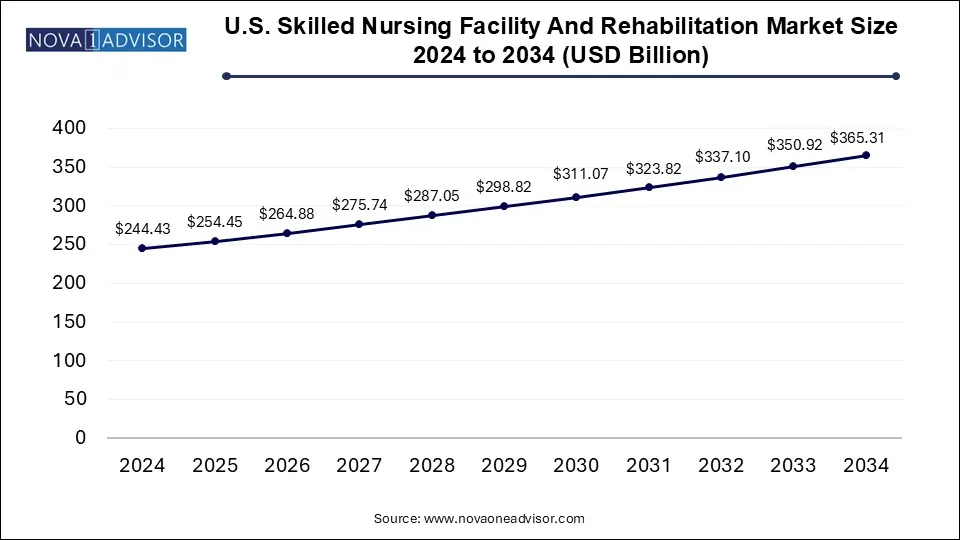

The U.S. skilled nursing facility and rehabilitation market size was exhibited at USD 244.43 billion in 2024 and is projected to hit around USD 365.31 billion by 2034, growing at a CAGR of 4.1% during the forecast period 2025 to 2034.

The rise in the geriatric population and the growing prevalence of chronic diseases is key drivers for the U.S. market. The recent advancements in technology and easier availability of Medicare and Medicaid and private insurance are likely to drive the market during the forecast period.

The skilled nursing and rehabilitation services in the U.S. have a lot of regulations by the government. Skilled nursing and rehabilitation services have to comply with the Code of Federal Regulations (CFR). Code 42 CFR subpart B gives all the requirements for these nursing facilities to comply for receiving payment under Medicare and Medicaid programs.

The reimbursement at skill nursing and rehabilitation facilities is based on Medicare part A & B. Medicare part A gives reimbursement based on inpatient and hospital. According to part A, the prospective payment system is followed where these therapy facilities are paid on the daily basis covering the patient-associated services that include therapy services calculated in minutes nursing along with daily room services. Medicare part B pays for all therapy services given using the CPR codes.

| Report Coverage | Details |

| Market Size in 2025 | USD 254.45 Billion |

| Market Size by 2034 | USD 365.31 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 4.1% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Type of Facility |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | The Ensign Group, Inc; Brookdale Senior Living, Inc; Genesis Healthcare, Inc; Extendicare; Sunrise Senior Living, LLC; ProMedica; Golden Living Centers; Life Care Centers of America |

The freestanding segment dominated the market for U.S. skilled nursing facility and rehabilitation held the largest revenue share of 84.0% in 2024 and is expected to register the fastest CAGR of 4.03% during the forecast period. The freestanding facilities offer skilled nursing and personalized care for 24 hrs. Rehabilitation services like physical and occupational therapy and speech-language, pathology services are also provided at these facilities. The freestanding facilities are the dominating segment because of their lower cost than that of hospital-based facilities.

Hospital-based facilities are having services after the stay in the hospital like wound care, post-acute care and rehabilitation. These facilities boost hospital performance by reducing the length of hospital stay which creates more room for new patients as the older patients are transferred to these facilities. High injuries in the workplace, chronic diseases and an increasing no of accidents boost the market for these hospital-based facilities.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. skilled nursing facility and rehabilitation market

By Type of Facility