The U.S. soft drinks market size was exhibited at USD 286.25 billion in 2023 and is projected to hit around USD 601.04 billion by 2033, growing at a CAGR of 7.7% during the forecast period 2024 to 2033.

The U.S. soft drinks market is a dynamic and highly competitive industry, anchored in deep-rooted consumer habits, a strong brand landscape, and continuous innovation. With an estimated value surpassing USD 300 billion in 2024, the market plays a central role in the American food and beverage economy. Soft drinks in the U.S. are more than thirst quenchers—they represent lifestyle choices, convenience culture, social rituals, and wellness aspirations. This wide spectrum of consumption behaviors supports a diverse product lineup, from traditional sodas to emerging health-centric hydration beverages.

Over the past decade, consumer preferences have undergone significant transformation. A growing focus on health and wellness, environmental sustainability, and ethical sourcing has reshaped the market. While legacy carbonated beverages remain staples, their dominance is being gradually challenged by low-calorie drinks, functional beverages, and plant-based hydration alternatives. Moreover, technological advancements in formulation, packaging, and distribution are enabling companies to address evolving demands faster and more efficiently.

Large beverage companies like Coca-Cola and PepsiCo are diversifying into non-carbonated, low-sugar, and fortified options through organic product development and acquisitions. At the same time, independent players and startups are disrupting traditional categories by introducing clean-label, nutrient-enhanced drinks via digital channels. This multi-layered ecosystem continues to flourish due to the U.S. consumers’ high propensity to explore, adapt, and personalize their beverage choices. With climate change influencing sourcing and innovation, and digital transformation changing how consumers interact with brands, the U.S. soft drinks market remains in a state of high-speed evolution.

Health & Wellness-Driven Innovation: Rising concerns about sugar intake, obesity, and overall wellness are prompting consumers to shift toward zero-sugar, low-calorie, and functional beverages enriched with vitamins, electrolytes, or adaptogens.

Sustainability and Eco-Friendly Packaging: Consumer demand for environmentally responsible products is pushing manufacturers to adopt recyclable packaging, plant-based bottles, and water-efficient production practices.

Premiumization and Craft Soft Drinks: Consumers are showing a growing interest in craft sodas and artisanal beverages that offer unique flavors, limited editions, and premium ingredients.

Plant-Based and Botanical Drinks: Beverages incorporating botanical extracts, herbs, and plant-based ingredients are gaining traction as alternatives to traditional synthetic formulations.

Digital-First and DTC Beverage Brands: Brands like OLIPOP and Poppi are succeeding by selling directly through online platforms, leveraging social media influencers, and offering subscription-based models.

Functional Hydration and Mental Wellness: Products with added benefits such as stress relief, energy boost, or enhanced focus are increasingly sought after, especially among millennials and Gen Z.

Flavor Experimentation: Exotic, nostalgic, or global flavor inspirations—like hibiscus, matcha, turmeric, or tamarind—are being infused into soft drinks to appeal to adventurous palates.

Hybrid Beverages: The boundaries between categories are blurring as brands launch drinks that are part soda, part tea, or part juice and energy drink combinations.

| Report Coverage | Details |

| Market Size in 2024 | USD 308.29 Billion |

| Market Size by 2033 | USD 601.04 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 7.7% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Distribution Channel |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. |

| Key Companies Profiled | The Coca‑Cola Company.; PepsiCo; Keurig Dr Pepper; National Beverage Corp.,; Carolina Beverage Corp.; BlueTriton; The Kraft Heinz Company; DS Services of America, Inc.,; Monster Energy Company; AriZona Beverages USA |

The most significant driver of growth in the U.S. soft drinks market is the consumer shift toward health-oriented and functional beverages. As health and wellness trends have permeated all corners of the food and beverage sector, soft drinks have seen a fundamental repositioning. Once associated mainly with sugary sodas, the category now includes vitamin-infused water, prebiotic sodas, nootropic drinks, and clean-label sports beverages.

Consumers are no longer just looking for flavor—they seek beverages that serve a purpose. For instance, a working professional might opt for an energy drink with L-theanine for calm alertness, while a fitness enthusiast might choose an electrolyte drink with added magnesium and BCAAs. Brands like Vitaminwater, BODYARMOR, and Bai have successfully positioned themselves at the intersection of taste and function, significantly increasing their market share. This trend not only expands the consumer base but also increases per-capita consumption by diversifying usage occasions.

A major challenge in the U.S. soft drinks market is navigating regulatory complexities, especially around sugar content, health claims, and labeling transparency. Government regulations aimed at combating obesity and diabetes are putting pressure on soft drink manufacturers to reduce sugar content and disclose nutritional information more explicitly. Several cities and states have proposed or implemented sugar taxes, impacting the profitability of traditionally sweetened carbonated drinks.

In addition, functional beverages, which often boast health-related benefits, are under scrutiny by the FDA regarding the validity and transparency of such claims. This presents a barrier for new and existing brands looking to differentiate through wellness positioning. Failure to comply with emerging guidelines can result in fines, product recalls, or reputational damage, thereby constraining innovation and time-to-market for new launches.

The expansion of direct-to-consumer (DTC) and personalized beverage platforms presents a significant opportunity in the U.S. soft drinks space. E-commerce is not only a sales channel but also a brand-building tool. Brands like Hint Water and OLIPOP are leveraging their online presence to educate, personalize, and engage with customers. Subscription boxes, personalized flavor profiles, and customer data analytics enable these brands to build loyalty and adjust offerings quickly.

Moreover, DTC allows beverage companies to bypass traditional retail gatekeepers, manage margins better, and test niche products on smaller scales. With AI and machine learning integration, companies can now provide personalized hydration solutions based on lifestyle, activity levels, and taste preferences. This high-touch consumer engagement, when paired with fast shipping and value-driven pricing, is reshaping consumer expectations across the category.

Carbonated drinks dominated the U.S. soft drinks market in terms of volume and value, holding the largest share in 2024. Despite a slight dip in growth due to rising health concerns, brands like Coca-Cola, Pepsi, and Dr Pepper continue to command shelf space and consumer loyalty. Their robust marketing efforts, product diversification (e.g., zero sugar, caffeine-free), and cultural relevance maintain their widespread appeal. These drinks also benefit from their longstanding association with fast food chains, movie theaters, and sporting events. New flavors and seasonal editions have played a role in keeping consumer interest alive, even as consumption moderation grows.

Energy drinks are projected to be the fastest-growing product segment through 2034. These beverages, once considered niche, have become mainstream among working professionals, athletes, and college students. Brands like Red Bull, Monster, and Celsius have seen explosive growth by targeting lifestyle positioning—whether it's productivity, performance, or mental focus. Innovations such as sugar-free formulations, natural caffeine, and adaptogenic blends are further fueling demand. New entrants with cleaner labels and functional ingredients—like plant-based energy or mood-enhancing elements—are also disrupting the segment. These beverages’ strong presence in convenience stores and gyms contributes to high repeat purchases.

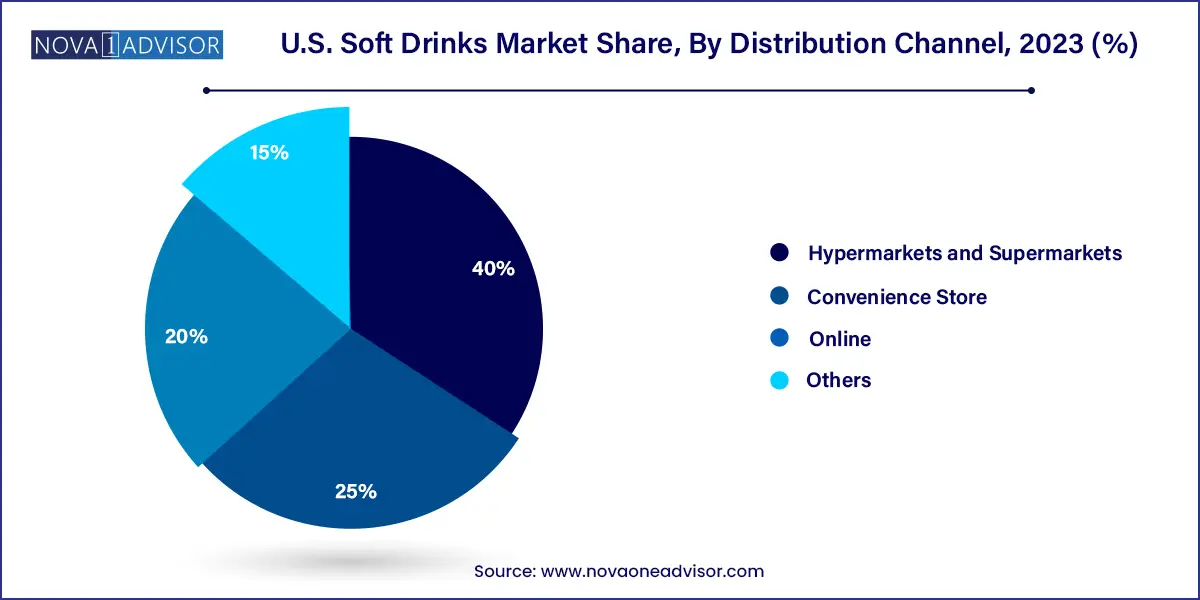

Hypermarkets and supermarkets are the dominant distribution channels, thanks to their vast product assortments, in-store promotions, and mass-market accessibility. Major retail chains like Walmart, Kroger, and Costco have dedicated beverage aisles, offering everything from legacy sodas to emerging wellness drinks. Their ability to support bundling, bulk discounts, and exclusive partnerships makes them vital for brand visibility and trial. Seasonal promotions, such as Super Bowl or summer-themed beverage packs, contribute significantly to spike volumes in this channel.

Online sales are the fastest-growing distribution channel, witnessing a steep rise post-pandemic. Shoppers increasingly prefer ordering drinks online for convenience, variety, and direct access to niche brands. E-commerce platforms offer not only standard products but also customizable bundles, loyalty programs, and exclusive digital-first launches. The convenience of auto-replenishment through subscription models and influencer marketing has been a boon for online-first brands. Whether via Amazon, Walmart.com, or brand-owned websites, digital is becoming the primary touchpoint for younger and health-conscious consumers who prioritize education and ingredient transparency.

In the U.S., the soft drinks market is shaped by demographic diversity, regional lifestyle patterns, and evolving public policy. For instance, urban areas such as New York, San Francisco, and Chicago are seeing a shift toward wellness beverages like kombucha, vitamin waters, and low-sugar iced teas. These cities also host a higher concentration of premium and artisanal beverage brands that cater to eco-conscious and affluent consumers. Local co-ops and organic grocery chains carry exclusive regional labels and new-age brands.

Conversely, rural and suburban areas show higher consumption of traditional sodas, energy drinks, and large-format value packs. Southern states like Texas and Georgia continue to be high per-capita consumers of carbonated beverages, driven by cultural habits, climate, and dining preferences. The Midwest shows a growing fondness for sports and energy drinks, especially among young male demographics. The West Coast, however, is leading in plant-based, organic, and functional drinks due to a stronger wellness ecosystem and regulatory push against sugar.

Seasonal preferences also play a role: cold beverages such as iced teas and sparkling waters see spikes during summer, while richer flavors in carbonated drinks gain traction in colder months. Holidays, sports events, and college semesters influence demand cycles, giving brands numerous touchpoints to launch limited editions and aggressive campaigns.

February 2025 – PepsiCo launched “Stardust,” a line of limited-edition cosmic-flavored sodas under its Starry brand, with a marketing campaign that leveraged augmented reality (AR) filters on Instagram and TikTok.

March 2025 – Coca-Cola acquired a majority stake in a botanical energy drink startup called “ZenRoot” to expand its wellness-focused beverage portfolio. The deal marked Coca-Cola’s strategic push into herbal and natural ingredients.

January 2025 – Monster Beverage Corp. unveiled its new “Unleashed Naturals” range, which includes organic, adaptogenic energy drinks targeting wellness-conscious millennials and gym-goers.

December 2024 – OLIPOP, a prebiotic soda brand, raised $45 million in Series C funding, with plans to increase nationwide retail presence and invest in microbiome-friendly R&D.

November 2024 – Red Bull USA partnered with Uber Eats to offer flash delivery of energy drinks during sports games and late-night events, creating a new digital impulse channel.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. soft drinks market

Product

Distribution Channel