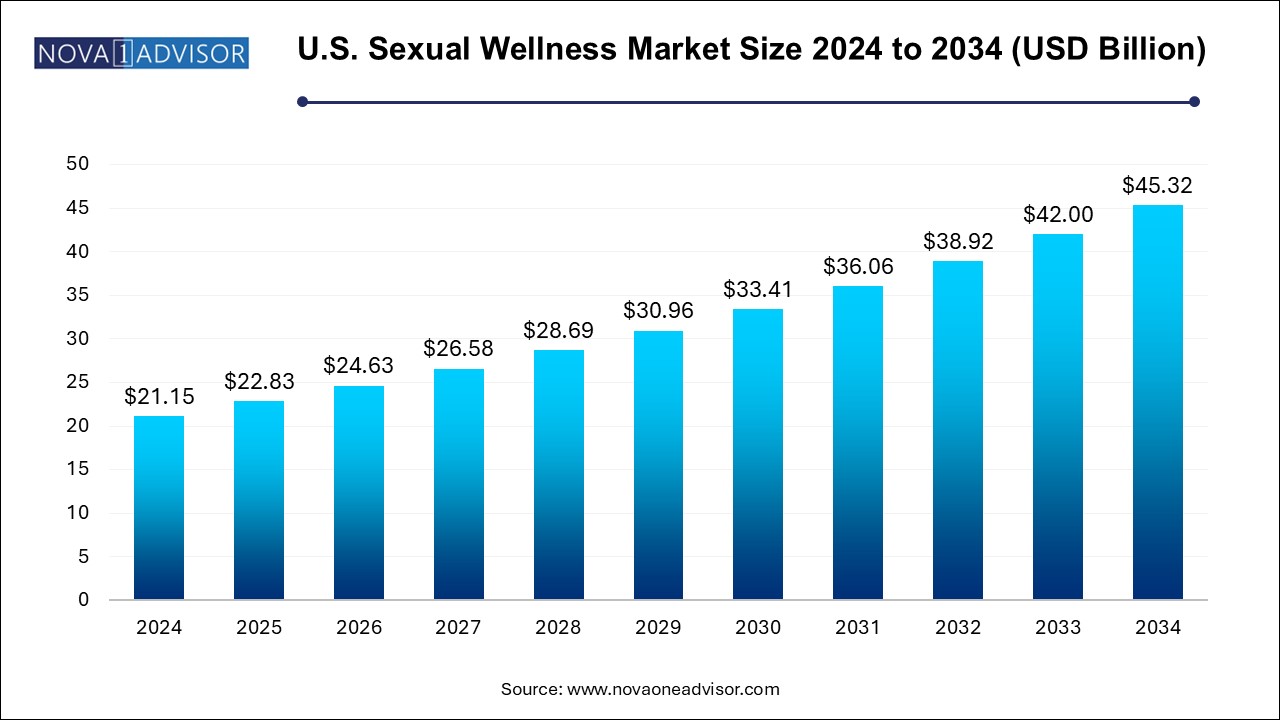

The U.S. sexual wellness market size was exhibited at USD 21.15 billion in 2024 and is projected to hit around USD 45.32 billion by 2034, growing at a CAGR of 7.92% during the forecast period 2024 to 2034.

The U.S. sexual wellness market has evolved into a multi-billion-dollar industry, driven by shifting social attitudes, increased sexual health awareness, and the rising demand for products that promote both physical pleasure and emotional well-being. No longer confined to discreet adult stores or whispered conversations, sexual wellness is entering the mainstream with bold branding, digital campaigns, and increasing support from health professionals. Products such as vibrators, personal lubricants, and condoms have transitioned from taboo to trendy, as consumers across age groups especially millennials and Gen Z embrace a holistic view of health that includes sexual well-being.

The definition of sexual wellness has broadened significantly in recent years. It is now recognized not just as the absence of dysfunction or disease, but as a positive and fulfilling component of overall health. Public campaigns advocating safe sex, gender inclusivity, and open discussions around sexual pleasure have reduced the stigma once associated with sexual wellness products. As a result, consumers are increasingly shopping for these items in mainstream stores, online marketplaces, and even pharmacies.

Technological integration has also played a critical role. From app-connected vibrators to discreet subscription boxes for personal lubricants and intimate hygiene, innovation is shaping a market that’s as functional as it is experiential. Furthermore, the COVID-19 pandemic brought intimacy and sexual health into sharper focus, especially with lockdowns fostering self-exploration and online purchasing behavior. As consumer comfort grows and e-commerce flourishes, the U.S. sexual wellness market is expected to continue its dynamic upward trajectory.

Mainstream Retail Adoption: Retailers like Target, CVS, and Walmart have begun selling sexual wellness products, helping destigmatize purchases and reaching a broader customer base.

Growth in E-commerce and Direct-to-Consumer Brands: D2C startups like Maude, Dame, and Cake are disrupting the market by offering gender-neutral, elegant, and body-safe products through online platforms.

Personalization and Smart Technology: Products such as app-controlled vibrators and customizable subscription services are gaining traction, offering users more control and enhanced experiences.

Inclusive Branding and Gender-Neutral Marketing: Companies are shifting away from gender stereotypes to appeal to LGBTQ+ and non-binary consumers, promoting inclusivity across product design and advertising.

Focus on Sexual Health Education: Brands are creating educational content about topics like consent, pleasure anatomy, and communication, positioning themselves as partners in sexual well-being.

Rise of Women-Owned Brands: Women entrepreneurs are leading the charge in product innovation and market disruption, changing how the industry engages with female consumers.

Sustainability in Packaging and Materials: Eco-conscious consumers are demanding products that are biodegradable, reusable, and sustainably packaged, pushing manufacturers to innovate responsibly.

| Report Coverage | Details |

| Market Size in 2025 | USD 22.83 Billion |

| Market Size by 2034 | USD 45.32 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 7.92% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Product, Distribution Channel, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered | Northeast; Southeast; Southwest; Midwest; West |

| Key Companies Profiled | Church & Dwight Co., Inc.; Reckitt Benckiser Group plc; Veru Inc.; Doc Johnson Enterprises; Mayer Laboratories, Inc.; LifeStyles Healthcare Pte Ltd; BioFilm, Inc.; LELO; Trigg Laboratories Inc.; Unbound; CC Wellness |

One of the most powerful drivers of the U.S. sexual wellness market is the evolution of societal attitudes toward sexuality, pleasure, and intimacy. Over the past decade, the narrative has shifted from repression and shame to empowerment and education. This change is largely propelled by movements advocating for gender equality, body positivity, and sex positivity. As the conversation around sexuality becomes more inclusive and normalized, consumers are more likely to seek products that enhance their intimate lives without guilt or secrecy. This cultural shift has created fertile ground for startups and established companies alike to enter the market, experiment with design, and cater to consumers across all sexual orientations and identities.

Millennials and Gen Z consumers, in particular, are leading this transformation. They prioritize self-care and emotional well-being and view sexual wellness as an integral part of both. These generations are more likely to discuss sex openly, use dating apps, and try new experiences. As a result, the market is moving beyond functionality to embrace empowerment and aesthetics. Products are now designed to be not just effective but also beautiful, discreet, and proudly displayed. This increasing normalization of sexual wellness continues to drive demand across both urban and suburban regions in the U.S.

Despite the progress in mainstreaming sexual wellness, the market faces significant challenges due to regulatory ambiguity. The lack of consistent classification by the Food and Drug Administration (FDA) and varying state laws create a confusing landscape for manufacturers and consumers. For instance, vibrators and other sex toys are often labeled as “novelty items” rather than medical devices or wellness tools. This categorization limits the ability to make health-related claims and restricts marketing potential. Similarly, ingredients in lubricants may not be uniformly evaluated for safety across different regulatory bodies, leading to consumer mistrust.

These regulatory gaps can deter innovation and delay product launches, especially for startups that lack the legal and financial resources to navigate the complexities. Inconsistent labeling requirements can also affect transparency, making it harder for consumers to make informed decisions. Without clear guidelines, the market risks a disconnect between consumer expectations and product safety, which could hamper long-term growth. Addressing these inconsistencies through clearer policy frameworks and standards would be essential for fostering innovation while ensuring consumer trust and protection.

A largely untapped opportunity in the U.S. sexual wellness market lies within the aging population. As Americans live longer and remain sexually active into older age, there is a growing need for products designed specifically for seniors. Conditions such as menopause, erectile dysfunction, vaginal dryness, and reduced libido are common but often under-discussed. With over 54 million Americans aged 65 and older, this demographic represents a substantial market segment that has historically been underserved by the sexual wellness industry.

There is increasing recognition among healthcare providers and gerontologists that sexual well-being is crucial to the overall quality of life for older adults. Educational campaigns, including those from the AARP and sexual health clinics, are beginning to address this need. Brands that offer hormone-free lubricants, low-vibration intensity toys, and ergonomic designs tailored for mobility limitations are likely to succeed in capturing this niche. Furthermore, the willingness of aging consumers to embrace online shopping and telemedicine services presents an opportunity for D2C brands to expand into new verticals.

Sex toys dominated the product segment due to their expansive variety, broad appeal, and rising social acceptance. Vibrators, in particular, are the most widely sold subcategory within this group, accounting for a substantial portion of revenue. From bullet and wand vibrators to high-tech app-controlled devices, these products cater to a diverse audience, including singles and couples. Female consumers are especially contributing to this growth, spurred by women-centric brands that focus on body-safe materials, discreet packaging, and empowering marketing. The introduction of quiet motors, waterproof devices, and multi-functionality has made these products more user-friendly and desirable. Additionally, sex toys are often promoted as part of self-care, wellness, and mental health routines, making them culturally relevant.

Sex dolls are among the fastest-growing sub-segments, driven by advancements in robotics, customization, and artificial intelligence. Once limited to niche markets, sex dolls are gaining attention among consumers seeking companionship, intimacy, or therapeutic value. Some models are now equipped with heating functions, voice interaction, and programmable personalities. These enhancements make them appealing to a variety of demographics, including older adults and individuals with disabilities. As technological sophistication increases, the perception of sex dolls is shifting from novelty to companionship tool. Companies investing in hyper-realistic features and sustainable materials are further accelerating this segment’s rise.

Condoms remain a critical component of the sexual wellness market, with male condoms taking the lead due to their availability, affordability, and effectiveness in preventing STIs and unintended pregnancies. The male condom segment benefits from government health campaigns, youth sex education, and wide retail accessibility. Brands are innovating with ultra-thin, textured, and flavored options to enhance pleasure without compromising safety. Additionally, subscription-based condom delivery services have emerged to promote consistent usage and privacy in purchasing.

Female condoms are growing in popularity but still represent a smaller portion of the market. Increased efforts in promoting gender-equitable options and empowering women to take control of their sexual health are helping to bridge the gap. Public health agencies and NGOs are working to improve awareness and affordability, especially among underserved populations. If pricing and comfort concerns are addressed, this segment has considerable room for growth.

Personal lubricants form another essential segment, with water-based lubricants dominating due to their compatibility with sex toys, condoms, and sensitive skin. They are the go-to solution for dryness and enhanced sensation. This segment is being propelled by the demand from both younger consumers seeking pleasure enhancement and older adults addressing physiological changes.

Silicone-based lubricants are the fastest-growing lubricant sub-segment due to their long-lasting effect and suitability for shower play. Although slightly more expensive, their silky texture and extended performance make them a preferred choice for experienced users. Oil-based lubricants, while niche, are also gaining traction in intimate massage and alternative sexual practices, especially with the introduction of natural and organic formulas.

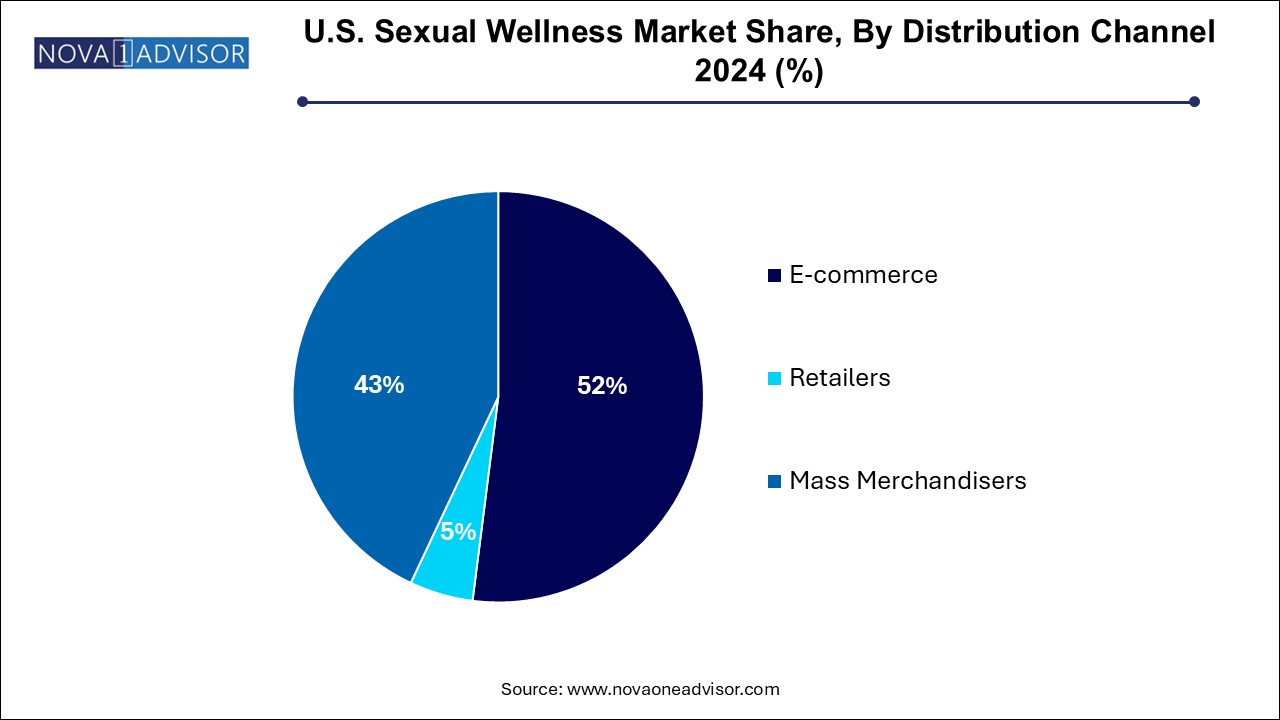

E-commerce dominated the distribution channel segment, reflecting the growing consumer preference for discreet, private, and convenient purchasing. Platforms like Amazon, specialty e-retailers, and D2C brand websites offer wide product assortments, user reviews, and fast shipping all factors that enhance customer confidence. Subscription models, bundling discounts, and targeted email marketing allow brands to build customer loyalty. The pandemic also boosted online shopping habits, making e-commerce a primary revenue generator. Data security, discreet packaging, and return policies play a critical role in sustaining online sales for intimate products.

Retailers are witnessing renewed interest due to mainstream acceptance and improved in-store visibility. Pharmacies, supermarkets, and big-box retailers are creating dedicated wellness aisles for sexual health products, offering shoppers a chance to explore products without stigma. Vibrant packaging, informative signage, and integration with adjacent categories like skincare and mental health supplements are drawing foot traffic and boosting cross-category purchases. Mass merchandisers are also adopting inclusive marketing strategies, increasing accessibility across geographies and demographics.

The United States is one of the most progressive and commercially advanced markets for sexual wellness products globally. Cultural shifts, advocacy efforts, and rising awareness around gender, consent, and pleasure are fostering a favorable environment for product innovation and consumption. State-level sex education mandates, rising STIs, and improved mental health literacy are pushing consumers to adopt products not just for pleasure but for health and safety as well. California, New York, and Florida are among the highest-consuming states, thanks to their urban density and liberal consumer bases.

The country also leads in digital innovation and startup activity. American companies are pioneering inclusive branding, ergonomic designs, and smart technologies. Federal and state governments continue to play a critical role in promoting public health measures related to safe sex and reproductive rights, indirectly supporting condom and lubricant sales. However, regional disparities remain, with the Midwest and certain Southern states lagging due to conservative cultural norms. Nonetheless, growing digital penetration is helping bridge these gaps.

March 2025 – Maude, a wellness brand co-founded by actress Dakota Johnson, launched a new line of gender-neutral vibrators and lubricants in partnership with Target, marking a milestone in mainstream retail acceptance.

January 2025 – Dame Products announced FDA registration for its flagship vibrator, making it one of the first sex toys to be officially categorized as a wellness device in the U.S.

October 2024 – Cake, a D2C sexual wellness brand targeting Gen Z, raised $8 million in Series A funding to expand its product line and retail footprint in Walgreens and CVS.

August 2024 – Trojan launched a new campaign aimed at destigmatizing female condom usage, with a focus on college campuses and health clinics across the U.S.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. sexual wellness market

Product

By Distribution Channel

By Region