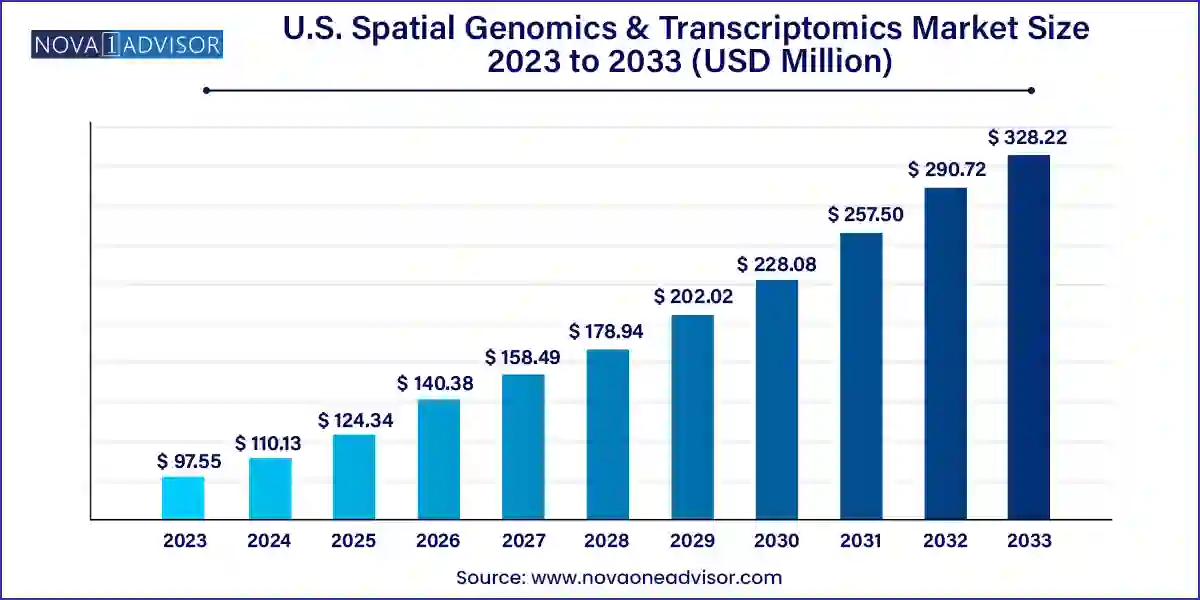

The U.S. spatial genomics & transcriptomics market size was exhibited at USD 97.55 million in 2023 and is projected to hit around USD 328.22 million by 2033, growing at a CAGR of 12.9% during the forecast period 2024 to 2033.

The U.S. Spatial Genomics and Transcriptomics market is emerging as one of the most promising sectors within the broader life sciences industry, driven by the need to unravel the spatial organization of biological molecules in tissues. These technologies offer insights into the complex architecture of tissues, enabling researchers to understand gene expression within the cellular context. This is particularly crucial for comprehending diseases such as cancer, neurodegenerative disorders, and autoimmune conditions at a molecular level.

Spatial genomics and transcriptomics represent the convergence of next-generation sequencing, advanced imaging, and bioinformatics tools. The growing application of these technologies in translational research, drug development, and personalized medicine has significantly expanded the market's footprint across the U.S. With the shift toward precision medicine, these tools help uncover cell-specific gene activity and spatial distribution, offering unparalleled insights into tissue microenvironments.

Adoption is widespread across academic institutions, biotech startups, pharmaceutical companies, and clinical research organizations. Government funding initiatives, such as those by the National Institutes of Health (NIH) and National Cancer Institute (NCI), are also fueling market growth. Moreover, integration with AI and machine learning is facilitating the analysis of high-dimensional data, transforming how scientists interpret complex spatial datasets.

Convergence of Spatial Data and AI: Use of AI and machine learning to decode massive spatial transcriptomic datasets.

Miniaturization and Automation: Development of compact, semi-automated platforms that allow high-throughput analysis.

Expansion in Single-Cell Analysis: Increasing focus on resolving spatial heterogeneity at the single-cell level.

Shift Toward In-Vivo Applications: Progress in real-time spatial transcriptomics techniques such as TIVA.

Integrated Multi-Omics Approaches: Fusion of transcriptomics with proteomics, metabolomics, and epigenomics.

Adoption in Oncology: Strong emphasis on cancer microenvironment mapping using spatial tools.

Open-Source Bioinformatics Tools: Growing availability of community-supported platforms like Seurat and Giotto.

Spatial Atlas Projects: Initiatives like Human BioMolecular Atlas Program (HuBMAP) driving demand.

Collaborations Between Tech and Pharma: Increased partnerships to accelerate biomarker discovery.

Rise of Spatial Proteogenomics: Integrating protein and gene expression for a holistic cellular view.

| Report Coverage | Details |

| Market Size in 2024 | USD 110.13 Million |

| Market Size by 2033 | USD 328.22 Million |

| Growth Rate From 2024 to 2033 | CAGR of 12.9% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Technology, End-use |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | U.S. |

| Key Companies Profiled | NanoString Technologies, Inc.; S2 Genomics, Inc.; Illumina, Inc.; Dovetail Genomics; 10x Genomics; Seven Bridges Genomics; Readcoor, Inc; Bio-Techne; Advanced Cell Diagnostics (ACD) |

One of the most compelling drivers of this market is the increasing application of spatial transcriptomics in oncology. Understanding the tumor microenvironment and how gene expression varies within a single tumor mass is critical for developing targeted therapies. Spatial transcriptomics allows oncologists to identify tumor heterogeneity, immune infiltration, and gene activity across different regions of the tumor.

For instance, in breast cancer research, spatial transcriptomics has helped distinguish between aggressive and dormant cancer regions by examining gene expression in situ. Pharmaceutical companies are leveraging this technology to stratify patient populations and enhance the success rate of clinical trials by targeting gene expression profiles more accurately. As precision oncology becomes mainstream, spatial tools will continue to serve as foundational technologies.

Despite their immense promise, the high cost and technical complexity of spatial genomics and transcriptomics platforms remain a significant restraint. Instruments often require specialized laboratory setups, high-throughput sequencers, and advanced imaging equipment. Additionally, they demand skilled personnel proficient in molecular biology and computational biology, creating barriers for widespread adoption in smaller labs.

Operational expenses are also elevated due to the need for high-quality reagents, sample preparation kits, and proprietary software for data analysis. While prices are expected to decline with technological maturity, the current cost dynamics limit accessibility primarily to well-funded academic or corporate institutions. Until more cost-effective, user-friendly systems become available, the adoption curve will remain steep for many end-users.

The future growth of the U.S. spatial genomics and transcriptomics market lies in integrating these platforms with AI-powered analytics. Spatial datasets are inherently complex, featuring hundreds of thousands of data points mapped over three-dimensional tissue architecture. AI and machine learning algorithms can identify hidden patterns, classify cell types, and predict disease progression by analyzing these datasets.

Several startups are emerging with dedicated platforms that couple spatial omics data with AI workflows. These tools not only enhance interpretation speed and accuracy but also allow for real-time feedback in clinical research. In pharmaceutical R&D, AI integration is enabling automated biomarker discovery and predictive modeling, which significantly reduces time-to-market for novel therapies.

Spatial transcriptomics leads the product segment, especially sequencing-based methods such as FFPE tissue sample analysis and laser capture microdissection (LCM). These technologies are widely used in cancer biology, where spatial context is crucial to understanding tumor heterogeneity. The ability to preserve spatial coordinates during sequencing enables the identification of gene expression signatures in specific tissue compartments, enhancing therapeutic targeting and patient stratification.

Meanwhile, spatial genomics is witnessing the fastest growth, especially techniques like FISH and massively-parallel sequencing. As more genomic tools become spatially integrated, researchers are increasingly turning to these methods to investigate genomic rearrangements, epigenetic markers, and DNA interactions within a tissue context. Genome perturbation and biochemical techniques are also gaining popularity, particularly in developmental biology and neuroscience.

Instruments dominated the technology segment, primarily due to their indispensable role in generating spatial genomic and transcriptomic data. These instruments, such as automated slide scanners, high-resolution fluorescence microscopes, and NGS platforms, are foundational to spatial workflows. Their adoption is high in academic research centers and biopharma labs, where precision and reproducibility are critical. Companies like 10x Genomics, NanoString, and Vizgen have developed platforms with integrated imaging and sequencing capabilities, making them central to the experimental pipeline.

Conversely, software is the fastest-growing segment, driven by the need to process, visualize, and interpret vast amounts of spatial data. Bioinformatics tools, including both commercial software and open-source platforms, enable 3D visualization and spatial mapping of gene expression. Imaging tools, cloud-based storage, and analytical databases are becoming increasingly sophisticated, enabling deeper insights into tissue architecture and disease pathology.

Academic customers account for the dominant market share, largely due to ongoing research grants, federal funding, and the widespread deployment of spatial platforms in universities and institutes. These institutions are using spatial tools to explore cell lineage, organ development, and disease progression. Major universities are leading initiatives in spatial atlas development and often collaborate with private companies to validate new technologies.

On the other hand, pharmaceutical manufacturers represent the fastest-growing end-use segment. The need to discover novel drug targets, validate biomarkers, and understand tissue-level drug response is accelerating the adoption of spatial technologies in pharma. These companies are leveraging spatial data to improve clinical trial design, stratify patients, and enhance regulatory submissions with robust data sets.

The U.S. serves as the global epicenter for spatial genomics and transcriptomics innovation. With its combination of top-tier research institutions, biotech clusters, and funding mechanisms, the country has fostered a conducive ecosystem for this emerging field. States like Massachusetts (Boston-Cambridge), California (Bay Area and San Diego), and North Carolina (Research Triangle) are hotbeds of spatial research activity, housing major academic institutions and startups.

Government programs like the NIH’s Human Biomolecular Atlas Program (HuBMAP) have been instrumental in mapping the human body at cellular resolution, driving demand for spatial technologies. In parallel, venture capital funding for biotech startups working in spatial omics has surged in the U.S., encouraging further innovation. Educational programs are also expanding to include spatial biology training, ensuring a robust future workforce to support the market's long-term growth.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. spatial genomics & transcriptomics market

Technology

Product

End-use