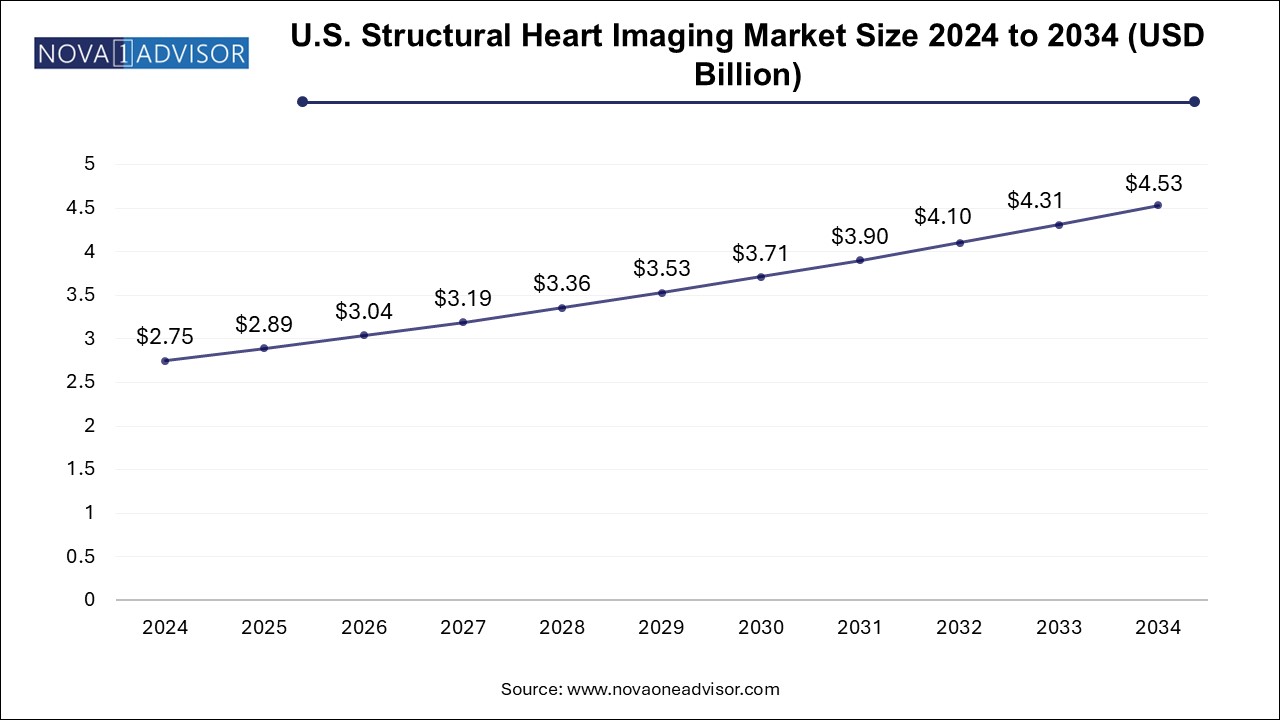

The U.S. structural heart imaging market size was exhibited at USD 2.75 billion in 2024 and is projected to hit around USD 4.53 billion by 2034, growing at a CAGR of 5.11% during the forecast period 2025 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 2.89 Billion |

| Market Size by 2034 | USD 4.53 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 5.11% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Modality, Procedure, Application, End-use |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | Siemens Healthineers; GE Healthcare; Koninklijke Philips N.V.; Canon Medical Systems; Fujifilm Holdings Corporation; Shanghai United Imaging Healthcare Co., LTD; Abbott; Terumo Corporation; Samsung Medison Co., Ltd.; Lepu Medical Technology |

The rising prevalence of structural heart diseases, an aging population, and increasing adoption of minimally invasive procedures like TAVR and TMVR. Technological advancements such as 3D/4D echocardiography, AI-powered diagnostics, and fusion imaging have improved accuracy and efficiency in diagnosis and treatment planning. Expanding hospital infrastructure, increased awareness of early diagnosis, and collaborations between imaging companies and healthcare providers further fuel market growth.

The expansion of structural heart imaging in the U.S. is primarily driven by the growing prevalence of heart diseases and an increasing emphasis on preventive health checkups. Structural heart diseases, such as aortic stenosis, mitral regurgitation, and congenital heart defects, are becoming more common, particularly among the aging population, which is more vulnerable to these conditions. Early detection and accurate diagnosis are essential for managing these diseases effectively, fueling the demand for advanced imaging technologies. Simultaneously, patients are increasingly aware of the importance of preventive healthcare. People are increasingly opting for regular health screenings to detect potential cardiovascular issues before they become severe, which has led to a greater reliance on structural heart imaging solutions.

The presence of major manufacturers, such as Siemens Healthineers, GE Healthcare, and Koninklijke Philips N.V., is significantly driving market growth in the U.S. These industry leaders are consistently innovating and introducing advanced imaging products to meet the growing demand for accurate and efficient diagnostic solutions. For instance, in August 2024, Siemens Healthineers received FDA clearance for the ACUSON Origin, an advanced cardiovascular ultrasound system integrated with artificial intelligence (AI) capabilities. This advanced system is designed to enhance diagnostic accuracy and streamline workflows, demonstrating the industry's focus on leveraging AI to improve imaging outcomes. The continuous efforts of these key players to develop and commercialize new technologies not only cater to the rising prevalence of structural heart diseases but also strengthen the market's growth by offering healthcare providers state-of-the-art tools for patient care.

The angiogram segment held the largest market share of about 36.4% in 2024. This dominance can be attributed to its widespread use in diagnosing and evaluating structural heart diseases, such as coronary artery disease and congenital heart defects. Angiograms provide detailed imaging of blood vessels, enabling precise visualization of blockages, abnormalities, or structural issues, which are critical for treatment planning. In addition, advancements in imaging technologies, such as digital subtraction angiography (DSA) and 3D angiography, have further enhanced the accuracy and efficiency of these procedures, driving their adoption.

The CT segment is expected to grow at the fastest CAGR of 8% over the forecast period; this can be attributed to its increasing adoption in diagnosing and evaluating structural heart diseases. Computed tomography (CT) provides high-resolution, 3D images of the heart and surrounding structures, offering unparalleled accuracy in detecting anomalies such as valve defects, congenital abnormalities, and coronary artery disease. The integration of advanced technologies, such as dual-energy CT and AI-powered image processing, has further enhanced its diagnostic capabilities and efficiency. Moreover, the growing demand for non-invasive diagnostic methods and the expanding use of CT in pre-procedural planning for interventions like TAVR and TMVR contribute to this segment growth.

Transcatheter Aortic Valve Replacement (TAVR) segment dominated the market by capturing a share of 23.4% in 2024. This dominance is owing to the growing preference for minimally invasive procedures to treat aortic stenosis, especially among high-risk and elderly patients who cannot undergo open-heart surgery. TAVR offers numerous benefits, including faster recovery times, lower procedural risks, and better patient outcomes, making it a suitable option for both patients and healthcare providers. Moreover, advancements in imaging technologies such as 3D echocardiography and CT have improved procedural planning and guidance, further boosting the adoption of TAVR. The rising prevalence of aortic stenosis and expanding FDA approvals have increased the segment's leading position in the structural heart imaging industry.

The Transcatheter Mitral Valve Repair (TMVR) segment is expected to grow significantly with a CAGR of 7.24% over the forecast period 2025 to 2034. This growth is driven by the increasing prevalence of mitral valve diseases, such as mitral regurgitation, particularly among the aging population. TMVR offers a minimally invasive alternative to open-heart surgery, making it an attractive option for high-risk patients or those ineligible for traditional surgical procedures. Advancements in imaging technologies, including 3D/4D echocardiography and fusion imaging, have enhanced procedural accuracy and outcomes, further encouraging the adoption of TMVR.

The interventional cardiology segment dominated the market by capturing a share of more than 59.8% in 2024 and is also expected to grow at the fastest CAGR over the forecast period. This dominance is attributed to the increasing prevalence of cardiovascular diseases, including structural heart conditions, which require advanced interventional procedures for treatment. Furthermore, the adoption of minimally invasive techniques, such as Transcatheter Aortic Valve Replacement (TAVR) and Transcatheter Mitral Valve Repair (TMVR), depends on interventional cardiology devices and imaging technologies. Advancements in imaging systems, including 3D/4D echocardiography and intravascular ultrasound (IVUS), have significantly improved these procedures' precision and success rates, contributing to their growing popularity.

The diagnostic imaging segment is also expected to grow over the forecast period. This is owing to the increasing demand for accurate and non-invasive diagnostic tools for detecting and evaluating structural heart diseases. Advancements in imaging technologies, such as 3D/4D echocardiography, cardiac MRI, and CT, are enhancing diagnostic precision and procedural planning, driving adoption. Furthermore, the rising prevalence of cardiovascular conditions and the growing focus on early diagnosis and preventive healthcare are further contributing to the segment's expansion.

Hospitals & clinics segment dominated the market with a share of nearly 55.0% in 2024, driven by the availability of advanced diagnostic and imaging technologies, skilled healthcare professionals, and comprehensive patient care services. These facilities are primary points of care for diagnosing and treating structural heart diseases, offering access to advanced equipment and minimally invasive procedures such as TAVR and TMVR. Moreover, the growing prevalence of cardiovascular diseases and increasing patient visits for early diagnosis and treatment further contribute to the segment's growth.

The ambulatory surgical centers segment is anticipated to experience the fastest growth of 6.80% over the forecast period. This growth is driven by the increasing demand for cost-effective, efficient, and minimally invasive procedures performed in outpatient settings. ASCs offer shorter wait times, reduced hospital stays, and lower procedural costs compared to traditional hospital settings, making them an attractive option for patients and providers. In addition, advancements in portable imaging technologies and the growing preference for same-day procedures are fueling this segment's expansion.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. structural heart imaging market

By Modality

By Procedure

By Application

By End-use

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.1.1. Modality

1.1.2. Procedure

1.1.3. Application

1.1.4. End use

1.1.5. Estimates and forecast timeline

1.2. Research Methodology

1.3. Information Procurement

1.3.1. Purchased database

1.3.2. internal database

1.3.3. Secondary sources

1.3.4. Primary research

1.3.5. Details of primary research

1.4. Information or Data Analysis

1.4.1. Data analysis models

1.5. Market Formulation & Validation

1.6. Model Details

1.6.1. Commodity flow analysis (Model 1)

1.6.1.1. Approach 1: Commodity flow approach

1.6.2. Volume price analysis (Model 2)

1.6.2.1. Approach 2: Volume price analysis

1.7. List of Secondary Sources

1.8. List of Primary Sources

1.9. Objectives

1.9.1. Objective 1

1.9.2. Objective 2

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.2.1. Modality outlook

2.2.2. Procedure outlook

2.2.3. Application outlook

2.2.4. End use outlook

2.3. Competitive Insights

Chapter 3. U.S. Structural Heart Imaging Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook

3.2. Penetration & Growth Prospect Mapping

3.3. Industry Value Chain Analysis

3.3.1. Reimbursement framework

3.4. Market Dynamics

3.4.1. Market driver analysis

3.4.1.1. Growing prevalence of cardiac diseases

3.4.1.2. Technological advancements

3.4.1.3. Increasing adoption of minimally invasive procedures

3.4.2. Market restraint analysis

3.4.2.1. High cost of advanced imaging systems

3.4.2.2. Stringent regulatory approvals

3.5. U.S. Structural Heart Imaging Market Analysis Tools

3.5.1. Industry Analysis - Porter’s

3.5.1.1. Supplier power

3.5.1.2. Buyer power

3.5.1.3. Substitution threat

3.5.1.4. Threat of new entrant

3.5.1.5. Competitive rivalry

3.5.2. PESTEL Analysis

3.5.2.1. Political landscape

3.5.2.2. Technological landscape

3.5.2.3. Economic landscape

Chapter 4. U.S. Structural Heart Imaging Market: Modality Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. U.S. Structural Heart Imaging Modality Market Movement Analysis

4.3. U.S. Structural Heart Imaging Market Size & Trend Analysis, by Modality, 2021 - 2034 (USD Million)

4.4. Echocardiogram

4.4.1. Echocardiogram market estimates and forecast 2021 - 2034 (USD Million)

4.5. Angiogram

4.5.1. Angiogram market estimates and forecast 2021 - 2034 (USD Million)

4.6. CT

4.6.1. CT market estimates and forecast 2021 - 2034 (USD Million)

4.7. MRI

4.7.1. MRI market estimates and forecast 2021 - 2034 (USD Million)

4.8. Nuclear Imaging

4.8.1. Nuclear imaging market estimates and forecast 2021 - 2034 (USD Million)

4.9. Other Modalities

4.9.1. Other modalities market estimates and forecast 2021 - 2034 (USD Million)

Chapter 5. U.S. Structural Heart Imaging Market: Procedure Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. U.S. Structural Heart Imaging Procedure Market Movement Analysis

5.3. U.S. Structural Heart Imaging Market Size & Trend Analysis, by Procedure, 2021 - 2034 (USD Million)

5.4. Transcatheter Aortic Valve Replacement (TAVR)

5.4.1. Transcatheter Aortic Valve Replacement (TAVR) market estimates and forecast 2021 - 2034 (USD Million)

5.5. Surgical Aortic Valve Replacement (SAVR)

5.5.1. Surgical Aortic Valve Replacement (SAVR) market estimates and forecast 2021 - 2034 (USD Million)

5.6. Transcatheter Mitral Valve Repair (TMVR)

5.6.1. Transcatheter Mitral Valve Repair (TMVR) market estimates and forecast 2021 - 2034 (USD Million)

5.7. Left Atrial Appendage Closure (LAAC)

5.7.1. Left Atrial Appendage Closure (LAAC) market estimates and forecast 2021 - 2034 (USD Million)

5.8. Tricuspid Valve Replacement and Repair

5.8.1. Tricuspid Valve Replacement and Repair market estimates and forecast 2021 - 2034 (USD Million)

5.9. Paravalvular Leak Detection and Repair

5.9.1. Paravalvular Leak Detection and Repair market estimates and forecast 2021 - 2034 (USD Million)

5.10. Annuloplasty

5.10.1. Annuloplasty market estimates and forecast 2021 - 2034 (USD Million)

5.11. Valvuloplasty

5.11.1. Valvuloplasty market estimates and forecast 2021 - 2034 (USD Million)

5.12. Other Structural Heart Procedures

5.12.1. Other Structural Heart Procedures market estimates and forecast 2021 - 2034 (USD Million)

Chapter 6. U.S. Structural Heart Imaging Market: Application Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. U.S. Structural Heart Imaging Application Market Movement Analysis

6.3. U.S. Structural Heart Imaging Market Size & Trend Analysis, by Application, 2021 - 2034 (USD Million)

6.4. Diagnostic Imaging

6.4.1. Diagnostic imaging market estimates and forecasts 2021 - 2034 (USD Million)

6.5. Interventional Cardiology

6.5.1. Interventional cardiology market estimates and forecasts 2021 - 2034 (USD Million)

Chapter 7. U.S. Structural Heart Imaging Market: End Use Estimates & Trend Analysis

7.1. Segment Dashboard

7.2. U.S. Structural Heart Imaging End Use Market Movement Analysis

7.3. U.S. Structural Heart Imaging Market Size & Trend Analysis, by End Use, 2021 - 2034 (USD Million)

7.4. Hospitals & clinics

7.4.1. Hospitals & clinics estimates and forecast 2021 - 2034 (USD Million)

7.5. Ambulatory Surgical Centers

7.5.1. Ambulatory surgical centers market estimates and forecast 2021 - 2034 (USD Million)

7.6. Diagnostic Imaging Centers

7.6.1. Diagnostic imaging centers market estimates and forecast 2021 - 2034 (USD Million)

7.7. Other end use

7.7.1. Other end use market estimates and forecast 2021 - 2034 (USD million)

Chapter 8. Competitive Landscape

8.1. Recent Developments & Impact Analysis, By Key Market Participants

8.2. Company/Competition Categorization

8.3. Key company market share analysis, 2024

8.4. Company Position Analysis

8.5. Company Categorization (Emerging Players, Innovators and Leaders

8.6. Company Profiles

8.6.1. Siemens Healthineers

8.6.1.1. Company overview

8.6.1.2. Financial performance

8.6.1.3. Product benchmarking

8.6.1.4. Strategic initiatives

8.6.2. GE Healthcare

8.6.2.1. Company overview

8.6.2.2. Financial performance

8.6.2.3. Product benchmarking

8.6.2.4. Strategic initiatives

8.6.3. Koninklijke Philips N.V.

8.6.3.1. Company overview

8.6.3.2. Financial performance

8.6.3.3. Product benchmarking

8.6.3.4. Strategic initiatives

8.6.4. Canon Medical Systems

8.6.4.1. Company overview

8.6.4.2. Financial performance

8.6.4.3. Product benchmarking

8.6.4.4. Strategic initiatives

8.6.5. Fujifilm Holdings Corporation

8.6.5.1. Company overview

8.6.5.2. Financial performance

8.6.5.3. Product benchmarking

8.6.5.4. Strategic initiatives

8.6.6. Shanghai United Imaging Healthcare Co., LTD

8.6.6.1. Company overview

8.6.6.2. Financial performance

8.6.6.3. Product benchmarking

8.6.6.4. Strategic initiatives

8.6.7. Abbott

8.6.7.1. Company overview

8.6.7.2. Financial performance

8.6.7.3. Product benchmarking

8.6.7.4. Strategic initiatives

8.6.8. Terumo Corporation

8.6.8.1. Company overview

8.6.8.2. Financial performance

8.6.8.3. Product benchmarking

8.6.8.4. Strategic initiatives

8.6.9. Samsung Medison Co., Ltd.

8.6.9.1. Company overview

8.6.9.2. Financial performance

8.6.9.3. Product benchmarking

8.6.9.4. Strategic initiatives

8.6.10. Lepu Medical Technology

8.6.10.1. Company overview

8.6.10.2. Financial performance

8.6.10.3. Product benchmarking

8.6.10.4. Strategic initiatives