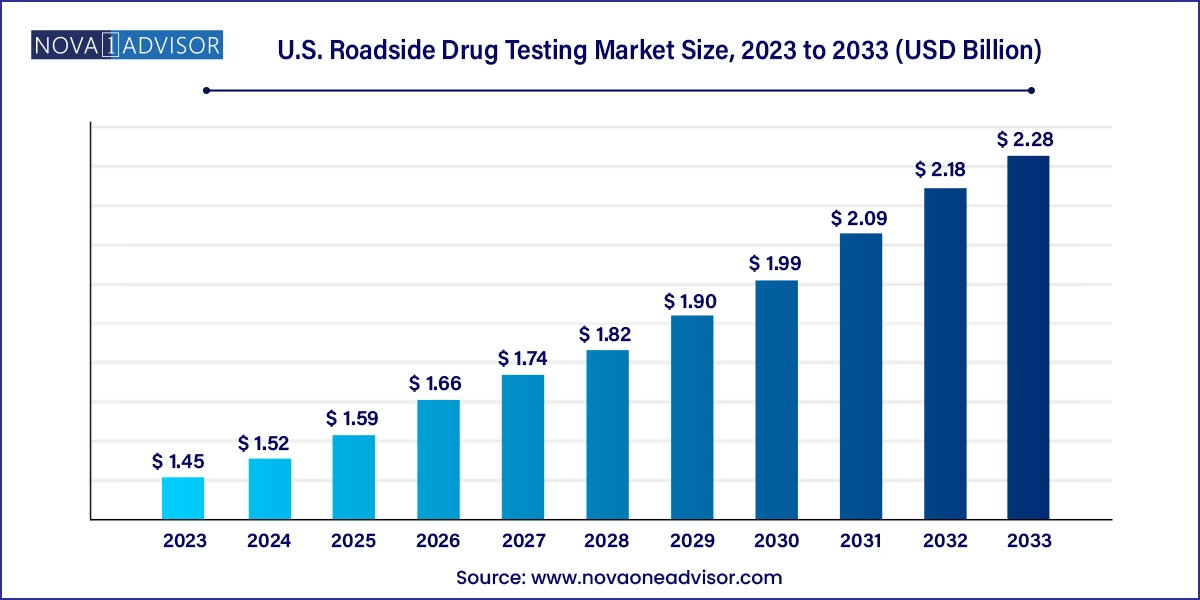

The U.S. roadside drug testing market size was exhibited at USD 1.45 billion in 2023 and is projected to hit around USD 2.28 billion by 2033, growing at a CAGR of 4.65% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 1.52 Billion |

| Market Size by 2033 | USD 2.28 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 4.65% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Drug, Sample, Test Location, State |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | Drägerwerk AG & Co. KGaA; Abbott; Intoximeters; Lifeloc Technologies, Inc.; Hound Labs, Inc.; Immunalysis Corporation; CMI Inc.; Alcohol Countermeasure Systems Corp.; AK GlobalTech Corp.; PAS Systems International, Inc |

The market is likely to show promising growth due to increasing awareness of the danger of drug-impaired driving and rising drug use, especially with the legalization of marijuana in many states. Law enforcement agencies are investing in new technologies for accurate and efficient testing to ensure public safety. Moreover, government regulations and campaigns against impaired driving are boosting the demand for reliable roadside testing solutions. The market expansion is also fueled by rapid technological advancements, enabling quicker and more effective detection of various substances.

The rise in fatalities and accidents related to alcohol & substance abuse among drivers has become a significant public safety concern in the U.S. This trend is driving the demand for roadside drug testing as law enforcement and public health officials seek to combat impaired driving & enhance road safety. The growing prevalence of substance abuse in the U.S. has contributed to the marked increase in drug-impaired driving incidents. According to the National Highway Traffic Safety Administration (NHTSA), the number of traffic fatalities involving alcohol-impaired drivers has remained persistently high, accounting for nearly 30% of all traffic-related deaths. Moreover, the rise in use of prescription medications, recreational marijuana, and illicit drugs has exacerbated the problem, leading to a concerning surge in drug-related accidents & fatalities. This uptick underscores the urgent need for effective measures to detect and deter impaired driving.

Routine checking by police forces is significantly contributing to the growth of the market. As law enforcement agencies intensify efforts to combat impaired driving, the need for effective roadside drug testing solutions has become increasingly critical. Routine checks enable police officers to identify drivers under the influence of drugs more efficiently, ensuring safer roadways & deterring substance abuse. This heightened focus on drug detection has driven the demand for advanced roadside testing technologies that provide quick and accurate results.

The increasing prevalence of drug use and its impact on driving safety has prompted state & federal authorities to invest in more sophisticated testing tools. Public awareness campaigns and stricter regulations have further bolstered the need for these testing solutions. As a result, manufacturers and suppliers in the roadside drug testing market are experiencing significant growth, fueled by continuous advancements in testing technology and the expansion of law enforcement programs. Overall, routine checking by police forces can enhance road safety and propel the roadside drug testing market.

In 2023, 5.8% of individuals aged 12 years or older, or 16.4 million people, were classified as heavy alcohol users. This rate was notably higher among young adults aged 18 years to 25 years, where 6.9%, or 2.4 million people, reported heavy alcohol use. For adults aged 26 years and older, the percentage was 6.2%, corresponding to 13.9 million individuals. Approximately 0.5% of adolescents aged 12 years to 17 years, or about 141,000 people, were identified as heavy alcohol users.

Alcohol segment dominated the market with a share of 31.96% in 2023. Alcohol testing dominates the market because alcohol impairment is a well-established concern with established legal limits and widespread use of standardized testing devices such as breathalyzers. The effects of alcohol on driving ability are extensively studied, making it easier to enforce regulations and set impairment thresholds. In addition, alcohol is one of the most commonly consumed substances, leading to a higher frequency of testing. The established infrastructure and protocols for alcohol testing, along with public awareness of drunk driving laws, contribute to its dominance in the market.

On the other hand, cannabis/marijuana segment is expected to grow at the highest CAGR of 5.50% over the forecast period.In April 2023, Oculogica introduced a roadside cannabis test using the OcuPro headset, which analyzes eye-pupil characteristics to assess recent cannabis impairment. Unlike traditional tests that analyze THC in bodily fluids, OcuPro distinguishes between recent use (within 60-90 minutes) and older use. Currently being piloted in Missouri police departments, this FDA-cleared device aims to provide a scientifically validated method for detecting recent cannabis impairment, addressing a critical need in drug testing technology. Similarly, in November 2023, Minnesota launched two roadside tests to detect drug impairment in drivers following the legalization of recreational marijuana. Overseen by the Office of Traffic Safety, the project aims to evaluate and certify devices for future use, addressing the lack of a standard roadside test for drugs similar to breathalyzers for alcohol. SoToxa Oral Fluid Mobile Analyzer and Drager DrugTest 5000 will analyze THC and other substances in saliva.

Breath segment dominated the market with a share of 44.44% in 2023. Breath samples are the most commonly used method in roadside drug testing due to their practicality, non-invasive nature, and immediate results. Law enforcement officers favor breath tests because they are quick and easy to administer during traffic stops, minimizing the disruption for both the driver and the officer. Breathalyzers, the devices used to measure alcohol levels, have been well-established and widely accepted in the legal system, offering a reliable and standardized method for detecting alcohol impairment.

With the advancement of technology, breath-based testing is expanding beyond alcohol to detect certain drugs, although this is still in development compared to saliva or blood tests. The simplicity of breath tests, which require no specialized training to administer, and the ability to deliver instant results make them an ideal tool for roadside screening. Additionally, breath tests are less intrusive than blood or urine tests, leading to higher compliance from drivers. These factors, combined with the legal framework supporting breathalyzer use, have made breath samples the predominant method in roadside drug and alcohol testing, ensuring road safety by enabling law enforcement to swiftly identify and address impaired driving.

Highway police segment dominated the market with a share of 91.0% in 2023. The highway police segment dominated the roadside drug testing market because they are primarily responsible for enforcing traffic laws and ensuring road safety. Their jurisdiction over highways and major roads, where a significant proportion of traffic incidents occur, gives them a crucial role in monitoring and deterring impaired driving. Equipped with specialized training and tools, highway police conduct routine checks and operate sobriety checkpoints, making them key players in testing and enforcement.

Additionally, highway police are equipped with specialized training and resources to handle drug testing, making them the primary users of such technologies. The integration of drug testing into their routine procedures helps identify and address impaired drivers swiftly. As a result, highway police significantly influence market trends and product development, ensuring that testing solutions meet their specific needs for accuracy, reliability, and ease of use. Their dominance in the market reflects their central role in combating drug-impaired driving and enhancing overall traffic safety.

California Roadside Drug Testing Market Trends

California roadside drug testing market dominated with largest revenue share of 14.50% in 2023. The state generated the highest revenue due to its large population, significant number of roadways, and progressive stance on drug regulations. As the most populous state, California has a high volume of traffic, increasing the demand for effective roadside drug testing to ensure road safety. The state's comprehensive approach to drug enforcement, including strict DUI laws and widespread implementation of drug testing, further drives market demand. Additionally, California's progressive policies on drug legalization, such as the legalization of recreational marijuana, have heightened the need for reliable roadside testing to address the complexities of impaired driving. The state's large budget for law enforcement and public safety also supports the adoption of advanced drug testing technologies. Consequently, California's unique combination of factors makes it a key player and major influence in the market.

California roadside drug testing market is expected to grow over the forecast period. Advancements in portable drug testing devices, utilizing advanced chromatographic techniques, have enhanced real-time detection capabilities. These devices allow for swift and accurate substance analysis, supporting law enforcement in making prompt decisions. The continuous improvement of these technologies reflects the evolving challenges in addressing impaired driving across federal and municipal levels.

Texas Roadside Drug Testing Market Trends

The roadside drug testing market in Texas is growing at a lucrative growth rate. Texas has seen a rise in drug-related issues and enforcement challenges, particularly with the legalization of marijuana in neighboring states, which further fuels the need for accurate and efficient testing methods. The state's commitment to public safety and its substantial law enforcement budget also support the widespread adoption of advanced roadside drug testing technologies.

New York Roadside Drug Testing Market Trends

New York roadside drug testing market is expected to grow over the forecast period.New York has emerged as one of the leading state in the U.S. in implementing and refining roadside drug testing policies. The state’s proactive approach to addressing the issue of drug-impaired driving has driven significant advancements in the development and deployment of roadside drug testing technology. A key factor contributing to New York’s leadership in this domain is the state’s high rate of drug-related traffic fatalities. The alarming statistics on drug-impaired driving incidents are encouraging policymakers to prioritize the development of effective countermeasures. By investing in R&D, New York has been at the forefront of testing & validating new drug testing devices and methodologies.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. roadside drug testing market

Drug

Sample

Test Location

States