The U.S. senior living market size was exhibited at USD 923.75 billion in 2023 and is projected to hit around USD 1,391.23 billion by 2033, growing at a CAGR of 4.18% during the forecast period 2024 to 2033.

The senior living industry in the United States is at a critical inflection point. Fueled by a rapidly aging population, evolving healthcare expectations, and lifestyle shifts among older adults, the demand for diversified, flexible, and high-quality senior living options is expanding at an unprecedented pace. Traditional models of care are being reimagined as today’s older adults seek autonomy, comfort, community engagement, and wellness-focused environments over institutionalized care.

Senior living communities now range from vibrant independent living villages to highly specialized memory care units and medical-intensive skilled nursing facilities. The industry is also witnessing a deeper convergence with healthcare, wellness services, and digital infrastructure to support aging-in-place models and preventive care. Moreover, generational expectations are reshaping community design, amenities, and pricing strategies, pushing providers to become more adaptable, consumer-centric, and technologically integrated.

The COVID-19 pandemic also acted as a stress test for the industry, revealing vulnerabilities in care models and infrastructure, while accelerating innovation in infection control, telehealth, and safety protocols. As a result, operators are rethinking their value propositions with a renewed emphasis on resident well-being, transparency, and operational agility.

Lifestyle-Driven Living Spaces

Communities are increasingly designed to support active aging, social engagement, and recreational living, moving away from clinical or dormitory-style environments.

Healthcare Integration and On-Site Medical Services

Senior living operators are partnering with healthcare systems or hiring in-house medical staff to offer on-demand care and chronic disease management.

Technology as a Core Differentiator

Implementation of smart home features, emergency response systems, digital engagement platforms, and remote health monitoring tools is becoming widespread.

Middle-Income Market Focus

With a large portion of the aging population not qualifying for Medicaid but unable to afford luxury communities, the middle-income demographic is a major growth area.

Customized Memory Care Programming

Operators are moving beyond basic dementia care to offer personalized memory enrichment plans, including sensory therapy and cognitive stimulation.

Rise of Multigenerational and Mixed-Use Communities

Developers are incorporating senior living into broader community plans that include retail, parks, and housing for younger families to encourage intergenerational interaction.

Decentralization and Rural Expansion

Smaller, home-like facilities in rural or suburban regions are growing to serve aging populations outside urban cores.

| Report Coverage | Details |

| Market Size in 2024 | USD 962.36 Billion |

| Market Size by 2033 | USD 1,391.23 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 4.18% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Facility |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | Genesis Healthcare; Brookdale Senior Living Solutions; Lincare, Inc.; The Ensign Group, Inc; Extendicare; Sunrise Senior Living, LLC; Life Senior Living Facilities; Golden Living Centers; LifeCare Centers of America Corporate; Peninsula behavioral health; Sava Senior Care Administrative Services LLC; Kindred Healthcare, LLC; Capital Senior Living; Merrill Gardens; Integral Senior Living (ISL); Belmont Village, L.P.; The Villages; Pultegroup, Inc.; Latitude Margaritaville; Hot Springs Village; Rossmoor Walnut Creek; Robson Ranch; Sun Lakes; Green Valley; Life Care Services; Five Star Senior Living; Atria Senior Living; Erickson Living; Kensington Park Senior Living; Masonicare; ProMedica Health System, Inc.; Azura Memory Care; Affinity Living Group |

The most powerful force driving the senior living market is demographic inevitability. The U.S. is experiencing a marked increase in the senior population, with the Baby Boomer generation now entering retirement age. As this group transitions into their late 60s and 70s, the need for both residential and healthcare support is rising steadily.

However, this is not just a story of volume it's also about evolving expectations. Unlike previous generations, today’s seniors are more health-conscious, technologically adept, and financially active. Many have led independent lives and expect their retirement years to reflect a similar sense of autonomy and vibrancy. As such, the demand is not only for more beds, but for better experiences personalized care, private accommodations, resort-like amenities, and intellectual and recreational engagement.

Senior living providers that align with these lifestyle demands while offering scalable healthcare support are best positioned to thrive over the next decade.

A persistent and systemic restraint in the U.S. senior living market is the growing challenge of staffing not just in quantity, but in quality. Senior care is an emotionally demanding, labor-intensive field that requires continuous presence, compassion, and specialized skills. However, recruitment and retention of staff remain difficult across all levels, from caregivers to registered nurses to operations managers.

Factors such as low wage competitiveness, high burnout rates, and limited career development pathways have led to chronic understaffing, especially in skilled nursing and memory care facilities. This strain compromises care quality, resident satisfaction, and regulatory compliance. Moreover, rising labor costs are squeezing already thin margins in a business that must constantly balance affordability and excellence.

Operators must explore creative solutions such as better compensation packages, career advancement programs, and technology-driven support systems to reduce burnout and enhance workforce resilience.

Technology is no longer an add-on in senior living it is becoming a core pillar of differentiation and scalability. The shift toward digital-first living has penetrated older demographics as well, with increasing tech adoption among seniors. This opens up a vast opportunity for senior living communities to invest in digital infrastructure that improves resident outcomes, enhances safety, and streamlines operations.

From wearables that track health vitals and detect falls, to AI-powered scheduling and medication management tools, digital transformation is reshaping care delivery. Telemedicine integration, virtual family visit platforms, and cognitive health apps are also being embraced. Facilities equipped with technology that enables residents to live independently longer and remain connected to their families and care teams will attract more residents and achieve operational efficiencies.

In the long term, the digital senior living ecosystem including smart home integration, predictive analytics, and remote clinical services will likely emerge as a defining factor for competitiveness.

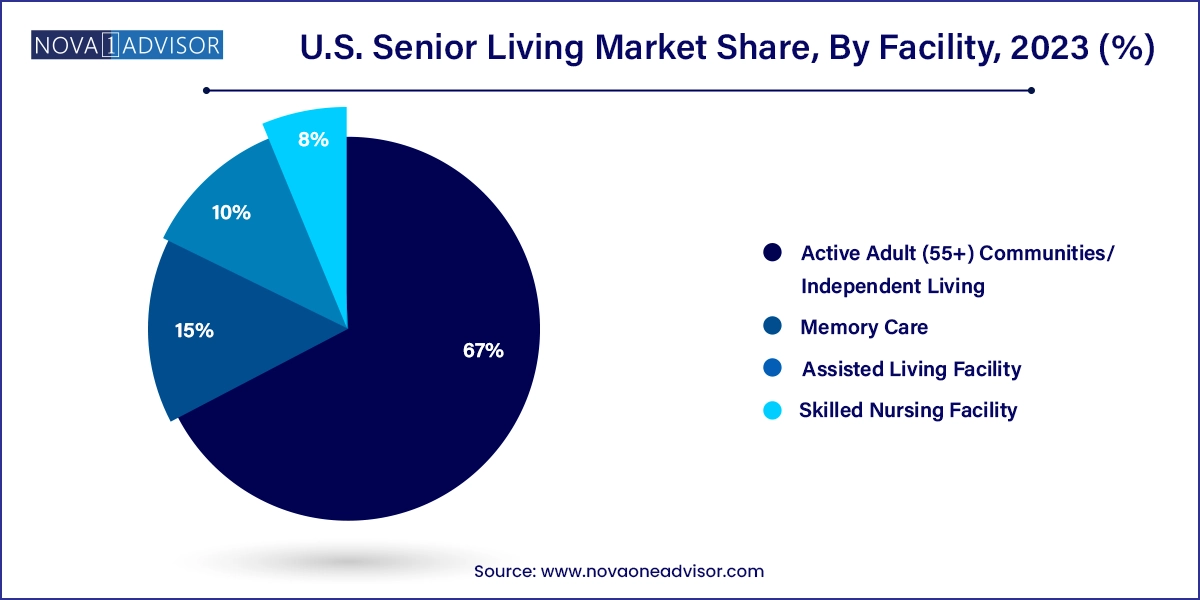

Assisted Living Facilities (ALFs) Dominate the Market

Assisted living facilities form the backbone of the U.S. senior living market. These communities cater to seniors who are largely independent but require help with daily activities such as bathing, dressing, medication management, and mobility. What makes ALFs especially appealing is their hybrid approach — offering residential freedom combined with on-site care and services.

These facilities usually offer private apartments, communal dining, wellness programs, and social activities, creating a lifestyle environment rather than a medical setting. For many seniors, this option serves as a transition between independent living and nursing care. ALFs have the broadest market appeal due to their flexible care model and moderate pricing structures, making them the go-to choice for a wide range of older adults and their families.

Memory Care Facilities Are the Fastest Growing Segment

Memory care is emerging as the fastest-growing segment in the senior living space due to the rising incidence of Alzheimer’s disease and other dementia-related conditions. With increasing life expectancy, cognitive impairments are becoming more prevalent among seniors, necessitating facilities that can provide 24/7 supervision, specialized staff, and structured therapeutic programs.

These communities often operate as secure wings within ALFs or as standalone facilities. They focus on sensory engagement, memory-triggering activities, and environmental design elements that reduce confusion and agitation. Demand is expected to climb steeply as clinical diagnoses become more accurate and families seek care models that combine safety, empathy, and cognitive support. Operators that invest in staff training, facility design, and person-centered memory programs will lead this segment's growth.

The U.S. senior living market is a patchwork of regional diversity shaped by population aging trends, climate preferences, affordability, and state-level policy frameworks. While states like Florida and Arizona are often associated with retiree migration due to their warm climates and tax incentives, senior living demand is expanding nationwide.

Urban centers are moving toward high-rise senior communities with wellness amenities and transit access, while rural regions are favoring smaller, home-like care models. Affordability remains a key differentiator—coastal states often feature higher-end luxury communities, whereas the Midwest and South see higher adoption of community-funded or non-profit facilities.

State and federal policies on Medicaid, long-term care insurance, and development incentives continue to influence where and how senior living projects are developed. Nonetheless, demand is clearly rising across the country, and future success will depend on market localization and adaptive service offerings.

March 2025 – Serenity Villages Launches Mid-Income Senior Community in Kansas

Serenity Villages announced the opening of a new senior living community tailored for middle-income retirees in Topeka. The project offers modular apartments, on-demand healthcare, and shared wellness spaces at affordable price points.

February 2025 – Harmony Living Integrates AI Health Monitoring in All Facilities

Harmony Living unveiled its partnership with a health-tech startup to integrate AI-powered health tracking and fall detection systems across 60+ assisted living sites nationwide. The move aims to reduce hospitalizations and improve proactive care.

January 2025 – Elmwood Residences Debuts Intergenerational Living Campus in Oregon

Elmwood introduced a pioneering living model that integrates senior housing with university student accommodations and shared community amenities. The program supports companionship, knowledge exchange, and reduced loneliness.

December 2024 – Maple Leaf Senior Care Expands Memory Care Footprint in the Northeast

Maple Leaf announced a $200M investment in specialized memory care facilities in Connecticut and Massachusetts, featuring sensory therapy gardens, AI-powered cognitive games, and dedicated dementia care wings.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. senior living market

Facility

Regional