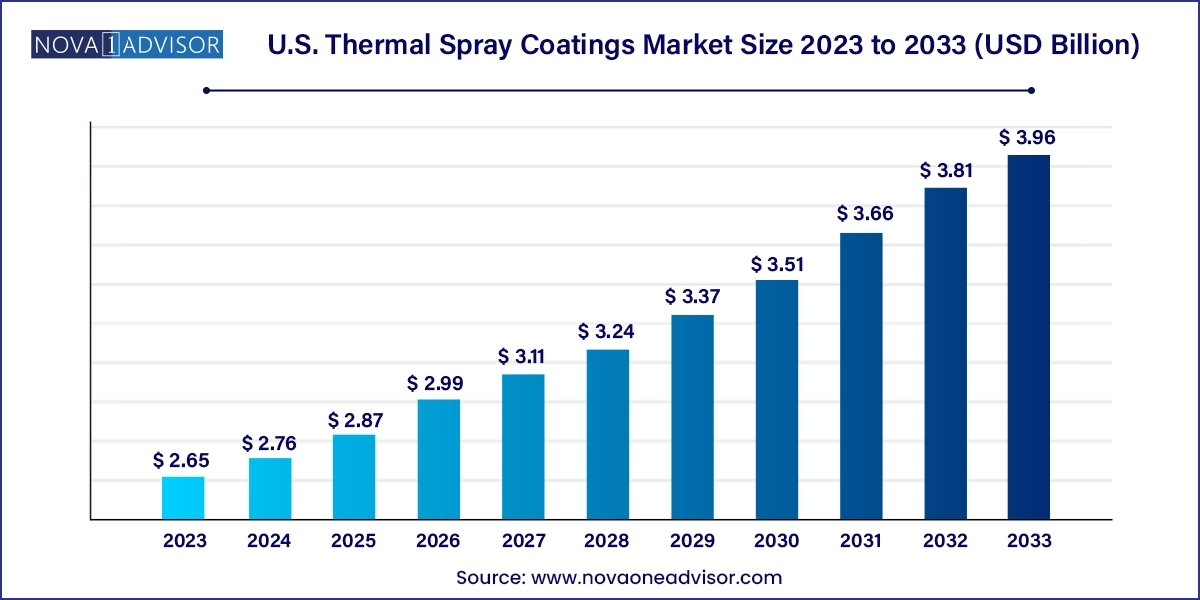

The U.S. thermal spray coatings market size was exhibited at USD 2.65 billion in 2023 and is projected to hit around USD 3.96 billion by 2033, growing at a CAGR of 4.11% during the forecast period 2024 to 2033.

The U.S. Thermal Spray Coatings Market is undergoing a significant transformation, driven by advancements in materials science, the increasing demand for high-performance industrial components, and expanding applications in aerospace, energy, and medical sectors. Thermal spray coatings involve the application of molten or semi-molten materials onto a substrate to enhance surface properties such as wear resistance, corrosion resistance, thermal insulation, and electrical conductivity. These coatings are critical in extending the lifespan and reliability of high-value components, particularly in harsh environments.

In the U.S., the market benefits from a strong industrial base, robust aerospace and defense infrastructure, and growing emphasis on energy efficiency and asset longevity. Thermal spray technology is widely used for turbine blades, aircraft engine parts, automotive pistons, biomedical implants, and drilling equipment reflecting its versatility and high-performance attributes.

As industries seek alternatives to electroplating, hard chrome, and environmentally hazardous coating methods, thermal spraying offers a greener, more customizable solution. With rising investment in gas turbines, 3D printing of metals, and advanced manufacturing, the U.S. market is poised for sustained growth.

Shift from Hard Chrome to HVOF and Plasma Sprays: Aerospace and automotive industries are phasing out chromium coatings due to health and environmental risks, favoring HVOF and plasma technologies.

Integration of Advanced Materials: Carbides, ceramics, and high-performance polymers are increasingly used to meet demanding wear, thermal, and chemical resistance specifications.

Rise in Cold Spray Applications: Cold spray, a low-temperature technology, is being explored for additive repairs, especially in defense, due to minimal heat-affected zones.

Growing Use in Biomedical Implants: Thermal spray coatings like hydroxyapatite and titanium are being applied to orthopedic implants to enhance biocompatibility and osseointegration.

3D Printing and Coating Synergies: Additive manufacturing combined with thermal spraying is being used to finish or repair 3D-printed metal components, especially in aerospace.

OEM Partnerships and On-Site Coating Services: Companies are moving closer to customers by offering mobile coating units and on-demand spraying, particularly for large infrastructure projects.

Investment in Automated Spray Booths: Robotics and AI integration are enhancing repeatability, quality, and safety in industrial coating facilities across the U.S.

| Report Coverage | Details |

| Market Size in 2024 | USD 2.76 Billion |

| Market Size by 2033 | USD 3.96 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 4.11% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Material, Technology, Application |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | OC Oerlikon Management AG; Praxair S.T. Technologies Inc.; Chromalloy Gas Turbine LLC; Kennametal Inc.; TOCALO Co. Ltd.; APS Materials Inc.; ASB Industries Inc.; Bodycote PLC; Eurocoating SpA; FM Industries Inc. |

A significant driver of the U.S. thermal spray coatings market is the continued growth and innovation within the aerospace and defense sectors. The U.S. is home to major aerospace OEMs such as Boeing, Lockheed Martin, and Raytheon Technologies, all of which rely heavily on thermal spray coatings to protect turbine blades, combustion chambers, and landing gear components from high-temperature oxidation, erosion, and corrosion.

Thermal barrier coatings (TBCs) applied using plasma spray and HVOF techniques are essential in improving the fuel efficiency of jet engines and enhancing safety and performance in high-stress applications. The rise in commercial aviation, resurgence of domestic travel post-COVID, and increasing defense budgets are all fueling the need for reliable, lightweight, and long-lasting coatings.

With newer generations of engines operating at higher temperatures to meet fuel economy and emissions standards, thermal spray coatings are not just preferred they're essential. Companies involved in MRO (Maintenance, Repair, and Overhaul) services are also expanding their use of coatings to restore components instead of replacing them, offering cost advantages and sustainability.

While thermal spray coatings offer superior performance, their adoption can be limited by the high initial cost of equipment and the technical expertise required for process optimization. Technologies like plasma spray or HVOF involve capital-intensive infrastructure, including controlled-atmosphere chambers, robotic arms, and gas handling systems, making them less accessible for small or mid-sized enterprises.

Moreover, achieving consistent results requires rigorous surface preparation, parameter control, and post-coating inspections. Training skilled operators and engineers is a challenge, particularly for cold spray and newer hybrid processes, which are not yet widely standardized.

As a result, many potential users defer implementation, relying on external service providers rather than building in-house capabilities. While contract coating services are growing, the barrier to entry for equipment manufacturers and OEMs remains significant, especially in price-sensitive sectors like automotive remanufacturing and general manufacturing.

An emerging opportunity in the U.S. thermal spray coatings market is the surging demand from the medical device industry, especially for orthopedic implants, dental components, and prosthetics. Thermal spray coatings like hydroxyapatite (HA), titanium, and bioinert ceramics are used to improve the osseointegration of implants with bone tissue, reduce wear and friction, and enhance corrosion resistance inside the human body.

As the U.S. population ages, and chronic conditions like arthritis and osteoporosis become more prevalent, the demand for joint replacements and spinal implants is increasing. According to industry estimates, over 1 million joint replacement surgeries are performed annually in the U.S.—each a potential market for thermal spray coatings.

FDA-approved coatings that enhance the lifespan, biocompatibility, and stability of implants are attracting investment from biomedical firms and contract manufacturers. Additionally, robotic spray systems are being adapted to handle precision coatings on small, intricate medical components, enhancing production throughput and quality assurance.

Metals dominated the thermal spray coatings market, especially nickel, aluminum, copper, and cobalt-based alloys. These coatings offer thermal conductivity, corrosion protection, and electrical performance, and are widely used in automotive, aerospace, and power generation. For example, nickel-chromium coatings are frequently used on turbine blades for oxidation resistance, while aluminum-based coatings are applied to protect steel structures from marine environments. In the oil & gas sector, metal coatings are also applied to valves and pipelines to prevent wear and cavitation.

Carbides are the fastest-growing material segment, with materials like tungsten carbide (WC) and chromium carbide (CrC) gaining traction for their extreme hardness and wear resistance. Carbides are used in cutting tools, pump components, and downhole drilling tools, offering longer operational lifespans in abrasive environments. The high demand from industrial gas turbines and mining equipment is fueling the expansion of carbide-based spray coatings, particularly via HVOF technology, which preserves particle hardness better than plasma spraying.

Plasma spray held the largest market share in terms of technology due to its versatility and ability to handle a wide range of materials, including ceramics, metals, and composites. Plasma spray systems generate temperatures exceeding 15,000°C, making them ideal for thermal barrier coatings, biomedical implants, and aerospace applications. Their ability to coat complex shapes and achieve thick, dense coatings gives them an edge in high-spec industries. U.S.-based aerospace MRO companies commonly use plasma spray for turbine blade refurbishment and protection of hot-section components.

Cold spray is the fastest-growing technology, particularly for applications in defense, electronics, and 3D-printed metal repairs. Unlike other thermal spray techniques, cold spray involves accelerating particles at supersonic speeds without melting them, which avoids thermal degradation of sensitive substrates. The U.S. Department of Defense has funded multiple projects using cold spray for repairing helicopter gearboxes, armored vehicles, and corrosion-damaged aircraft skins. This growth is expected to continue with the development of portable and robotic cold spray units.

Aerospace was the leading application segment, owing to the extensive use of thermal barrier and wear-resistant coatings in aircraft engines, airframes, and landing gear components. The demand for lightweight materials with surface reinforcement is increasing as aerospace OEMs target fuel efficiency and reduced maintenance. U.S. military aircraft upgrades and commercial aviation growth (e.g., fleet expansions by American Airlines and Delta) are contributing to consistent demand in this sector.

Medical is the fastest-growing application, driven by the proliferation of orthopedic and dental implants, surgical instruments, and minimally invasive devices. As U.S. healthcare continues to invest in advanced technologies and personalized medicine, medical manufacturers are adopting thermal spray coatings for enhancing implant lifespan and biological integration. Coatings like hydroxyapatite, titanium oxide, and bioglass are applied to joint replacements, while antimicrobial coatings are being explored to reduce infection risks post-surgery.

The U.S. market for thermal spray coatings is characterized by high technological maturity, regulatory compliance, and robust industrial diversification. Aerospace hubs in California, Washington, and Connecticut, automotive centers in Michigan and Ohio, and medical device clusters in Minnesota and Massachusetts represent major demand centers.

Public-private partnerships, such as those promoted by the Department of Energy (DOE) and Defense Advanced Research Projects Agency (DARPA), support R&D into thermal spray applications for energy, defense, and sustainability. Additionally, the Infrastructure Investment and Jobs Act (IIJA) is increasing investments in pipeline rehabilitation, bridge coatings, and corrosion-resistant systems many of which use thermal spray as an enabling technology.

Academic research institutions like Ohio State University, University of Connecticut, and Penn State University play a pivotal role in advancing materials science and thermal spray process optimization, fostering innovation and training the next generation of engineers and technologists.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. thermal spray coatings market

Material

Technology

Application