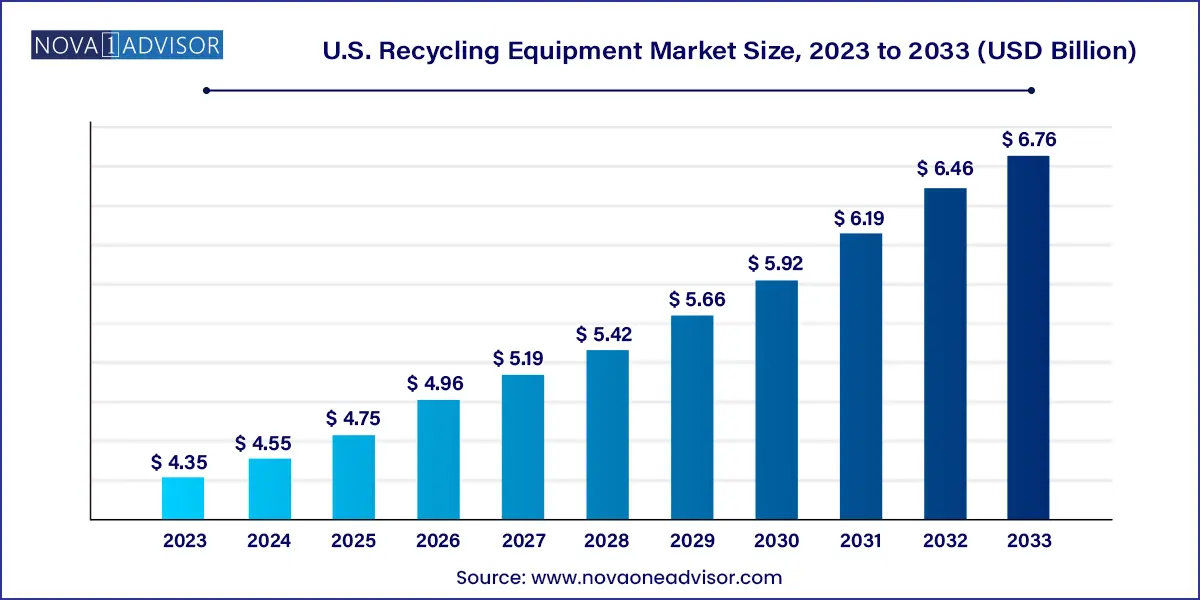

The U.S. recycling equipment market size was exhibited at USD 4.35 billion in 2023 and is projected to hit around USD 6.76 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2024 to 2033.

The U.S. recycling equipment market is undergoing a transformative phase, fueled by the nation’s ongoing push toward sustainable waste management practices, increasing volumes of recyclable materials, and the modernization of traditional recycling facilities. As landfills approach capacity and environmental consequences of unregulated waste disposal come into sharper focus, recycling has transitioned from a supportive function to a core pillar of national sustainability policies.

At the heart of this transformation lies the growing adoption of advanced machinery and systems that make recycling processes faster, more efficient, and cost-effective. Whether it’s an industrial-grade baler compressing tons of cardboard, an automated shredder reducing bulky materials into manageable sizes, or high-precision separators sorting materials by density and composition, the tools of the trade are rapidly evolving. Moreover, the concept of recycling is no longer confined to traditional materials like plastic, metal, and paper. It now encompasses e-waste, construction debris, rubber byproducts, and even complex polymer blends.

U.S.-based municipalities and private players are investing in state-of-the-art facilities and smart recycling systems to address the increasing waste load, particularly in urban regions. This is complemented by policy shifts favoring extended producer responsibility (EPR), stricter disposal regulations, and incentives for companies employing sustainable practices. As such, the market for recycling equipment has become a strategic enabler of national environmental objectives.

Automation and Smart Sorting

Facilities are adopting robotics, AI, and machine vision to increase sorting accuracy, reduce labor reliance, and improve contamination detection rates.

Shift Toward Modular Equipment Designs

Equipment that can be easily upgraded or modified is gaining traction, especially for facilities dealing with multiple waste streams.

Rise of Recycling-as-a-Service (RaaS)

Equipment leasing, remote maintenance, and software-based optimization are becoming popular among businesses that prefer operational flexibility.

Growth in Urban Mining and E-Waste Recovery

Electronic waste recycling is expanding rapidly as smartphones, computers, and EV batteries become major sources of rare and valuable metals.

Sustainability-Driven Investments

Both public and private sectors are prioritizing funding into recycling infrastructure as part of net-zero emission and circular economy targets.

Localized Recycling Hubs

Instead of transporting materials to centralized facilities, communities are establishing decentralized recycling hubs to reduce logistics costs and carbon emissions.

Cross-Industry Partnerships

Equipment manufacturers are increasingly partnering with technology startups and materials science firms to create innovative, hybrid solutions for waste processing.

| Report Coverage | Details |

| Market Size in 2024 | USD 4.55 Billion |

| Market Size by 2033 | USD 6.76 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 4.5% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Equipment, Processed Material |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. |

| Key Companies Profiled | American Baler Company; CP Manufacturing Inc.; General Kinematics Corporation; Mayfran; Spaleck USA LLC; Himes Service Company; Revolution Systems; Marathon Equipment; Recycling Equipment Manufacturing; Plexus Recycling Technologies. |

A powerful driver shaping the recycling equipment landscape in the U.S. is the infusion of advanced technologies into traditionally mechanical processes. From AI-powered sensors capable of identifying complex waste compositions to IoT-enabled systems that offer real-time monitoring of equipment performance, innovation is redefining what’s possible.

For example, a modern plastics recycling plant may now use near-infrared (NIR) spectroscopy to distinguish between polyethylene and polypropylene, thereby increasing the purity of output materials and making them more marketable for manufacturers. These precision-based technologies improve throughput rates, reduce contamination levels, and minimize the need for manual labor — all while maintaining strict compliance with environmental standards.

Despite the promising outlook, the market is not without its challenges. One of the primary restraints is the significant upfront investment required to procure and install advanced recycling equipment. Machines like heavy-duty shears, robotic separators, or extrusion lines demand not only a large financial outlay but also space, specialized operators, and regular maintenance.

Moreover, many smaller municipalities and recycling operators in the U.S. still rely on aging infrastructure and cannot afford costly upgrades, leading to inefficiencies and missed opportunities in material recovery. Without government grants or financial incentives, these entities may find it difficult to transition to more modernized systems.

An exciting opportunity for market expansion lies in the e-waste segment. The U.S. is one of the largest generators of electronic waste globally, with millions of tons of discarded devices being added to the waste stream annually. These devices often contain valuable materials like lithium, gold, silver, and palladium, which can be economically recovered using specialized recycling equipment.

The opportunity for equipment manufacturers lies in creating solutions tailored to this niche — such as precision shredders for circuit boards, compactors for batteries, and chemical leaching systems for rare metal extraction. As federal regulations tighten and awareness about e-waste hazards spreads, this segment is poised to become a major driver for future equipment demand.

Baler Presses Dominate the Equipment Segment

Among the different equipment types, baler presses have long held a dominant position. These machines play an indispensable role in compressing recyclable materials such as cardboard, plastic film, and aluminum into compact bales that are easy to store and transport. Their usage spans across recycling centers, retail distribution warehouses, supermarkets, and manufacturing units. The versatility, energy efficiency, and ability to dramatically reduce waste volume make them a staple in nearly every major recycling facility.

Balers also contribute to enhanced revenue generation by producing uniform bales that fetch higher market prices due to their easier handling and consistent quality. Furthermore, new-age baler presses are equipped with hydraulic sensors and programmable logic controllers (PLCs) that automate pressure settings based on material type, further improving efficiency and throughput.

Separators Are Emerging as the Fastest Growing Equipment Category

On the other hand, separators have shown the most aggressive growth trajectory in recent years. As waste streams become more mixed and complex particularly with the rising proportion of composite and multi-layered materials the demand for high-precision sorting has skyrocketed. Air separators, magnetic separators, and optical sorting machines now form the backbone of material recovery facilities (MRFs) seeking higher purity outputs.

The rise in AI-enabled separation technology is a significant factor contributing to this growth. These systems can now differentiate items based on shape, color, material density, and chemical signature. As environmental regulations and end-market quality standards become more stringent, adoption of advanced separators is expected to outpace traditional equipment.

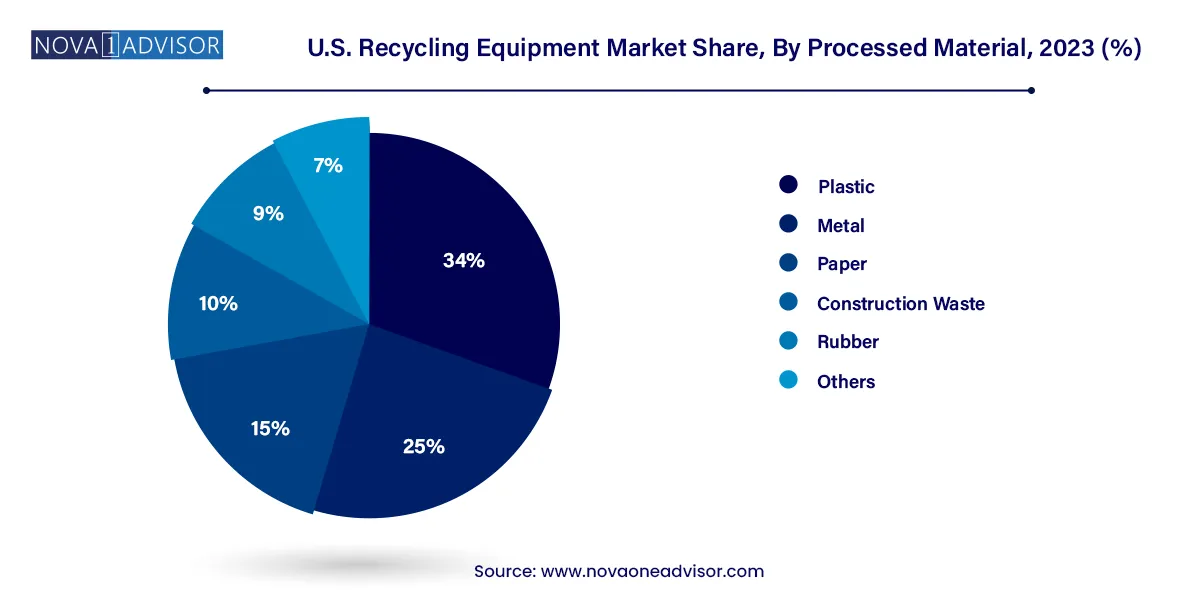

Metal Recycling Holds the Largest Share in the Processed Material Segment

In terms of processed material, metal recycling continues to dominate the U.S. recycling equipment market. Ferrous and non-ferrous metals such as steel, aluminum, copper, and brass are not only abundant in the waste stream but also retain high intrinsic value even after multiple recycling cycles. Metal shredders, granulators, and shears are heavily utilized across scrapyards, vehicle dismantling centers, and appliance recycling facilities.

Due to strong demand from construction, defense, and automotive industries, recycled metal is considered a strategic resource. Equipment that supports faster processing and better separation of alloys is particularly in demand, helping recyclers deliver purer, high-grade outputs to secondary manufacturers.

Plastic Recycling Is the Fastest Growing Sub-segment

Plastic recycling is rapidly emerging as the fastest-growing processed material category, primarily due to environmental concerns and increased pressure to reduce plastic waste. From polyethylene terephthalate (PET) to high-density polyethylene (HDPE) and polyvinyl chloride (PVC), plastic recovery is now a national priority.

Recyclers are investing in extruders, agglomerators, and advanced sorting machinery to process a wider array of plastic waste — including single-use containers, industrial film, packaging foam, and even biodegradable composites. The rising popularity of chemical recycling technologies and closed-loop manufacturing systems is further accelerating equipment upgrades in this segment.

The United States represents a highly dynamic market for recycling equipment, with evolving regulations, industrial waste production, and sustainability goals shaping regional priorities. States such as California, Oregon, New York, and Washington have set ambitious targets for zero waste, landfill diversion, and plastic bans, creating high demand for next-generation recycling systems.

Urban centers like Los Angeles and New York City are deploying AI-powered recycling hubs, while midwestern states are investing in metal shredding and auto-recovery operations due to their industrial base. Meanwhile, southern states are showing a preference for decentralized, mobile recycling units in response to their sprawling geography and lower population density.

Federal initiatives like the Infrastructure Investment and Jobs Act are also expected to funnel millions into waste management improvements, indirectly boosting the recycling equipment ecosystem. However, a lack of national standardization in recycling protocols continues to present operational challenges, often requiring equipment manufacturers to develop custom solutions for different state requirements.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. recycling equipment market

Equipment

Processed Material