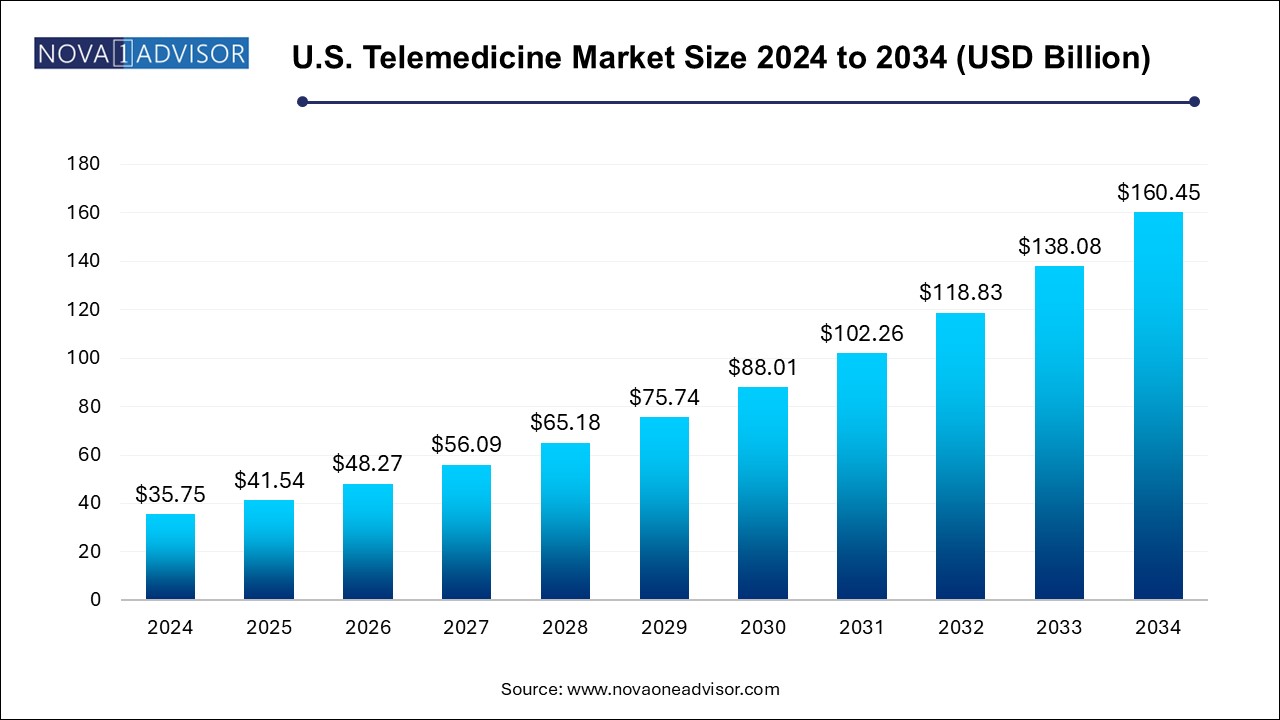

The U.S. telemedicine market size was exhibited at USD 35.75 billion in 2024 and is projected to hit around USD 160.45 billion by 2034, growing at a CAGR of 16.2% during the forecast period 2024 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 41.54 Billion |

| Market Size by 2034 | USD 160.45 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 16.2% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Component, Modality, Application, Delivery Model, Facility, End user |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | MDlive, Inc. (Evernorth); American Well Corporation; Twilio Inc.; Teladoc Health, Inc.; Doctor On Demand, Inc. (Included Health); Zoom Video Communications, Inc.; SOC Telemed, Inc.; NXGN Management, LLC; HP Development Company, L.P.; Practo; VSee |

This growth is driven by factors such as strategic initiatives from key companies and a rise in healthcare consumerism. In addition, the increasing adoption of telemedicine by healthcare providers, growing patient acceptance, and consumer demand are expected to enhance the quality of care and contribute significantly to the telemedicine industry growth during the forecast period. For instance, according to a report from Rock Health published in February 2023, 80% of individuals have used a telemedicine service at least once in their lifetime. Furthermore, according to McKinsey’s Consumer Health Insights survey from November 2021, 55% of patients reported greater satisfaction with telehealth or virtual care visits compared to traditional in-person appointments.

Growing adoption of smartphones by consumers is driving U.S. telemedicine industry growth. As of 2023, the Demandsage report indicates that 82.2% of individuals in the U.S. owned smartphones. Furthermore, continuous advancement in network infrastructure and growing network coverage are boosting the demand for telemedicine services. According to the Kepios analysis, in January 2024, there were 331.1 million people using the internet in the U.S. The internet penetration rate in the U.S. reached 97.1% of the total population at the beginning of 2024. The analysis from Kepios shows that the number of internet users in the USA grew by 1.8 million (+0.5 percent) from January 2023 to January 2024.

In addition, limited healthcare availability in isolated regions is anticipated to be a significant factor propelling market expansion throughout the projected timeframe. For instance, in February 2024, Theresa Greenfield, the State Director of USDA Rural Development in Iowa, revealed that the Agency is allocating USD 1.8 million through three grants to enhance telemedicine and distance learning services, aiming to improve access to educational, training, and healthcare resources that are often limited or inaccessible in rural areas of Iowa.

In addition, developing economies with shortage of healthcare resources are using digital technologies to meet their healthcare needs. According to the National Center for Health Workforce Analysis, as of November 2023, around 102 million individuals reside in primary care Health Professional Shortage Areas (HPSAs), while 77 million individuals live in dental health HPSAs. In total, 167 million people, nearly half of the U.S. population, inhabit mental health HPSAs. The growing number of individuals residing in Health Professional Shortage Areas is expected to contribute to market growth. Moreover, rapid advancements in technology are expected to further boost the demand for online consultation, thereby contributing to market growth of telemedicine solutions and services over the forecast period.

By component, the product segment dominated the market in 2024 and is anticipated to witness significant growth during the forecast period. Telemedicine products allow virtual meetings, multi-group teleconsultation, surgery demonstration, teleconsultation, tele-education, tele-practice, and more. Moreover, telemedicine products have some significant advantages over conventional methods of medical management. For instance, next-generation telemedicine helps save time of commute and offers real-time support. Therefore, the segment is expected to grow lucratively over the forecast period. Increasing launch of new products is fostering telemedicine industry growth. In September 2022, RxDefine now known as Ostro, a prominent engagement platform focused on educating and empowering both healthcare consumers and healthcare professionals, revealed the introduction of RxTelehealth, its telehealth solution designed for life sciences companies.

The services segment in the telemedicine market is anticipated to witness the fastest growth with a CAGR of 17.1% over the forecast period. The ongoing shift towards value-based care and preventive healthcare is contributing to the expansion of telemedicine services. In August 2024, Concentra, a prominent provider of occupational medicine, revealed the introduction of its behavioral health service through Concentra Telemed, the telemedicine platform for workers’ compensation. The behavioral health telemedicine service offered by Concentra will serve as a crucial care option that smoothly integrates into the workers’ compensation system.

By modality, the real-time segment dominated the market with a revenue share of 38.3% in 2024. Real-time telemedicine technologies offer an extra edge for patient monitoring via the use of electronic mediums, mainly video conferencing. This allows for a truly interactive experience between the patient and physician, making the medical assessments easier. In addition, the convenience of virtual consultations, particularly for routine check-ups, mental health support, and urgent care is supplementing telemedicine industry growth. Moreover, with the rapid advancements in video conferencing technology, internet connectivity, and wearable health devices, real-time telemedicine has become more reliable and accessible.

The store and forward segment in the telemedicine market is anticipated to witness the fastest CAGR growth over the forecast period. Store-and-forward systems enable the digital transfer of patient information, such as documents, digital images, and pre-recorded videos, through a secure messaging service to a cloud-based platform. This technology is particularly beneficial for evidence-based care. As compared to real-time visit, this technology offers data access after it has been collected, reduces waiting time, and includes communication tools. The most common applications of store-and-forward or asynchronous telemedicine consultations are in fields such as pathology, radiology, ophthalmology, and dermatology. Furthermore, store-and-forward technology enhances patient satisfaction and improves treatment efficiency.

By application, the teleradiology segment dominated the market with a share of 24.3% in 2024. The teleradiology segment is growing rapidly due to the increasing demand for diagnostic imaging services. Moreover, advancements in imaging technologies, including high-definition CT scans and MRIs, the integration of AI, and improved image compression and storage solutions, are enhancing the quality and efficiency of teleradiology services. In September 2024, Experity, the national leader in on-demand healthcare solutions, revealed a significant upgrade to its teleradiology overread services, featuring an integration that utilizes artificial intelligence (AI) to aid radiologists in interpreting x-ray images. This AI technology provides a more thorough perspective on imaging services for detecting fractures by recognizing subtle irregularities that might not be reflected in a patient’s medical history or could have been missed otherwise.

The telepsychiatry segment in the telemedicine market is anticipated to witness the fastest CAGR growth over the forecast period. Telepsychiatry services help provide affordable, convenient, and readily accessible mental health services. The growing adoption of strategic initiatives by market players is accelerating market growth. In July 2024, Talkiatry, a prominent provider of high-quality, in-network psychiatric services, announced a partnership with Magellan Health, Inc., a leader in behavioral health and associated services, aimed at expanding telepsychiatry offerings throughout California.

By delivery model, the web/mobile segment dominated the market in 2024 and is anticipated to witness the fastest growth of 16.3% during the forecast period owing to the widespread use of smartphones and mobile applications. The increasing adoption of mobile health apps that allow patients to schedule virtual consultations, monitor their health metrics, and receive prescriptions is making healthcare more accessible and convenient. This model allows for seamless integration with other digital health solutions, such as wearable devices and remote monitoring tools, thereby escalating U.S. telemedicine industry growth. In addition, the rise of 5G and improved internet infrastructure across the U.S. has enhanced the speed and reliability of virtual consultations, supporting high-quality video calls and real-time interactions. According to the Telefonaktiebolaget LM Ericsson report from 2023, 59% of smartphone subscriptions in North America are on 5G networks. Among U.S. subscribers, 53% express satisfaction with their 5G services, while the satisfaction rate for Canadian subscribers is 37%.

The call centers segment in the telemedicine market is anticipated to witness significant CAGR growth over the forecast period owing to the increasing demand for efficient 24/7 access to healthcare information and services. Call centers provide an essential function in telemedicine by connecting patients to healthcare professionals for consultations, appointment scheduling, or answering medical queries, particularly for non-urgent situations. In addition, advancements in artificial intelligence (AI) and automated systems have significantly improved the efficiency of these call centers.

By facility, the tele-home segment dominated the market in 2024 and is anticipated to witness significant growth of 16.6% during the forecast period. Tele-home services allow patients to receive medical care in the comfort of their own homes, ranging from virtual consultations to remote monitoring of chronic conditions and post-acute care. Increasing demand for at-home care solutions, particularly as the aging population grows and more individuals prefer to receive care in a familiar environment rather than in a hospital or clinic is driving telemedicine industry expansion. Based on the 2021 CDC report, the proportion of adults utilizing telemedicine rose with age, starting at 29.4% for those aged 18-29 and increasing to 43.3% for adults aged 65 and older. Moreover, the increase in wearable devices and home health monitoring tools has simplified the process for healthcare providers to manage patients' vital signs, such as blood pressure, glucose levels, and heart rate remotely thus, fostering market growth.

The tele-hospital segment in the telemedicine market is anticipated to witness lucrative growth over the forecast period. This growth is largely attributed to the increasing demand for healthcare services that extend beyond traditional brick-and-mortar facilities. Tele-hospitals provide patients with the ability to access a comprehensive range of hospital-level care remotely, including emergency services, consultations with specialists, and post-surgical monitoring, all without the necessity of visiting a physical hospital. In addition, the expansion of tele-hospitals is fueled by the need for cost-effective healthcare solutions in the U.S. Virtual consultations and remote monitoring effectively minimize the need for hospital admissions and in-person visits, consequently reducing overall healthcare costs thus, fostering segmental growth.

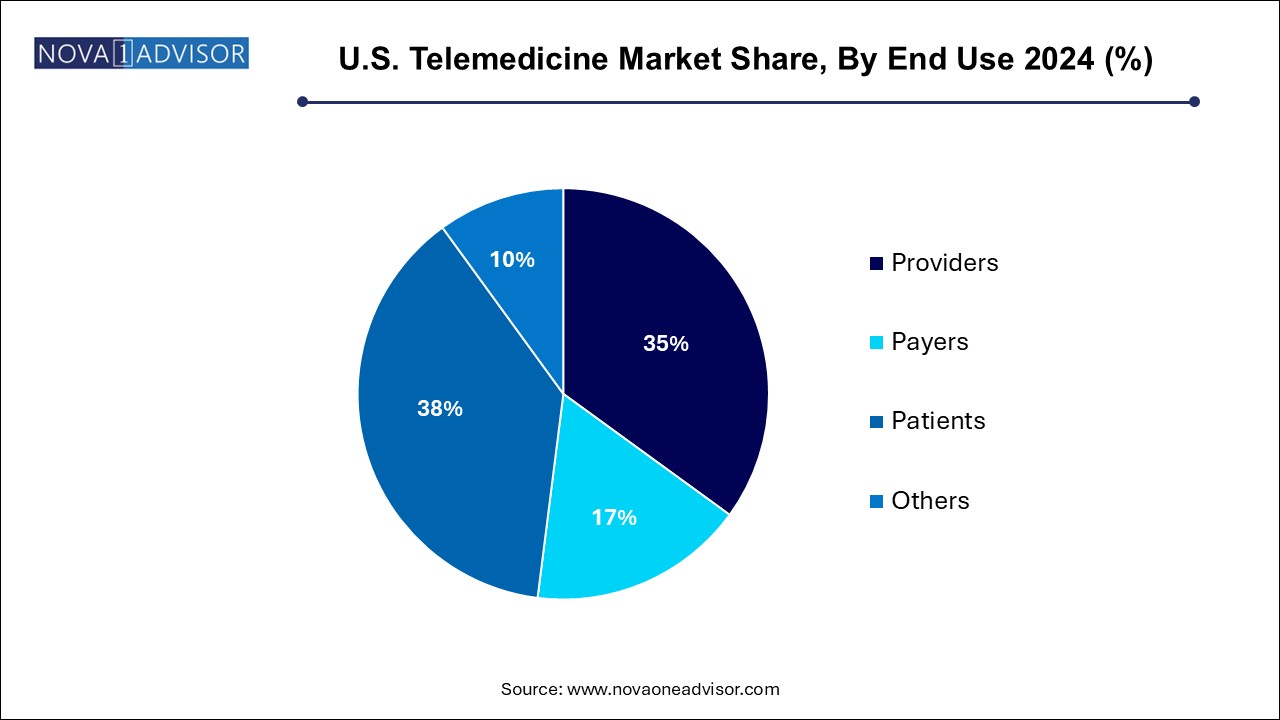

By end use, the patients segment dominated the market with a revenue share of 38.0% in 2024 owing to the increasing demand for convenient, accessible, and cost-effective healthcare. Patients are increasingly seeking telemedicine services as they offer flexibility to access medical consultations from home, reducing the need to travel to clinics or hospitals. This is especially beneficial for those in rural or underserved areas where healthcare facilities are scarce or far away. Furthermore, the growing awareness of telemedicine's availability and efficacy, combined with the expansion of insurance coverage for telehealth services, is encouraging more patients to utilize these services.

The providers segment in the telemedicine market is anticipated to witness the fastest CAGR growth over the forecast period. Healthcare providers, including hospitals, clinics, and private practitioners, are increasingly adopting telemedicine to improve care accessibility, reduce overhead costs, and expand their patient base. Telemedicine allows providers to optimize their time and resources by reducing the need for in-person visits. Telemedicine platforms enable providers to monitor chronic conditions remotely, improving the management of long-term health issues and reducing the frequency of hospital readmissions.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. telemedicine market

By Component

By Modality

By Application

By Delivery Mode

By Facility

By End Use