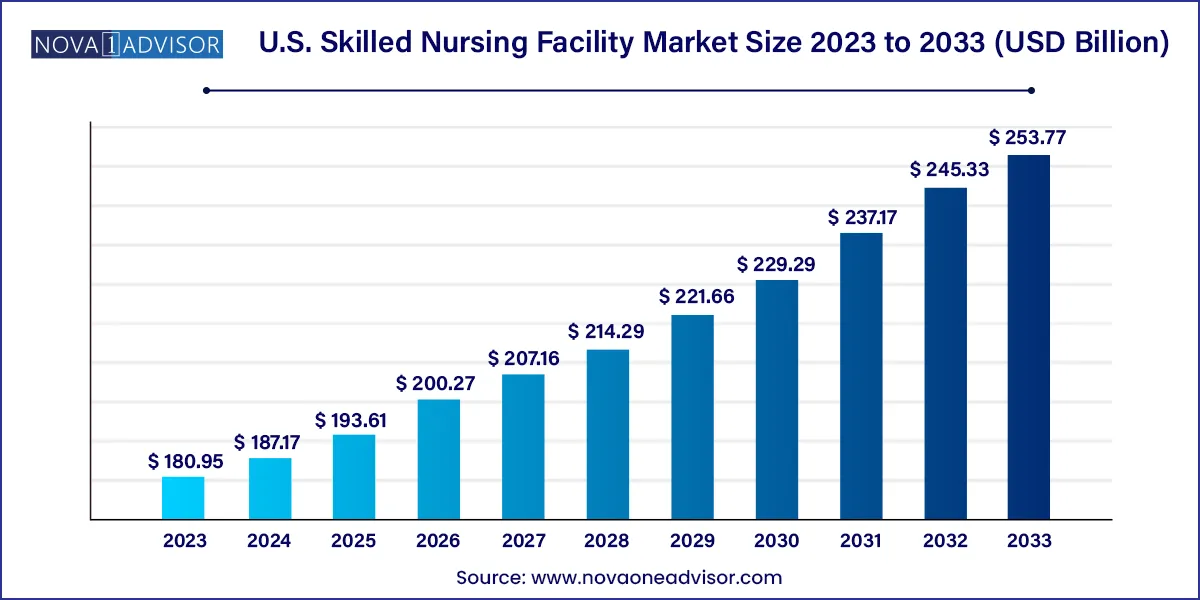

The U.S. skilled nursing facility market size was exhibited at USD 180.95 billion in 2023 and is projected to hit around USD 253.77 billion by 2033, growing at a CAGR of 3.44% during the forecast period 2024 to 2033.

The U.S. Skilled Nursing Facility (SNF) Market plays a pivotal role in the healthcare delivery system, providing medically necessary services to patients who require a higher level of care than typical assisted living facilities but not the full resources of a hospital. These facilities offer rehabilitation, long-term custodial care, and post-acute services primarily for elderly patients or individuals recovering from surgery, stroke, or serious illness. Staffed with licensed nurses and often integrated with physicians and therapists, SNFs are critical for reducing hospital readmissions and managing chronic conditions effectively.

As the U.S. population ages, the demand for skilled nursing care continues to rise, particularly among those aged 75 and older. This trend, coupled with an increasing burden of chronic illnesses such as diabetes, heart disease, and dementia, fuels the need for specialized care services that combine clinical monitoring with rehabilitative therapies. Furthermore, the shift toward value-based care and bundled payment models is placing SNFs at the forefront of cost-effective healthcare transitions.

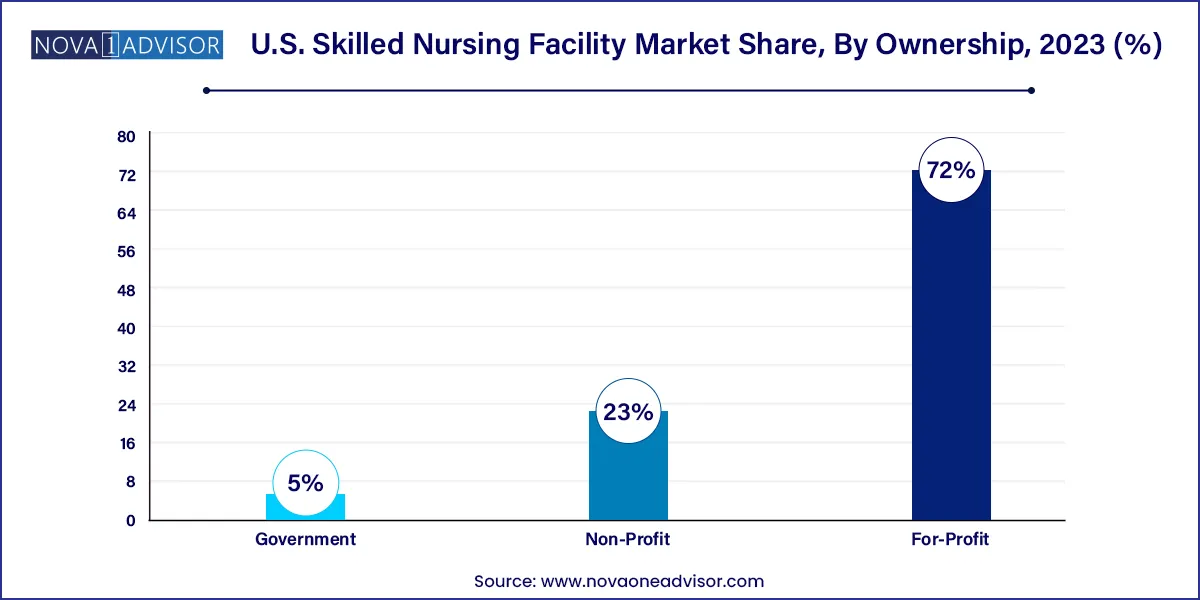

The market is a mix of for-profit, non-profit, and government-run institutions, with operational models varying by ownership and location. The sector is shaped by Medicare and Medicaid reimbursement policies, regulatory mandates, and staffing requirements, all of which influence profitability, capacity, and quality of care. With mounting pressure on quality metrics and patient satisfaction scores, skilled nursing facilities are adopting technological solutions, electronic health record (EHR) systems, and outcome-based care protocols to stay competitive and compliant.

| Report Coverage | Details |

| Market Size in 2024 | USD 187.17 Billion |

| Market Size by 2033 | USD 253.77 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 3.44% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Type of Facility, Ownership |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | The U.S. |

| Key Companies Profiled | Genesis Healthcare; Brookdale Senior Living Solutions; The Ensign Group; Inc; Extendicare; Sunrise Senior Living; LLC; Life Care Services; Golden Living Centres; Life Care Centres of America Corporate; Peninsula behavioral health; Sava Senior Care Administrative Services LLC; Lincare, Inc. |

A primary driver of the U.S. SNF market is the increasing demand for post-acute care services due to the aging population. As life expectancy rises and baby boomers enter their senior years, more Americans are experiencing extended recovery periods after hospitalization, surgery, or acute illness. These patients often require continued medical supervision, physical therapy, wound care, and medication management—services that SNFs are specifically designed to provide.

Moreover, the prevalence of comorbid conditions among the elderly makes at-home recovery challenging, if not unfeasible. Skilled nursing facilities offer a structured, 24-hour supervised environment equipped with the resources to manage complex health issues. With hospitals discharging patients earlier to control costs and free up capacity, SNFs serve as an essential bridge between acute care and home health, making them increasingly vital in care coordination efforts.

One of the most persistent challenges in the skilled nursing sector is navigating the evolving regulatory landscape and reimbursement structure. The reliance on Medicare and Medicaid for funding exposes SNFs to volatility in policy changes, rate cuts, and stringent compliance measures. The implementation of the Patient-Driven Payment Model (PDPM), for instance, has fundamentally altered reimbursement calculations based on patient conditions rather than therapy minutes, affecting revenue flows.

Facilities are also burdened with documentation requirements, audits, and reporting mandates that strain administrative resources. At the same time, meeting quality-of-care benchmarks like staffing ratios, patient safety outcomes, and infection control standards is both essential and costly. These pressures make it difficult for smaller or under-resourced SNFs to remain financially viable, leading to closures or acquisition by larger chains.

An area of significant opportunity within the U.S. SNF market lies in the creation of specialized care programs targeting high-need patient populations. With rising incidences of Alzheimer’s disease, Parkinson’s, and orthopedic conditions requiring rehabilitative therapy, facilities that develop tailored care pathways can differentiate themselves while improving patient outcomes.

Memory care units, for example, that incorporate sensory stimulation, cognitive therapies, and secured environments are in high demand. Similarly, SNFs offering stroke recovery, cardiopulmonary rehabilitation, and pain management services attract referrals from hospitals and physicians. By aligning with accountable care organizations (ACOs) and integrated delivery networks (IDNs), SNFs can strengthen referral streams, share data, and demonstrate value in managing high-risk populations.

Freestanding facilities dominate the U.S. SNF market, accounting for the majority of operational skilled nursing units. These facilities are independently licensed and typically focus on either long-term custodial care or post-acute rehabilitation. Freestanding SNFs have the flexibility to design services around specific community needs and often partner with home health agencies or hospice providers for care continuity. With a broader geographic presence and the ability to scale operations, freestanding SNFs remain a critical access point for skilled nursing services across both rural and suburban regions.

Hospital-based SNFs are among the fastest-growing segments, driven by healthcare systems' emphasis on seamless care transitions and population health management. These units are physically located within or adjacent to hospitals, enabling close collaboration between acute care and post-acute teams. Patients discharged from surgical or intensive care units often transition to hospital-affiliated SNFs for close monitoring, making these facilities essential in lowering readmission rates. As hospitals seek to maintain control over patient outcomes and reimbursement, the integration of SNFs into broader care delivery systems is accelerating.

For-Profit organizations hold the largest share in the skilled nursing market, representing a significant portion of the total number of SNFs in the U.S. These entities often operate large networks under national or regional brands, enabling them to benefit from economies of scale, centralized administrative functions, and standardized quality protocols. While some for-profit SNFs face scrutiny over care quality, many have invested in modern facilities, electronic systems, and patient engagement tools to enhance their offerings and appeal to both patients and payers.

Non-Profit SNFs are emerging as a trusted and fast-growing segment, particularly in communities that prioritize mission-driven care over commercial objectives. These facilities are frequently affiliated with religious organizations, charitable foundations, or academic institutions. Non-profit SNFs tend to report higher patient satisfaction scores and lower staff turnover, attributed to their community-centric models and reinvestment in staff training and resident programming. With an emphasis on holistic care, these facilities often develop palliative care, dementia support, and family engagement services that set them apart in the marketplace.

The skilled nursing facility landscape in the U.S. is shaped by healthcare policy, demographic dynamics, and market consolidation. States like California, Texas, Florida, and New York lead in facility numbers due to their large elderly populations. However, regional disparities in access, staffing availability, and reimbursement rates create challenges for consistent nationwide service delivery.

CMS continues to drive quality improvement initiatives through the Five-Star Quality Rating System and value-based purchasing (VBP) programs. Facilities are incentivized to improve patient outcomes, reduce hospital readmissions, and demonstrate clinical efficiency. Public-private partnerships, telehealth waivers, and Medicare Advantage contracts are reshaping how SNFs are integrated into the broader continuum of care. As healthcare evolves toward home-based and community-centered models, skilled nursing facilities will need to redefine their role while maintaining core competencies in complex care delivery.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. skilled nursing facility market

Type of Facility

Ownership