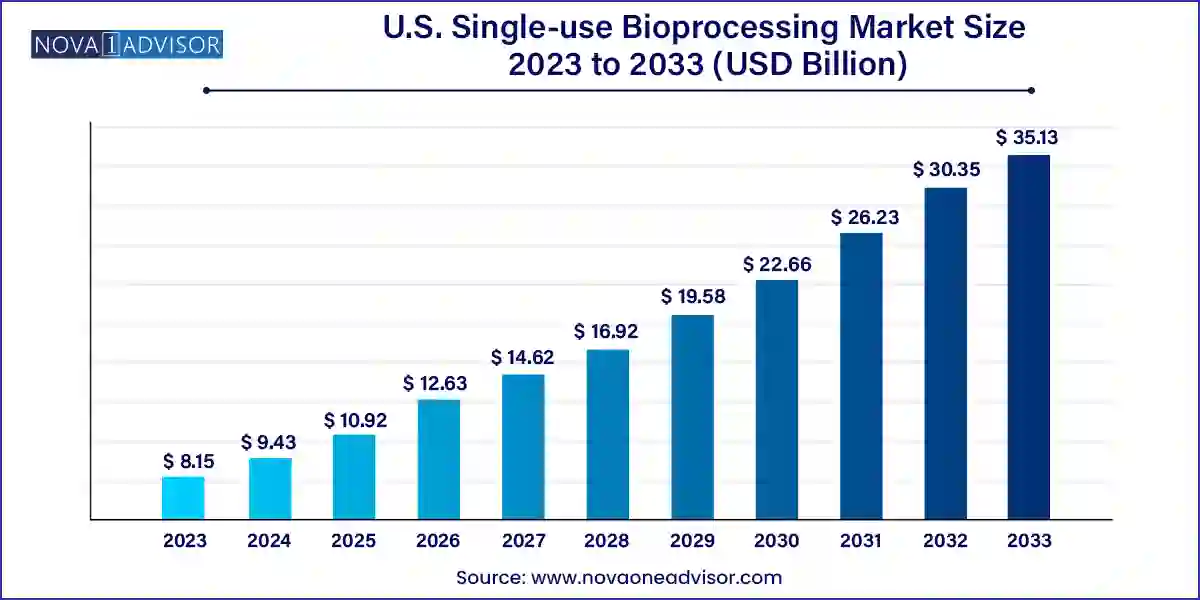

The U.S. single-use bioprocessing market size was exhibited at USD 8.15 billion in 2023 and is projected to hit around USD 35.13 billion by 2033, growing at a CAGR of 15.73% during the forecast period 2024 to 2033.

The U.S. single-use bioprocessing market represents a transformative shift in the biopharmaceutical manufacturing landscape. Traditionally, bioprocessing has relied on stainless-steel equipment and clean-in-place (CIP) systems that involve intensive labor, time, and capital expenditure. However, with the rise of biologics, increasing demand for flexible manufacturing, and a need for faster production cycles, single-use technologies (SUTs) have emerged as a preferred alternative. Single-use bioprocessing systems (SUBs) are pre-sterilized, disposable systems used in the production of biologics, vaccines, and biosimilars.

The U.S. leads globally in both innovation and adoption of these technologies. With a robust biotechnology sector, highly developed R&D infrastructure, and a dynamic network of contract manufacturing organizations (CMOs) and contract research organizations (CROs), the country continues to witness exponential growth in demand for scalable, agile, and contamination-free bioprocessing solutions. The COVID-19 pandemic further highlighted the need for rapid scale-up, driving unprecedented adoption of single-use systems in vaccine and therapeutic production. Today, U.S. facilities use single-use equipment across all phases of biologics development, from early-stage cell culture to commercial manufacturing.

The U.S. single-use bioprocessing market represents a transformative shift in the biopharmaceutical manufacturing landscape. Traditionally, bioprocessing has relied on stainless-steel equipment and clean-in-place (CIP) systems that involve intensive labor, time, and capital expenditure. However, with the rise of biologics, increasing demand for flexible manufacturing, and a need for faster production cycles, single-use technologies (SUTs) have emerged as a preferred alternative. Single-use bioprocessing systems (SUBs) are pre-sterilized, disposable systems used in the production of biologics, vaccines, and biosimilars.

The U.S. leads globally in both innovation and adoption of these technologies. With a robust biotechnology sector, highly developed R&D infrastructure, and a dynamic network of contract manufacturing organizations (CMOs) and contract research organizations (CROs), the country continues to witness exponential growth in demand for scalable, agile, and contamination-free bioprocessing solutions. The COVID-19 pandemic further highlighted the need for rapid scale-up, driving unprecedented adoption of single-use systems in vaccine and therapeutic production. Today, U.S. facilities use single-use equipment across all phases of biologics development, from early-stage cell culture to commercial manufacturing.

Growing Preference for Modular and Scalable Bioproduction: Modular manufacturing plants incorporating single-use systems are enabling faster time-to-market.

Integration of Sensors and Smart Analytics: Single-use probes and smart sensors are providing real-time monitoring, enhancing process control and automation.

Expansion of CDMO Capabilities: Contract manufacturing organizations are investing in single-use infrastructure to serve small and mid-sized biotechs.

Sustainability and Waste Management Innovations: Efforts are underway to reduce plastic waste through recycling programs and biodegradable materials.

Standardization and Interoperability: The demand for interoperable systems is driving development of industry-wide standards for connectors, bags, and valves.

Rise in Personalized Medicine and Small Batch Production: Single-use systems are ideally suited for small, personalized batches such as gene and cell therapies.

Increased Use in Continuous Manufacturing: Hybrid systems using SUBs in continuous production environments are being explored to maximize efficiency.

| Report Coverage | Details |

| Market Size in 2024 | USD 9.43 Billion |

| Market Size by 2033 | USD 35.13 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 15.73% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Workflow, End-use |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | U.S. |

| Key Companies Profiled | Sartorius AG; Danaher; Thermo Fisher Scientific, Inc.; Merck KGaA; Avantor, Inc.; Eppendorf SE; Corning Incorporated; Lonza; PBS Biotech, Inc.; Meissner Filtration Products, Inc. |

A primary driver of the U.S. single-use bioprocessing market is the rapid expansion of biologics, biosimilars, and advanced therapies such as CAR-T and gene therapies. Biologics manufacturing requires high levels of precision and sterility, making disposable systems ideal for eliminating cross-contamination and enhancing reproducibility. According to FDA data, over 60% of drug approvals in recent years have been biologics or biopharmaceutical products, highlighting a clear industry shift.

Single-use technologies enable quicker changeovers between products, reduce cleaning validation requirements, and facilitate multiproduct production. Biopharma giants like Bristol-Myers Squibb and Genentech, as well as emerging players like Beam Therapeutics, are increasingly deploying SUBs for clinical and commercial production. The ease of scaling single-use systems from lab to pilot to commercial scale further adds to their appeal.

One of the key restraints in the single-use bioprocessing market is the growing concern over environmental sustainability. Single-use systems are primarily composed of plastic polymers such as polyethylene and polypropylene. The disposal of large volumes of plastic waste after single use poses a significant environmental burden, especially as facilities scale up operations.

Although waste is typically incinerated to prevent biohazard contamination, this process releases greenhouse gases and raises sustainability questions. Regulatory pressure, public scrutiny, and corporate ESG mandates are pushing manufacturers to explore recyclable, biodegradable, or reusable alternatives. The industry’s slow progress in developing commercially viable solutions to these waste challenges remains a significant hurdle.

The rising prominence of personalized medicine and cell and gene therapies presents a major opportunity for the U.S. single-use bioprocessing market. These therapies often require small-scale, patient-specific manufacturing environments, which are ideally suited for single-use systems. SUBs provide flexibility, rapid changeovers, and contamination-free environments critical for autologous cell therapies.

For instance, the production of CAR-T cell therapies like Yescarta and Kymriah involves complex, multi-step processes that are best managed using modular, disposable equipment. As more of these therapies enter clinical and commercial pipelines, demand for purpose-built single-use bioreactors, tubing, and sampling systems is rising. Companies that offer tailored solutions for low-volume, high-variability production will capture significant market share.

Simple and peripheral elements dominated the U.S. single-use bioprocessing market due to their essential role in supporting fluid transfer, monitoring, and sampling processes. Tubing, connectors, filters, and sampling systems are used universally across bioprocess workflows, regardless of scale. Their ease of integration, relatively low cost, and disposability make them indispensable. Additionally, innovations in sensor technology such as single-use pH and oxygen sensors are enhancing process control. Real-time analytics through disposable sensors have allowed for greater consistency and process optimization.

Apparatus and plants represent the fastest-growing product segment, driven by the expanding use of single-use bioreactors, mixing systems, and chromatography systems in upstream and downstream processing. Bioreactors up to 2000L are particularly in demand, offering sufficient scale for clinical production while retaining single-use flexibility. As continuous bioprocessing gains traction, the need for integrated, modular systems built around single-use apparatus is growing. Storage and filling systems are also being widely adopted, helping streamline batch finalization without the need for cleaning or sterilization.

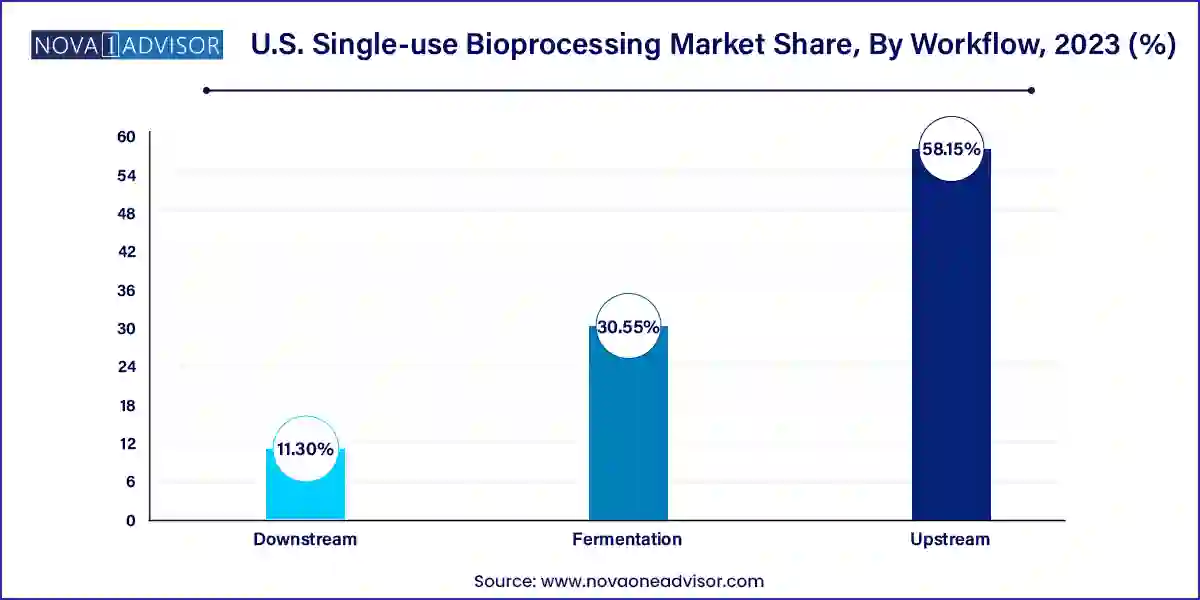

Upstream processing dominated the market, as it involves cell culture, media preparation, and fermentation processes that rely heavily on sterile environments. Single-use bioreactors, tubing systems, and sampling bags are commonly used in upstream phases, especially for mammalian cell culture. These systems are replacing stainless steel setups in pilot and production-scale operations due to their cost-effectiveness and faster batch turnover.

Downstream processing is emerging as the fastest-growing workflow segment with the development of disposable chromatography columns, filtration systems, and pumps. These systems help in purifying biological molecules and final product formulation. As downstream bottlenecks remain a concern in large-scale biologics manufacturing, innovations in single-use purification equipment are addressing challenges related to throughput and recovery. The integration of analytics and real-time monitoring is enhancing downstream yield and reducing product loss.

Biopharmaceutical manufacturers, particularly in-house production facilities, lead the market in terms of adoption and consumption of single-use systems. Companies producing commercial biologics require high-throughput and compliant solutions, and single-use technologies offer significant efficiency advantages. Furthermore, in-house facilities maintain tighter control over quality and timelines, making SUBs integral to agile production strategies.

CMOs and CROs represent the fastest-growing end-user category, driven by the surge in outsourcing of drug development and manufacturing. Startups and small biotechs lacking infrastructure are turning to service providers who specialize in single-use workflows. CDMOs such as Catalent and Thermo Fisher are expanding single-use production lines to serve this growing demand. Their flexibility, speed-to-market, and cost-effectiveness are reshaping the contract services landscape.

The U.S. market for single-use bioprocessing continues to thrive due to a confluence of factors including its expansive pharmaceutical manufacturing base, proactive regulatory environment, and leading position in biologics innovation. Key biomanufacturing hubs in Massachusetts, California, and North Carolina have seen heavy investments in single-use infrastructure. The presence of bioprocessing leaders such as Thermo Fisher Scientific, Sartorius, and Danaher supports strong domestic availability and innovation.

The U.S. government has also played a pivotal role in promoting flexible biomanufacturing through programs like BARDA and Operation Warp Speed. These efforts have catalyzed investments in rapid deployment of vaccine manufacturing platforms that heavily rely on single-use components. Additionally, FDA’s favorable stance on modular manufacturing and its guidance on continuous production are fostering the widespread adoption of disposable systems.

April 2025 – Thermo Fisher Scientific announced a $100 million investment in its single-use technology facility in Nashville, Tennessee, to meet rising demand for bioproduction components.

February 2025 – Pall Corporation (Danaher) unveiled its new Allegro MVP platform designed for scalable and automated single-use manufacturing.

December 2024 – Sartorius Stedim Biotech expanded its site in Yauco, Puerto Rico, to include a new production line for single-use bioreactor bags and filters.

October 2024 – Repligen Corporation acquired a U.S.-based single-use tubing and assembly company to strengthen its supply chain and customization capabilities.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. single-use bioprocessing market

Product

Workflow

End-use