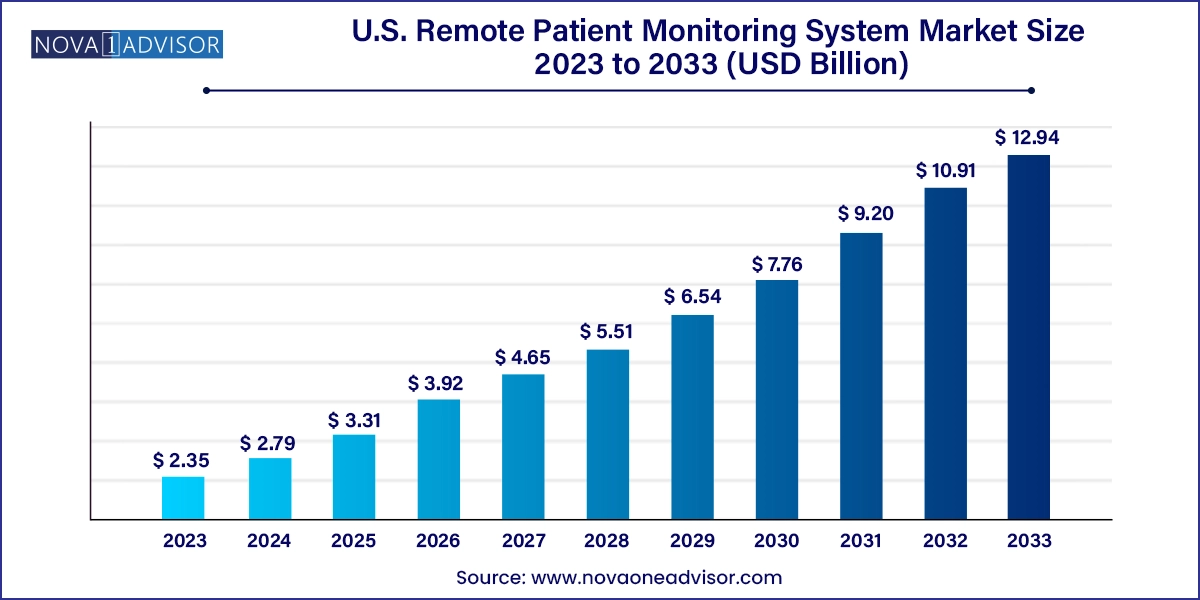

The U.S. remote patient monitoring system market size was exhibited at USD 2.35 billion in 2023 and is projected to hit around USD 12.94 billion by 2033, growing at a CAGR of 18.6% during the forecast period 2024 to 2033.

The U.S. Remote Patient Monitoring (RPM) System Market is experiencing an unprecedented surge, transforming the healthcare delivery paradigm from hospital-centric models to home-based, patient-empowered care. Remote patient monitoring systems utilize digital technologies to collect medical and health data from individuals in one location and electronically transmit it to healthcare providers in a different location. This evolution is driven by the need for continuous care, rising chronic disease prevalence, and the imperative to manage healthcare costs efficiently.

The U.S. healthcare system, which is heavily burdened by chronic illnesses like diabetes, cardiovascular diseases, and hypertension, has found relief in RPM tools that allow proactive, real-time monitoring. These systems are critical in reducing hospital readmissions, enabling timely interventions, and enhancing patient compliance. The aging population, increasingly tech-savvy patient base, and supportive policies from institutions like CMS (Centers for Medicare & Medicaid Services) have collectively accelerated the adoption of remote patient monitoring.

In recent years, RPM systems have extended beyond chronic disease management into areas such as post-operative recovery, mental health tracking, and fitness monitoring. The COVID-19 pandemic acted as a catalyst, showcasing the utility of RPM tools in minimizing in-person contact while maintaining continuity of care. Today, RPM devices range from basic blood pressure cuffs to sophisticated multiparameter monitors integrated with cloud analytics and AI for predictive diagnostics.

The market is also witnessing dynamic shifts in patient-provider interaction. Hospitals, payers, device manufacturers, and tech companies are increasingly collaborating to develop interoperable and user-friendly platforms. The landscape is vibrant with startups and giants alike companies like Philips, Medtronic, and Dexcom have significantly expanded their RPM portfolios in response to growing demand. These developments signal a future where remote monitoring becomes a standard feature in U.S. healthcare delivery.

AI and Predictive Analytics Integration: RPM platforms are increasingly leveraging AI to predict adverse events, personalize care, and improve diagnostic accuracy.

Growth of Wearable Health Tech: Smartwatches and wearable sensors are becoming mainstream, extending monitoring to fitness, sleep, hydration, and even mental wellness.

Home Healthcare Boom: RPM is driving the shift from institutional care to home-based models, especially among elderly and post-acute patients.

CMS Policy Support: Expanded Medicare reimbursement codes for RPM services are encouraging providers to implement remote monitoring in standard care pathways.

Interoperability and Cloud Integration: Systems that can seamlessly sync with EHRs and cloud-based databases are dominating procurement decisions.

Focus on Real-Time Monitoring for High-Risk Patients: ICU-grade monitoring technologies are being miniaturized for remote use among high-risk populations.

Data Security and HIPAA Compliance: Ensuring patient data protection is becoming a key product differentiator as regulatory scrutiny intensifies.

| Report Coverage | Details |

| Market Size in 2024 | USD 2.79 Billion |

| Market Size by 2033 | USD 12.94 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 18.6% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Application, Infection, End use |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. |

| Key Companies Profiled | Welch Allyn; Smiths Medical; Abbott; Boston Scientific Corporation; Dräger Medical, GE Healthcare; Honeywell; Johnson & Johnson; LifeWatch; Medtronic; Masimo; Vitls, Inc; CareValidate; Biotronik; American Telecare |

The most powerful force fueling the U.S. RPM system market is the growing chronic disease burden coupled with the aging population. According to the CDC, six in ten Americans live with at least one chronic disease, such as heart disease, stroke, cancer, or diabetes. These conditions account for the majority of the nation’s $4.1 trillion annual healthcare expenditure. Remote patient monitoring offers a viable solution to this escalating burden by enabling continuous oversight without necessitating frequent in-person visits.

For instance, a diabetic patient using a connected glucose monitor can automatically send real-time blood sugar readings to a healthcare provider, triggering alerts if abnormal patterns arise. Similarly, hypertension patients equipped with remote BP monitors benefit from consistent evaluation and medication adjustment. Among older adults, especially those living alone or in assisted living, wearable devices and multiparameter monitors act as lifelines, helping detect complications early and reducing hospital admissions. The demographic shift toward an aging society makes RPM an indispensable tool in both preventative and palliative care landscapes.

Despite its tremendous promise, a pressing challenge limiting market growth is concerns surrounding data privacy and regulatory compliance. The exchange and storage of sensitive health information over digital platforms raise significant cybersecurity risks. Breaches could lead to unauthorized access to personal health records, identity theft, and legal repercussions. These risks are particularly concerning in the U.S., where HIPAA (Health Insurance Portability and Accountability Act) strictly governs patient data handling.

RPM vendors must design systems that are not only secure but also adaptable to evolving compliance standards. However, the rapid pace of technological innovation sometimes outpaces regulatory frameworks, leaving grey areas in compliance interpretation. Smaller providers or startups, lacking robust cybersecurity infrastructure, may struggle to meet these standards. Furthermore, trust remains a key barrier many patients are still wary about having their biometric data constantly recorded and stored in the cloud, making privacy a critical consideration in adoption strategies.

A rapidly emerging opportunity in the U.S. RPM system market lies in its expansion beyond disease management into preventive and wellness monitoring. As the healthcare industry gradually shifts from reactive to proactive care models, RPM tools are being integrated into wellness programs targeting early detection and lifestyle optimization. The surge in obesity, metabolic syndrome, and stress-related disorders presents an ideal scenario for using RPM systems as preventive tools.

For example, fitness trackers and smartwatches equipped with heart rate, sleep, and oxygen saturation monitors are not only popular among health-conscious individuals but are increasingly being recommended by physicians to track risk markers before they manifest as disease. In corporate wellness programs, wearable devices monitor employee health metrics to encourage physical activity and stress reduction. These use cases are carving out a new customer segment that spans healthy individuals, fitness enthusiasts, and those at-risk but not yet clinically diagnosed. This broadens the RPM market well beyond traditional patient groups.

Vital sign monitors dominated the product category in the U.S. RPM system market, owing to their foundational role in capturing essential physiological metrics such as blood pressure, heart rate, temperature, and respiratory rate. These devices are the first line of monitoring in most chronic and acute care scenarios, offering real-time insights that can guide clinical decisions. Among these, blood pressure monitors and heart rate monitors (ECGs) hold substantial market share due to the prevalence of hypertension and cardiovascular diseases in the U.S.

The fastest-growing subsegment within vital sign monitors is pulse oximeters, especially following the COVID-19 pandemic, which emphasized the need for continuous oxygen saturation monitoring at home. Pulse oximeters became ubiquitous in both clinical and non-clinical settings, and their integration into wearable formats has accelerated growth. In addition, respiratory rate monitors and spirometers are witnessing increased demand for managing COPD and post-viral recovery, especially among the aging population.

Specialized monitors are gaining traction, particularly among patients with complex conditions. Multi-parameter monitors (MPMs) are extensively used in post-operative care and high-risk chronic disease management. These devices combine several monitoring functions—such as ECG, SpO2, temperature, and respiratory rate—into a single compact unit, simplifying both data management and patient compliance. Anesthesia and fetal heart monitors are crucial in maternal care and surgical monitoring, where real-time data is critical for outcomes.

Among specialized monitors, blood glucose monitors are expanding rapidly, driven by the diabetes epidemic in the U.S. The emergence of Continuous Glucose Monitoring (CGM) systems, like Dexcom’s G7 and Abbott’s FreeStyle Libre, has revolutionized diabetes management. These devices provide dynamic glucose readings, trend analysis, and integration with insulin delivery systems, making them an essential RPM tool.

Cardiovascular diseases dominated the RPM application segment, as heart-related conditions remain the leading cause of death in the U.S. Remote ECG monitoring, BP tracking, and weight monitoring for heart failure patients have become routine in chronic care pathways. These tools help cardiologists monitor patient vitals in real time, preventing events like arrhythmias or sudden cardiac arrest through timely interventions.

The fastest-growing segment is weight management and fitness monitoring, fueled by increased consumer awareness and integration of fitness-focused RPM tools into daily lifestyles. Obesity, affecting over 42% of U.S. adults, is linked to numerous conditions such as diabetes, heart disease, and sleep apnea. Devices like connected weighing scales, calorie trackers, and metabolic monitors are now being used not only in fitness contexts but also in clinical programs like bariatric care or pre-diabetes management. Additionally, these tools are being bundled into corporate wellness programs and insurance-driven incentive models.

Sinus infections accounted for the largest market share in the infection monitoring segment due to their high prevalence, particularly in children and individuals with allergies. Monitoring tools help track fever, respiratory rate, and oxygen levels to detect complications such as bacterial secondary infections or progression to bronchitis. RPM use in this space includes temperature monitors and connected nasal airflow trackers in advanced home kits.

Eye infections, however, are seeing the fastest growth, particularly among contact lens users and those with compromised immunity. Smart sensors embedded in wearable glasses or external monitors now track blinking patterns, redness, and inflammation metrics. Companies are developing eye-focused RPM solutions for conditions like conjunctivitis, post-cataract surgery recovery, and even dry eye disease. The rising integration of tele-ophthalmology with RPM tech is further propelling this segment.

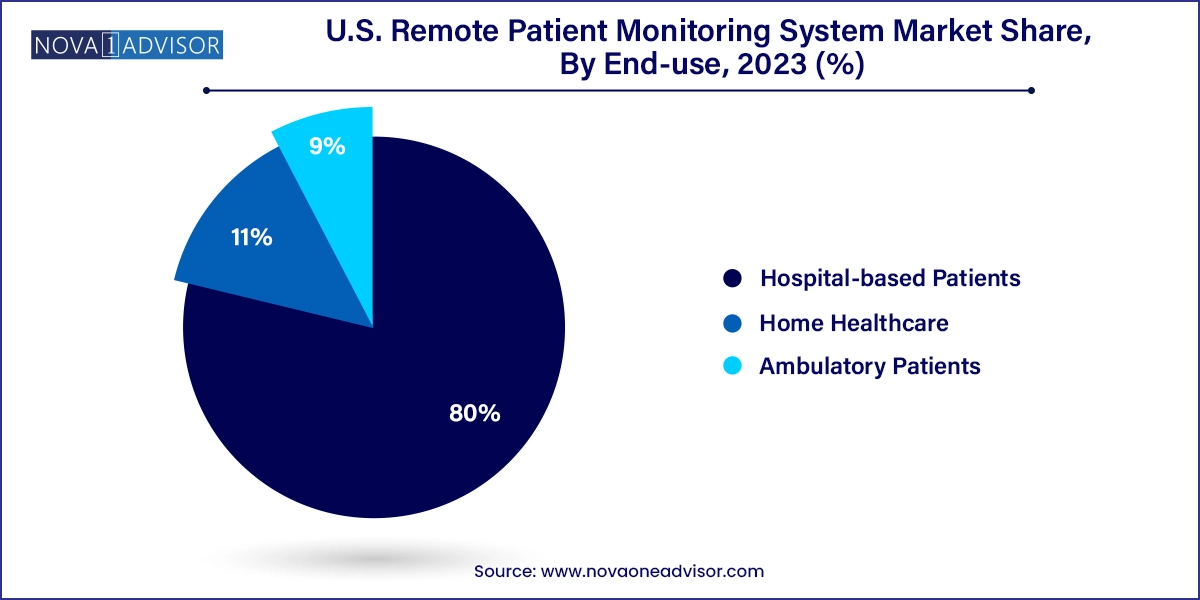

Home healthcare emerged as the leading end-use segment, representing the shift toward decentralized and patient-centric care. RPM systems in home settings allow patients to manage chronic conditions, recover post-surgery, or track early symptoms from the comfort of their homes. This is especially beneficial for the elderly, disabled, or immunocompromised patients who face mobility or infection risk in clinical visits. Devices are designed with simplicity, Bluetooth connectivity, and voice integration to assist less tech-savvy users.

Ambulatory patients are the fastest-growing end-use segment, representing individuals with short-term or mobile care needs. These include patients discharged early from hospitals under care transition models or those undergoing outpatient monitoring for non-severe illnesses. Ambulatory use is prevalent in managing COVID-19 recovery, mild cardiac conditions, and medication titration for newly diagnosed patients. This segment is supported by insurance reimbursement, remote coaching apps, and virtual nurse visits that complement RPM hardware.

The U.S. stands at the forefront of the global RPM market, driven by a combination of technological innovation, regulatory support, and healthcare transformation goals. The CMS reimbursement expansion for remote patient monitoring services under CPT codes (e.g., 99453, 99454, 99457) has removed a significant adoption barrier for providers, incentivizing the implementation of RPM systems across hospitals and clinics. States like California, Texas, and Florida have become hotspots for RPM deployments, especially among Medicare Advantage and value-based care organizations.

Private insurers are also embracing RPM programs, offering discounts or free devices to policyholders. The Veterans Health Administration (VHA), one of the country’s largest healthcare systems, runs an expansive RPM program that has improved access for rural veterans. Urban centers like New York and Chicago are seeing innovation hubs emerge around RPM startups, while rural areas are leveraging RPM to bridge access gaps. Initiatives like remote maternity care for underserved populations and school-based RPM trials for asthma monitoring further highlight the diversity and reach of RPM applications in the country.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. remote patient monitoring system market

Product

Application

End-use

Infection