further enhanced market penetration.

The market is poised for sustainable growth driven by technological advancements in dressing materials, increasing investment in oncology care, and supportive regulatory policies favoring patient safety. However, reimbursement challenges and lack of standardized treatment protocols still pose barriers to uniform market expansion.

Rising Adoption of Advanced Wound Dressings: Hydrogel, hydrocolloid, and silicone-coated dressings are gaining popularity due to their enhanced moisture-retention capabilities and patient comfort.

Development of Plant-Based and Natural Formulations: There is a growing preference for honey-based and herbal creams that offer anti-inflammatory and healing benefits with fewer side effects.

Integration of AI in Radiation Therapy Planning: Improved targeting in radiotherapy is reducing severe radiodermatitis incidents, prompting a shift in treatment approaches and demand for milder skincare products.

Teledermatology and Remote Consultations: Online platforms offering consultations and product recommendations are streamlining access to radiodermatitis management options.

Expansion of Online Pharmacies: With the surge in e-commerce, online pharmacies have become a vital distribution channel for radiodermatitis products, especially in remote areas.

Patient-Centered Oncology Care: Institutions are increasingly focused on improving quality of life during cancer treatment, boosting investments in skin-related supportive care products.

Personalized Skincare Solutions: Companies are leveraging dermatogenomic data to develop customized topical treatments for patients undergoing radiation therapy.

| Report Coverage | Details |

| Market Size in 2024 | USD 341.36 Million |

| Market Size by 2033 | USD 562.19 Million |

| Growth Rate From 2024 to 2033 | CAGR of 5.7% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Distribution Channel, Facility Type |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | Stratpharma AG; Smith & Nephew plc; Molnlycke Health Care AB; Derma Sciences, Inc.; Convatec, Inc.; 3M; Alliqua BioMedical; BMG Pharma spA |

One of the most significant drivers propelling the U.S. radiodermatitis market is the growing cancer burden coupled with increasing adoption of radiotherapy. As cancer prevalence continues to climb, with projections by the National Cancer Institute indicating over 22 million survivors by 2030, the number of patients undergoing radiation therapy is also on the rise. Radiotherapy remains a cornerstone in cancer management, with over half of all cancer patients requiring it at some point during treatment.

The side effects of radiation, particularly on the skin, create a considerable demand for effective radiodermatitis treatments. Radiodermatitis affects approximately 95% of patients receiving radiation therapy, making its management an integral component of oncologic care. As treatment durations extend due to improved survival, long-term skin care management is increasingly necessary. This translates into a consistent and expanding demand for both prescription and over-the-counter solutions.

Despite the rising demand for radiodermatitis solutions, a major hindrance in the U.S. market is the absence of standardized clinical protocols for treatment and prevention. Unlike more established dermatologic or oncologic conditions, radiodermatitis lacks universally accepted guidelines regarding optimal care practices, dosage regimens, or product selection. This variability in clinical practices creates confusion among providers and impacts product adoption.

Further complicating matters, some healthcare providers may under-prioritize skin care, especially in high-volume oncology centers, focusing more on tumor-targeted outcomes. Consequently, even effective products might not see wide-scale usage if they aren't integrated into institutional treatment pathways. Moreover, reimbursement inconsistencies for radiodermatitis products discourage their prescription or adoption, particularly in outpatient settings.

A notable opportunity emerging in the U.S. radiodermatitis market lies in the development of innovative, non-invasive, and plant-based formulations. Increasing patient preference for gentle and natural therapies has sparked demand for herbal and botanical agents that offer anti-inflammatory, antimicrobial, and regenerative properties. Honey-impregnated dressings and aloe vera–based hydrophilic creams are prime examples of such innovation.

This trend opens doors for startups and mid-sized companies to penetrate the market by offering clean-label, hypoallergenic, and evidence-backed natural products that are easily accessible through retail and online pharmacies. Moreover, clinical research demonstrating the efficacy of these formulations could gain traction among oncologists and dermatologists, translating into prescription-driven growth. Brands that align themselves with the "clean and green" trend while ensuring regulatory compliance and efficacy validation are well-positioned to capture a significant market share.

Topical products dominated the U.S. Radiodermatitis Market by product type in 2024, owing to their ease of application, accessibility, and growing portfolio of medicated creams. Within this category, corticosteroids remain widely used for reducing inflammation and managing early-stage symptoms. Hydrophilic creams enriched with vitamins and emollients are also gaining ground due to their soothing properties. These products are often preferred by both oncologists and patients for daily use due to their ability to reduce skin dryness, itching, and redness commonly caused by radiotherapy.

Among subtypes, antibiotics and hydrophilic creams are expected to be the fastest growing due to increasing awareness about secondary infections in radiodermatitis wounds. Products like silver sulfadiazine and mupirocin-based topicals are frequently prescribed to prevent bacterial colonization. Natural variants such as calendula ointments and honey-based gels have shown promising results in clinical trials and are steadily being integrated into supportive care regimens. As newer research backs their efficacy, growth in this segment is projected to outpace that of corticosteroids.

Dressings are also gaining momentum, especially among patients with more severe manifestations of radiodermatitis. Hydrogel and silicone-coated dressings dominate this subsegment, with honey-impregnated gauze emerging as a promising alternative. Their moisture-locking capability, reduced trauma upon removal, and ease of use make them suitable for long-duration applications. As radiation therapy becomes more advanced and aggressive, the need for dressings that facilitate skin healing without interrupting cancer therapy has become paramount.

Silicone-coated dressings are expected to be the fastest-growing subsegment, favored for their non-adherent and flexible characteristics. These dressings significantly reduce the pain and skin tears associated with traditional dressings, making them ideal for sensitive, irradiated skin. The growing availability of customizable sizes and designs is further driving adoption.

Hospital pharmacies accounted for the largest revenue share in the U.S. market due to their integration within oncology care facilities and direct patient access during treatment sessions. Radiotherapy patients often receive prescribed topical products or dressings immediately post-procedure, making hospital pharmacies a primary channel. Additionally, many hospital systems enter into bulk purchase agreements or formulary inclusions with product manufacturers, ensuring consistent supply and preferred pricing.

However, online pharmacies are witnessing the fastest growth, primarily due to patient convenience, expanded product variety, and increasing digital adoption across the healthcare ecosystem. The availability of over-the-counter hydrophilic creams, barrier films, and silicone-based dressings on e-commerce platforms has reduced patient reliance on physical pharmacies. Furthermore, the rise of telehealth and e-prescriptions has enabled direct product delivery to patients' homes. Several platforms even offer subscription-based models or bundles tailored for radiotherapy cycles.

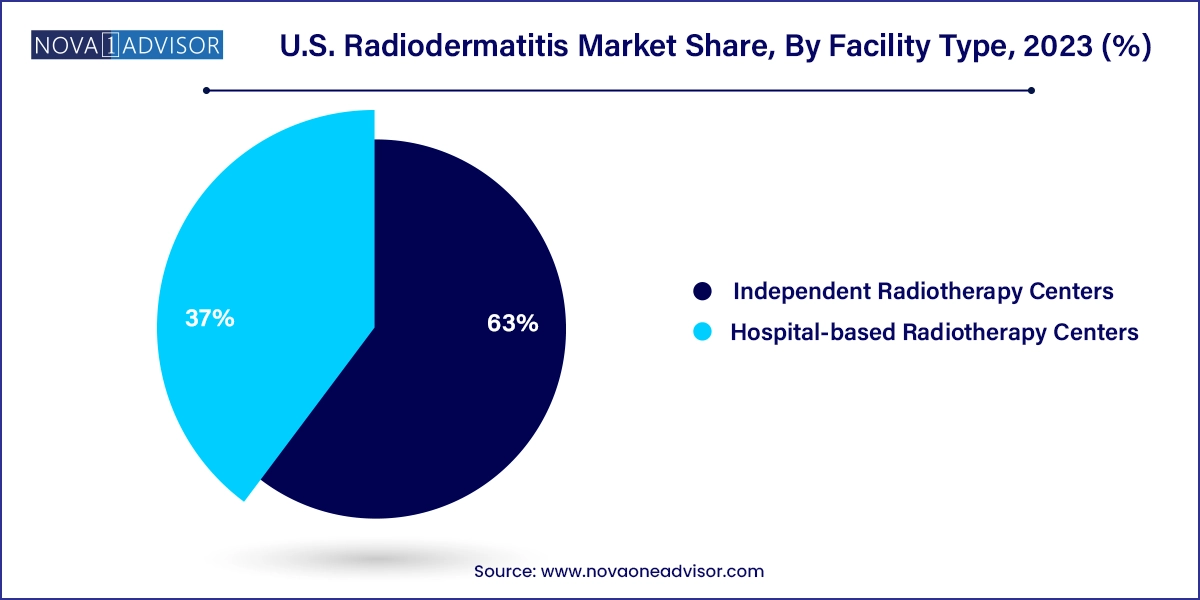

Hospital-based radiotherapy centers lead the U.S. radiodermatitis market in terms of product consumption, given their high patient throughput and comprehensive oncology infrastructure. These centers typically follow strict post-treatment protocols that include skin care and wound management. With the presence of multidisciplinary teams, including oncologists, dermatologists, and wound care nurses, the integration of radiodermatitis management into patient care pathways is more systematic.

Independent radiotherapy centers, however, are projected to grow at a faster pace, driven by rising outpatient radiation treatments and increasing investment in standalone oncology clinics. These centers are leveraging more patient-centric models, where skin care guidance and post-therapy support are bundled into personalized treatment programs. The shift toward value-based healthcare is prompting these facilities to invest in advanced products to minimize complications like severe radiodermatitis, which could otherwise compromise treatment compliance.

In the United States, radiodermatitis has become a significant clinical and quality-of-life concern as the number of cancer survivors continues to grow. The U.S. boasts a comprehensive network of over 2,500 radiation oncology centers, offering a mix of academic, public, and private care services. States with high cancer incidence rates, such as California, Florida, and Texas, also report elevated cases of radiodermatitis, fueling regional demand.

Government initiatives like the Cancer Moonshot Initiative have enhanced investments in oncology supportive care, encouraging the development and adoption of specialized skincare regimens. Additionally, collaborations between the FDA and industry stakeholders have enabled smoother approval pathways for novel wound care products. Non-profit organizations and advocacy groups also contribute by running awareness campaigns about managing radiotherapy side effects. The evolving insurance landscape, with increasing coverage for outpatient supportive care products, further supports market penetration.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. radiodermatitis market

Product

Distribution Channel

Facility Type