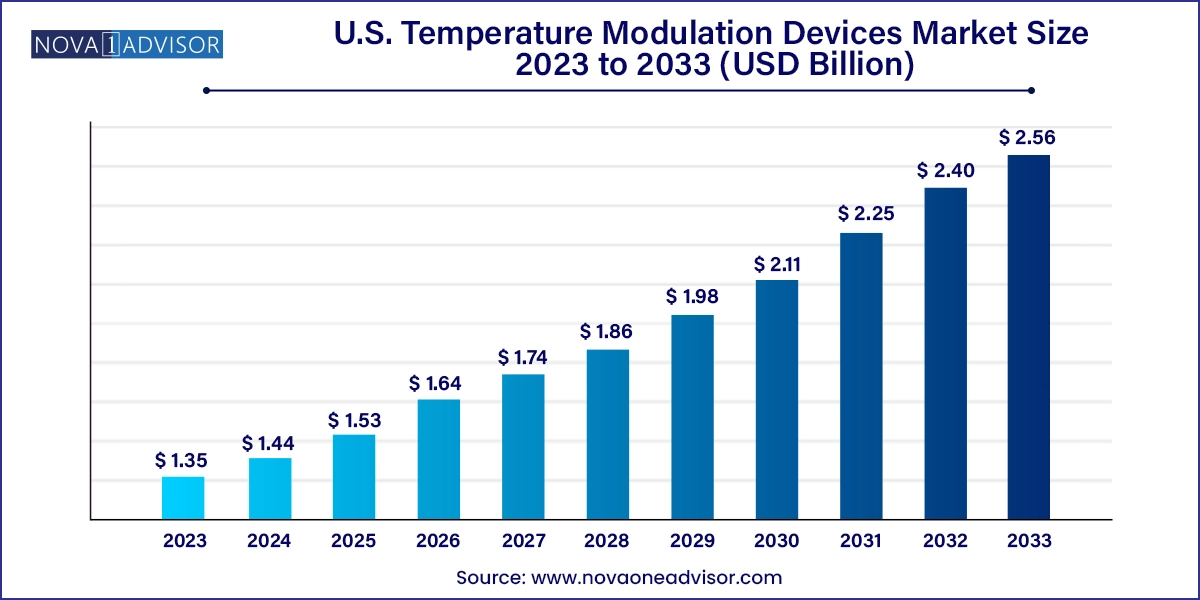

The U.S. temperature modulation devices market size was exhibited at USD 1.35 billion in 2023 and is projected to hit around USD 2.56 billion by 2033, growing at a CAGR of 6.6% during the forecast period 2024 to 2033.

The U.S. Temperature Modulation Devices Market plays a crucial role in modern healthcare delivery, enabling precise control of patient body temperature during medical procedures, trauma management, perioperative care, and critical care interventions. These devices are essential in preventing hypothermia, managing fever, improving surgical outcomes, and stabilizing patients in life-threatening conditions such as cardiac arrest, stroke, or sepsis. From operating rooms and intensive care units (ICUs) to emergency departments and ambulances, temperature modulation devices are integrated into protocols across healthcare settings.

The U.S. market is driven by the country’s advanced healthcare infrastructure, rising surgical volumes, and growing awareness of the importance of thermal regulation in critical and perioperative care. Furthermore, temperature modulation has gained significant attention in the treatment of neurological injuries, including traumatic brain injuries and cardiac arrest, where targeted temperature management (TTM) has been shown to improve patient outcomes. These clinical applications are expanding rapidly with growing research evidence and institutional adoption.

The market encompasses a wide range of devices including conductive warming systems (mattresses, pads), convective warming blankets, fluid and blood warmers, and high-end cooling systems. Innovations in portability, automation, and integration with electronic medical records (EMRs) have transformed temperature modulation systems into intelligent tools that can adapt to changing patient conditions in real-time. From intraoperative warming devices used in routine surgeries to complex cooling systems deployed in neurocritical care units, the spectrum of devices and use cases continues to grow.

Additionally, the aging U.S. population, high prevalence of chronic diseases, and increased emergency department visits are creating consistent demand for efficient thermal management. The market is also benefiting from defense, EMS, and military applications, where rapid rewarming of trauma patients is vital for survival. Temperature modulation is no longer considered a luxury or secondary protocol it is now a standard of care supported by clinical guidelines, reimbursement frameworks, and training programs. Consequently, the U.S. temperature modulation devices market is poised for sustained growth and technological advancement.

Integration of AI and Smart Sensing: Devices equipped with sensors and AI algorithms are automating thermal regulation based on real-time vitals and environmental conditions.

Increased Adoption of Portable Devices: The demand for compact, battery-operated warmers and cooling systems is rising in EMS, ambulatory care, and military settings.

Rise in Targeted Temperature Management (TTM): TTM is gaining traction in ICU protocols for cardiac arrest, sepsis, and traumatic brain injuries, driving the need for precision cooling systems.

Technological Innovation in Conductive and Convective Warming: Hybrid systems combining conductive and convective principles are being developed to optimize heat delivery.

Single-Use and Disposable Accessories: To prevent cross-contamination and simplify logistics, the market is seeing growing use of disposable pads, covers, and hoses.

Increased Usage in Pediatric and Neonatal Care: Temperature modulation devices are being adapted for neonatal and pediatric patients, emphasizing gentle and non-invasive methods.

Focus on Regulatory Compliance and Interoperability: Devices are increasingly designed to comply with FDA and hospital interoperability standards, ensuring seamless integration into electronic health records.

| Report Coverage | Details |

| Market Size in 2024 | USD 1.44 Billion |

| Market Size by 2033 | USD 2.56 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 6.6% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. |

| Key Companies Profiled | 3M; Belmont Medical Technologies; GE Healthcare; BD; ICU Medical; The Surgical Company; Stryker; Gentherm; ZOLL Medical Corporation |

A primary driver of the U.S. temperature modulation devices market is the increasing volume of surgical procedures and the growing emphasis on maintaining perioperative normothermia. Hypothermia during surgery, even by a few degrees, can lead to adverse outcomes including increased blood loss, delayed wound healing, and higher infection risk. As a result, major surgical associations, including the American Society of Anesthesiologists (ASA), have emphasized the use of warming devices as standard care in the operating room.

In a country where millions of surgeries ranging from orthopedic replacements to cardiovascular and oncological interventions are performed annually, the demand for temperature regulation equipment is substantial. Conductive and convective warming systems are deployed before, during, and after surgery to maintain core body temperature. Moreover, as same-day and outpatient surgical centers increase in number, portable warming systems are gaining importance. With hospitals seeking to reduce readmission rates and complications, thermal management devices are being adopted not just in ORs but also in pre-op and recovery units, driving sustained market demand.

Despite growing recognition of their clinical benefits, the high cost of temperature modulation systems remains a significant barrier to widespread adoption, especially for smaller hospitals, ambulatory surgical centers (ASCs), and EMS providers. Advanced systems capable of both warming and cooling, with integrated feedback loops and smart controls, can be prohibitively expensive often requiring not just the initial device purchase but also investments in accessories, maintenance contracts, and staff training.

Additionally, many devices require specialized disposables, proprietary circuits, or consumables that add to recurring costs. In budget-constrained environments, especially in rural healthcare settings or community hospitals, these ongoing expenses can deter procurement. Maintenance and calibration requirements further complicate long-term use. Hospitals are often required to ensure strict adherence to manufacturer protocols, which may involve downtime, technician visits, and quality assurance testing. These logistical and financial challenges can impede broader adoption despite evident clinical advantages.

A rapidly emerging opportunity in the U.S. temperature modulation devices market is the expanding use of portable warming and cooling systems in emergency medicine, including prehospital and ambulance-based care. Emergency responders often treat patients in uncontrolled environments where temperature-related complications such as hypothermia or fever can significantly worsen outcomes. For instance, in trauma and hemorrhagic shock, rapid warming of IV fluids and blood is critical to restoring hemodynamic stability.

The demand for compact, rugged, battery-operated warming units is growing among EMS teams, military medical units, and disaster response personnel. Devices that can be carried into the field or installed in ambulances are increasingly being adopted for rapid rewarming, especially in cases of battlefield injuries, wilderness rescues, or hypothermic drownings. Manufacturers are responding with lightweight units that include quick-connect tubing, digital displays, and rapid heating features. As public and private emergency systems evolve toward more mobile and modular setups, this opportunity is expected to become a significant growth vector for the market.

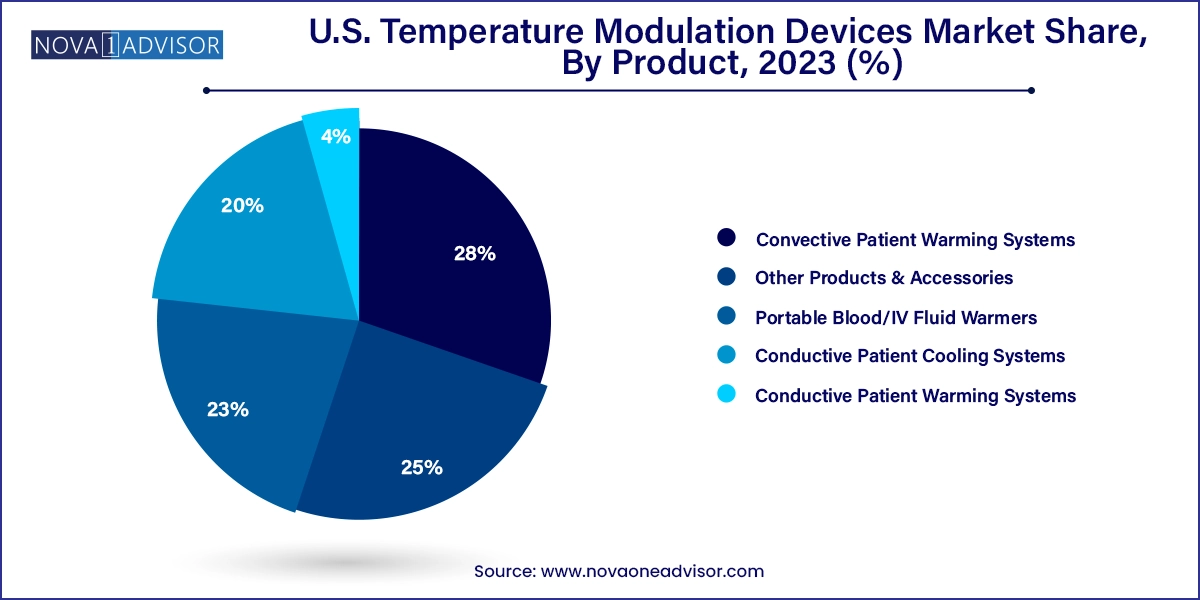

Conductive patient warming systems dominated the U.S. temperature modulation devices market, due to their extensive use across surgical suites, recovery rooms, and intensive care units. These systems use heated water or electric elements to deliver uniform thermal energy through mattresses, pads, or blankets placed directly in contact with the patient. Their precise temperature control and compatibility with long procedures make them ideal for operating rooms and post-op care. Conductive systems are also preferred in cases where convective air flow might be undesirable, such as in burns, open wounds, or sterile environments. With increasing adoption of Enhanced Recovery After Surgery (ERAS) protocols, which emphasize normothermia, conductive systems have become routine fixtures in perioperative care.

On the other hand, portable blood/IV fluid warmers are the fastest-growing product segment, driven by their critical role in emergency and field medicine. Hypothermia from transfusing cold fluids is a serious risk in trauma and prehospital care, prompting widespread use of fluid warming devices. These compact systems are being deployed in ambulances, operating rooms, and even home infusion therapy settings. Battery-operated models capable of warming fluids in seconds are particularly valued by EMS teams. Recent innovations include disposable warming cartridges, smart temperature regulation, and universal compatibility with different IV bag sizes. As emergency services modernize and trauma protocols evolve, portable fluid warmers are gaining traction rapidly.

Within the United States, the temperature modulation devices market is well-supported by a robust healthcare infrastructure, well-established surgical protocols, and advanced trauma care systems. Leading U.S. hospitals have integrated temperature regulation across operating rooms, cardiac care units, transplant programs, and neurocritical care departments. With approximately 50 million surgical procedures performed annually in the country, temperature management has become a foundational component of perioperative quality improvement initiatives.

Moreover, the United States has seen notable adoption of Targeted Temperature Management (TTM) in cardiac arrest and traumatic brain injury protocols. The American Heart Association and other critical care associations endorse TTM to improve neurologic outcomes post-resuscitation. Many ICU protocols now mandate cooling to 32–36°C for 24–48 hours in eligible patients, significantly boosting demand for precision cooling systems.

Ambulance services and air medical transport providers in the U.S. are increasingly equipping vehicles with compact warming systems. In parallel, the U.S. military and Veterans Health Administration (VHA) continue to invest in rugged, field-deployable warming and rewarming devices. As a result, the country is not only the largest market for these devices but also a leader in their innovation and protocol development.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. temperature modulation devices market

Product