The U.S. roll-your-own tobacco products market size was exhibited at USD 3.95 billion in 2023 and is projected to hit around USD 6.02 billion by 2033, growing at a CAGR of 4.3% during the forecast period 2024 to 2033.

.webp)

The U.S. Roll-your-own (RYO) Tobacco Products Market has experienced notable evolution in recent years, emerging as a niche yet increasingly visible segment within the broader tobacco industry. Characterized by consumer-driven demand for customization, cost efficiency, and perceived natural alternatives to mass-manufactured cigarettes, the RYO category continues to attract both seasoned smokers and a younger generation exploring artisanal, hands-on tobacco experiences.

RYO tobacco products include loose tobacco blends, rolling papers, cigarette tubes, injectors, filters, and paper tips—components that allow users to hand-roll or machine-roll their own cigarettes. These products are often considered more cost-effective than pre-rolled cigarettes due to favorable taxation structures and the ability to control portion sizes. Additionally, the RYO segment appeals to users seeking to reduce chemical additives, enjoy flavor-rich tobacco, or exercise greater control over smoking rituals.

Despite facing regulatory scrutiny and anti-smoking campaigns, the U.S. RYO market has retained resilience, largely fueled by price-sensitive consumers, boutique tobacco enthusiasts, and DIY culture proponents. Innovations in rolling paper materials, eco-friendly filters, flavored tobacco, and compact injection machines have revitalized market appeal. With shifting consumer behavior, ongoing debates on harm reduction, and the rise of alternative tobacco formats like heated tobacco and nicotine pouches, the RYO market is navigating both opportunities and challenges in a highly dynamic landscape.

In 2024, the market was valued at approximately USD XX billion, and projections through 2034 estimate a modest but consistent CAGR, signaling the segment’s continued relevance in the evolving U.S. tobacco ecosystem.

Shift Toward Organic and Additive-Free Tobacco: Rising health consciousness has led to growing demand for natural, chemical-free tobacco blends.

Sustainable and Eco-Friendly Rolling Papers: Brands are introducing unbleached, hemp-based, and biodegradable rolling papers to appeal to environmentally conscious consumers.

Miniaturization and Portability of RYO Tools: Compact injectors and handheld rolling machines are gaining popularity for their convenience and discreet usability.

Customization and Personalization of Smoking Experience: Smokers are increasingly experimenting with blending flavors, paper types, and filter strengths.

Growth in Online Retail Channels: E-commerce platforms are expanding access to RYO kits, specialty blends, and accessories with discreet packaging and subscription models.

Cultural Resurgence of Hand-Rolled Cigarettes in Artisan Spaces: RYO smoking is gaining traction in niche lifestyle subcultures focused on craftsmanship and authenticity.

Tighter State-Level Regulations on Commercial Cigarettes: Tax hikes and flavor bans on factory-made cigarettes are indirectly boosting interest in roll-your-own alternatives.

| Report Coverage | Details |

| Market Size in 2024 | USD 4.12 Billion |

| Market Size by 2033 | USD 6.02 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 4.3% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Distribution Channel |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. |

| Key Companies Profiled | Imperial Brands; British American Tobacco; Scandinavian Tobacco Group A/S; Altria Group, Inc.; Philip Morris International; HBI International; Curved Papers, Inc.; Karma Filter Tips; Shine Brands; Japan Tobacco International |

One of the primary drivers of the U.S. RYO tobacco products market is the economic appeal of roll-your-own cigarettes compared to conventional, pre-manufactured cigarette brands. As federal and state excise taxes on traditional cigarettes continue to rise—particularly in states like New York, California, and Illinois—many smokers are seeking more affordable alternatives that provide comparable satisfaction without the premium price tag.

RYO products offer users the ability to buy bulk tobacco and create cigarettes at a fraction of the cost. In some jurisdictions, loose tobacco is taxed at a lower rate than pre-rolled cigarettes, and this price differential becomes especially attractive to heavy users or those on fixed incomes. Moreover, consumers perceive that they can reduce waste and improve value by rolling smaller cigarettes or mixing tobacco with herbal substitutes. This budget-friendly dimension is a significant contributor to RYO’s sustained relevance among cost-conscious segments.

Despite its economic benefits and customizable appeal, the RYO market faces significant restraint in the form of regulatory pressures and negative health perceptions. Federal authorities like the FDA and public health agencies consistently warn that roll-your-own cigarettes are no safer than conventional ones, countering a common myth among some users. As a result, anti-smoking campaigns continue to target RYO consumers with the same urgency as traditional cigarette users.

Additionally, evolving policies—such as taxation reforms aimed at equalizing excise duties across all tobacco formats—could undermine the current price advantage of RYO products. Municipalities and states are also considering restrictions on flavored rolling papers or menthol tobacco blends, which are popular among younger users. If such measures are widely adopted, they could shrink the category’s growth potential and complicate compliance for smaller manufacturers and retailers.

An emerging opportunity in the U.S. RYO tobacco market lies in the development of sustainable, eco-conscious accessories and advanced functional tools. As environmental awareness grows among American consumers, there's increasing demand for recyclable packaging, biodegradable filters, organic rolling papers, and reusable injectors. Startups and established players alike are experimenting with new materials like unbleached hemp, bamboo, and corn-based polymers for accessories that reduce waste and appeal to health-conscious, environmentally mindful users.

In tandem, technology-enabled injectors and smart rolling kits—capable of providing uniform roll quality, compact design, and even digital customization—are becoming popular among millennials and Gen Z smokers seeking convenience with a modern touch. Brands that successfully integrate sustainability with functionality and personalization are likely to tap into a new wave of consumers who seek more than just cost savings—they want experiences that reflect their values and aesthetics.

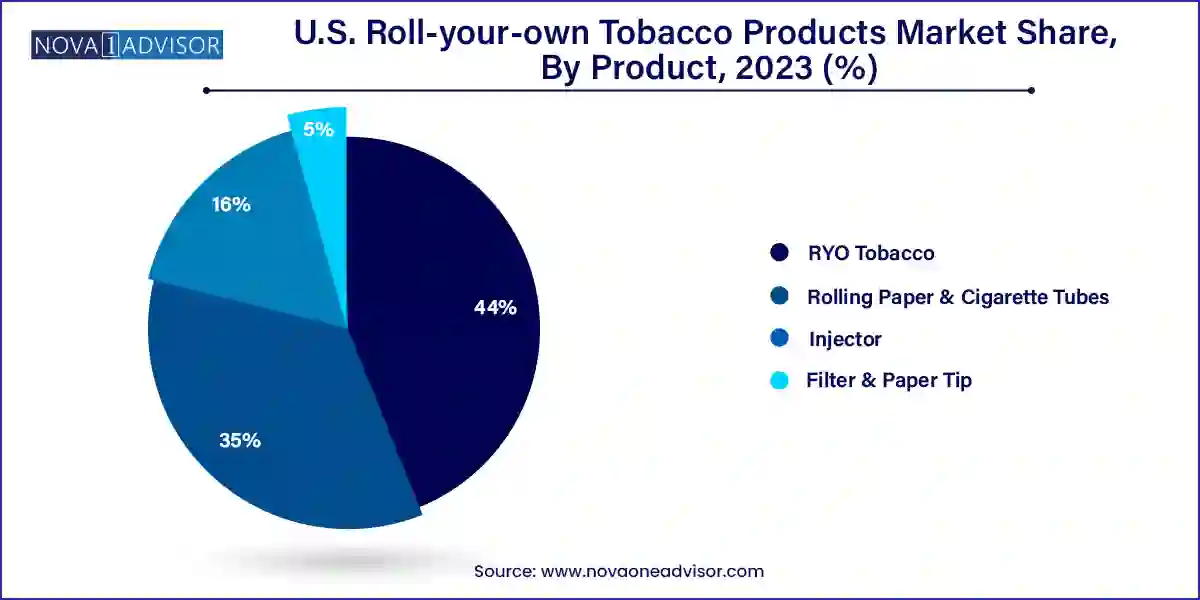

RYO tobacco remains the dominant product segment in the U.S. roll-your-own tobacco products market, driven by its central role in the consumer's ability to manually craft cigarettes. Available in various blends, strengths, and moisture levels, loose RYO tobacco provides flexibility and a traditional smoking experience that resonates with DIY enthusiasts and long-time tobacco users. Tobacco brands offering organic, additive-free, or aromatic variants have captured growing interest, particularly from users who seek customization and a more “authentic” tobacco profile. Brands like Drum, Bugler, and OHM continue to lead the segment through wide availability and loyalty-driven repeat purchases.

Conversely, rolling papers and cigarette tubes are the fastest-growing segment, reflecting rising consumer demand for smoother, cleaner, and more sustainable smoking accessories. Innovations such as hemp-based papers, slow-burning wraps, perforated tips, and biodegradable filter tubes have given rise to a robust aftermarket of RYO enhancements. This segment’s growth is further fueled by dual-use consumers who combine rolling papers with cannabis or herbal blends—an overlapping trend particularly visible in states where cannabis use has been legalized. As consumers become more discerning, the preference for high-quality, flavor-neutral, and customizable rolling options will continue to drive the upward momentum in this segment.

Offline distribution channels dominate the U.S. RYO tobacco products market, led by convenience stores, tobacconists, and specialized smoke shops. These physical retailers provide immediate product access and cater to a wide demographic, from loyal older consumers to casual buyers. Moreover, many retailers offer private-label or regional tobacco brands alongside national ones, enabling personalized customer interactions and bundled sales of tobacco, rolling papers, and injectors. The offline market thrives on impulse purchases and in-store promotions, especially in areas with high foot traffic and permissive tobacco laws.

However, the online distribution segment is the fastest-growing, driven by digital-native consumers, regulatory loopholes in certain states, and a desire for discreet purchasing. E-commerce platforms, including brand-owned websites and third-party marketplaces, are leveraging autoship options, curated bundles, loyalty points, and anonymous delivery to expand reach. Brands like Smoker’s Outlet, Rolling Paper Depot, and BuyPipeTobacco.com have emerged as leading online destinations. This channel also enables broader access to niche and premium RYO products, including imported tobacco, artisanal papers, and luxury injectors, thereby supporting long-tail growth in a fragmented market.

Within the U.S., the roll-your-own tobacco market reveals varying degrees of popularity, regulation, and consumer behavior across states. California, Texas, Florida, and New York represent the largest markets due to population density and urban lifestyle patterns. In states like California, with high cigarette taxes and a robust anti-smoking culture, RYO products are often used as a more cost-effective alternative and occasionally by users trying to taper consumption.

Meanwhile, in Midwestern and Southern states, RYO is viewed as both an economic choice and a cultural staple, particularly among rural or working-class communities. The growth of herbal blends and hemp-infused RYO products in states with legalized cannabis frameworks (e.g., Colorado, Oregon) has also contributed to hybrid consumer trends where tobacco and cannabis accessories converge. On the legislative front, states such as Massachusetts and New Jersey are pushing for greater taxation parity between cigarettes and RYO tobacco, which may impact future purchasing behavior.

From a demographic standpoint, younger consumers aged 25–40 in metropolitan areas are increasingly seeking artisanal RYO experiences, often complemented by eco-conscious rolling papers or minimalist injectors. At the same time, older smokers remain the backbone of traditional RYO consumption, relying on familiar brands and bulk-buying patterns. This bifurcation in the market underscores the importance of customized marketing strategies, regional promotions, and flexible distribution models for continued success in the U.S. landscape.

February 2025 – Republic Tobacco launched a new line of US-grown organic RYO tobacco blends under its Top brand, targeting health-conscious users with chemical-free formulations.

January 2025 – Zig-Zag introduced a biodegradable rolling paper series made from hemp and corn husk fibers, emphasizing sustainability and aligning with its “natural lifestyle” branding.

November 2024 – E-commerce retailer Smoker’s Outlet Online expanded its product catalog to include nicotine-free herbal rolling blends and smart rolling machine kits compatible with Bluetooth.

October 2024 – RAW Rolling Papers announced a collaboration with a prominent cannabis lifestyle brand to release limited-edition cones and papers, blending cross-category appeal.

August 2024 – Top-O-Matic, a leading injector machine brand, introduced a compact travel-friendly cigarette maker, addressing portability demands of urban consumers.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. roll-your-own tobacco products market

Product

Distribution Channel