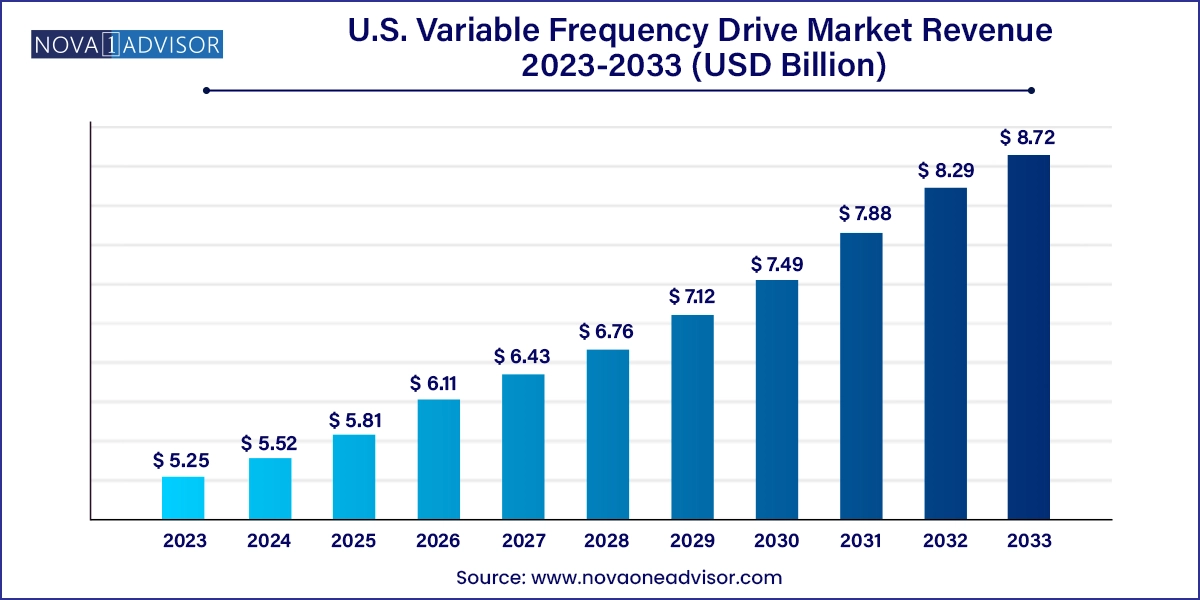

The U.S. variable frequency drive market size was exhibited at USD 5.25 billion in 2023 and is projected to hit around USD 8.72 billion by 2033, growing at a CAGR of 5.2% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 5.52 Billion |

| Market Size by 2033 | USD 8.72 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 5.2% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product Type, Power Range, Application, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. |

| Key Companies Profiled | ABB Ltd.; General Electric; Hitachi, Ltd.; Schneider Electric; SIEMENS AG; Eaton; Addison Electric, Inc.; Rockwell Automation, Inc.; Yaskawa Electric Corporation; Johnson Controls International |

Variable frequency drives are considered a highly adequate and effective energy management tool to improve operational performance and the energy efficiency of HVACs. These drives can reduce the overall maintenance and operating cost of HVAC systems after their integration, driving their usage. In the United States, the positively growing real estate market and rising demand for energy-efficient solutions are some notable factors encouraging growth in the HVAC industry, consequently expanding the VFD market in the country. Additionally, the U.S. government has implemented stringent policies and guidelines to reduce energy consumption and mark a shift towards sustainability, which is expected to drive expansion in the form of advanced and innovative offerings.

The U.S. accounted for 17.34% of the revenue share in the global variable frequency drive market in 2023. The country plays a vital role in shaping the global VFD market owing to the level of technological innovation, stringent energy efficiency regulations and policies, increased environmental awareness, and international trade influence. The U.S. is a hub for numerous manufacturers and technology companies that are at the forefront of research and development in electrical engineering and industrial automation. U.S.-based VFD manufacturers have an extensive presence internationally, facilitated by global distribution networks and partnerships. This has made U.S.-manufactured VFDs more accessible globally and strengthened its influence in the worldwide VFD market.

The country has witnessed rapid industrialization in the past few years, resulting in a substantial expansion of its manufacturing and industrial sectors. Major infrastructural and manufacturing industries, such as wastewater treatment, pulp & paper, mining, chemical, oil & gas, petrochemical, and cement, are leading consumers of variable frequency drives in the country. These sectors require various types of equipment and machinery that rely on VFDs for ensuring precise speed control and energy savings. VFDs are used in motors, pumps, fans, and other mechanical components to regulate energy consumption based on specific operational requirements. As industrial sectors expand, the demand for VFDs increases.

Variable frequency drives offer several important benefits to end-users, such as reducing engine wear, providing better energy savings than a traditional motor, preventing oversizing in industries, and being easy to repurpose. Their role in effectively controlling motor speed for meeting application requirements is especially important, leading to drastic reduction in energy consumption. As per the Energy Information Administration (EIA), in 2022, the total end-use electricity consumption in the U.S. grew by approximately 3.2% compared to 2021. In 2022, the industrial sector represented 35% of the overall energy consumption for end-use applications in the country; it accounted for 33% of the total energy consumption during the same period. Thus, the use of VFDs is expected to significantly lower energy consumption and cost of electric motors, boosting their demand.

The oil & gas segment accounted for the largest revenue share of 20.66% in the market in 2023. This industry heavily relies on various applications such as distribution, production, and refining, which involve the use of heavy power motor-driven pumps and pumping systems. To achieve optimal performance and minimize energy consumption when operating electric motors, systems incorporate variable frequency drives (VFDs). Several applications in this sector, even though not requiring a continuous 100% flow, usually run needlessly during usage at full speed, undermining energy savings. Integrating VFDs is aimed at maximizing operating profits by ensuring efficient motor control and energy usage.

The infrastructure segment is expected to advance at the fastest CAGR during the forecast period. A steady growth in commercial and residential projects in the country has created a strong demand for Variable Frequency Drives (VFDs) in the construction sector. Additionally, a move towards electric motors from hydraulic and mechanical drives to meet energy-saving targets mandated by government regulations has further driven the requirement of VFDs in this segment. These drives offer the construction sector with a tool to fine-tune energy consumption by controlling motor speed and torque precisely. As governments continue to focus on energy efficiency and environmental responsibility, the demand for VFDs is expected to increase further in the U.S.

In terms of power range, the micro (0-5 kW) segment accounted for the leading revenue share of 34.17% in 2023. The demand for micro-power variable frequency drives (VFDs) in the U.S. is mainly driven by their applications in compressors, electric fans, and kilns. These drives are utilized extensively to control the speed and torque of electric motors by varying the frequency and voltage of the power supply. Micro frequency drives are widely used in various end-use industries to power equipment such as conveyors, centrifugal pumps, fans, belts, and pumps. They offer several advantages, including reduced maintenance, energy savings, extended equipment life, and improved system efficiency.

Meanwhile, the low (6-40 kW) power drive segment is expected to advance at the fastest growth rate through 2033. They are regarded for their energy efficiency and cost-effectiveness, making them an appealing option for various industries in the U.S. These drives use less capital while conserving more energy, resulting in a shorter payback period. Additionally, they offer superior process control, which has further boosted their popularity. Low-power drives are designed to minimize energy consumption while maintaining optimal performance. Moreover, such drives offer precise and accurate control over various industrial processes, bringing significant benefits to industries such as automotive, oil & gas, food & beverage, construction, and paper & pulp.

Based on application, pumps accounted for the leading revenue share of 29.43% in 2023 in the U.S. variable frequency drive market. Pumps have inbuilt VFDs, which reduces power consumption and their running cost, while allowing them to run at variable speeds without a gearbox. Additionally, these drives offer motor thermal overload safety and phase loss detection, in addition to benefits such as damaged pipe protection, loss of prime detection, low/high-pressure level monitoring, no-flow pump detection, and pump over-cycle safety. The extensive presence of oil & gas industries and water treatment facilities, which heavily utilize pumps, in the U.S. supplements segment growth.

The HVAC segment, on the other hand, is expected to advance at the highest CAGR during the forecast period. A VFD is considered to be of massive advantage in terms of energy management that helps enhance energy efficiency as well as the operational performance of HVAC systems. Major reductions in system motor energy usage can be made possible by matching system capacity to the actual load. The U.S. government has implemented regulations regarding HVAC system operations due to increasing global warming concerns, which has led to the standardization of manufacturing procedures. Subsequently, positive developments in the country’s HVAC sector are expected to propel the VFD industry’s progress.

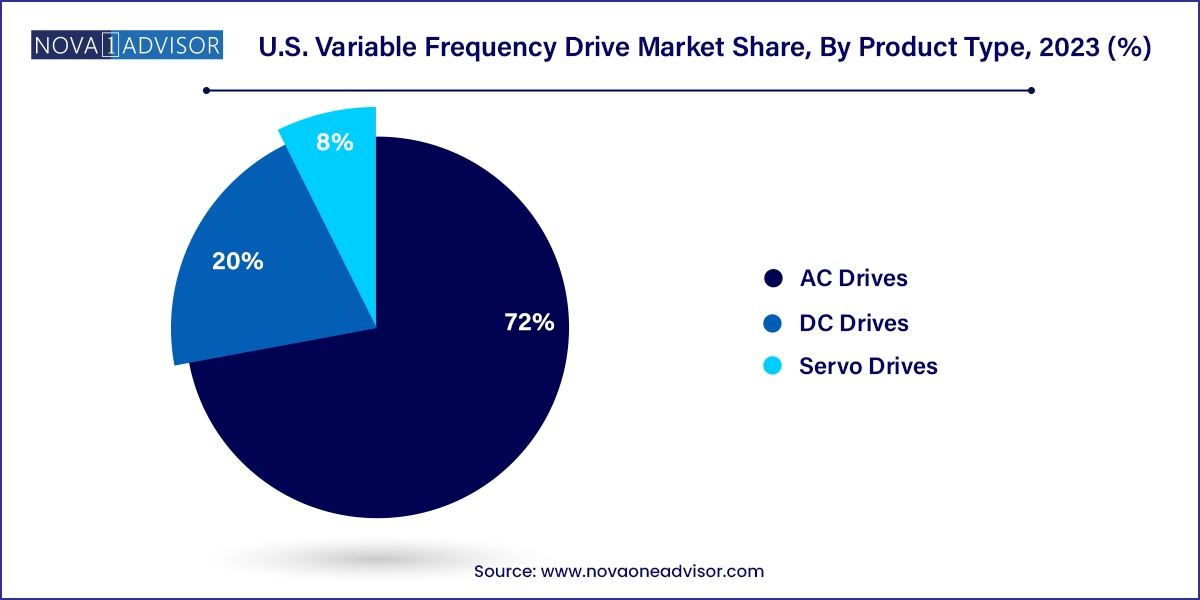

The AC drive segment accounted for a dominant share of 72.0% in the U.S. market for variable frequency drives in 2023. This share is aided by the deployment of AC drives in almost all industries on a wide scale. Furthermore, their amplified application in medium and heavy industries, such as power generation, infrastructure, food & beverages, automotive, and pulp & paper, is poised to fuel segment expansion. The U.S. government is focusing on improving industrial policies and regulations to create a favorable environment to explore new industries and enhance sustainability among competitors. The food industry is increasingly adopting automation to comply with the standards and laws established by industry associations to meet the quality of products being delivered.

The DC drives segment accounted for a substantial revenue share in the market in 2023. The oil & gas industry is a major consumer of DC drives owing to their operating capabilities. A DC drive saves energy to regulate flow by changing speed rather than using throttling valves, thus saving electrical energy costs. The U.S. is witnessing an increasing production of oil and natural gas, especially from shale resources, reducing the country’s import reliance and boosting the economy in terms of investment and employment. As per the Short-Term Energy Outlook analysis by the U.S. EIA, crude oil production was expected to average 12.4 million barrels daily (b/d) in 2023, surpassing the record of 12.3 million b/d achieved in 2019. The projection for 2024 projects a further increase, highlighting healthy growth for the industry. This, in turn, is expected to drive the demand for DC drives for improving efficiency and performance of equipment, leading to operational benefits.

Southern U.S. accounted for the highest revenue share of 31.46% in 2023, aided by this region having a strong historical background and benefitting from a favorable geographical position and reliable infrastructure. The South is recognized for its cost-effectiveness, making it an attractive destination for establishing and conducting business operations. Some southern states such as Georgia, Texas, and Louisiana have implemented business-friendly policies, including tax incentives, to attract investment and foster economic growth. The strong presence of automotive and oil & gas sectors in this region is expected to aid market expansion. For instance, VFDs are widely used in the automotive industry for applications such as controlling motor speed in production lines, conveyor systems, and other equipment.

The Midwest U.S. region is expected to advance at the fastest CAGR during the assessment period. States included in this region feature the presence of a variety of industries, each with their own unique application for VFDs. For instance, Illinois has a robust healthcare sector, with numerous hospitals, medical centers, and research institutions. Healthcare facilities utilize VFDs to control motor speed in HVAC systems, pumps, and other critical equipment, ensuring energy efficiency and precise control. On the other hand, Ohio has witnessed increasing investments in construction and infrastructure development activities, highlighting the need for VFDs to improve energy efficiency, optimize power usage, and enhance the control of HVAC systems in buildings and infrastructure.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. variable frequency drive market

Product Type

Power Range

Application

End-use

Regional