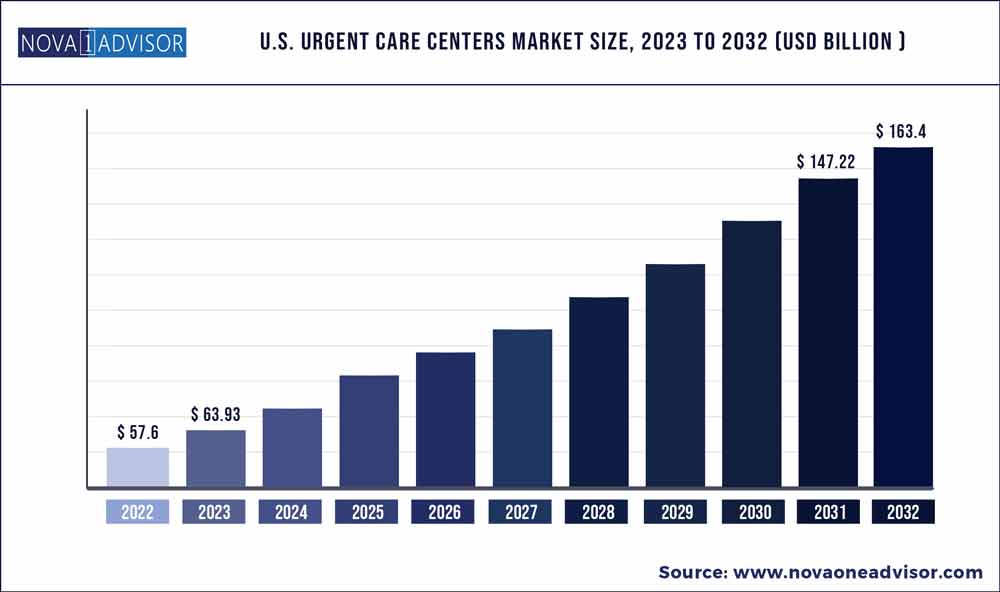

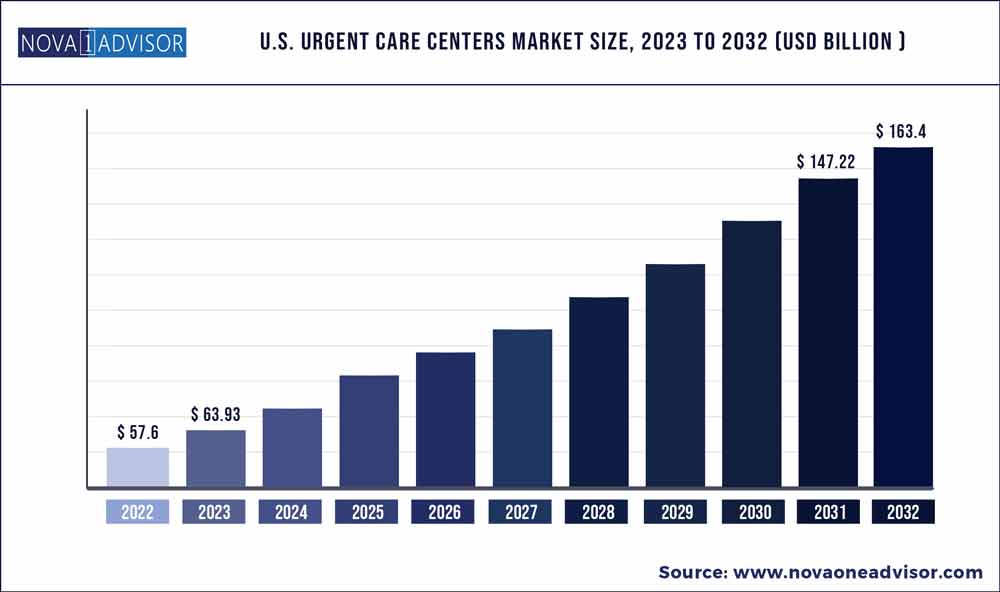

The U.S. Urgent Care Centers market size was estimated at USD 57.6 billion in 2022 and is expected to surpass around USD 163.4 billion by 2032 and poised to grow at a compound annual growth rate (CAGR) of 10.99% during the forecast period 2023 to 2032.

Key Takeaways

- The acute respiratory infection segment dominated the market in 2022 with a 29% revenue share and is expected to continue its lead during the forecast period.

- Influenza and pneumonia segment is anticipated to witness significant growth during the forecast period.

- The general symptoms segment is expected to witness lucrative growth during the forecast period.

- Based on ownership, the market is bifurcated into hospitals, physicians, corporations, and others. The hospital-owned segment held the largest share of 41% in 2022 and is expected to grow at the fastest CAGR of 11.39% during the forecast period.

U.S. Urgent Care Centers Market Report Scope

| Report Coverage |

Details |

| Market Size in 2023 |

USD 63.93 Billion |

| Market Size by 2032 |

USD 163.4 Billion |

| Growth Rate From 2023 to 2032 |

CAGR of 10.99% |

| Base Year |

2022 |

| Forecast Period |

2023 to 2032 |

| Segments Covered |

Application, Ownership |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Concentra, Inc.; American Family Care; CityMD Urgent Care; MedExpress Urgent Care; NextCare Urgent Care; Tenet Health Urgent Care; FastMed Urgent Care; Ascension Health Urgent Care; WellNow Urgent Care; Sutter Health; Aurora Urgent Care; Intuitive Health |

The growth can be attributed to the delivery of rapid services and short wait times compared to primary care physicians (PCPs). As per the Urgent Care Association (UCA), it took one hour less for around 97% of patients to meet providers or medical practitioners in Urgent Care Centers (UCCs), which is significantly lower compared to PCPs. Moreover, around 98% of urgent care patients are in the appropriate room for care and around 2% are in emergency settings.

The rise in the number of UCCs in the U.S. has provided various benefits to healthcare professionals and patients. A major shift from conventional hospitals or clinics to UCCs has been observed in the country in recent years. Various factors such as affordability, transparency, and efficiency in health delivery are significant in fueling market growth. Patients receive immediate care and treatment at these centers, as they are easy to access, which is expected to drive the demand for UCCs across the country.

The number of UCCs has significantly increased in the past few years, owing to the rising patient demand for rapid and affordable health services. According to the UCA, in the U.S., the number of UCCs increased to 9,279 in 2019 from 8,774 in 2018. As per UCA, 400-500 new UCCs are opened in the U.S. every year. In 2019, Hawaii reported the highest percentage usage of these facilities followed by Virginia, New Mexico, Maryland, and Louisiana. Washington, DC, Iowa, North Dakota, Massachusetts, and Alaska reported the lowest percentage usage of these facilities.

The average cost of treatment at UCCs is much lower compared to the PCPs, which majorly contributes to the increase in the patient influx at these facilities. It is used to treat similar conditions for which patients tend to visit PCPs. The average cost of treatment at these facilities without insurance ranges from USD 80 to USD 280 for acute treatment and around USD 140 to USD 440 for more advanced treatment. The average cost of PCPs without insurance range from USD 300 to USD 600 which is considerably higher compared to UCCs.

Telehealth adoption has developed a huge demand for these facilities in the U.S. as it reduces the cost of treatment and generates more revenue per provider. As per the American Medical Association, around 70% of PCPs visits and around 40% of ED visits are unnecessary. These visits could be effectively handled by UCCs through telemedicine consultations. As per the Fair Health report, Texas ranked first for telehealth usage in 2019 owing to the telehealth-related legislation passed in 2018 and 2019.

Application Insights

Based on application, the U.S. urgent care centers market is bifurcated into acute respiratory infection, influenza pneumonia, general symptoms, joint/soft tissue issues, injuries, digestive system issues, ear infections, skin infections, strains, sprains, and fractures, diseases of the respiratory tract, urinary tract infections, and others.

The acute respiratory infection segment dominated the market in 2022 with a 29% revenue share and is expected to continue its lead during the forecast period. This can be attributed to the rising demand for these categories owing to the growing prevalence of respiratory conditions. As per a FAIR Health white paper published in March 2021, among all diagnostics categories, acute respiratory diseases and infections were the most common diagnostics categories, accounting for around 32% of the total claim line distribution in these facilities based on diagnostic category.

Influenza and pneumonia segment is anticipated to witness significant growth during the forecast period. The growth can be attributed to the longer flu sessions in 2022. According to the NCHS mortality surveillance data, pneumonia, influenza, and/or COVID-19 (PIC) contributed to 9.2% of the total deaths that occurred during September 10, 2022, ending the week (week 36).

The general symptoms segment is expected to witness lucrative growth during the forecast period. This can be attributed to the growing awareness regarding diagnosis and treatment for general signs and symptoms owing to the fear of the spread of the COVID-19 virus. As per a FAIR Health white paper published in March 2021, among all diagnostics categories, general symptoms accounted for around 4% of the total claim line distribution in urgent care centers based on diagnostic category.

Ownership Insights

Based on ownership, the market is bifurcated into hospitals, physicians, corporations, and others. The hospital-owned segment held the largest share of 41% in 2022 and is expected to grow at the fastest CAGR of 11.39% during the forecast period. The growth can be attributed to the growing interest among healthcare systems such as HCA, Aurora Health, Carolinas Healthcare, Dignity Health, and others; to provide accessible care at an affordable price. For instance, in January 2022, HCA Healthcare acquired MD Now Urgent Care from private-equity firm Brentwood Associates.

The physicians-ownership segment has reported a decline in growth in the past few years. The decline in growth can be attributed to the increased regulatory and administrative burdens and decreasing reimbursement for these facilities. These physicians are selling their facilities to private equity firms, investors, insurance companies, hospitals, and joint ventures as a part of their exit strategy.

With the decline in the number of physician-owned centers, the market share of corporation-owned centers has increased in recent years. PE firms and insurers are the major investors in the corporation-owned centers. These firms are implementing strategies to reduce operating costs by appointing nurse practitioners & physician assistants, negotiating with vendors & suppliers, and outsourcing technology services. Thus, allowing them to offer consistent and affordable services across the UCCs.

A new trend emerging in the market is the hybrid/dual model of emergency care and urgent care. The hybrid/dual model operates as urgent care and emergency room under one roof wherein the type of care is determined by factors such as the severity of the injury and type of treatment. The key benefit of this model is patients are billed according to the care received and can save on higher bills of emergency care for non-emergent treatment. Companies such as Intuitive Health are operating multiple dual ER & urgent care centers across the country.

Key Companies & Market Share Insights

The companies are adopting various strategies, including the launch of advanced services and geographic expansion. Several facilities are offering specialized services to a specific cohort. For instance, in November 2020, Texas Health Recourses launched Texas Health Breeze Urgent Care, which provides personalized care at affordable pricing. Some prominent players in the U.S. urgent care centers market include:

- Concentra, Inc.,

- American Family Care

- CityMD Urgent Care

- MedExpress Urgent Care

- NextCare Urgent Care

- Tenet Health Urgent Care

- FastMed Urgent Care

- Ascension Health Urgent Care

- Aurora Urgent Care

- WellNow Urgent Care

- Sutter Health

- Intuitive Health

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the U.S. Urgent Care Centers market.

By Application

- Acute respiratory infection

- General Symptoms

- Injuries

- Joint/Soft Tissue Issues

- Digestive System Issues

- Skin Infections

- Urinary Tract Infections

- Ear Infections

- Sprains, Strains, and Fractures

- Influenza Pneumonia

- Disease of Respiratory Tract

- Others

By Ownership

- Hospital

- Corporation

- Physicians

- Others