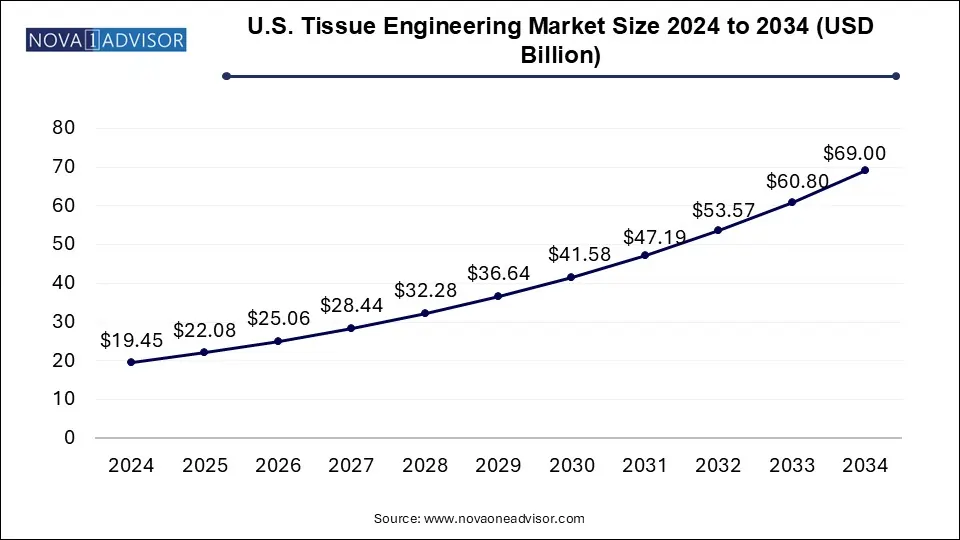

The U.S. tissue engineering market size was exhibited at USD 19.45 billion in 2024 and is projected to hit around USD 69.00 billion by 2034, growing at a CAGR of 13.5% during the forecast period 2025 to 2034.

The primary driver of this growth is the escalating demand for pioneering tissue engineering solutions that can treat chronic diseases and aid in the repair and regeneration of tissues. Furthermore, the progress in regenerative medicines, the increase in funding & investments for creating sophisticated tissue engineering products, and the mounting requirement for regenerative medicines are crucial contributors to this market’s expansion. In addition, the surge in research activities aimed at developing advanced solutions for tissue repair and reconstruction, coupled with the growing acceptance of novel cell therapies, adds to the optimistic future of this market.

U.S. accounted for over 47.8% of the global tissue engineering market in 2024. The escalating prevalence of chronic conditions, including cardiovascular diseases, diabetes, and orthopedic disorders, has fueled the need for tissue engineering solutions that can mend or substitute impaired tissues. According to a recent study by the American Health Association, approximately 133 million citizens, which is close to half of the population, are afflicted with a minimum of one chronic disease like hypertension, heart disease, or arthritis. This figure is projected to escalate to 170 million by the year 2030. Progress in 3D tissue engineering technology, including substituting embryonic cells with stem cells, developing organ-on-a-chip technology, and applying 3D bioprinters capable of effectively creating in vitro implants, is anticipated to boost growth.

The tissue engineering field has witnessed substantial advancements owing to the progress in biomaterials, 3D bioprinting, stem cell research, and gene editing methodologies, which have facilitated the creation of intricate and operational tissues. There is an increase in demand for regenerative medicine and tissue engineering clinical trials, which has led to the expansion of this market. There are currently 58 studies in progress for regenerative medicine and 63 ongoing studies for tissue engineering, as reported by the clinicaltrials.gov website. Despite this, the market's growth is hindered by ethical concerns related to stem cell research, tissue-engineered products, and product development.

Every year, around 18,000 new cases of traumatic spinal cord injury (tSCI) are reported in the United States, as per data provided by the National Spinal Cord Injury Statistical Center. The market growth is anticipated to increase in the predicted period due to chronic diseases, which are the primary causes of death and disability across the globe. The tissue regeneration technology is becoming increasingly popular due to its effective products and low rejection rates. Furthermore, there's a trend toward performing more regenerative treatments.

Presently, ongoing pre-clinical studies are concentrating on using tissue-engineered vascular grafts for cardiovascular surgeries and treatments. In addition, tissue-engineered bladders have demonstrated successful implantation outside the patient market for tissue engineering is expected to grow, driven by increased government funding for medical and academic research. For instance, in January 2024, Sartorius, a supplier of biopharmaceutical equipment, acquired a 10% stake in BICO, a company at the forefront of 3D bioprinting. This USD 49.91 million investment is part of a broader collaboration between the two companies. Their joint research and development efforts will focus on developing digital solutions for cell line development workflows. Stem cell treatments hold considerable importance for treating various medical conditions, which has led to substantial investment in research and clinical application. The swift advancements in stem cell research have improved the management of diseases. As a result, with the rising incidence of cancer, diabetes, and other chronic diseases, the emphasis on stem cell research has grown.

| Report Coverage | Details |

| Market Size in 2025 | USD 22.08 Billion |

| Market Size by 2034 | USD 69.00 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 13.5% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Application |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | Zimmer Biomet Holdings, Inc.; AbbVie (Allergan); Becton Dickinson and Company; B. Braun; Integra LifeSciences Corporation; Organogenesis Holdings Inc.; Medtronic; ACell, Inc.; Athersys, Inc.; Tissue Regenix Group plc; Stryker Corporation; RTI Surgical, Inc.; ReproCell, Inc.; Baxter International, Inc. |

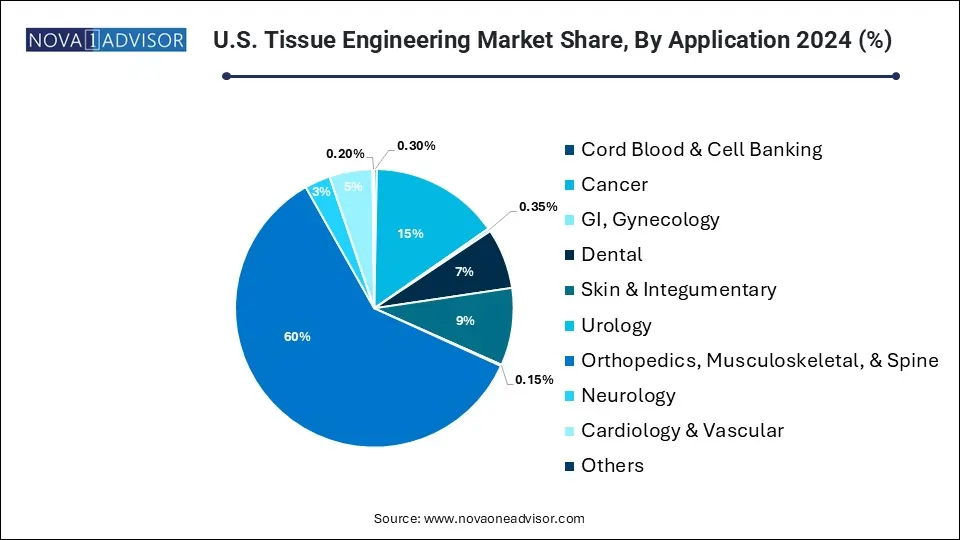

Orthopedics, musculoskeletal, & spine dominated the market and held the largest revenue share of 60.0% in 2024. The rise in musculoskeletal disorders has led to the growth of tissue engineering as a vital treatment method for orthopedic surgeons. This approach manages various disorders, from meniscal deficits in young athletes to osteochondral abnormalities in the glenohumeral joint. The market is expected to grow due to market players' adoption of various growth strategies and the launch of new products. For instance, in October 2022, LifeNet Health showcased its advanced allograft biologics for fusion at the North American Spine Society (NASS) 2022 Annual Meeting in Chicago. This included ViviGen MIS, the first viable cellular allograft delivery device for minimally invasive surgery.

The cardiology and vascular sector is predicted to experience the fastest CAGR of 25.0% during the forecast period. This segment's quick growth is attributed to the urgent requirement for innovative solutions in cardiac care. The field of tissue engineering has the potential to create cardiac grafts and regenerate tissues without causing adverse effects such as immunogenicity. The use of advanced biomaterials, such as synthetic polymers, like polyglycolic acid and polylactic acid, in cardiac tissue engineering has significantly contributed to this growth. These advancements enable the development of functional and viable engineered tissues, addressing challenges in cardiac care and driving the rapid expansion of tissue-engineered products in cardiology.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. tissue engineering market

By Application