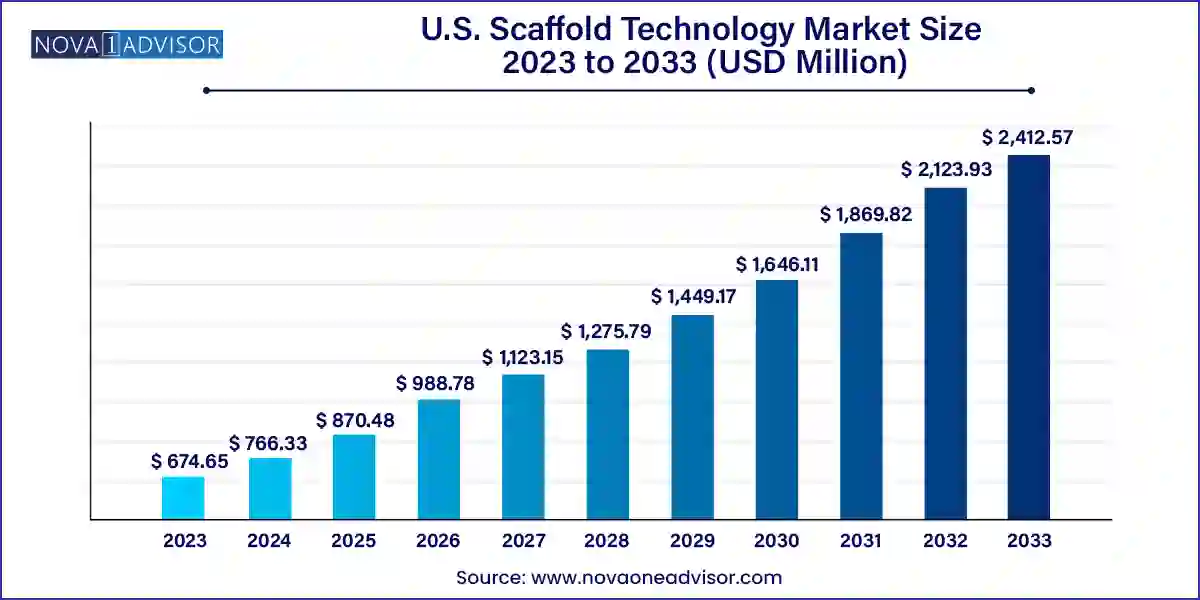

The U.S. scaffold technology market size was exhibited at USD 674.65 million in 2023 and is projected to hit around USD 2,412.57 million by 2033, growing at a CAGR of 13.59% during the forecast period 2024 to 2033.

driven by increased demand for 3D cellular models, body reconstruction procedures, and advancements in nanofiber-based scaffold technologies. This growth is fueled by the replacement of animal models in drug testing and rising need for medical solutions.

The U.S. scaffold technology market is at the forefront of a biomedical revolution, playing a pivotal role in tissue engineering, regenerative medicine, and drug discovery. Scaffold technologies are engineered platforms that support cell attachment, growth, and differentiation mimicking the extracellular matrix and enabling the formation of functional tissues. As the country continues to witness a surge in chronic diseases, injuries, and degenerative conditions, scaffold-based solutions are gaining traction across both academic research and commercial healthcare settings.

Driven by advancements in biomaterials science, bioengineering, and 3D printing, scaffold technology in the U.S. has evolved from a niche academic concept into a commercially viable tool in various clinical applications. Whether in bone regeneration, wound healing, organoid development, or cancer research, scaffolds offer an essential structure for restoring tissue function. Particularly notable is their role in stem cell therapy and regenerative medicine, where they help in constructing tissue constructs that can be implanted into damaged areas to promote healing and regeneration.

The market benefits significantly from the U.S.'s well-established biomedical research ecosystem. With government grants from bodies such as the NIH, robust academic-industry collaboration, and rising private investments, the country fosters a strong environment for innovation. Furthermore, the U.S. Food and Drug Administration (FDA) has progressively streamlined approval pathways for scaffold-based therapeutics and implants, facilitating a faster route from lab to market.

From hydrogel-based 3D bioprinting platforms to nanofiber scaffolds for cardiovascular tissue regeneration, the scaffold technology landscape in the U.S. is rich in diversity and potential. As regenerative therapies continue to move from clinical trials to clinical practice, the demand for advanced, functional, and biocompatible scaffold technologies is poised to accelerate dramatically.

Rapid Advancement in 3D Bioprinting Scaffolds: Increased usage of hydrogel-based scaffolds in bioprinting tissues and organs for research and transplant.

Integration of Smart Materials: Scaffolds embedded with biosensors and responsive polymers that react to stimuli for real-time feedback and healing modulation.

Personalized Scaffold Design via AI: AI and machine learning algorithms are being applied to create patient-specific scaffold designs based on biological and anatomical data.

Use of Decellularized Tissue Scaffolds: Naturally-derived matrices from animal or human tissue being adopted for improved integration and reduced immunogenicity.

Rising Application in Oncology Research: Scaffold models being used to simulate tumor microenvironments for drug screening and cancer biology research.

Collaborations with Research Institutes: Companies are forming strategic alliances with universities and research centers to accelerate innovation in scaffold design and application.

Government Support for Regenerative Therapies: Grants and funding initiatives by NIH, BARDA, and DARPA for scaffold-related regenerative solutions in orthopedics, neurology, and wound care.

Miniaturization and High-Throughput Screening: Development of micropatterned surface microplates compatible with automated systems for large-scale cell assays.

| Report Coverage | Details |

| Market Size in 2024 | USD 766.33 Million |

| Market Size by 2033 | USD 2,412.57 Million |

| Growth Rate From 2024 to 2033 | CAGR of 13.59% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Type, Disease Type, Application, End-use |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | U.S. |

| Key Companies Profiled | Thermo Fisher Scientific, Inc.; Merck KGaA; Tecan Trading AG; REPROCELL Inc.; 3D Biotek LLC; Becton, Dickinson, and Company; Medtronic; Xanofi; Molecular Matrix, Inc.; Pelobiotech; 4titude; Corning Incorporated; Akron Biotech; Avacta Life Sciences Limited.; Vericel Corporation; NuVasive, Inc.; Allergan |

A key growth driver of the U.S. scaffold technology market is its expanding use in regenerative medicine and tissue engineering, fields that are redefining the future of healthcare. As the need to repair or replace damaged tissues due to trauma, aging, or disease grows, scaffold technologies provide the essential structure to support cell growth, differentiation, and integration into host tissues. This is particularly vital in treating orthopedic injuries, burns, cardiovascular defects, and neurological disorders.

With over 120,000 people on organ transplant waiting lists in the U.S., scaffold-enabled biofabrication presents a life-changing opportunity. Products like 3D-printed bone scaffolds for craniofacial reconstruction or hydrogel scaffolds used in heart patches are already transitioning into clinical use. Companies like Organovo and research institutions such as Wake Forest Institute for Regenerative Medicine are at the forefront, using bioengineered scaffolds for liver, kidney, and heart tissue regeneration. These advances are strongly supported by federal funding and a patient population increasingly open to innovative treatments, setting the stage for massive growth.

Despite significant potential, scaffold technology development is hindered by high production costs and complex regulatory approval processes. Scaffold manufacturing especially those involving bioprinting, decellularization, or composite materials requires highly specialized infrastructure, expertise, and raw materials. As a result, companies often face steep capital investments and lengthy R&D cycles.

Furthermore, obtaining FDA approval for scaffold-based therapeutics or implants, particularly when involving novel materials or autologous cells, can be arduous. Developers must navigate stringent biocompatibility, sterility, and efficacy standards, requiring extensive preclinical and clinical data. This delays market entry and inflates costs, posing challenges for startups and small innovators. Despite efforts to streamline regulations for regenerative products, this remains a significant barrier for widespread commercialization and affordability in clinical use.

A promising opportunity lies in leveraging scaffold technologies for personalized drug discovery and development. Conventional 2D cell cultures fail to replicate the complex 3D architecture of human tissues, limiting the predictive power of drug testing. Scaffold-based 3D cultures, in contrast, simulate in vivo-like environments, enabling more accurate testing of therapeutic efficacy and toxicity.

Pharmaceutical and biotech companies in the U.S. are increasingly adopting scaffold models to expedite preclinical research. For example, nanofiber-based scaffolds are being used to culture tumor spheroids that mimic actual cancers, allowing for personalized cancer treatment strategies. Additionally, scaffolds aid in growing patient-specific organoids to test drug responses, reducing trial-and-error in therapy selection. This approach is especially valuable in oncology, neurology, and rare diseases. As precision medicine grows, scaffold-assisted drug discovery will become an essential tool, offering market players immense untapped potential.

Hydrogels emerged as the dominant scaffold type in the U.S. market due to their versatility, biocompatibility, and hydration properties that closely mimic native extracellular matrices. Hydrogels are widely used in applications such as wound healing, 3D bioprinting, and immunomodulation. Their highly porous structure facilitates nutrient transport and cell migration, making them ideal for regenerative applications. In wound care, hydrogel scaffolds have demonstrated significant success in accelerating tissue regeneration and managing chronic wounds such as diabetic ulcers.

In the sub-segment of hydrogel applications, 3D bioprinting is gaining the most momentum. Bioprinting uses hydrogel bioinks to print tissue layers, providing structural integrity while preserving cellular function. This has enormous implications for organ development and in vitro disease modeling. Companies like CELLINK and Allevi are innovating hydrogel-based bioprinting platforms, supported by research collaborations with U.S. universities. As bioprinting matures, hydrogel scaffolds are poised to become the fastest-growing type, especially in regenerative medicine and developmental biology.

Meanwhile, nanofiber-based scaffolds represent a fast-growing segment. These scaffolds, often produced through electrospinning, mimic the nanoscale structure of natural tissues and provide high surface area for cell attachment. Their utility in bone, cardiac, and nerve tissue engineering is attracting significant research funding and clinical exploration.

Orthopedics, musculoskeletal, and spine applications dominated the disease-type segmentation of the U.S. scaffold technology market. This dominance is largely driven by the high incidence of bone fractures, osteoarthritis, and spinal injuries in the aging American population. Scaffold implants made from polymeric materials or hydrogels are used to regenerate cartilage, bone tissue, and intervertebral discs. Hospitals and surgical centers increasingly adopt scaffold-aided procedures for joint repair and spinal fusions, as they reduce recovery times and improve functional outcomes.

At the same time, cancer-related scaffold applications are emerging as the fastest-growing segment. Scaffolds are being engineered to model tumor microenvironments and test anti-cancer agents. For example, breast cancer organoid models developed using micropatterned scaffolds allow researchers to test new therapies in personalized contexts. The use of scaffolds in simulating hypoxic, angiogenic, and metastatic tumor conditions is helping oncologists better understand tumor behavior and treatment responses, particularly in aggressive cancers like glioblastoma and pancreatic carcinoma.

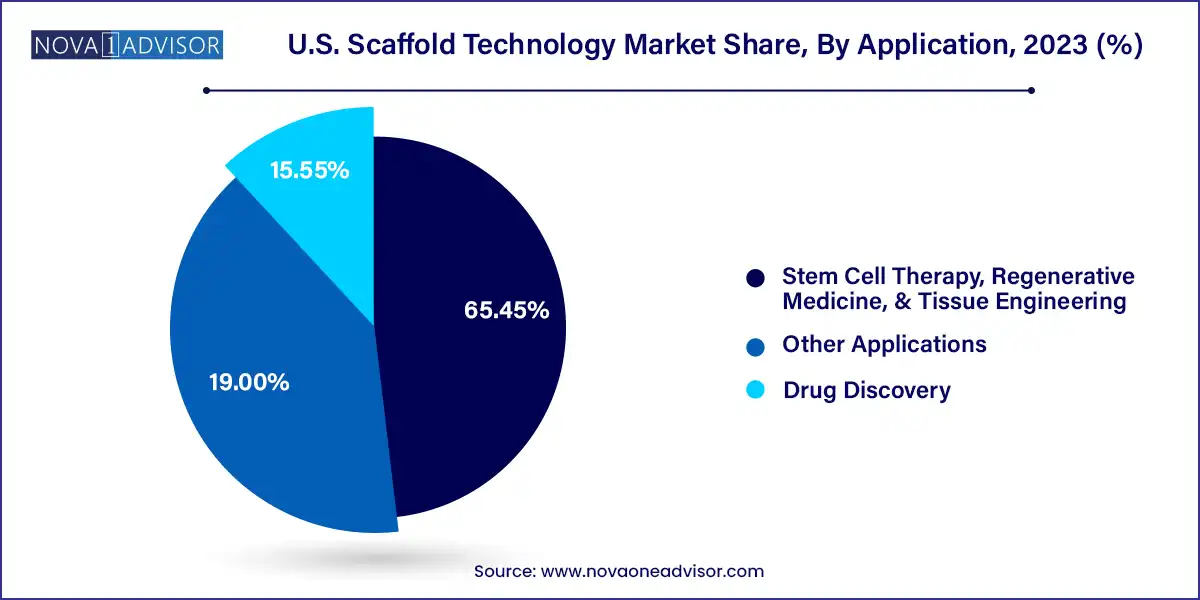

Stem cell therapy, regenerative medicine, and tissue engineering applications dominate the U.S. scaffold technology landscape. Scaffolds serve as essential carriers and stimulators for stem cell differentiation and tissue formation. Hospitals and research institutions use scaffolds for applications ranging from cartilage repair to cardiac tissue regeneration. In particular, collagen-based scaffolds integrated with mesenchymal stem cells are now being applied in pilot human trials for treating myocardial infarctions and osteochondral defects.

Meanwhile, drug discovery is rapidly growing as a high-impact application. Biotech and pharmaceutical companies are investing in scaffold platforms to culture organoids and tissue models for high-throughput screening. For example, micropatterned surface microplates enable simultaneous testing of hundreds of compounds on 3D tissues, enhancing the efficiency and accuracy of preclinical studies. As the pharmaceutical industry shifts toward human-relevant models, scaffolds will become a staple in future drug development workflows.

The biotechnology and pharmaceutical industries dominate scaffold technology adoption in the U.S. These end-users utilize scaffolds in drug screening, regenerative therapy development, and preclinical modeling. Companies like Amgen, Genentech, and Pfizer have established partnerships with scaffold innovators to accelerate their R&D pipelines. Scaffolds allow pharma companies to build in vitro tissue systems that replicate human physiology better than traditional petri dish models, helping reduce late-stage clinical trial failures.

In parallel, research laboratories and institutes are emerging as the fastest-growing end-users. Academic medical centers and government-funded research programs are adopting scaffold technologies to explore regenerative therapies, neural regeneration, and developmental biology. NIH-funded centers are leveraging scaffold-based platforms to study spinal cord injuries and brain organoids, while university labs are investing in bioprinting platforms for educational and translational research purposes.

The U.S. presents a dynamic and innovation-rich landscape for scaffold technology. Research-intensive states such as Massachusetts, California, and Maryland serve as epicenters for scaffold innovation due to their robust biotech infrastructure, NIH-funded research institutions, and strong start-up ecosystems. Institutions like Harvard, Stanford, and Johns Hopkins regularly collaborate with industry to advance scaffold research, supported by grants from the NIH, NSF, and BARDA.

Moreover, FDA’s evolving regulatory framework for regenerative medicine is contributing to scaffold commercialization. For example, the Regenerative Medicine Advanced Therapy (RMAT) designation has accelerated clinical trials for scaffold-integrated stem cell therapies. With increasing public awareness of personalized and regenerative therapies, the U.S. continues to be the global pacesetter for scaffold technology adoption and development.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. scaffold technology market

Type

Disease Type

Application

End-use