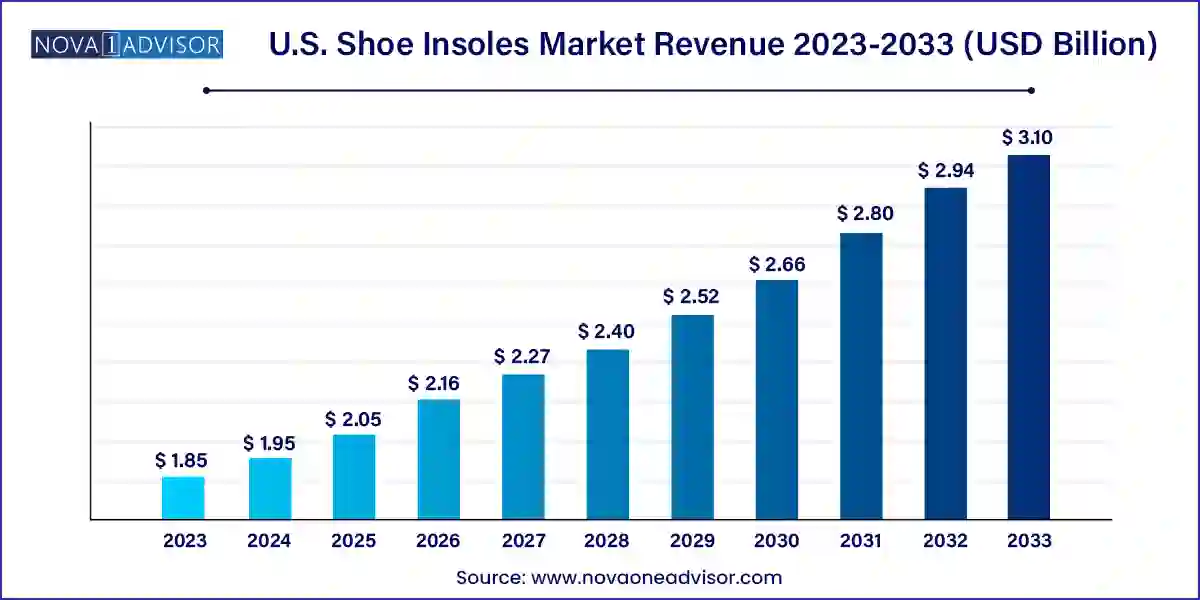

The U.S. shoe insoles market size was exhibited at USD 1.85 billion in 2023 and is projected to hit around USD 3.10 billion by 2033, growing at a CAGR of 5.3% during the forecast period 2024 to 2033.

The U.S. shoe insoles market has evolved significantly over the past decade, transitioning from a niche orthopedic segment to a mainstream component in footwear across casual, athletic, and medical categories. With increasing awareness regarding foot health, lifestyle changes, rising participation in sports and fitness activities, and growing incidences of foot-related ailments, the market has garnered heightened consumer attention.

Shoe insoles, also known as footbeds or inner soles, are components inserted into shoes to provide comfort, support, and relief from conditions such as plantar fasciitis, flat feet, and arch pain. These insoles not only enhance comfort during regular wear but also serve as vital aids in improving posture, absorbing shock, and redistributing foot pressure. The rise in customized and orthotic insoles, especially among aging populations and athletes, has created new growth pathways in the U.S.

Several innovative materials such as memory foam, gel, carbon fiber, and thermoplastic elastomers have redefined product performance. Meanwhile, the intersection of biomechanical science and modern material engineering has opened doors to premium and smart insole technologies, expanding market scope even further. Moreover, the direct-to-consumer (DTC) business model adopted by several startups and footwear companies is streamlining distribution and enhancing consumer outreach.

The market is highly fragmented, with a blend of multinational corporations and domestic specialists competing on aspects such as design innovation, product personalization, and pricing. As of 2024, the U.S. shoe insoles market continues to expand steadily, expected to grow at a significant CAGR through 2034, driven by both consumer demand and medical necessity.

Rise in Custom and 3D-Printed Insoles: Consumer demand for personalized comfort is fueling the trend of customized and 3D-printed insoles. Companies like Wiivv and FitMyFoot offer custom-fit products based on foot scans via mobile apps.

Increased Athletic Participation: The U.S. has witnessed a surge in athletic activities and fitness regimes, creating greater demand for high-performance insoles designed for running, training, and other sports.

Technological Advancements in Materials: Advancements in smart and responsive materials, such as memory foam and temperature-regulating gels, are redefining insole performance metrics.

Integration of Smart Features: Smart insoles embedded with sensors that track movement, gait, and weight distribution are gaining traction among both athletes and healthcare professionals.

Sustainability and Eco-Friendly Products: Brands are increasingly using sustainable materials such as recycled foams or bio-based polymers to cater to environmentally conscious consumers.

Increased Prevalence of Foot Disorders: Rising awareness and diagnoses of foot conditions such as plantar fasciitis, diabetic foot ulcers, and overpronation are prompting more consumers to seek orthotic insoles.

E-commerce and DTC Boom: The growing preference for online shopping and the rise of DTC brands have improved accessibility to a wider variety of insole types for diverse applications.

| Report Coverage | Details |

| Market Size in 2024 | USD 1.95 Billion |

| Market Size by 2033 | USD 3.10 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 5.3% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Application, Material, End-user, Type |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. |

| Key Companies Profiled | Bauerfeind AG; Foot Science International; Superfeet Worldwide, Inc.; Texon International Group; FootBalance System Ltd.; Sidas; ENERTOR; YONEX Co., Ltd.; Asics Corporation; New Balance Athletics, Inc. |

One of the most significant drivers of the U.S. shoe insoles market is the increasing consumer awareness of foot health. As sedentary lifestyles, obesity, and chronic health conditions become more prevalent, many individuals experience foot pain, lower back issues, and joint problems. The American Podiatric Medical Association (APMA) notes that over 75% of Americans will experience foot problems at some point in their lives. Consequently, consumers are seeking over-the-counter and customized insole solutions as non-invasive and cost-effective methods to manage such issues.

Insoles that provide arch support and cushioning are being increasingly adopted to reduce fatigue during prolonged standing or walking. Moreover, podiatrists frequently recommend orthotic insoles as part of conservative treatment plans for conditions like plantar fasciitis, metatarsalgia, and flat feet. This growing health consciousness has propelled insole usage beyond athletic performance, anchoring it firmly in everyday wellness routines.

Despite the expanding consumer base, the market faces a critical restraint in the form of inconsistent product efficacy and lack of standardization. The quality, performance, and durability of shoe insoles vary significantly across brands and price points. While some products provide measurable relief and biomechanical support, others merely offer superficial comfort without addressing root causes of discomfort or pain.

Additionally, the absence of universally accepted performance standards makes it challenging for consumers to discern between medically beneficial insoles and generic inserts. Inadequate consumer education and the proliferation of low-cost imitations can diminish trust in the category. This inconsistency can potentially limit consumer repurchase intent and brand loyalty, especially when users experience no tangible benefits.

The integration of wearable technology into shoe insoles presents a compelling opportunity for manufacturers. Smart insoles embedded with sensors can collect data on gait, pressure points, temperature, and posture in real-time. These innovations are revolutionizing performance monitoring for athletes, rehabilitation programs, and eldercare.

For instance, companies like Plantiga and Moticon are developing sensor-integrated insoles that are gaining popularity among sports professionals and physical therapists for biomechanical assessment. Furthermore, smart insoles can alert diabetic patients to temperature anomalies in the feet, potentially preventing ulcers or injuries. The convergence of foot orthotics and digital health is poised to transform how consumers engage with insole products, opening new revenue streams and clinical partnerships.

Full-length insoles hold the largest market share, providing complete foot coverage and uniform support from heel to toe. These insoles are highly versatile, compatible with a wide range of footwear, and often used for orthopedic and casual applications alike. Full-length insoles are especially effective for individuals who require consistent arch support or cushioning throughout the foot. They are also more likely to be recommended by podiatrists for chronic foot disorders or diabetic foot care.

While full-length insoles dominate in usage, heel cups are experiencing the fastest growth due to their targeted pain-relief capabilities. Heel cups are compact inserts that cushion the heel and alleviate pressure and impact in that area. They are particularly beneficial for individuals suffering from plantar fasciitis, heel spurs, or Achilles tendonitis. The growing preference for lightweight and minimalistic foot support options, especially among active users and older adults, is propelling this segment at a robust pace.

The orthotic segment dominates the application category in the U.S. shoe insoles market due to the widespread need for corrective foot solutions. Orthotic insoles are medically designed to align the foot, reduce pain, and redistribute pressure. They are commonly prescribed for individuals with flat feet, plantar fasciitis, and diabetes-related foot complications. Their effectiveness in improving overall posture and minimizing strain on the knees and back has made them a mainstay across healthcare and personal wellness sectors. As aging populations and chronic conditions continue to rise, orthotic insoles are expected to maintain their dominance over the forecast period.

In contrast, the fastest-growing subsegment is athletic insoles. The boom in recreational sports, marathons, and fitness programs has led to rising demand for performance-enhancing insoles. Designed for shock absorption and sweat control, athletic insoles are increasingly sought by runners, basketball players, and gym-goers. Brands are investing in athlete-endorsed designs and performance data-backed models, expanding the market appeal and driving rapid growth in this segment.

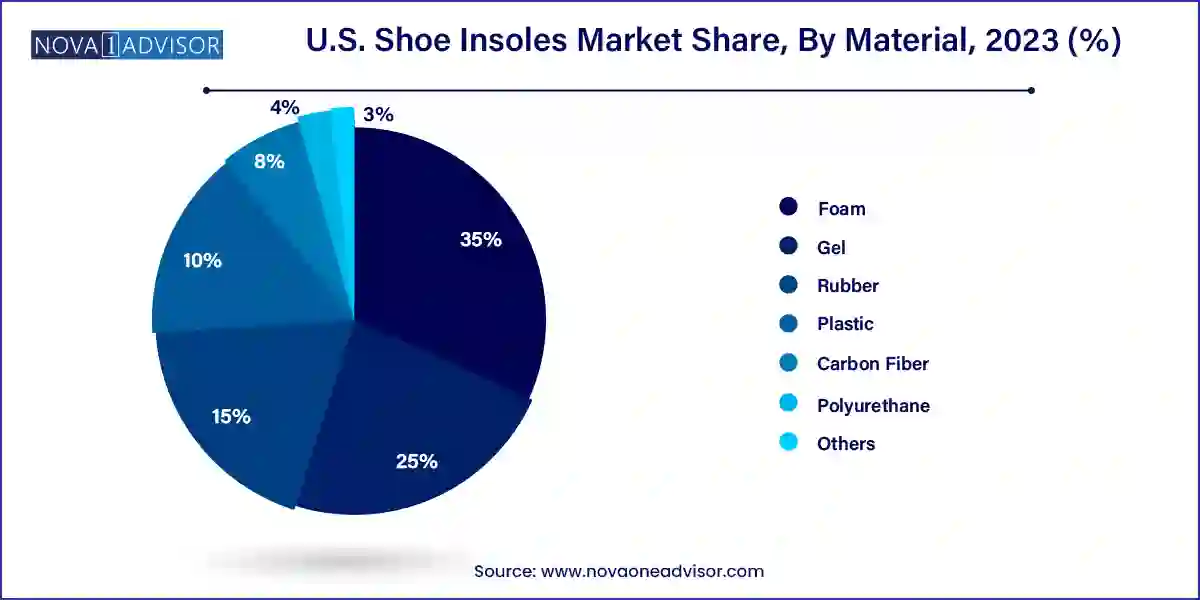

The foam-based shoe insoles category accounted for a revenue share of 35.0% in 2023. Memory foam and EVA (ethylene-vinyl acetate) foams are especially popular for casual and orthotic applications. These materials mold to the foot's shape and provide basic support for users seeking enhanced comfort in daily use. Foam insoles are commonly available through retail and online platforms, making them accessible to a wide range of consumers.

However, carbon fiber is emerging as the fastest-growing material segment. Known for its superior strength-to-weight ratio, carbon fiber insoles offer enhanced durability and rigidity, making them suitable for high-impact sports and medical applications requiring strong arch or heel support. Though they come at a premium price, their performance and longevity are unmatched, which appeals to elite athletes, runners, and individuals with severe orthopedic needs. Advancements in lightweight composite materials are expected to boost this segment significantly over the next decade.

Men account for the dominant share of the U.S. shoe insoles market. This dominance can be attributed to the higher prevalence of orthopedic issues among working-age males, their greater participation in intense physical activities, and a higher tendency to invest in comfort-enhancing products. Additionally, men’s footwear often lacks sufficient built-in support, leading to higher aftermarket insole adoption. Large-scale marketing campaigns, especially by sports and athletic brands targeting male demographics, further drive this dominance.

On the other hand, the women’s segment is rapidly expanding. Increasing awareness around foot health among women, especially in urban and fitness-focused populations, is contributing to higher adoption rates. High-heeled and narrow-toe shoes often contribute to discomfort and foot problems among women, prompting a shift toward insoles that offer targeted relief and improved ergonomics. In recent years, brands have also started offering gender-specific designs that cater to the unique biomechanics of women’s feet, accelerating growth in this segment.

The U.S. market is characterized by a unique confluence of healthcare awareness, consumer lifestyle, and innovation. With a large population segment aged 40 and above, the demand for medical-grade orthotic insoles continues to rise. Furthermore, the nation’s strong athletic culture and focus on preventive healthcare drive consistent sales across both performance and wellness product categories.

U.S. consumers are also early adopters of tech-enabled solutions, which has fueled interest in smart and customizable insoles. The growth of retail channels such as Amazon, Walgreens, CVS, and specialized orthotic retailers has enhanced product accessibility across urban and suburban regions. Government reimbursement programs for orthopedic supplies and increasing insurance coverage for podiatric conditions further support the demand for medical insoles.

Superfeet (April 2024): Superfeet announced the launch of a new line of eco-friendly insoles crafted from recycled foam and biodegradable packaging. This initiative aligns with the company’s sustainability roadmap and caters to the environmentally conscious consumer segment.

Wiivv (February 2024): Wiivv expanded its partnership with wearable health platform Fitbit, integrating gait analysis from its 3D-printed smart insoles into fitness tracking for improved performance feedback.

Dr. Scholl’s (December 2023): Dr. Scholl’s launched a new campaign targeting women’s foot wellness, featuring insoles designed for high heels and dress shoes with additional arch support and cushioning.

Orpyx Medical Technologies (October 2023): Orpyx released its updated line of smart diabetic foot insoles with real-time pressure monitoring, aiming to reduce foot ulcers among diabetic patients through predictive alerts.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. shoe insoles market

Application

Material

End-user

Type